Shocks we Have Known, and the Return of Macro

The author is old enough to remember the rolling power cuts and “three day weeks” during 1973 and 1974 in the UK that were introduced by the government of the day in order to conserve the UK’s energy supplies in the wake of the first oil shock and industrial action by mine workers. Other countries were obliged to adopt similar policies, such as “no drive days”. Naturally, with the work week curtailed by law, the economies could produce less and this predictably resulted in shortages of some goods in the short term (and we also wonder what impact the power cuts had on education outcomes – for a nine-year-old it was all “fun” and a break from the school routine but there will have been longer term consequences).

The bottom line was that as a result of the disruptions, the UK economy was poorer and supply constrained for some time as a result of the “shock”. However, the government thought that it could insulate the population from the impact of this real shock by simply giving them more money, with the consequence that there was an increase in nominal variables even as real variables shrank.

Unsurprisingly, the result was excess nominal demand that had to be choked off by rising prices.

Moreover, one should not downplay the longer term economic and social costs of the Heath / Barber (PM & Chancellor) “experiment”. Rising prices eroded real incomes, particularly amongst the poorest members of society and led to more labour militancy over the next 5 – 10 years as workers understandably attempted to get compensation for the regressive inflation. Higher inflation also “wiped out” the savings of middle income families, while punitive tax rates discouraged investment. By 1978 the country was, quite simply, in a mess; unable to produce growth, employment, or prosperity.

New Zealand also suffered a series of shocks in the 1970s and the early 1980s – the oil shock produced a sharp weaking in the terms of trade. A collapse in agricultural goods prices in the early 1980s also hit the economy hard, as did the UK’s decision to join the EEC and therefore stop buying as many goods from NZ as it had in the past. All of these events made NZ poorer, but the government responded with a monetary and fiscal easing that while successful in boosting nominal GDP, created a prolonged period of higher inflation, economic stagflation, resource mis-allocation and almost a welfare dependency in parts of the household and corporate sectors. By attempting to deny that the economy was poorer through demand-side policies, the economic system was ultimately compromised despite the authorities’ presumed noble intentions.

Ultimately, NZ had to suffer the “Rogernomics” and deep recession of the late 1980s in order to cure itself and “admit” that it had in fact simply been made poorer by the previous shocks. However, the economy that emerged in the early 1990s was fundamentally stronger and somewhat more vibrant, if a little over-dependent on its housing market.

Fortunately, we have no personal experience of perhaps the ultimate supply shock, namely total war. An economy that is on what Keynes’ described as a total war footing has to divert productive capacity to armaments, while at the same time transferring workers into military service. As a result, the economy’s ability to produce not only consumption goods but also many “non-essential” investment goods will be severely constrained or even curtailed. Fortunately for the UK in 1940, Keynes and others were able to provide a reasonably accurate estimate of what the economy’s productive potential was likely to be, and to advocate an appropriate tightening of policy (via credit policies, taxes, compulsory savings, bond sales outside the banking system and direct product rationing) to prevent the supply shock implied by the war manifesting itself in inflation. The US also followed a similar path a few years later (hence the fixation on War Bond sales in the film “Flags of our Fathers”).

Other countries were less successful and many in both the First and Second World Wars simply printed money to pay for the wars, with the result that inflation raged and domestic support for the governments waned. Wars (whether civil or international) are by definition destructive and disruptive; they make societies poorer and attempting to hide this fact by running looser policy settings is always ruinous (and we would include the US’s “Guns and Butter” approach in the late 1960s and early 1970s as being yet another, albeit less extreme, example).

On a slightly different tack, we would also offer the more micro example of a company that produces something that nobody wants, such as Betamax tape players, 8-track car stereos, Gull-wing sports cars with stainless steel bodies etc etc. In theory, the owners of a business that has not kept pace with innovation or market trends should simply close but experience has shown that in reality they often start borrowing ever larger amounts of money, or raising equity from investors that still “believe”, or even seeking government support so that they can keep producing goods and employing people. Unfortunately, all that this usually does is delay the inevitable and ensure that the final bankruptcy is even larger….

This all brings us back to COVID-19, which we would argue has been the first truly global supply shock since 1973. Indeed, the fact that it is the first supply shock in fifty years implies that few, if any, policymakers have any prior experience to help guide them.

Also, the economics profession is probably not being of much help to policymakers either. We suspect that most modern day academics – or even market economists – would scoff at Keynes’ essentially rough calculations that he showed in his important pamphlet “How to Pay for the War”, and today they would probably try to build some complex models that might only serve to complicate the subject, or support their own pet theories & positions. Economists have a nasty habit of using complexity and false accuracy to hide or even deny what is often the blindingly obvious.

In reality, we simply do not know at present by how much COVID-19 has reduced global supply and by how much it has made us poorer, merely that it has done so to some as yet to be determined extent. We do not know because we are very poor at measuring aggregate supply potential, and even when we look to the realized output data, this will likely be quite flawed in the near term as a result of the compromising of the seasonal adjustment models.

Most seasonal adjustment models could not “cope” with the dislocations caused by the GFC or even the US’s unusually cold winters in the mid-2010s, so they stand next to no chance of dealing with the impact of the lockdowns! Analysts need to be very careful when using seasonally adjusted data over the coming months, since the chances are that the models will have bene rendered ineffective by the timings of the lockdowns. We should not kid ourselves that we know much about the real costs of COVID-19 at this time.

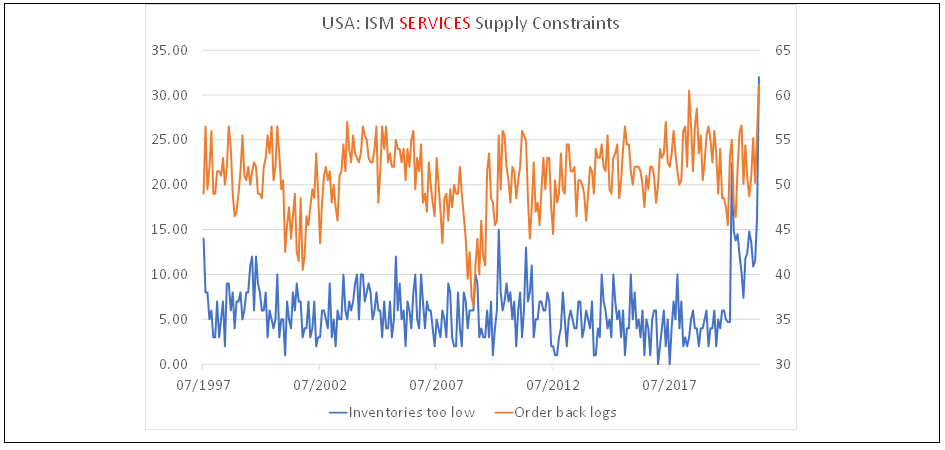

We are not usually supporters of the use of subjective survey data for forecasting purposes but in many respects this is all that we have available at present. What this data is telling us is that companies are experiencing / expecting a boom in sales but that they have neither the production nor the inventories available to meet it because of the supply-side shock implicit in the Pandemic.

The world is poorer in real terms because of the Pandemic and the new variants / patchy results of the vaccine programme imply that the shock will continue for longer than many were expecting – the UK was supposed to be “free” of restrictions by now but the delays keep creeping in…..

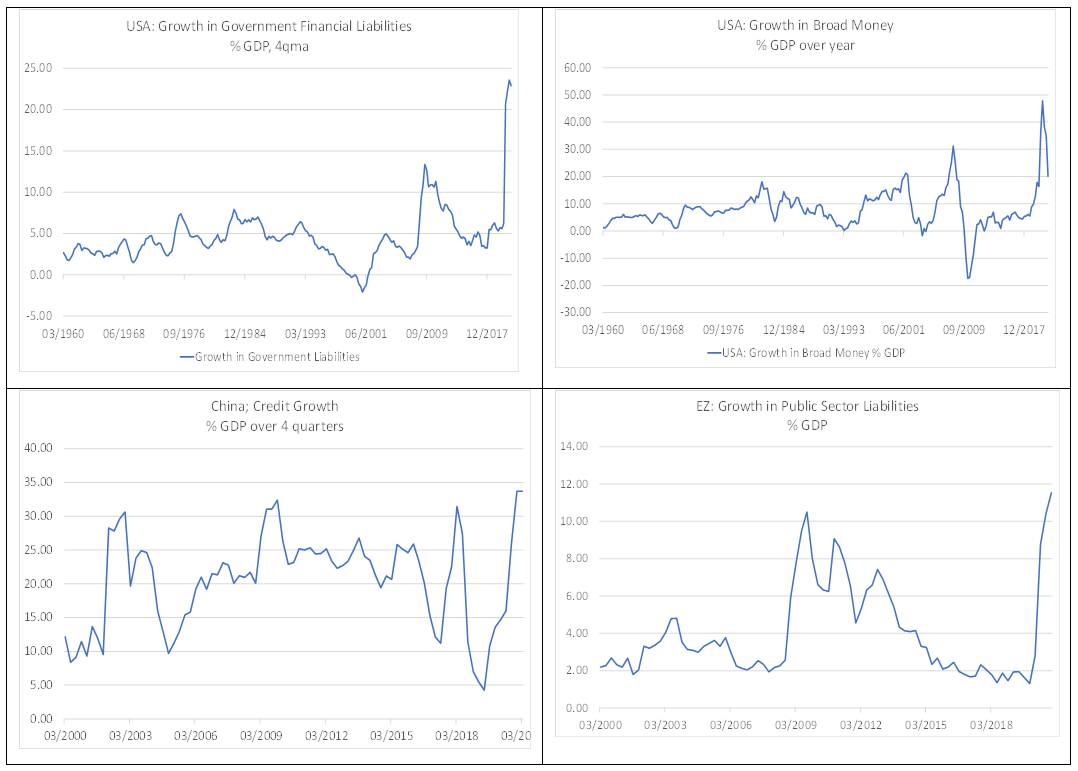

We also know that the global policy response to the Pandemic has been unprecedented and huge. Looked at relative to GDP, the monetary and fiscal policy responses in the USA have been extreme, and China’s policy response has been similarly immense. The EZ has been only a little more restrained.

In terms of what we do know, it is that global supply has been reduced by an amount (most likely a significant amount) but that, as they did in 1973, policymakers have responded to the supply crisis by providing an unprecedented boost to demand. History does repeat it seems, and therefore we should not be surprised to find that inflation is rising: nominal demand is up, real supply is down, and the price mechanism is working as it should.

Ultimately, this will impact bond prices but only when the internal dynamics of the bond markets allow. For example, we would argue that Treasury bond prices should be falling at present as inflation rates rise but that they are not doing so because the Fed is still creating liquidity, and the leveraged investor community needs bonds to back/facilitate its borrowing activities. Bond yields are not always good predictors of inflation and, as we noted in a recent piece about the UK Gilt market, institutional and market specific factors can delay – for a while – any reaction to fundamentals.

We also know that ultimately policymakers will one day have to react to the inflation – there will be a Volcker / Thatcher / Douglas out there who will have the political mandate that allows them to tighten and to cause a dis-inflationary recession. Clearly, we are not yet at this point but some of the recent polls / by-election results suggest that perhaps we are not as far from this point as many believe?

In the interim, there will most likely be a “grey area” in which some countries simply inflate and attempt to grow for as long as they can; other countries will stagflate with high inflation but low growth (this is usually those with the worst supply bottlenecks / least flexible economies); some will suffer political difficulties and unrest / collapse; and some will seek to control inflation early and produce sustainable growth with hard currencies.

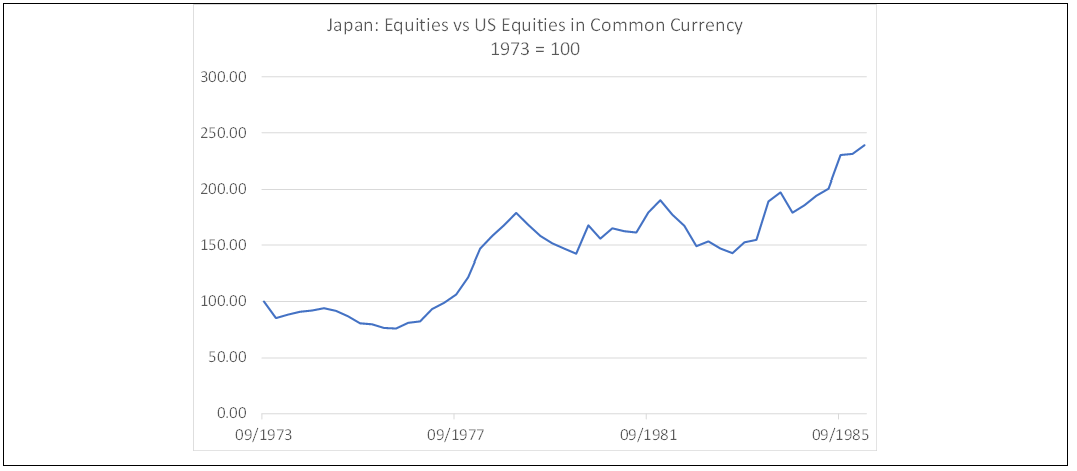

During the 1970s, it was Germany and Japan that fell into the latter category and emerged the stronger for it. Indeed, the BoJ’s switch to a dis-inflation / hard currency bias in 1976/77 apparently underpinned a period of marked outperformance by its equity market in dollar terms.

Certainly, the different outcomes / policy choices that governments make over the coming quarters will have vastly different implications for investors. Aside from identifying when the “big global policy U-turn” will actually occur (i.e. the “Volcker moment”), investors will need to focus on identifying the new hard currency countries which will likely produce steady sustainable returns for equity markets, while the stagflators or those countries that enter crises will most likely produce varying degrees of poor returns. The “inflate for as long as possible group” will presumably produce booms and busts in what will be soft currencies, just as they did in the 1970s.

Since Greenspan implicitly introduced a world of “soft budget constraints” in the wake of the 1987 stock market crash, macro-economic analysis has only really mattered occasionally during those usually brief periods when budget constraints were allowed to tighten.

However, by creating perhaps the ultimate in soft budget constraints over the last year within the context of a world that faces binding production constraints, policymakers have taken Greenspan’s model to an absurd level and most likely broken it. Ultimately, this may be good news for global growth & productivity – policymakers will have to get “real” again, and we sincerely hope that the transition period will produce gainful employment for the economics profession as macro starts to matter again, but in the near term we know that moving from ultra-soft to even medium budget constraints will likely prove painful for some – there are a lot of latter day DeLorean Motor Corporations out there that will not survive when budgets finally tighten. This really could be a case of Back to the Future…