There is a relatively simple narrative dominating markets at present, namely that the US economic recovery will accelerate as the latest stimulus measures are enacted, the output gap will close (if you believe it is negative – or it will widen further if you think as we do that it is already positive,) and US inflation will pick up by some amount. Opinions differ as to by how much inflation will accelerate – many people have chosen to follow the 2008 precedent and rely on the fact that QE did not cause headline inflation a decade ago – while others (ourselves included) see little or no validity in the 2009-10 precedent, at least at the moment. However, we suspect that there are only a very few people who do not expect faster nominal growth in the USA over the coming quarters and this, together with expectations for a stronger PRC economy and perhaps a belated recovery within the EZ, have fostered hopes for a global recovery - and some upward drift in inflation rates across the globe.

On this basis, one should be generally short sovereign bonds but be reasonably relaxed about credit spreads, while favouring cyclicals, banks, energy etc in the equity markets. We ourselves started talking nine months ago about this type of ‘1994 precedent’ for weakening bonds, a stronger dollar, and a sharp rotation into cyclical stocks and we suspect that this is now something of a very consensus view.

However, one part of the 1994 precedent / scenario has been forgotten – or at least not been given the attention that it deserves. Following 1994’s events, 1995 was in fact quite a bad year for global growth – China was probably as close to a recession as it could admit, Japan’s rate of GDP growth remained sub 2%, and growth in what was to become the Euro Zone slowed from over 4% at the end of 1994 to virtually zero by the end of 1995. Mexico spent 1995 recovering from its 1994 Crisis, and Brazil fell into a recession. The tightening of US liquidity conditions over 1994 reverberated around the World and many of the world’s weaker, or relatively fragile, economies ‘fell by the wayside’. Interestingly, the US itself was one the economies least affected by the slowdown: growth remained above 2%, although even this was only two thirds of what had been witnessed in 1994. Crucially, this was not the first time that the “US had sneezed but it had been the rest of the world had become bedridden”.

Unfortunately, we have recently witnessed what has amounted to a prolonged period of easy conditions and ‘anything goes’ soft budget constraints, thanks primarily to the stance of US domestic monetary policy. Since the NASDAQ Bust and 9-11, the Fed has allowed a massive creation of dollar liquidity both on and offshore, and although this paused rather abruptly in 2008, the disruption in credit supply during the GFC seems only to have been a temporary affair (particularly from an external perspective). This prolonged period of ‘anything goes’ has led to the creation of numerous excesses – highly valued asset prices, elevated house prices and unsustainable financial deficits across the World. Consequently, one could argue that the World is now occupying an inherently fragile position – just as it did in 1993 and even the early 1980s.

Of course, it can be argued – and indeed is argued in many quarters – that the Powell-era Federal Reserve simply has absolutely no intention of allowing dollar funding conditions to tighten either domestically or externally, and that therefore this underlying fragility is unlikely to be tested. Indeed, we have it on good authority that, even in private, the Chairman does not intend to allow conditions to tighten.

However, Mr Powell’s promises are based on two assumptions, namely that rising US inflation does not oblige him to tighten; and that he has absolute control over dollar credit conditions. Clearly, the only way in which inflation could force the Fed to tighten would be if it accelerated meaningfully and we do regard this as representing a significant risk later in the year for several important reasons.

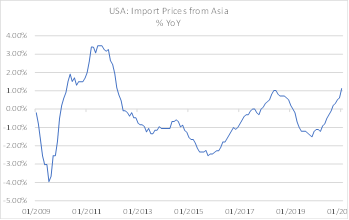

Unlike the situation that existed between 2008 and 2010, the proceeds of the Fed’s QE in 2020 have not been used to repay debt (deleveraging destroys money – hence money growth slumped once QE1 ended) but instead they have been used to inflate balance sheets and create ‘paper wealth’ that can now be spent in the real economy as the Pandemic retreats. Secondly, and again unlike the situation 2010, the US is today importing inflation rather than deflation from abroad.

Another crucial difference between 2008-2010 and today is that while the GFC was only a demand shock, the Pandemic has represented both a demand and supply shock. The Covid-19 slump has destroyed not only demand but also some part of the economy’s supply potential.

No one really knows by how much the economy’s ability to produce goods has been affected (most estimates centre at around 1-2% of GDP) but this does imply that the US economy today may only have a small negative output gap or perhaps even a positive output gap. Our own demand pressure index of capacity utilization suggests the latter, and this is clearly a far cry from the situation that existed in 2009-2010 when there was ample spare capacity in existence. If the various stimulus measures do succeed in creating a boom in nominal demand in the economy (as seems overwhelmingly likely), then the US could find itself with a positive output gap to rival those achieved in 1973, the late 1980s, and 2007. All these years witnessed accelerating inflation.

One of the Fed’s – and the dove’s – main weapons against the inflationistas is that the US reportedly no longer has a Phillips Curve type trade-off between growth / unemployment and wage inflation. For the last thirty years in their entirety this statement is probably true but there have been periods during which a Phillips Curve has appeared, most notably 2016-2019. Crucially, we have found that the Phillips Curve tends to reappear when growth rates in the individual States of the Union are synchronized in a particular direction and we can imagine no greater synchronizing event than the perceived end of the Pandemic. If the Post Covid-19 boom lifts growth in the majority of States, we expect the Phillips Curve to re-appear.

Given these factors, it is certainly not impossible that rising inflation could force Mr Powell’s hand towards an official tightening in monetary policy in 2022 (he even acknowledged as much in a recent Q&A session), but we are concerned that monetary conditions may in any case be tightening already, for reasons that are beyond the Fed’s control.

Credit flows with the global financial system now run almost exclusively on collateral, which in the real world means US Treasuries & German Bunds, then some way behind in the “pecking order” are JGBs, Gilts, OATs, and finally even some high-grade corporate debt in some areas. There are now very few Bunds available outside the EZ banking system, and perhaps even fewer JGBs - and so Treasuries are really now the only real form of collateral.

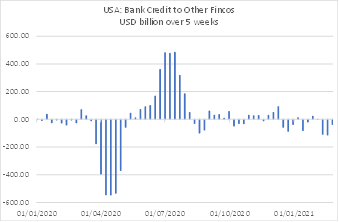

Last year, the US public sector withdrew (net) around $350 billion of collateral but the rise in the prices of Treasuries more than offset this, and thereby delivered a 10% (or more) increase in the stock of eligible collateral available to the system. It was this expansion of the “collateral base” that allowed the expansion in intra financial system credit flows last year that we follow so keenly – rising Treasury prices offset the decline in volumes and so we witnessed not just a rising USD monetary base thanks to the Fed’s QE but also a rising collateral base in the system.

However, this year we have witnessed a slight net reduction in the volume of bonds in circulation outside of the banking system, as well as a significant decline in the prices of Treasuries. As a result, we estimate that the stock of eligible collateral has declined by 6-7% YTD, even as the monetary base has increased. We suspect that it has been this, along with a potentially tighter regulatory regime and lenders’ own concerns over the validity of their VaR models that has led to a contraction in intra-financial system credit flows, and to a (highly) probable decline in the flow of credit across global borders so far this year.

To re-iterate, if US Treasury prices continue to weaken as they have been doing, then a binding and increasingly hard constraint on the ability of the global financial system to create dollar credit would be a shortage of collateral. In such a world it would not matter what was happening to the monetary base, QE, or even actual borrowing rates. From here, it would not be a large leap towards a tightening of global credit conditions and the removal of the accommodative soft budget constraints that many countries and sectors have thrived upon for so long. Indeed, recent price action in the BRL & TRY are suggestive of this event occurring as we write.

Rather ironically, it can be argued that because of the US public sector’s largesse, the US private sector is now in its best ‘financial health’ for some time and therefore perhaps much better able to stand a tightening in credit conditions than many entities abroad that have gorged themselves on USD credit over the last 20 years. Arguably, the US economy could withstand a moderate tightening in response to inflation, whereas some of its geopolitical competitors, with their large stock of dollar debts, might find the situation somewhat more uncomfortable.

While there are obviously some specific entities within the US that could not withstand a significant tightening in credit conditions – there will no doubt be the modern equivalents of the ENRONs, Maxwells and LTCMs that need constant injections of credit in order to survive, we can assume that the US private sector in aggregate is actually quite well-placed to survive any tightening of credit conditions if and when it occurs. Peripheral and rather spendthrift borrowers abroad – and in particular within some of the weaker EM - may however not fare quite so well.

Disclaimer:

The information in this report has been taken from sources believed to be reliable but the author does not warrant its accuracy or completeness. Any opinions expressed herein reflect the author’s judgment at this date and are subject to change. This document is for private circulation and for general information only. It is not intended as an offer or solicitation with respect to the purchase or sale of any security or as personalised investment advice and is prepared without regard to individual financial circumstances and objectives of those who receive it. The author does not assume any liability for any loss which may result from the reliance by any person or persons upon any such information or opinions. These views are given without responsibility on the part of the author. This communication is being made and distributed in the United Kingdom and elsewhere only to persons having professional experience in matters relating to investments, being investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005. Any investment or investment activity to which this communication relates is available only to and will be engaged in only with such persons. Persons who receive this communication (other than investment professionals referred to above) should not rely upon or act upon this communication. No part of this report may be reproduced or circulated without the prior written permission of the issuing company.