Snapshot

While economic data is likely to remain soft, driven by the more recent lockdowns in the US and Europe, markets are rightly looking through the near-term gloom as impending vaccines for COVID-19 are showing the proverbial light at the end of this nightmarish tunnel. Over 2021, the world, in our view, should gradually return to some sense of normalcy as the pandemic slowly recedes in the rear-view mirror. The accompanying acceleration of demand will be further fuelled by ample liquidity which continues to slosh through the system from very accommodative monetary policy and still relatively generous fiscal support.

The so-called “reflation trade” is on, with many equity markets delivering close to, if not their best, monthly performance ever. Such a broad shift in sentiment borders on froth in various corners of the market, but we still see opportunities in markets that have been particularly slammed by COVID-19, including emerging markets. Easy US Federal Reserve (Fed) policy and returning growth in the rest of the world help to ensure a weaker dollar, reinforcing support for value opportunities.

However, there is still much that can go wrong, particularly on the policy front. Support for risk assets has been buoyed by exceptionally low rates that are predictably beginning to lift. For now, central banks have shown success in their synchronised quest to print money and build balance sheets, but what happens as output gaps close and demand pressures build? As markets assess the eventual unwind of these programs, increased rate volatility will make the risk environment more challenging. This is not a near-term concern, per se, but a risk that we will watch very closely into 2021.

Cross-asset1

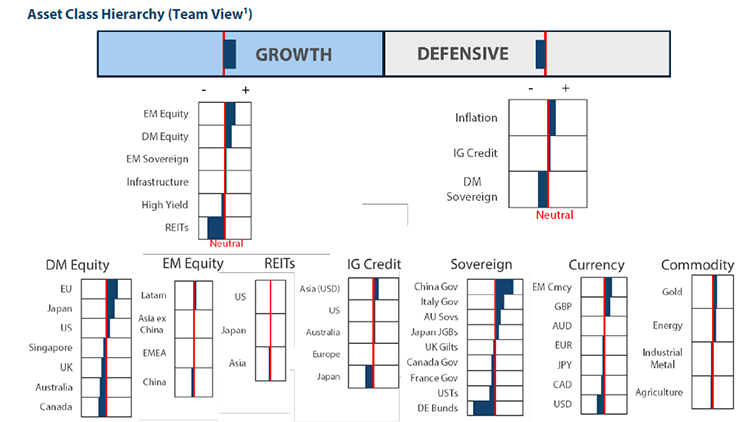

We turned more positive on growth assets this month with a small downgrade to defensive assets, given the decline in uncertainty following the US presidential election and a more promising near-term outlook for viable vaccines. The outlook is not free and clear, per se, given the new waves of COVID-19 hitting the US and Europe that are leading to new lockdowns, but the pandemic endgame is coming into sight where society can return to some semblance of normalcy during 2021. Meanwhile, while mobility is in decline due to new measures to contain the virus, activity still seems adequate mainly on account of manufacturing where inventories still need to be replenished. China demand remains robust, while US demand should pick up through the first half of 2021 as the vaccine is distributed country wide.

The Fed has promised easy policy for the next several years, which spells a reasonably attractive environment for risk assets in the months ahead. Consequently, we increased our positive view on equities with emerging markets (EM) getting a slightly larger position than developed markets (DM) on account of the anticipated weak dollar environment, ample liquidity and improving demand conditions. Conversely, we reduced other growth assets including high yield, infrastructure, REITs and EM debt. We also lifted growth currencies while reducing defensive currencies given our anticipation of a continued weak dollar environment.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Growth looks more secure as lockdowns have inflicted less damage than one might have imagined, while manufacturing has remained strong. The promise of imminent vaccines has lifted sentiment, offsetting the pull-back in investment and hiring plans due to the impending return of more normal sources of demand as the vaccine is rolled out.

The new concern might only be the speed of the rotation to value with little damage to growth as long-term rates have only risen modestly so far. Optimism seems rational, but what could disappoint? For one, the global distribution of vaccines will be challenging, and it is possible that the road to broadening herd immunity may be bumpier than what markets have currently priced.

There is also uncertainty about the degree to which economies have been scarred as some elements of demand will have permanently shifted. Economies can readjust to new patterns of demand, but it will take time for labour forces and investment to follow, meaning that demand during the adjustment could be weaker than some expect.

Lastly, reflation breeds higher rates, which markets can ordinarily absorb, but rates are coming from all-time lows and could have a fair way to adjust. How do central banks unwind from such extreme policies? This is not a current concern given large output gaps, but eventually these issues will come to the forefront and could further weigh on growth assets. All this is to say that while markets are showing extreme optimism, there are important risks to consider in the months ahead.

Europe benefits from a strong rotation, but is it durable?

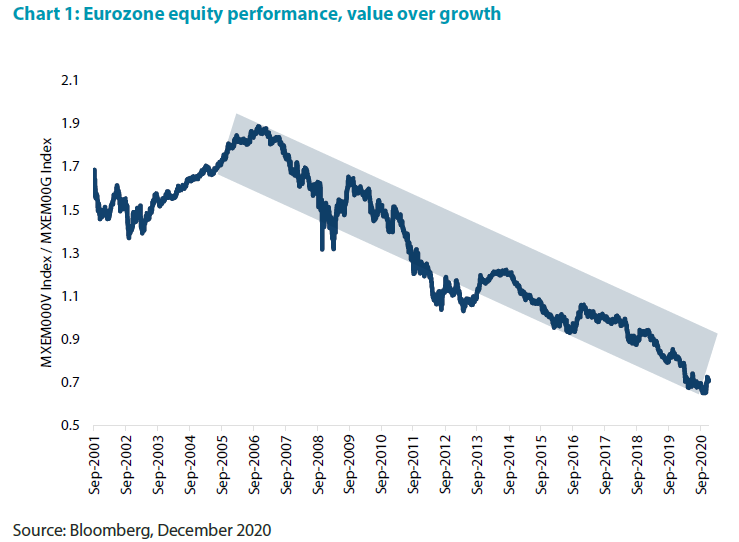

European equities ground lower during the summer months on second wave COVID-19 woes, but they have shifted to the top performers since early November. Markets have been supported mainly by value stocks on account of better growth prospects due to positive surprises in vaccine development. We have had a positive view of European equities mainly on account of its overall value tilt and high beta to a recovery, but the European economy has been sick for the better part of a decade, so it is worth taking a deeper dive into the fundamentals that drive markets going forward.

US equities have strongly outperformed the rest of the world over the last decade, much of which can be attributable to its growth tilt—specifically, technology. On the other hand, Europe weighs heavily in more value-oriented sectors such as financials, industrials and air travel. Value sectors could outperform as COVID-19 recedes, but looking back in history, we see that since 2006 growth has generally outperformed value except for brief periods.

Is the rally different this time? We are not sure, but certainly much has changed due to the coronavirus crisis. The principal reasons for Europe’s lost decade are two-fold: unreasonable fiscal austerity and failure to recapitalise the banks following the global financial crisis (GFC). On the first point, Europe’s pivot away from austerity is clear. The issuance of a European bond was an important break-through toward a fiscal union. As for banks, the European Central Bank (ECB) has implemented several programmes intended as “back door” recapitalisations, but banks are still hindered by a flat yield curve and post-GFC regulations that make re-leveraging more difficult.

Still, Europe is an open economy that depends on external demand for its exports, and demand is picking up—perhaps more so than at any time since the GFC. First, China’s focus on quality growth has led to more sustainable demand than the fits and starts of too much credit followed by too much tightening. Second, the fiscal and monetary taps have been turned on worldwide, which will ultimately lift global demand. Again, Europe benefits from such increases in demand.

We believe the European equity rally can continue to endure, particularly as demand normalises. In fact, it could even exceed levels experienced over the last decade due to these dynamics. However, continued weakness in the banking sector may give pause as the rally advances. It is possible that high growth could reinvigorate the banking sector, but it will be important to watch as these dynamics unfold.

Conviction views on growth assets

- Favour EM over DM: Both categories were upgraded, but EM slightly more given that it is the bigger beneficiary of returning global demand—particularly for commodities—and improving local demand conditions owing to the vaccine.

- Rotating to value in EM: Among EM, we have long favoured China and North Asia for the strong opportunities in technology hardware and software, as well as the China consumer. This month, we reduced China and Asia in favour of LatAm and EMEA, which are perhaps the biggest beneficiaries of returning external demand.

Defensive assets

Our cautious views on sovereign bonds have not changed from last month. The emergence of positive news on potential vaccines has helped markets look past the concerning global spike in COVID-19 cases and the US congressional gridlock on further fiscal stimulus. The US presidential election has also concluded, which reduces both political and pandemic risks to the global economic outlook. As a result, we expect US bond yields to lead global rates higher as central banks and governments continue their push to reflate the global economy.

We continue to prefer investment grade (IG) credit over government bonds. Global credit spreads have maintained a gradual tightening trend since earlier this year and are closing in on pre-pandemic levels. While spreads are unlikely to fluctuate much from these levels, upward pressures on global benchmark yields will likely detract from further spread gains. Nevertheless, the yield premium of global credit still makes it preferable to sovereign bonds.

Inflation protection assets, and in particular gold, continue to be our preferred asset class within the defensive sector. Gold has traditionally been a strong performer in reflationary environments. We expect this to be no different in the current environment in which central banks are committed to accommodative policies well into the future. However, we are also cognizant that the improving global outlook creates upward risks to both nominal and real yields in coming months and valuations for gold have also become less attractive following the large rally in prices this year. While this dulls some of gold’s shine in the near term, we still expect the precious metal to play an effective role as an inflation hedging asset.

Coming in from the cold

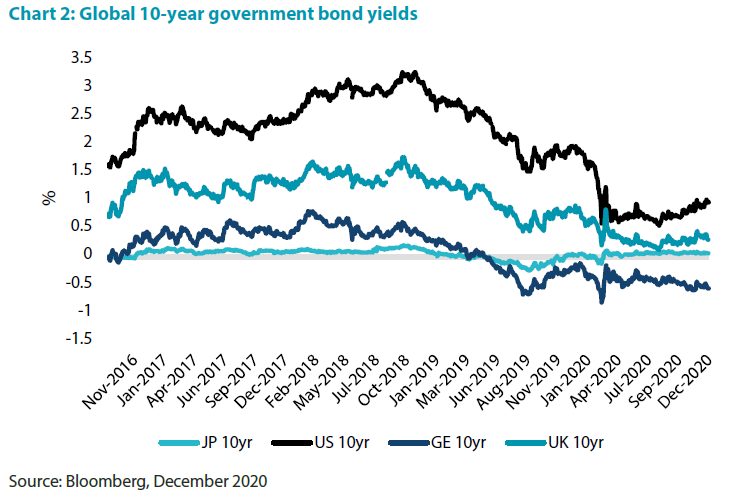

The Bank of Japan (BOJ) has led the world’s major central banks in its use of unconventional monetary policy over several decades, ostensibly to support economic growth and encourage reflation. The latest iteration began in April 2013 with Quantitative and Qualitative Easing (QQE) and then Yield Curve Control (YCC) was added in September 2016. The volatility of Japanese government bond (JGB) yields was already lower than its developed market peers prior to this but YCC reduced it considerably further. Chart 2 shows the path of major government bond yields since the BOJ’s YCC began. The narrow trading range for 10-year JGB yields and lack of volatility is quite apparent as the BOJ has been largely successful in keeping yields close to 0%.

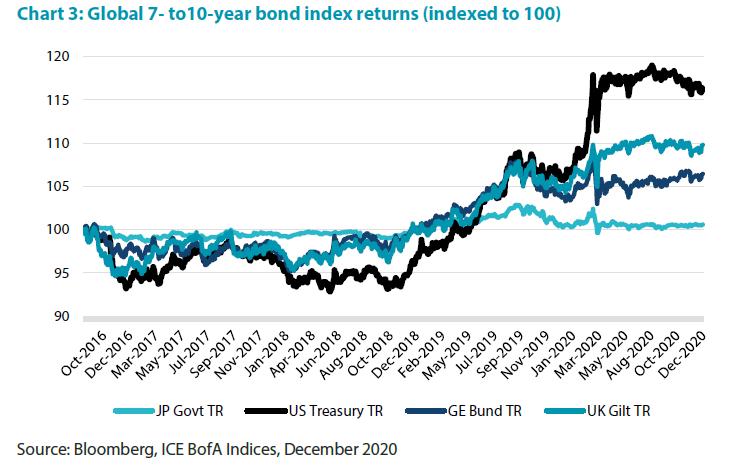

While the lack of volatility has certainly made life difficult for JGB traders, it has also set the JGB market apart from its major global peers in terms of its returns. Chart 3 shows that the returns of 7- to-10-year JGBs have been essentially flat since YCC began in 2016, befitting their near-zero yields to maturity. Other major bond market returns such as those of US Treasuries, German bunds and UK gilts have fluctuated significantly compared to JGBs.

Not surprisingly, JGBs outperformed other sovereign markets from 2016 to 2018 as global bond yields were led higher by US Treasuries in the aftermath of the 2016 US presidential election. This outperformance was soon reversed as US GDP growth peaked in 2018, leading to a decline in bond yields that later accelerated in the wake of the pandemic. Largely because of the impact of YCC on JGBs, other countries have offered better returns for some time.

As we look ahead, we expect global bond yields to trend higher once again, which will improve the relative attractiveness of owning JGBs markedly. With the BOJ likely to keep its policy prescriptions unchanged for the foreseeable future, the performance of JGBs should continue to be low and steady. But unlike the last few years, this will become a virtue rather than a handicap for JGB returns relative to their peers.

Conviction views on defensive assets

- Steeper yield curves ahead: We expect yield curves to steepen as investors increasingly look ahead to a strong global recovery in 2021, driven by coordinated monetary and fiscal policy and successful vaccines.

- Take the spread in IG credit: Credit spreads continue to offer an attractive yield premium that will drive credit outperformance over sovereign bonds.

- Gold still has a role: While the improving global outlook creates risks for real yields, central banks are likely to ensure accommodative monetary conditions prevail. Although some consolidation in prices can be expected, gold has traditionally been a strong performer in reflationary environments.

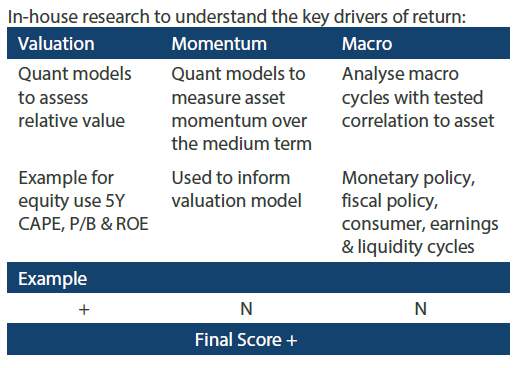

Process