Assessing PM Kishida’s record stimulus package

Japanese Prime Minister Fumio Kishida began his tenure by outlining a larger-than-expected stimulus package in a bid to support the pandemic-hit economy and provide relief for households facing hardships due to the outbreak. The package, with a record JPY 55.7 trillion (roughly USD 490 billion) in fiscal spending, also includes Kishida’s signature policies, such as narrowing the wealth gap.

While the size of the package has drawn criticism from some, a significant part of the spending could be considered necessary as it will fund measures aimed at stimulating demand that had been weakened by the pandemic. Measures include the “GoTo” Travel campaign, through which the government subsidises travel and lodging fees for tourists. The large size of the stimulus could create demand sufficient to shore up the economy—succeeding where the preceding Suga and Abe administrations were left wanting. Public health is another area in which his predecessors were seen to have fallen short and which Kishida seems intent on improving. A significant part of the stimulus will be allocated to vaccine development and ensuring that the country’s medical facilities and personnel will not be stretched to the limit if Japan faces another coronavirus wave.

The portions of the stimulus unrelated to COVID-19 relief are aimed at narrowing the wealth gap and encouraging economic growth by supporting research and development (R&D) in advanced technologies. It must be noted that policies aimed at the wealth gap could lead to higher tax rates in the long run. Meanwhile, directly supporting R&D in advanced technologies is an entirely new approach by the government, which until now had provided support only through deregulation and loans. Taking a financial stake in R&D exposes the government to the risk of losing its investments should the research fail to bear fruit. These concerns might take some of the shine off the record stimulus, but there are still a number of aspects—notably policies aimed at generating demand and reinforcing COVID-19 measures—that allow us to view the package positively.

Gauging capital market trends under a new political administration

A noticeable trend in the Japanese capital markets is the steady increase in hostile takeover bids (TOBs) and corporate divestitures. We believe the trend reflects the increase in the number of investors, such as activist funds and strategic buyers, taking an active market role. These investors have publicly presented corporations with the option to reform themselves strategically, and their actions have made it easier for institutional investors to present their agenda as shareholders. The trend has been unimpeded by the pandemic, and we view it as a positive development for Japan that institutional investors are more easily able to present their agendas to corporations when they feel reform is necessary. This is positive both from a shareholder and corporate management perspective.

The immediate question for capital market participants is how corporate governance reform, under which Japan has been aiming to stimulate capital market activity, and the restructuring of the Tokyo Stock Exchange (TSE) will fare under Prime Minister Kishida. Kishida is seen to be less enthusiastic towards pro-market reforms than his predecessors Suga and Abe. At any rate, the answer is that the corporate governance reform and TSE’s restructuring will continue. However, matters could be slightly complicated as Kishida wants to drop quarterly disclosure requirements for companies, in line with the view held by some in the ruling party that such disclosures prompt companies to focus excessively on immediate profits.

However, empirical evidence from academic research suggests that the introduction of mandatory quarterly disclosures has not, on the whole, driven Japanese companies to short-termism. Moreover, a significant number of UK companies continue to disclose results every quarter even after the mandatory reporting requirement was removed in 2014. Japanese companies may do the same, in our view, with companies focusing on the positive aspects that a regular disclosure of information provides.

Market: Japanese stocks slip in November as Omicron variant dents sentiment

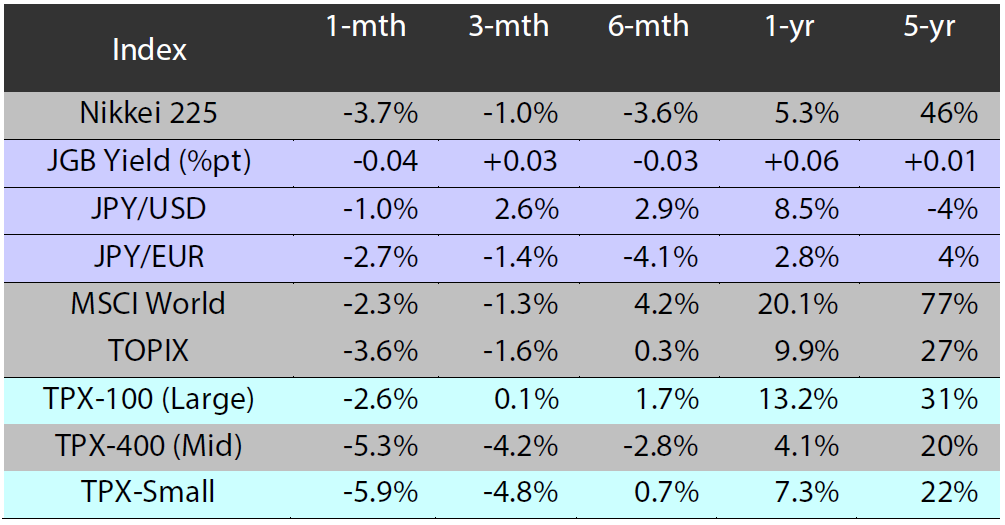

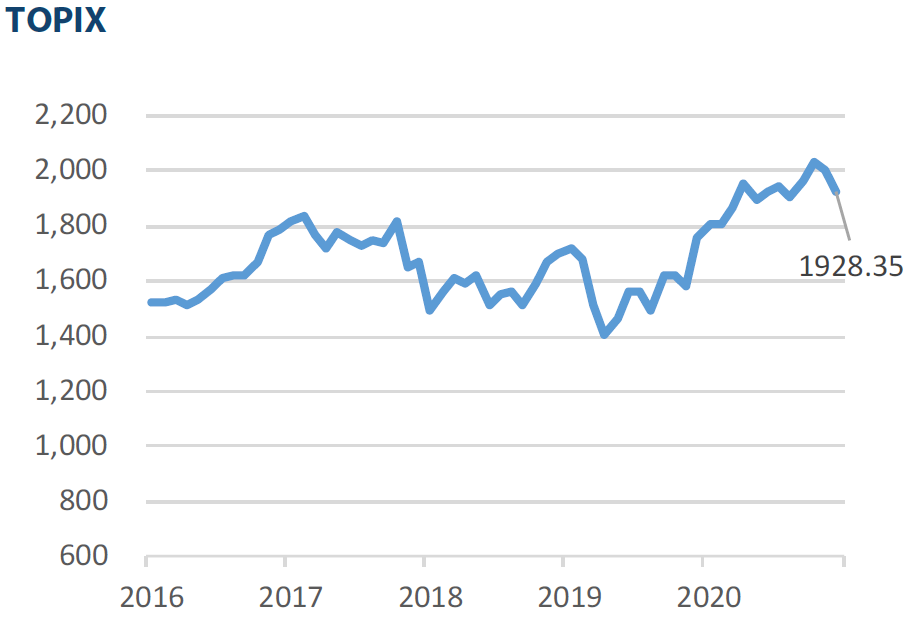

The Japanese equity market ended November lower with the TOPIX (w/dividends) down 3.61% on-month and the Nikkei 225 (w/dividends) down 3.68%. Share prices were bolstered by expectations for continuity in government policy following the victory of Japan’s ruling party in the lower house election, where it achieved an absolute stable majority, in addition to expectations arising from the detailed economic policies announced by the new administration. However, such positive factors were not enough to offset the downward pressure from pandemic-related developments. In particular the market was weighed down by global economic uncertainty amid a rebound in COVID-19 cases in Europe and concerns that the normalisation of economic activity would be delayed due to the discovery of the new Omicron variant and the resulting border control measures aimed at preventing its spread, including the reinstitution of a total ban on the entry of non-resident foreigners in Japan. Of the 33 Tokyo Stock Exchange sectors, only the Electric Appliances and Precision Instrument sectors rose, while the remaining 31 sectors declined, with Air Transportation; Iron & Steel; and Fishery, Agriculture & Forestry among the most significant.

Exhibit 1: Major indices

Source: Bloomberg, as at 30 November 2021

Source: Bloomberg, as at 30 November 2021

Exhibit 3: Major market indices

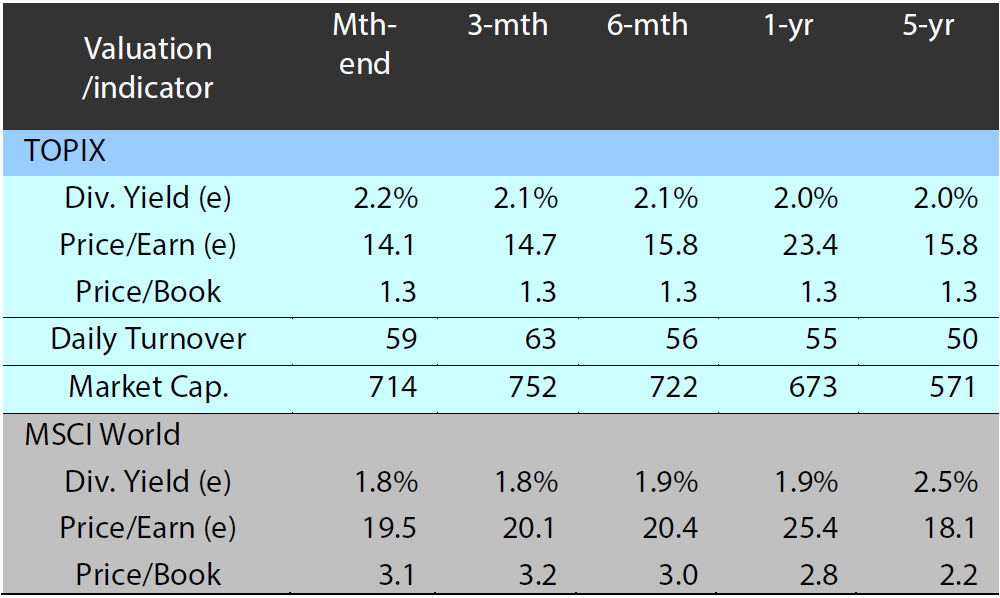

Exhibit 2: Valuation and indicators

(e) stands for consensus estimates by Bloomberg. Turnover and market cap in JPY trillion. Source: Bloomberg, as at 30 November 2021

(e) stands for consensus estimates by Bloomberg. Turnover and market cap in JPY trillion. Source: Bloomberg, as at 30 November 2021

Source: Bloomberg, as at 30 November 2021

Source: Bloomberg, as at 30 November 2021