During his now quite famous Jackson Hole session this year, the Fed Chairman outlined what at face value looks to be a profound shift in the Fed’s way of thinking about the economy. Initially, we were sceptical that Chairman Powell was truly intending to make maximum employment in the US’s less prosperous regions his principal policy target, since it seemed to us that to do so would risk repeating the errors of Chairman Burns in the early 1970s, when for a variety of reasons – some of which were well-meaning – Burns provided too much monetary stimulus to the US economy and in so doing triggered the breakdown in Bretton Wood, the OPEC oil embargo, a period of global monetary ‘anarchy’ and of course higher inflation in the US and elsewhere. The Road to Hell was paved with (some) good intentions.

At the time, we thought that Mr Powell’s comments at Jackson Hole were aimed primarily at the bond markets and were simply a little ‘cheap’ intervention & forward guidance to keep the ‘bond vigilantes’ at bay. Over recent weeks, however, we have started to take Mr Powell at his word, and it does seem that he genuinely wishes to try to create a better world at what is undoubtedly an awkward time for the Union.

Mr Powell is famous for ‘not having a model’. The Powell Fed is by its nature one that reacts to incoming data and events, and the nature of its reactions are then determined by the Fed’s advisors. We saw this in December 2018, September 2019 and most importantly in mid-March this year, when on each occasion the Fed purchased tens of billions of dollars’ worth of bonds in a matter of days, not as some grand QE event as many commentators would have us believe, but rather as a targeted ‘price keeping operation’ in the bond markets. In March this year, this was a move made necessary by a couple of Hedge Funds having got themselves into trouble, and the fact that many of the large risk parity funds were about to rebalance away from bonds. To emphasize, the size of the bond purchases was not a macro decision but an endogenous micro response that did succeed in saving the world at that time, but which unleashed a terrific pulse of liquidity against the background of perhaps the Fed’s most explicit creation yet of a moral hazard problem.

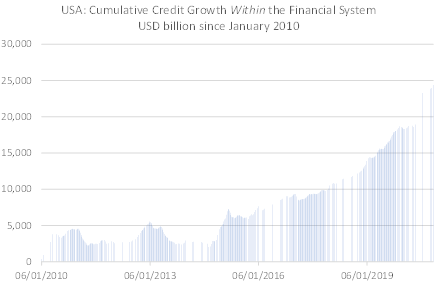

The Fed’s short term reaction to what admittedly was a very real problem at the time will one day, create a bigger problem, since it has clearly unleashed another wave of credit-financed risk taking by financial entities that believe that the Fed will always have their backs (until the day that it doesn’t….). We must confess that we were shocked by the ‘leverage chart’ that we constructed below.

As we have seen countless times since the beginnings of the Greenspan era, whenever the Fed creates the appearance of a lack of risk in the markets, the markets will naturally respond by seeking to create risk (which they need in order to produce excess returns) by ever more aggressive strategies. For example, the Fed may have reduced volatility in MBS in the wake of 9-11, but the markets created derivatives of derivatives on MBS so that they could manufacture the risk that they required….. Eventually, these maths and credit dependent strategies will blow up - usually when someone makes some wrong assumptions about correlations. As we shall see, correlations could yet be the undoing of the Powell-era Fed.

The FOMC’s apparent decision to pursue ‘full employment in as many States as possible’ is based on the rather brave assumption that the US no longer possesses a ‘Phillips Curve’ trade-off between the rate of unemployment and the rate of wage inflation. The notion that unemployment and wage inflation are no longer correlated is central to the current Fed’s thinking.

Statistically, it is true that one cannot identify a distinct Phillips Curve for much of the 2000-2020 period, and in particular in the 2010-2016 period. The consensus has a number of explanations for the breakdown in the relationship, most centred around the effects of globalization, technology, immigration, and labour mobility on the ‘natural rate’. We suspect that all of these factors have indeed played some role in changing the trade-off between wage growth and labour market conditions, but in our eyes the flaw in the consensus argument is that, while it has not been possible to identify a national Phillips Curve over the last 20 years, one can easily draw some very distinct ones at State and regional levels.

With this in mind, we would note that the fact that US economic growth since the GFC has tended to be concentrated in around six specific ‘hot spots’ in a small number of States, while many other States have been weak, has implied that there have been areas of high wage inflation such as the Bay Area and Seattle, and areas of wage deflation / stagnation. Given that there have been numerically more areas of weakness than strength, the ‘national situation’ has appeared almost random. However, it is also true that when the bulk of the States have started to experience better growth (i.e. conditions have become correlated), the national Phillips Curve has ‘reappeared’, as it did from late 2016 until 2019

And yet, in his Jackson Hole speech, Chairman Powell promised a more even or equitable growth profile across the nation’s various States. In effect, he is promising a correlated / coordinated recovery and, if he is successful in creating such an event, then we expect to see the economy operating firmly in the Northwest quadrant of the Phillips Curve. For the sake of argument, we can expect 3-4% wage inflation in Mississippi but >6% in Washington State under such a scenario.

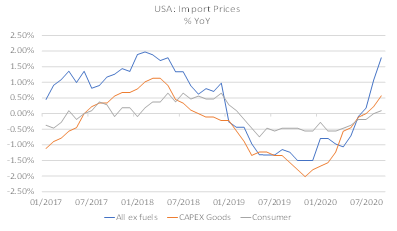

Meanwhile, and on another tack, the Fed’s ‘flooding of the world’ with dollar liquidity in March (thought necessary to save parts of the financial system) has, as we have charted at length elsewhere, created a powerful reflationary force within Asia. Many of the Asian economies are already growing quite strongly but, if there is to be not only a Post Covid-19 war boom in demand but also an effort by the Fed to suppress yields during the recovery (which will entail the Fed / Treasury conducting some form of quantitative easing – just as Greenspan did in 1993 H2), then we can assume that the Asian Region will get ever stronger. Typically, this results in an appreciation of the Asian currencies and the Region exporting inflation to the West. Crucially, we are already seeing signs that this process has begun.

In 2021/2, it seems that the US will likely face two inflationary processes – one domestic and one imported. We therefore believe that 2021 will witness a sharp rise in nominal growth within the economy and the assumption is that, initially at least, the Fed will attempt to offset the impact of this event on the bond markets through some further quantity-of-money-boosting-interventions of its own. If this is the case, it will be a powerful force for the equity markets (upwards) and the dollar (downwards).

The glaring problem in all of this that the markets are overlooking is that inflation is highly regressive. Since the less affluent members of society tend to spend a higher proportion of their incomes on everyday necessities and consumption goods in general (in the USA, it is estimated that more than 50% of households do not save), rising prices tend to exert a more deflationary effect on the real wages amongst lower income families. Moreover, these lower income families will tend to be situated in the weaker States in which nominal wage inflation rates – although perhaps better than they were – are still towards the lower end of the wage inflation spectrum.

Therefore, if the Fed’s stance creates inflation – as seems likely (in fact, we would argue that it is already happening), then the result could be more rather than less pressure on household real incomes in the more disadvantaged parts of the country, and a further increase in income and wealth inequality. This was certainly the case during the inflation of the 1970s.

Were this to transpire, it would leave the Federal Reserve with two choices: either continue with the ‘repression / growth at all costs strategy’, which we believe would ultimately lead the economy further down the path towards a publicly-owned banking system / state control of capital allocation / large public sector model similar to that practiced in parts of North Asia, or it would have to conduct a rather abrupt U-turn and tighten its stance.

Given that Mr Powell by his own admission is a person that reacts to events rather than prevents them, an inflation-squeeze on the real incomes of the very people that he is attempting to help would, we believe, cause the Fed to change tack, stop supporting bond prices and move towards arresting inflation. Such a policy U-turn would, we further believe, cause a cliff-edge in bond prices around the World. Clearly, any adjustment in real yields and bond prices could be extreme during such a policy shift.

At present, our ‘majority probability’ scenario for 2021 is that the Covid-19 War is (thankfully) won, the US economy picks up sharply, but the Fed initially at least represses bond yields by in effect easing into the recovery in a quantity sense (thereby creating the preconditions for an equity bubble / decline in the value of USD both internally and externally). However, at some point, when the higher inflation starts materially to impact the real wages of the poorer members of society (and this could occur as quickly as 2021H2), we could imagine the Fed conducting a major policy shift towards a tighter stance that would upset global financial markets.

As a result of the Covid-19 Crisis, 2020 has been a year of weak economies but strong liquidity flows. As ever, financial markets have traded off the latter and we suspect that this will remain the case in the near term, but if the Covid-19 War is won – and we must of course hope that it is won very soon – then we can expect to see much stronger economies next year, the return of inflation, and ultimately questions over the Fed’s ability to keep monetary policy conditions accommodative as rising prices place further pressure on the social fabric.

Disclaimer:

The information in this report has been taken from sources believed to be reliable but the author does not warrant its accuracy or completeness. Any opinions expressed herein reflect the author’s judgment at this date and are subject to change. This document is for private circulation and for general information only. It is not intended as an offer or solicitation with respect to the purchase or sale of any security or as personalised investment advice and is prepared without regard to individual financial circumstances and objectives of those who receive it. The author does not assume any liability for any loss which may result from the reliance by any person or persons upon any such information or opinions. These views are given without responsibility on the part of the author. This communication is being made and distributed in the United Kingdom and elsewhere only to persons having professional experience in matters relating to investments, being investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005. Any investment or investment activity to which this communication relates is available only to and will be engaged in only with such persons. Persons who receive this communication (other than investment professionals referred to above) should not rely upon or act upon this communication. No part of this report may be reproduced or circulated without the prior written permission of the issuing company.