Japan’s “Show Me the Money” Corporate Governance: 3Q Record High

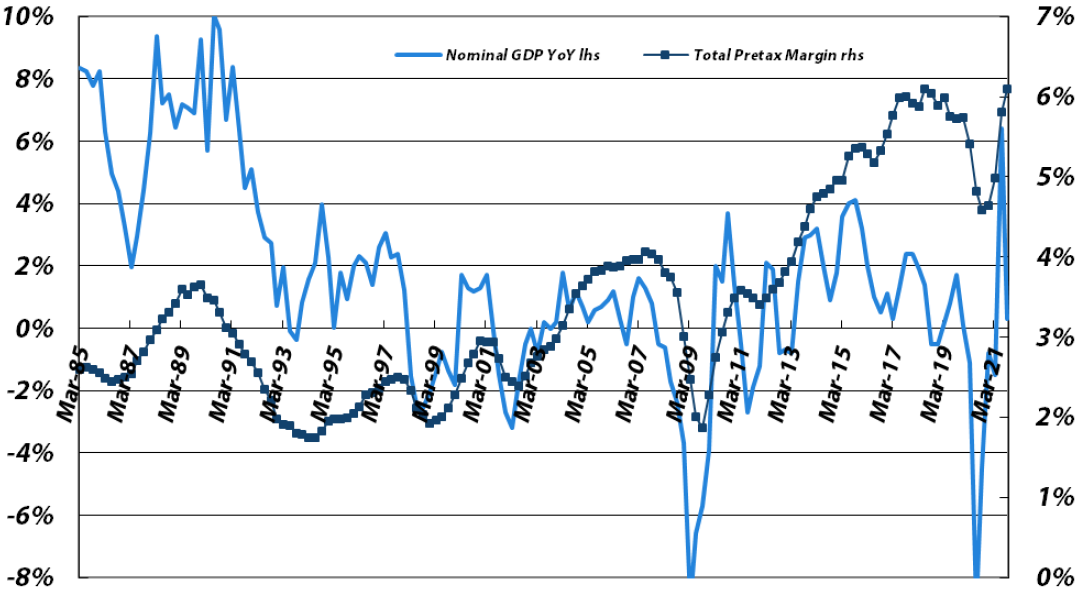

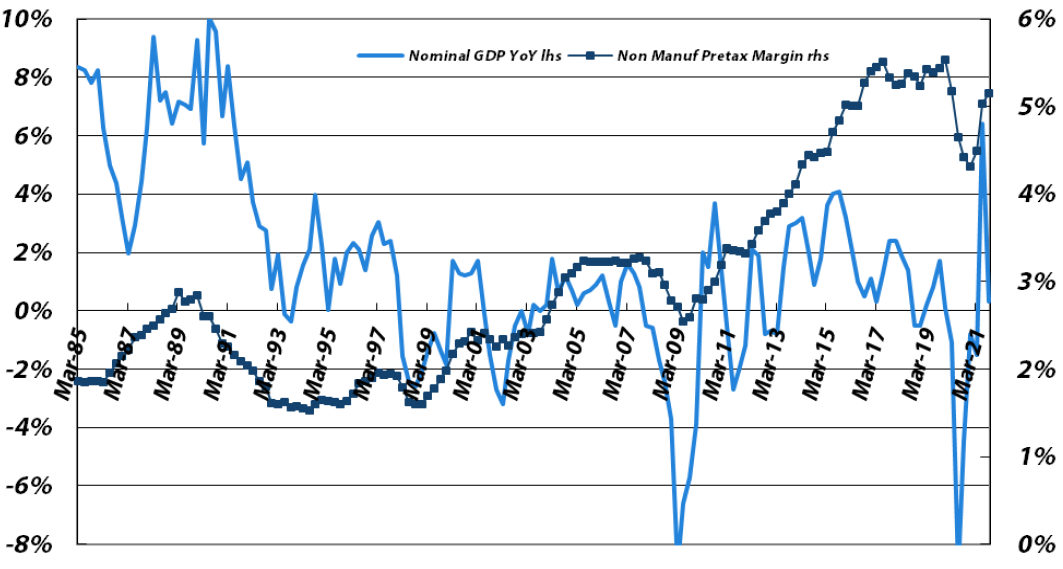

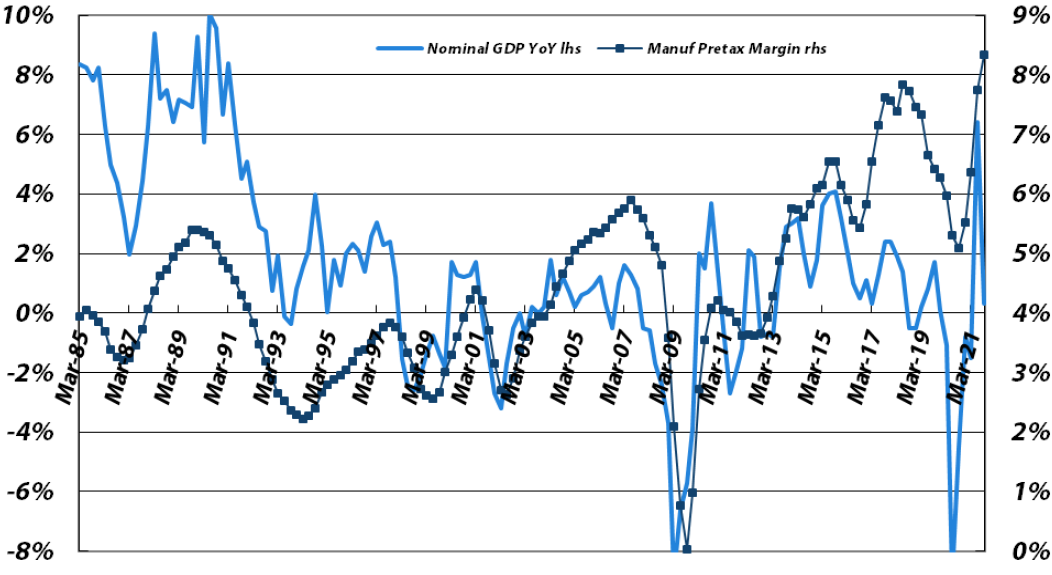

The just released 3Q CY21 data on aggregate corporate profits in Japan was very positive, as although for the single quarter, the overall corporate recurring pre-tax profit margin declined from the 2Q, as it does routinely for this non-seasonally adjusted data, it was a record high for any 3Q, and on a four-quarter average, it recorded a new high. Both the non-financial service and manufacturing sectors contributed, with the latter surging to record high. Note that the strong results occurred despite quite weak GDP, further proving the long-held theme of this report that profit margins remain on a structural uptrend despite sluggish GDP growth, as shown in the charts below. Both increased pricing power and corporate technology and efficiency should be credited for this, which boosts the value of Japanese companies and thus, of Japanese citizens, emboldening them to take more risk in this evolving era that requires such in order to remain globally competitive.

Four-quarter Average Pretax Profit Margin vs. Japanese Nominal GDP YoY Growth

(for all large non-financial companies, not just listed ones)

Sources: Japan Ministry of Finance, Bloomberg, data through 3Y2Q21

Sources: Japan Ministry of Finance, Bloomberg, data through 3Y2Q21

Non-manufacturers (excluding financials):

Sources: Japan Ministry of Finance, Bloomberg, data through CY3Q21

Sources: Japan Ministry of Finance, Bloomberg, data through CY3Q21

Manufacturers:

Sources: Japan Ministry of Finance, Bloomberg, data through CY3Q21

Sources: Japan Ministry of Finance, Bloomberg, data through CY3Q21

One should also note that the Ministry of Finance statistics cited in this report do not cover post-tax income, and due to corporate tax cuts a few years ago, the overall net recurring profit margin (which is unfortunately unpublished) has expanded even more sharply than the pre-tax data shown above, allowing shareholders to benefit from higher dividends and share buybacks. Also due to buybacks, EPS has been (and still is) growing even faster than net profits.

As for dividends, they have risen rapidly too, more than doubling since 2013 for the Tokyo Stock Exchange Index. Crucially, in order to stabilise Japan’s future, an Equity/Dividend Culture must be better established among retail investors in Japan. There have been gradual image improvements for equity investing since the speculative burst of the 1980s bubble, but achieving a structurally higher dividend payout ratio would be a master stroke as most domestic retail investors don’t accept buybacks as a primary reason to invest long-term in Japanese equities whereas they cherish dividend income, especially given prevailing flat or negative interest rates. Clearly, much progress has been made regarding dividends in the past few years, but much more is needed on this front.

As for the corporate view on dividends, even the most reluctant would now likely agree that their prior resistance to corporate governance reform was unwarranted and should realise that holding excess cash is equally unwarranted now and that Japan’s dividend payout ratio is rather low by mature country standards. Unfortunately, many corporations prefer buybacks to dividends for exactly the wrong reason: dividends are sticky and hard to cut, whereas buybacks can drop to zero with minor embarrassment. But this argument implies to current and potential shareholders that these Japanese companies have little confidence in their future, which is somewhat embarrassing and likely far too conservative. Indeed, in order to be effective as a support for share prices, dividends need to be communicated as being maintained at a high level even in a recession, barring grave financial threats to the company. This should protect the Nikkei from falling too far during troubled times and reduce fearful volatility in the long-term. Such would crystallise the domestic equity culture that Japan has long tried to instill, just like most of the rest of the developed world, and also would entice foreign investors back into Japanese equities.