Record-high stocks may hit turbulence, but path being forged for sustained gains

In late February, the Nikkei Stock Average topped 38,915—a record peak marked in 1989 which until recently was thought to be unsurmountable. The Nikkei has kept going since, notching up fresh record highs and topping the 40,000 threshold early in March. The immediate spark behind the Nikkei’s rise above a record high that held for 35 years may have been a surge by chip-related stocks in response to strong results from a leading US tech company. The foundations were already there, however, for the Nikkei to vault to new highs, with factors including a weak yen, corporate governance reform and Japan’s exit from deflation helping to boost the corporate bottom line.

Many investors are now likely wondering what comes next. Will Japanese stocks soon plunge down a steep, slippery slope as they did after the Nikkei scaled its 1989 peak, or will they be more buoyant this time? While we have no way of telling the future, it would be reasonable to assume that the stock market, which is already at lofty levels, may face turbulence ahead. The market could come under pressure if investors are unable to connect the immediate factors fuelling the Nikkei’s current rise—such as governance reform, yen depreciation caused by wide US-Japan interest rate differentials and the rally by semiconductor-related companies—with the country’s longer-term economic prospects. Any upward momentum from governance reform prospects could be susceptible to volatility as it tends to benefit a section of the market rather than its entirety. As for semiconductor-related companies, the share prices of some could be exceeding their actual earnings growth capacity amid the general euphoria; as a result, the sector’s shares could run into turbulence if earnings fall short of market expectations.

In particular, the yen could cause short term volatility in the market as wages may rise high enough for the Bank of Japan (BOJ) to steer monetary policy towards higher interest rates, which would likely cause the Japanese currency to appreciate. While a stronger yen may initially hurt Japanese stocks, it would be a result of the BOJ acting for the correct reason (in response to strength in wages) and this in itself is likely to be positive for the market over the long term. Investors may eventually see the central bank’s response to rising wages as a sign that the Japanese economy is exiting a holding pattern and transitioning towards sustained growth. Such a realisation may generate investor inflows into equities that are different in nature from those currently being seen in the market.

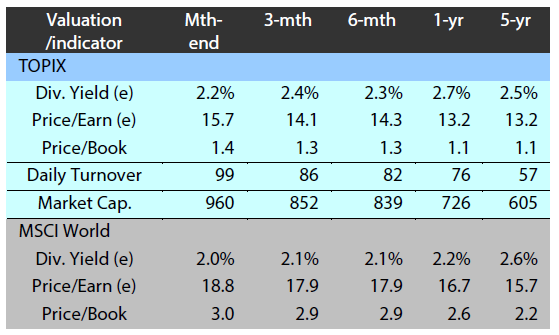

In sum, we can say that the stock market is in a healthier state compared to 1989, when Japan was at the height of the asset bubble era. Metrics like the price-to-earnings ratio show that Japanese companies are more profitable now than they were in 1989; furthermore, the market is supported by an economy finally shaking off the shackles of deflation with rising wages and increasing capital expenditure once again becoming the norm.

Focus sharpens on consumption, wages after Japan’s Q4 GDP contraction

In the section above we mentioned the possibility of the stock market, which is currently on a bull run, facing temporarily volatility, suggesting that stronger evidence of sustained economic growth would be needed to create a steady uptrend. The weaker-than-expected gross domestic product (GDP) numbers released in February showed why the convincing economic growth the market needs is yet to be fully realised. Weighed down by weak consumption and capital expenditure, Japan slipped into a technical recession as its GDP shrank an annualised 0.4% in Q4 2023 after seeing a 3.3% contraction in Q3 (although recent capex data imply an upward revision for the GDP). The lacklustre GDP data help explain why the stock market is potentially running ahead without the full support of economic growth and could eventually hit a few speed bumps as it does so.

In terms of GDP, the focal point in 2024 will continue to be private consumption. Up until now wages have been rising but failing to keep up with inflation. The situation could change in 2024, however, as rises in prices, particularly those of foodstuffs, have begun to show signs of easing. On the other hand, wages are expected to continue rising this year amid persistent labour shortages—a development we have followed regularly in this series. This means that there is a good chance of real wages finally outstripping inflation and rising in 2024 while in turn boosting consumption. Seen from a different angle, it is worth pointing out that Japan’s nominal GDP growth of 5.7% in 2023 was the highest since the 6.5% recorded in 1991. This significant rise could have a positive impact on sentiment as nominal growth is associated with how individuals actually feel and perceive economic conditions. Increasing nominal growth likely provided consumers with a taste of what higher pay feels like—something the older generations are unlikely to have experienced since the early 1990s when the economy was still in the last phase of the bubble era.

Many news headlines were dedicated to Germany overtaking Japan as the world’s third largest economy following the latest GDP release. With the two countries in the spotlight, it bears mentioning that relative to Japan, Germany relies more on China as a final destination for its goods. This means that slowing Chinese economic growth and consumption would have a greater negative impact on Germany than Japan, which focuses more on China as a manufacturing base.

Market: Japan equities continue rising in February on strong earnings, weak yen

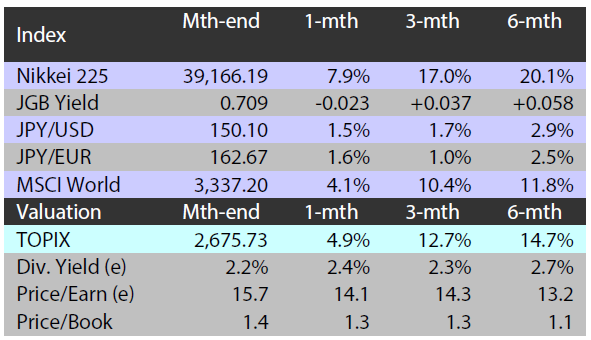

The Japanese equity market ended February higher with the TOPIX (w/dividends) up 4.93% on-month and the Nikkei 225 (w/dividends) rising 7.99%. A number of positives bolstered stocks, including overall solid domestic corporate earnings and comments from the BOJ governor implying that even if the central bank were to scrap its negative interest rate policy, it would maintain monetary easing, which in turn led the yen to weaken further against the US dollar amid the outlook for the prolongation of the BOJ’s ultra-loose policy, and spurred expectations for strong earnings for exporters. At the same time, investors are anticipating enhanced shareholder returns as a result of the Tokyo Stock Exchange’s push to encourage listed companies to improve capital efficiency. Japanese equities were also supported by the rise in US equities on the back of strong earnings results at major semiconductor firms benefitting from the generative AI boom.

Of the 33 Tokyo Stock Exchange sectors, 25 sectors rose, with Transportation Equipment, Insurance, and Oil & Coal Products posting the strongest gains. In contrast, 8 sectors declined, including Textiles & Apparels, Marine Transportation, and Foods.

Exhibit 1: Major indices

Source: Bloomberg, 29 February 2024

Exhibit 2: Valuation and indicators

Source: Bloomberg, 29 February 2024