Japan’s July upper house elections marked a pivotal moment in its political and economic trajectory. While the ruling coalition’s loss raises concerns over fiscal discipline, it could steer Japan toward a consumption-led economy. Japan could experience domestic-driven growth not seen in decades.

Fiscal concerns valid, but potential for structural shift should not be overlooked

The upper house elections held late in July marked a major turning point in Japanese politics. The ruling coalition of the Liberal Democratic Party (LDP) and Komeito lost its majority in the chamber, following on from its loss of the lower house majority in 2024. This outcome reflects growing voter dissatisfaction driven by concerns over rising living costs, the LDP’s political funding scandal, and a broader desire for fresh political alternatives. Many voters turned to newer parties, signalling a shift in public sentiment.

From a market perspective, the coalition’s defeat was expected and did not trigger major volatility. Investors had feared a more significant loss, so the market met the outcome calmly. The most notably point is that most parties, regardless of their ideology, now favour fiscal expansion. The LDP, which would like to rein in spending, now has to compromise with parties on matters related to fiscal stimulus. As a result, rather than industry-focused spending—such as on AI, semiconductors and space—policy priority could shift to consumer-targeted measures such as subsidies and tax cuts.

A shift towards greater fiscal spending raises two key points: the direction of long-term yields and the outlook for Japan’s credit ratings. First, fiscal expansion could lead to higher inflation, which in turn may accelerate the rise in long-term government bond yields. Short-term rates, on the other hand, may not rise as much as the Bank of Japan (BOJ) is expected to refrain from hiking interest rates until it can fully gauge the impact of increased fiscal stimulus. Second, weakened fiscal discipline could lead to credit spread widening. However, such a risk may be temporary. As inflation rises, tax revenues are expected to increase, helping to reduce Japan’s debt burden in real terms. This dynamic could offset some of the pressure on credit ratings and mitigate long-term concerns about fiscal sustainability.

While higher long-term yields and wider credit spreads present certain risks, the potential for a major structural shift in Japan’s economy following the coalition’s upper house elections loss may warrant greater attention. A transition to a consumption-led economy can help Japan move decisively away from its traditional reliance on exports and a weaker yen. Such a shift would represent a major positive turning point, offering a rare opportunity for sustainable domestic growth. Japan has already laid the groundwork for such a transition, with wages rising amid a persistent shortage of labour—a dynamic that supports stronger household spending. A successful transition, however, will depend heavily on the government’s ability to spend wisely to guide Japan towards a consumption-led economy. If Japan can build a resilient, consumption-driven economy, it may be better positioned to withstand a stronger yen, particularly if the dollar weakens in response to future rate cuts by the Federal Reserve.

It must be said that there are risks to increased fiscal spending, notably inflation outpacing wage growth and dampening consumer sentiment. However, government policies such as free tuition and subsidies for utilities could help lower inflation and support real income growth. If these policies succeed, they could spark a virtuous cycle of consumption and growth.

The most exciting aspect of the upper house elections outcome is that Japan may be on the verge of becoming a country unlike anything investors have seen in decades. While concerns about Japan’s fiscal discipline and credit rating are valid, the potential for a positive structural shift should not be overlooked. Due to its status as a minority government, the coalition will have to engage in a gradual process of policy compromises with the opposition parties. The process is likely to be slow and measured, helping Japan avoid a Liz Truss-style market shock similar to the event the UK experienced in 2022.

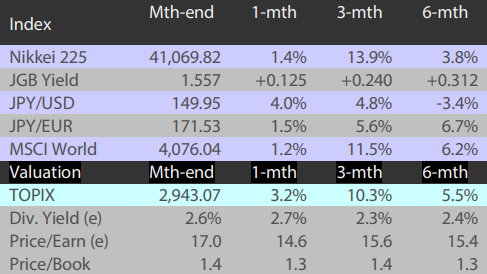

Japanese equities rise in July on easing tariff concerns

The Japanese equity market ended July higher with the TOPIX (w/dividends) up 3.17% on-month and the Nikkei 225 (w/dividends) rising 1.44%. From early to mid month, the market trended downward amid uncertainty surrounding the import tariffs that the US would apply to Japan, as well as the rise in long-term interest rates following extensive news coverage of the struggles of Japan’s ruling party in the recent upper house election, leading to expectations for the opposition party, which supports expansionary fiscal policy, to gain influence. However, later in the month after Japan and the US successfully bartered a trade agreement, expectations grew that the concerns regarding economic deterioration triggered by the reciprocal tariffs would recede, which boosted Japanese equities. The market was also supported by the BOJ leaving policy rates unchanged at its Monetary Policy Meeting.

Of the 33 Tokyo Stock Exchange sectors, 31 sectors rose, with Nonferrous Metals, Oil & Coal Products, and Banks posting the strongest gains. In contrast, only 2 sectors declined: Other Products and Retail Trade.

Exhibit 1: Major indices

Source: Bloomberg, 31 July 2025

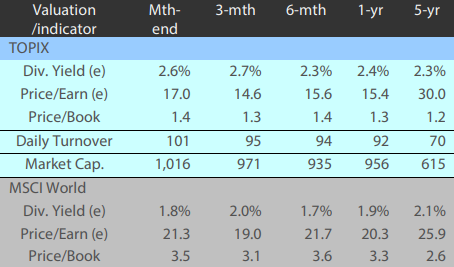

Exhibit 2: Valuation and indicators

Source: Bloomberg, 31 July 2025