This is the “swan song” of this report, which comes at an appropriate time because it was always meant to prove to readers that corporate governance, and the overall case for investing in Japanese equities, was sound. Now that the market’s performance and global enthusiasm for Japan has swelled, there is less need for the report, although it is useful to note the continuance of its impressive trend.

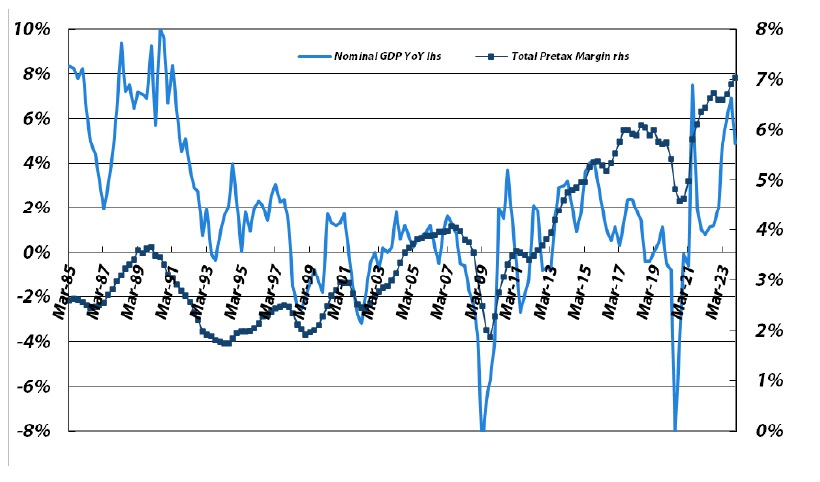

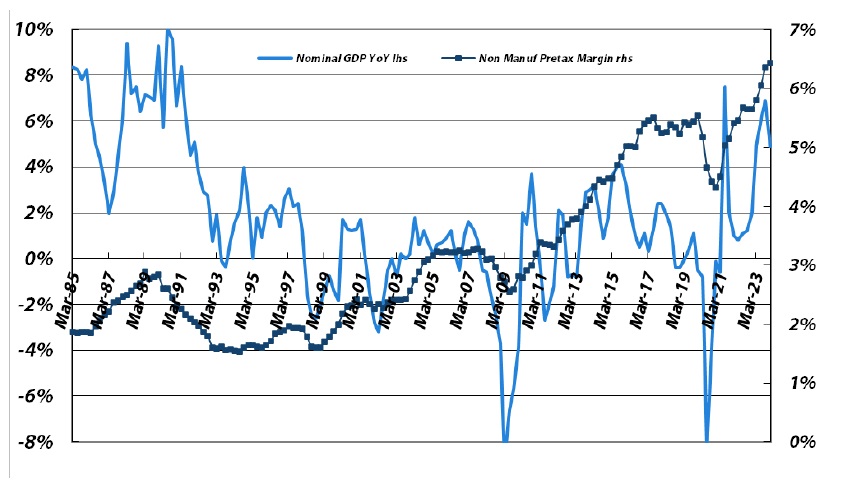

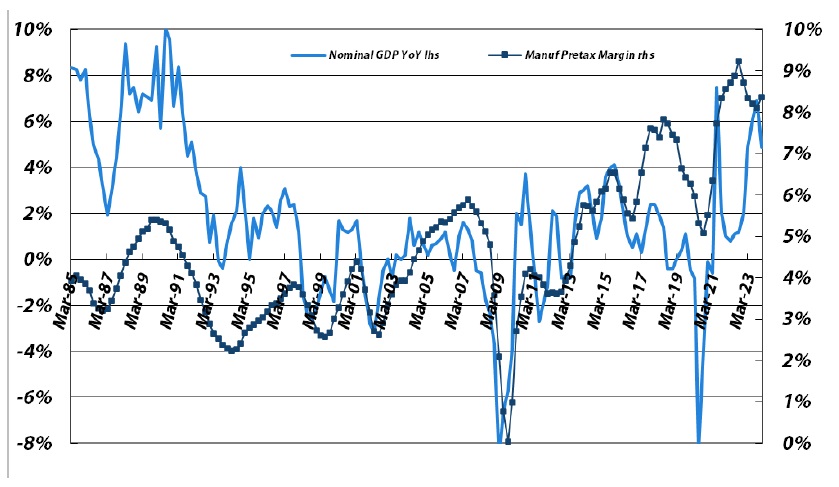

Some readers may not be familiar with the title-phrase, carried on since 2006, but it refers to the comedic movie “Jerry Maguire” in which a sports agent successfully delivers a lucrative contract to his American football client after long negotiations. Although there are many aspects of the deal in this movie, like in the issue of corporate governance, in the end, profit growth should be the ultimate factor and it is positive that Japan’s corporate governance is delivering in this way. Indeed, in the just-released 4Q CY23 data on aggregate corporate profits, the overall corporate recurring pre-tax profit margin surged to another record high on a four-quarter average. The non-financial service sector hit another record high, while the manufacturing sector rebounded towards its record high. The former sector’s pre-tax profits grew 10% YoY in the 4Q due to increased margins and revenues, while the latter’s rebounded to +20% YoY after a recent flat trend. The long-held theme of this report that profit margins remain on a structural uptrend, despite sluggish domestic GDP growth, still holds (although recent nominal GDP growth has clearly assisted to some degree) and domestic and international investors finally realise that Japanese corporations are delivering solid profits and shareholder returns, with the increased expectation that such will likely continue over the intermediate term.

Four-quarter average pre-tax profit margin vs. Japanese nominal GDP YoY growth

(for all non-financial companies, not just listed ones)

Sources: Japan Ministry of Finance, Bloomberg, data through CY2Q23

Non-manufacturers (excluding financials):

Sources: Japan Ministry of Finance, Bloomberg, data through CY2Q23

Manufacturers:

Sources: Japan Ministry of Finance, Bloomberg, data through CY2Q23

One should also note that the Ministry of Finance statistics cited in this report do not cover after-tax income, and due to corporate tax cuts nearly a decade ago, the overall after-tax recurring profit margin has expanded even more sharply than the pre-tax data shown above, allowing shareholders to benefit from higher dividends and share buybacks. Also due to buybacks (coupled with very limited share-based compensation), EPS has been (and still is) growing even faster than after-tax profits.

It seems that the myth that Japanese companies do not reward shareholders is finally now dispelled (along with several other myths long cited for avoiding investing in the country), and, thus, the P/E ratio for the market has risen. However, valuations remain reasonably attractive, especially for long-term investors. Some investors likely still worry about Japan’s low economic growth, but this report’s theme should greatly help dispel such. Forward EPS estimates continue to rise in Japan, as well.

However, Japan’s MSCI in USD terms has not outperformed MSCI World over the past two years (and remains only slightly above post-1989 lows), which means that Japan is hardly in a bubble or even over-bought relative to the rest of the world. Thus, given the increased global realisation of Japan’s improvements, outperformance vs. global markets seems highly probable ahead. Indeed, there is much media attention to the Nikkei finally exceeding its bubble-era high, and perhaps many investors will be moved by this event, but that outlier-era should always have been irrelevant to investors over the post-2006 tenure. Instead, they should have been appreciating the improvements that had already been made and their likelihood of continuation under the trends of new political leadership and geopolitical circumstances. Those who did appreciate such profited enormously, especially domestic investors. Since the end of 2009, TOPIX has produced a total annual return of 10.4% in yen terms, and 6.7% in USD terms, although it must be noted that a good portion of such has occurred since the end of 2022.

As always, challenges lie ahead for Japan, particularly from circumstances abroad, but the core trend of corporate governance, coupled with solid improvements in all the factors that have made Japan successful, should provide a sound foundation for the future.