The subject of inflation has of course dominated markets in 2022 and most investors – no doubt cheered by some recent improvements in the reported rate of US headline inflation – are hoping that the issue will fade over the course of 2023 and leave them a “clearer run”.

The improvement in inflation over recent weeks has been the result of a variety of what might be described as “special factors”, including overt government subsidies on things like energy supply (it is amazing that many politicians are targeting the CPI or the optics of inflation rather than the underlying processes that drive rising prices); acute economic weakness in China; and some favourable statistical base effects. However, in his latest speech, Fed Chairman Powell made it all too clear that he and the Fed will not be swayed by these “optical factors”.

Mr Powell made it abundantly clear that the Fed will only view the War on Inflation as having been won when demand has fallen relative to supply and there is a negative output gap. Only then will wage and domestic service sector inflation rates soften, and only then will the underlying processes behind rising prices be contained. Unfortunately, the action of reducing demand relative to supply is usually called a recession, but Powell indicated this as a price worth paying to restore price stability and to maintain the purchasing power of money.

It is for this reason that we are forecasting a mild recession in the USA in 2023H2 (albeit a steeper profit recession as rising costs collide with weaker final demand); a deeper recession in Europe; and more severe recession in the UK & Australasia. We think that the bulk of the work has been done when it comes to generating these recessions – income trends are already weak and interest costs have increased significantly – but the coming global Quantitative Tightening will almost by definition definition deflate private sector balance sheets by reducing credit supply and depressing property and other asset markets – will likely deliver the coup-de-grace to global growth.

Admittedly, China’s economy may have a better 2023 than 2022 in growth terms, but even here the expected improvement will be modest. In short, 2023 will either be a global recession, or merely feel like one.

Ordinarily, one would assume that the creation of dis-inflationary recession would represent good news for bond prices, and it is true that bond yields have tumbled over recent weeks. Unfortunately, we believe that this will prove to have been a “false dawn” for the fixed income markets. We expect higher yields and steeper curves in the months ahead, even as central banks ease up on the pace of rate hikes. It should be remembered that the debt markets largely ignored rising inflation rates during 2021 because of their own internal dynamics but we fear that these same dynamics will result in rising yields even as the Recession of 2023 unfolds.

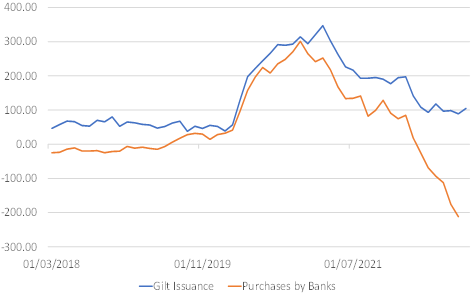

The media would have us believe that the recent “blow up” in the Gilt markets, the impact of which was felt across the spectrum of the domestic asset (savings) markets as well as the currency was the result of an ill-advised budget by PM Truss and her Chancellor. Certainly, the timing and the optics of the Truss budget were far from ideal, but it has long been our view that the Gilt market was already vulnerable because “real yields were so low as to make the Gilt market unfit for purpose” and because the internal supply and demand dynamics of the bond markets were turning extremely adverse as QE turned to QT. Removing the de facto MMT experiment was always going to cause Gilts problems…

UK: Gilt Issuance and Bank Purchases (NET)

GBP billion over 12 months

During October, UK Gilt prices sold off despite widespread expectations that the UK economy is in / heading for a recession as the simple weight of issuance undermined prices and non-bank bond investors demanded a higher yield before they would commit funds to the market. A key question for investors as we look into 2023 is whether the UK’s experience was merely a foretaste / warm up for what is about to happen on a global scale?

According to the US Department of the Treasury’s Funding Statement for 2022Q4, the US Government intended to raise $550 billion in net new debt over the quarter and to finish the year with a cash balance (savings) of $700 billion. Meanwhile, for the first quarter of next year, the government is apparently intending to borrow a further $600 billion, half of which is expected to be in the form of bills. The cash balance in March 2023 is forecast to be $500 billion, implying that the expected overall budget deficit in 2023Q1 is forecast to be of the order of $800 billion in total.

In reality, the October – November budget deficit has so far amounted to $670 billion, and December on average produces a small circa $20 billion deficit. This would seem to suggest that the Treasury’s budget deficit forecast for 2022Q4 has already been off by some $300 billion. Given the near 8% rate of inflation that the government is experiencing in its purchases, the overshoot is perhaps understandable. Unfortunately, another overshoot is probable in Q1 for the same reasons, and we expect a deficit of $900 billion in 2023Q1.

As a consequence, we can suggest that either Congress agrees to extend the Debt Ceiling in the next few weeks, and we are then treated to a “wall” of $1.5 trillion of Treasury debt issuance over the next three months, or we may have a US Debt Default Crisis looming in the early Spring if the Ceiling is not raised... Both outcomes would seem likely to raise longer term yields, even as the recession looms.

If anything, the situation in Europe is worse. During the height of the Pandemic in 2020, the Euro Zone governments borrowed a massive EUR1.1 trillion through the bond markets in order to fund their Pandemic policy response. However, concerted bond buying by not only the ECB but also by the commercial banking system implied that the supply of bonds available to non-bank investors barely increased that year. During 2021 and even the opening quarters of 2022, the continued bond buying by the ECB more than kept pace with the rate of issuance. Europe’s “MMT Experiment” has been comprehensive; in the 30 months from the beginning of the Pandemic, there was essentially no net issuance of government bonds outside of the banking system, a state of affairs that no doubt explains why European real yields are at record lows even today. However, the situation is beginning to change, quite radically.

According to JP Morgan, sovereign bond issuance in 2023 will total EUR900 billion, although in all probability this is an underestimate. It is likely that energy subsidies will cost more, and economic growth will be less and (wage) inflation higher than the official forecasters are assuming. Moreover, the European Recovery Fund, the EIB and the EC will all be borrowing as well. On top of this intense net issuance, we calculate that there is at least EUR1.5 trillion of Euro sovereign debt that is due to be rolled over in 2023.

In sharp contrast to prior years, the ECB is intending to shrink its balance sheet in 2023 by allowing some of its bond holdings to roll off. Moreover, the ECB has also started to unwind the TLTRO scheme, and we strongly believe that at least some of the former TLTRO funds were previously re-purposed to finance bond purchases by some domestic banking systems in 2021. Even on a quite conservative basis, it is quite easy to conceive of the European banking system – including the ECB – releasing EUR250 billion or more of bonds back into the markets.

On this basis, we calculate that net bond supply to non-bank investors – which has been minimal for years – will top EUR 1 trillion by some margin in 2023, while gross issuance could approach EUR2.5 trillion. For 2023 as a whole, the net funding requirement from the non-bank sector could be the equivalent of 9% of Euro Zone GDP, a simply unprecedented amount. Interestingly, peak debt issuance for the year tends to occur on the opening months of the year. The change in the internal supply and demand dynamics of Europe’s sovereign debt markets over the coming months will put the recent challenges in the UK’s Gilt market firmly in the shade. There is clearly a case for higher yields in the EZ as well.

Euro Zone: Sovereign Debt Issuance Outside Banking System

Actual and forecast, % GDP on rolling 4Q basis

We find it virtually inconceivable that investors will wish to acquire many of these bonds at the current ultra-low level of nominal and more particularly real yields, unless there is a Global Depression (first). Europe without the ECB’s QE will provide a very different environment for the bond markets, yields will be higher and those holding bonds today can expect potentially steep capital losses.

Moreover, we must also record that the largest net borrower – by some considerable margin, will be Germany as it seeks to insulate itself from higher energy prices while rebuilding its military. The last time that Germany embarked on such a mammoth relative borrowing spree was of course during its Re-unification, an event that wreaked havoc in European bond markets and tore the old European Exchange Rate Mechanism apart. Europe’s debt dynamics will add to the centrifugal forces that are already plaguing the Euro System.

Elsewhere, Japan does have an inflation problem of its own; the economy is running with a positive output gap and clearly staffers at the BoJ wish to tackle the inflation via higher yields and less QE (or even QT). However, the Ministry of Finance seems focussed on the fact that it has Y62 trillion of new bonds to issue and a further Y165 trillion of FILP and Treasury bonds maturing. As in Europe, it has been the banking system that has absorbed the overwhelming majority of government debt issuance over recent years (author’s note, we suspect that the true level of bank buying is somewhat larger in reality than these figures suggest, the BoJ may not record the JGBs that it acquires but then sells via Repos).

Japan: Monetizing the Deficit

Yen trillion over rolling 4 Quarters

It is our impression that the BoJ knows that it needs to tighten not just to control inflation but to maintain the “social contract” with savers (who by virtue of their asset allocation are very vulnerable to negative real rates) but the MoF evidently feels that Japan’s government cannot afford higher yields…

If the BoJ wins this particular argument, we would expect YCC to be modified in late January, a process that would of course imply higher nominal yields. However, if the MoF were to triumph and YCC is left unchanged, we would expect the JPY to fall very heavily indeed as not only foreign investors but also domestic savers dumped the currency. Already, more than half of the nation’s money supply is “backed” by JGBs held by the banking system that may never be repaid and, if the MoF confirms that they will never pay income either, then we suspect that some form of saver rout will occur to the discomfort of the currency (but potential benefit of higher yielding equities?).

In summary, it is firmly our view that bond markets largely failed to react to the strong economic growth and rising inflation environment of 2021 because there was a simple shortage of supply within the bond markets themselves that had been caused by the central banks’ own QE strategies. In 2023, as the central banks adopt QT in earnest and both release supply back into the markets and fail to absorb the rising levels of government issuance, we can expect bond market trends to once again diverge from economic fundamentals. Of course, this will leave equities facing the prospect of not only weaker growth but higher real yields, something that they would not usually welcome.

Disclaimer: The information in this report has been taken from sources believed to be reliable but the author does not warrant its accuracy or completeness. Any opinions expressed herein reflect the author’s judgment at this date and are subject to change. This document is for private circulation and for general information only. It is not intended as an offer or solicitation with respect to the purchase or sale of any security or as personalised investment advice and is prepared without regard to individual financial circumstances and objectives of those who receive it. The author does not assume any liability for any loss which may result from the reliance by any person or persons upon any such information or opinions. These views are given without responsibility on the part of the author. This communication is being made and distributed in the United Kingdom and elsewhere only to persons having professional experience in matters relating to investments, being investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005. Any investment or investment activity to which this communication relates is available only to and will be engaged in only with such persons. Persons who receive this communication (other than investment professionals referred to above) should not rely upon or act upon this communication. No part of this report may be reproduced or circulated without the prior written permission of the issuing company.