It may not be quite as profound as the eternal “chicken and the egg question” but nevertheless we suspect that deep in the bowels of some academic institutions, aging economists are still debating which came first, money or credit? Did the flow of money into the banks allow them to make loans, or did the loans create the money?

Our answer to this question would – in the best tradition of two-handed economists - be both are potentially correct and that it depends on the circumstances. Prior to 1985 it probably was money that came first but since the mid-1980s we could argue that it has been the “credit guys” that have been dominant over the “banking guys”. We believe that the shifting balance between money and credit trends explains much of the inflation / deflation debate and, as we look back over our own experiences over the last 35 years, we can begin to see some clear patterns emerging.

For us, Asia has always represented something of a “test tube” for analysis and this remains the case. During the 1970s and 1980s, it was apparent that in general deposit (money) growth led credit trends (i.e. money financed credit) and that there were frequent booms and busts in the system. There were even textbook-like lags visible between the monetary cycle, asset prices, economic activity, and inflation / currency outcomes. However, there is one cycle within Asia’s history that stands out as being different and that was 1992-1998. During that cycle (for which we were present in that region), credit trends both led and exceeded money growth trends, primarily because a great deal of the credit growth in the region was being driven by large capital inflows from western banks, many of whom had just discovered the attractions of the “carry trade”.

Most conventional analysis of debt & credit thinks of debt repayment as something that happens sometime in the distant future in a world that may well be larger by then. However, carry traders - it turned out - had rather shorter time horizons when it came to getting their money back and conventional economic theory frequently failed (fails?) to recognize this inconvenient truth.

In order to repay debt, one needs money (that can be raised by foregoing consumption – the conventional theory – or even by selling assets). The problem for Asia in 1992-1997 was that the reliance on carry traders for the funding of a significant part of the credit growth that had occurred in the region during these boom years implied that there was simply not enough money within the region to be able to repay the debts that were being created. By definition, it was physically impossible for the economies to repay all of the debt that they were creating and unfortunately this flaw in the plan was revealed in late 1996 when the carry-traders started to ask for their money back immediately (because of events that were occurring elsewhere).

The resulting scramble for ‘cash’ to finance the required deleveraging at first plunged the Asian economies into depressions; then debt defaults began to rise as the impossibility of the situation became clear until finally the Asian governments simply started printing money and collapsing their currencies. Naturally, the effective price of money rose because of the acute shortage, and this was manifested in severe asset price deflation and significant deflation in the real economies.

When mentioning deflation, however, many people’s thoughts naturally turn to Japan in the 1990s. During the 1960s and 1970s Japan experienced, like many other countries, monetary booms which were occasionally fierce – and ultimately inflationary, in which domestic money and credit trends essentially moved in tandem. The Heisei Boom of the late 1980s however witnessed some tendency for credit growth to exceed money growth, particularly in its closing stages during 1990-1991.

In this regard, Japan also seems to fit our model, although there was another structural factor at work in Japan in the early 1990s that we believe helped to tip the economy towards sustained deflation. Although in theory there was (nearly) enough money available to unwind the credit boom, a spate of institutional failures in the banking system and capital markets implied that the money that was present within the system ended up being hoarded by savers and not released into the markets so that the credit system could “clear”. Ultimately, it took massive public sector intervention and large fiscal deficits to move liquidity from those that had the money to those that needed to deleverage.

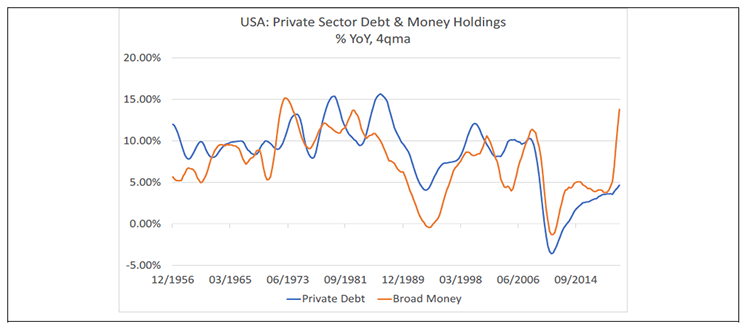

As it transpired, events in Asia & Japan provided a learning experiences that was to prove very useful in analysing what was to come in the West soon afterwards. If we look at money and credit trends in the USA, we can observe that until 1985, money and credit trends in the US had tended to be balanced, with money growth tending to lead credit growth. However, from the mid-1980s onwards, as the financial system was deregulated and seemingly underwritten by the Fed, the old-school bankers started to lose out to what Michael Lewis described in one of his books as the sexy credit guys. As a result, there were only two quarters between 1985 and 2008 in which money growth exceeded credit growth, and they occurred in the immediate aftermath of 9-11

The nature of the financial cycles between 1985 and 2007 (of which there were several) implied that the US – and in particular its financial system - was becoming ever less solvent. In practice, it was creating massive amounts of debt but funding this credit through fancy derivatives and complex special vehicles. But, at the system’s core, it was simply not creating enough money to unwind the debt if there was ever a day reckoning, as of course there was in 2008. When the system attempted to deleverage in the aftermath of the Lehman Debacle, the financial system soon “ran out of money” and the price of money rose via deflation in the asset markets as well as a sharp slowdown and deflationary scare in the real economy.

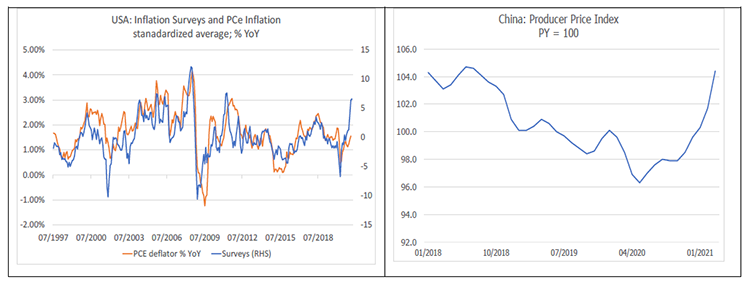

In the decade that followed the GFC, US money and credit trends ebbed and flowed, with some tendency for money growth to exceed credit growth. However, in 2017 there was finally a synchronized global credit and economic boom which went on to cause an inflation scare, albeit a short-lived one as money growth once again had failed to keep pace with credit growth during the upswing – particularly in the PRC. Once again, when credit conditions tightened in 2018, the global economy slowed sharply, and inflationary pressures evaporated quickly. Indeed, we did witness several solvency / funding crises in 2018-19.

Then came the COVID-19 crisis. In the US, we have since March 2020 witnessed an unprecedented gap emerge between money growth (rapid) and private credit growth (moderate), while in Europe money growth has exceeded credit growth and in Asia the two have moved broadly in line. This represents a unique situation; we have never before seen such an explosion in liquidity versus private debt, at least in the modern era. Against such a background, it comes as no surprise to find that US corporate liquidity looks to be at its strongest level in a generation and that the average household in the US appears to be in “rude financial health”, to quote one of their bankers.

On this basis, we should not be surprised to find that the threat of deflation has seemingly vanished and been replaced by a very real inflation of prices, particularly in both the USA and in Asia. The glut of money is, it seems, proving inflationary once again and the “solvency” analysis implied by our narrative suggests that higher inflation could be sustained.

There is certainly an argument that can be made to leave the analysis there, with the threat of inflation being the paramount economic risk to financial markets at present. Indeed, we believe that inflation is indeed the primary risk to asset prices over the next six months, but we are also only too aware that financial system leverage is now once again high in absolute terms and that the low level of yields / impact of QE on the banking system have conspired to leave what is now an immensely complicated financial system vulnerable to shocks.

In such an environment, it is not impossible that institutional failures, an inability for markets to clear, and other fragilities could yet deliver the “Japan outcome” whereby those that need liquidity in order to discharge their debts cannot access it. In the case of the USA, it might well be that the Federal Reserve is sufficiently large to step in both as the lender and perhaps more importantly dealer of last resort in a time of crisis, but we would not want to be in Chairman Powell’s shoes if the Fed were ever called upon to do what the BoJ failed to do in 1992-95.

In terms of strategy, all of this leaves us fearing an imminent inflation shock for markets (underweight bonds, EM & equity growth, some bias towards the USD and US small cap) but we are only too aware that, if markets do react to inflation and take fright, then the potential for systemic failures is far from zero and that these can easily result in deflationary outcomes even from potentially inflationary environments – as indeed they did in 2008-9. If there is a market event following what we suspect will be a quite sharp rise in US inflation this year, then the subsequent realized trajectory of inflation will ultimately depend on the amount of damage that is inflicted on the system and the Fed’s ability to contain / offset it.

Disclaimer:

The information in this report has been taken from sources believed to be reliable but the author does not warrant its accuracy or completeness. Any opinions expressed herein reflect the author’s judgment at this date and are subject to change. This document is for private circulation and for general information only. It is not intended as an offer or solicitation with respect to the purchase or sale of any security or as personalised investment advice and is prepared without regard to individual financial circumstances and objectives of those who receive it. The author does not assume any liability for any loss which may result from the reliance by any person or persons upon any such information or opinions. These views are given without responsibility on the part of the author. This communication is being made and distributed in the United Kingdom and elsewhere only to persons having professional experience in matters relating to investments, being investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005. Any investment or investment activity to which this communication relates is available only to and will be engaged in only with such persons. Persons who receive this communication (other than investment professionals referred to above) should not rely upon or act upon this communication. No part of this report may be reproduced or circulated without the prior written permission of the issuing company.