While the “tariff crisis” may have clouded Japan’s economic outlook, the prospects are certainly not opaque as it may look to reduce the role of US exports. Trade tensions have also prompted the Bank of Japan to hold monetary policy steady, but the central bank is still seen to be on course to hike interest rates in the longer term as it takes into account the continuous rise in domestic inflation.

“Tariff crisis” may prompt Japan to reduce reliance on US exports, accelerate shift to a domestic demand-led economy

As recently as six months ago, there was optimism that Japan could benefit from realignments in the global supply chain resulting from a fundamental change in US-China trade relations. However, such optimism has been tempered by Washington’s blanket tariffs on its trade partners. This development is especially concerning for Japan, given its large trade surplus with the US. Early in April, Japan faced a so-called reciprocal tariff of 24%, but the US later announced a 90-day pause on the levies.

The “tariff crisis” has certainly clouded Japan’s economic outlook, but it is worth assessing where Tokyo stands without being carried away by the flurry of headlines. Despite the uncertainty surrounding US tariff policies, Japan is benefitting from positive factors such as tight labour market and wage increases. The immediate focus will be on how Japan negotiates with the US to potentially reduce the tariff rate during the 90-day pause and beyond. In the longer term, Japan aims to decrease its reliance on exports to the US by shifting production to cater directly to local consumer demand, potentially involving luxury items like high-end automobiles, in a gradual process.

The gradual nature of this transition is crucial as it allows Japan time to bolster domestic demand, which is vital for sustaining wage growth. Japan’s shift towards a domestic demand-led economy will be pivotal in reducing its dependence on trade with the US.

There are also US-specific factors that Japan will be closely watching. The foremost is the US midterm elections in 2026. Ahead of the midterm elections, Washington could soften its tariff-related rhetoric if it feels that its trade policies are undermining voter support. A softening of tariff-related rhetoric can help Japan in two ways. First, it can keep US consumer demand intact, which would in turn ensure a degree of demand for Japanese goods. Second, it could favour Japan in its trade negotiations with the US. The future of US trade policies remains unclear, but Japan, if given the time, can make gradual adjustments without significant negative effects on its economy.

BOJ holds steady but still on course to raise interests rates in the long term

The trade policies embraced by the US can certainly be regarded as a turning point for the BOJ. As with the Federal Reserve, the BOJ has been forced to take a wait-and-see stance until the tariffs are negotiated and the impact on the economy can be assessed. As widely expected, the BOJ kept interest rates steady at 0.5% on 1 May as trade tensions clouded Japan’s economic outlook. With the immediate future uncertain, the likelihood of the BOJ raising interest rates in the near future has receded, especially with the hot labour market now facing potential challenges.

While rate hike prospects have receded in the short term, the BOJ is still expected to resume its tightening of monetary policy from the summer onwards and to raise rates at least once before the fiscal year ends in March 2026. US tariff policy is a factor the BOJ cannot ignore but the central bank must also continue to monitor domestic prices, which have continued rising. The BOJ may feel secure enough to raise rates if it feels confident that the upward movement in prices is firmly backed by increasing wages. Again, a gradual pace of change will be key in this regard. If Japan can maintain demand for labour by transitioning to a domestic demand-led economy and diversify its export destinations beyond the US, the virtuous cycle of wages and prices could remain largely unaffected.

Some observers may note the recent foreign exchange swings as a potential factor impacting BOJ policy. Not too long ago, the BOJ came under pressure to hike rates to curb the yen’s depreciation against the dollar. The yen has bounced back since; it was near 160 per dollar at the start of 2025 but is now close to 140. The rebound by the yen is seen as a factor likely to lessen the pressure on the BOJ to tighten monetary policy. However, from a historical perspective the yen remains relatively weak, and the degree of its recent appreciation may not be significant enough to warrant a delay in interest rate hikes. Exchange rates may have some influence on monetary policy, but they are unlikely to alter the BOJ’s commitment to hiking rates. The BOJ’s intention is to normalise interest rates as much as possible when the aforementioned virtuous cycle of wages and prices is intact, and exchange rates are unlikely to significantly affect its stance.

Japanese equities edge up in April amid hopes for slight easing in trade tensions

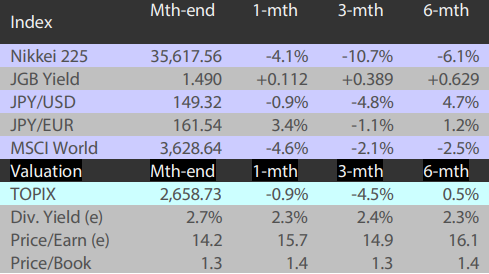

The Japanese equity market ended April higher with the TOPIX (w/dividends) up 0.33% on-month and the Nikkei 225 (w/dividends) rising 1.21%. Stocks were weighed down to an extent by concerns regarding a global economic downturn and a slowdown in fuel demand as a result of the intensifying trade friction between the US and China, spurred by the tariffs levied by the new US administration, with energy-related stocks being particularly impacted. On the other hand, the US administration announced a 90-day pause to the additional tariffs beyond the base “reciprocal tariffs” for certain countries and territories, which alleviated some concerns regarding a deterioration to the global economy. Additionally, remarks made by the US president prompted rising expectations for an ease of trade tensions between the US and China as well as room for tariff negotiations between the US and Japan, with such developments supporting Japanese equities overall.

Of the 33 Tokyo Stock Exchange sectors, 14 sectors rose, with Other Products, Construction, and Retail Trade posting the strongest gains. In contrast, 19 sectors declined, including Oil & Coal Products, Mining, and Banks.

Exhibit 1: Major indices

Source: Bloomberg, 30 April 2025

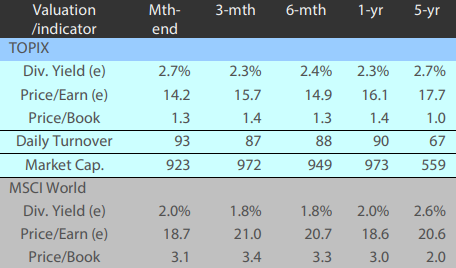

Exhibit 2: Valuation and indicators

Source: Bloomberg, 30 April 2025