Over the recent years, there has been a tendency amongst politicians and the media to target the CPI rather than inflation itself, or at least the inflation process. Too often have we heard from policymakers that inflation can be brought down through direct government subsidies or price controls. Subsidies may well have a justifiable social purpose, particularly during times of externalities such as wars but they have no role in controlling inflation. We have even heard that interest rates should not be increased “because they affect mortgage rates and mortgage costs are in the CPI”.

Comments such as these confuse the unit of measurement (i.e. the Consumer Price Index, which is itself a fairly arbitrary construct – after all, who buys a third of a TV a year??), with the process that causes prices to rise. The latter is usually the result of an imbalance between supply and demand and inflation can therefore only really be reduced by improving supply or reducing demand. Subsidies, which by their very nature are designed to support demand, tend to have the opposite effect in practice, particularly when they are financed via windfall profit taxes that undermine supply…

The situation is a little more complex when it comes to fuel prices. We believe that oil prices are rising at present for a variety of reasons – geopolitics (which may well get worse); cartel behaviour by producers; possibly some speculative forces; and because the world has systematically under-invested in hydrocarbon capacity for decades (extraction and refining).

Certainly, there seems to have been little investment in the sector according to the data and industry sources point to there having been a systemic lack of maintenance CAPEX in the industry, a situation that deteriorated further during the Pandemic when moving the necessary engineers into the correct locations proved very difficult at times – a week on the ground in Iraq involved an 8-week business trip from Europe.

It is entirely possible that troubled geopolitics will lead to further upward pressure on fuel and some other commodity prices. We remain convinced that the idea of a BRICS currency is a fundamentally bad one; there is simply no way that the BRICS could be considered as representing an optimal currency area. However, if the concept is merely camouflage for the formation of a cartel amongst commodity producers who perhaps do not have the greatest relations with the West, then the idea makes more sense. If the West found that in the future it was obliged to buy oil and other commodities via a gold-backed BRICS currency, this “extra hoop” would give its suppliers leverage over the price and, just as in 1973, this would have significant implications for the Rest of the World. That the PRC has been stockpiling Gold and Oil of late is interesting in this context.

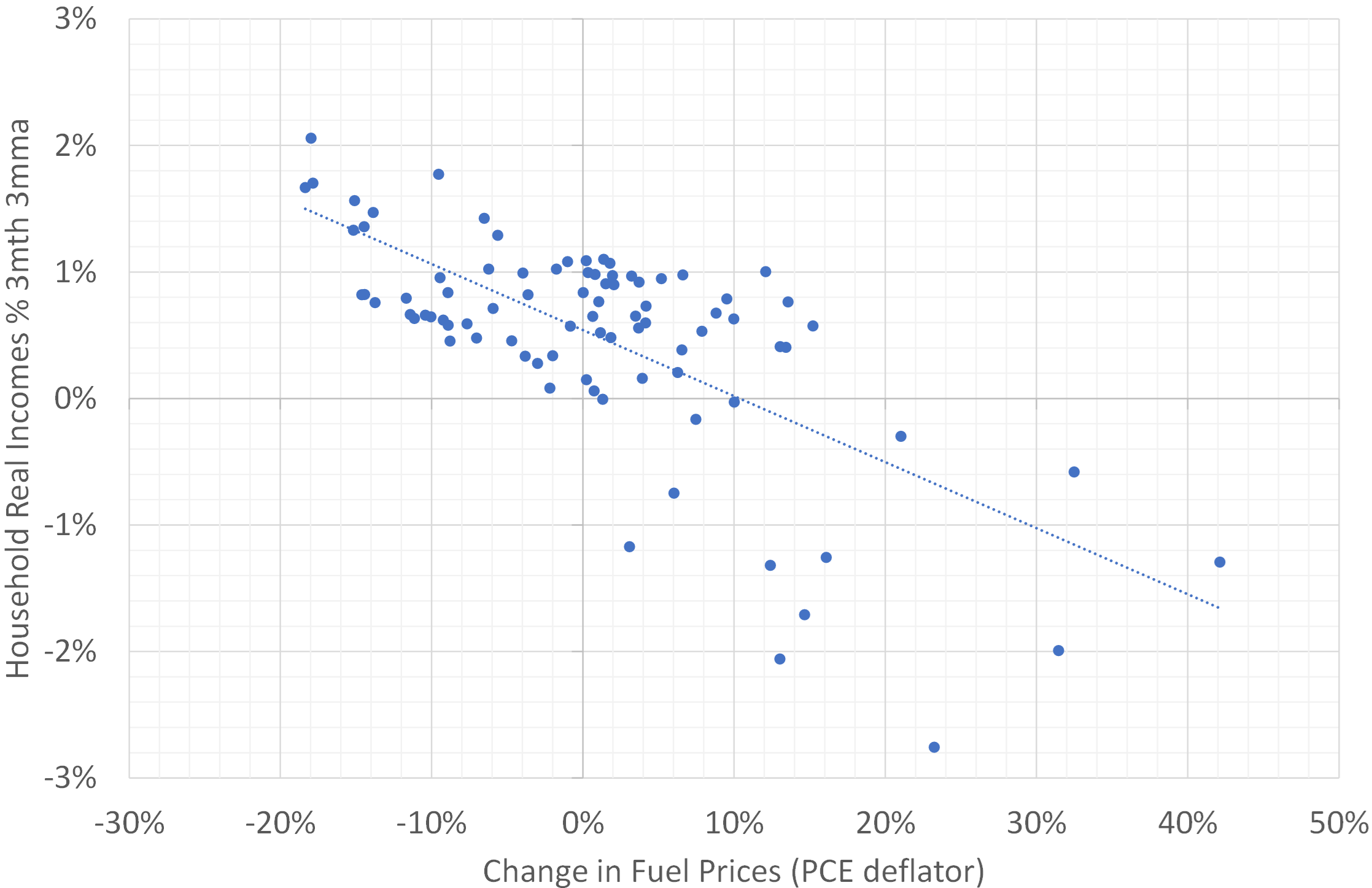

Energy prices are, of course, a significant component of the consumer price index itself, both directly and indirectly through their obvious impact on transport costs. Higher oil prices will raise the CPI, at least in the near term. However, the truth is that higher hydrocarbon prices typically transfer income and wealth from the many (i.e. virtually all of the World’s households) to the relatively few that own the resources. Yes, Western pension funds and private investors do own most likely shares in oil companies, but higher oil prices result in a transfer of income from those people that tend to possess a relatively high propensity to consume, such as Western Consumers, to those with a lower propensity to spend (at least on the types of goods that most people buy).

Therefore, while a higher oil price may be inflationary for the CPI “unit of measurement”, it tends to be deflationary for growth and activity, since it reduces real aggregate demand. Indeed, how many times have we witnessed an energy price shock tip an economy – or even the World - into recession?

Oil Prices & Incomes

It is true that higher energy prices can raise expectations of inflation and therefore encourage workers or companies to attempt to charge more for their output. Potentially, this could occur on this occasion – inflation expectations in the US do appear to have stopped declining - but this strategy will likely only “work” if the authorities accommodate the resulting demands and actions by running suitably loose monetary and fiscal policies. This does happen from time to time (1973 and 2021/2 being obvious cases in point) but if policy is restrictive when the shock occurs – as it was during 1990 – then the shock ultimately tends to be deflationary for most prices. All that happens is oil gains a higher relative price and the World Economy is weaker. Given the Fed’s current stance (if not the Administration’s fiscal stance), we would err towards the view that the FOMC has already done enough to prevent oil prices causing an inflation expectations rise in actual inflation rates.

In practice, and returning to the here-and-now, the recent rise in the oil price is already sapping household real incomes the World over and, if it forces CPI-targeting central banks to keep raising interest rates, this will only compound its deflationary impact on global growth and potentially force deflation in the “CPI-ex Oil” indices.

Longer term, higher oil prices might well represent good news for the Green Transition away from oil that must occur but, investors should be under no illusion that in the near term rising energy costs are bad for reported inflation, corporate profits, household incomes and activity. They also introduce yet more uncertainty into government policy formation in the near term, although shouldn’t be bad for bonds over the longer term given their impact on global growth, which does raise the interesting prospect that there could be a buying opportunity emerging in Fixed Income later this year.

Disclaimer: These views are given without responsibility on the part of the author. This communication is being made and distributed by Nikko Asset Management New Zealand Limited (Company No. 606057, FSP No. FSP22562), the investment manager of the Nikko AM NZ Investment Scheme, the Nikko AM NZ Wholesale Investment Scheme and the Nikko AM KiwiSaver Scheme. This material has been prepared without taking into account a potential investor’s objectives, financial situation or needs and is not intended to constitute financial advice and must not be relied on as such. Past performance is not a guarantee of future performance. While we believe the information contained in this presentation is correct at the date of presentation, no warranty of accuracy or reliability is given, and no responsibility is accepted for errors or omissions including where provided by a third party. This is not intended to be an offer for full details on the fund, please refer to our Product Disclosure Statement on nikkoam.co.nz.