The short answer is: it depends on the hedge fund you are looking at, and how they’re implemented to a wider KiwiSaver portfolio. For us, we would consider this question against our wholesale hedge fund, the Multi-Strategy Fund, and its allotted role within all of our diversified funds: Nikko AM KiwiSaver Scheme Conservative Fund, Nikko AM KiwiSaver Scheme Balanced Fund and Nikko AM KiwiSaver Scheme Growth Fund.

We find that the Nikko AM Wholesale Multi-Strategy Fund plays a thoroughly helpful role within well-structured diversified portfolios. This is because a good and well-shaped diversified fund (whether it’s at the lower risk end such as a conservative fund, or a more volatile and higher return seeking strategy such as a growth fund) should seek different sources of return. A traditional approach achieves this by using equities for growth and bonds/cash for income and stability. These are given different weightings dependent on the overall target return and accepted variability. However, the risk (as measured by volatility) and level of return are not only what matters when building a solid portfolio. It’s well known that the degree of correlation in returns is equally significant too. This means it’s desirable to have assets that behave in diverse ways under various economic scenarios, in order to soften the fund’s ‘shape’ or ‘journey’ and, safeguard their overall returns from being compromised.

To illustrate this, let’s observe the performance of Multi-Strategy relative to other Nikko AM sectors during the volatile period of the past 24 months.

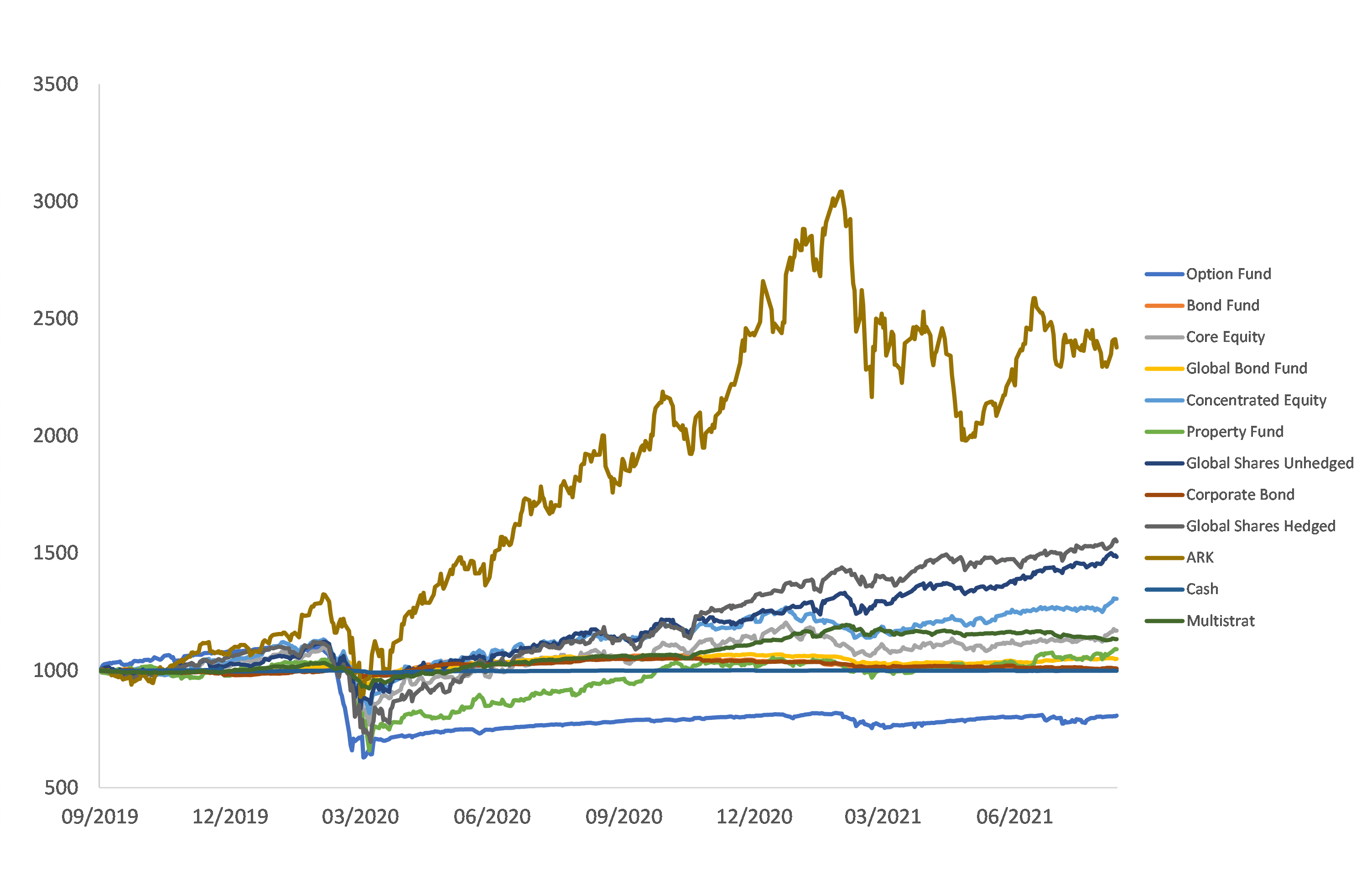

Figure 1: relative performance of underlying diversified fund sectors

Figure 1 shows the change in $1,000 invested in each of the underlying sectors used within the Nikko AM diversified funds. Firstly, for such a relatively short period we spot the enormous scale present i.e., even a strategy that moved as significantly as global equities through the COVID crash and bounced back, looks quite modest relative to the ARK strategy.

Secondly, we notice how it’s not quite possible to differentiate and determine the fixed income and cash sectors as all blur into a relatively flat line.

By removing the ARK and the income funds, we’ll now take a closer look at Multi-Strategy’s performance against the so-called ‘growth’ sectors:

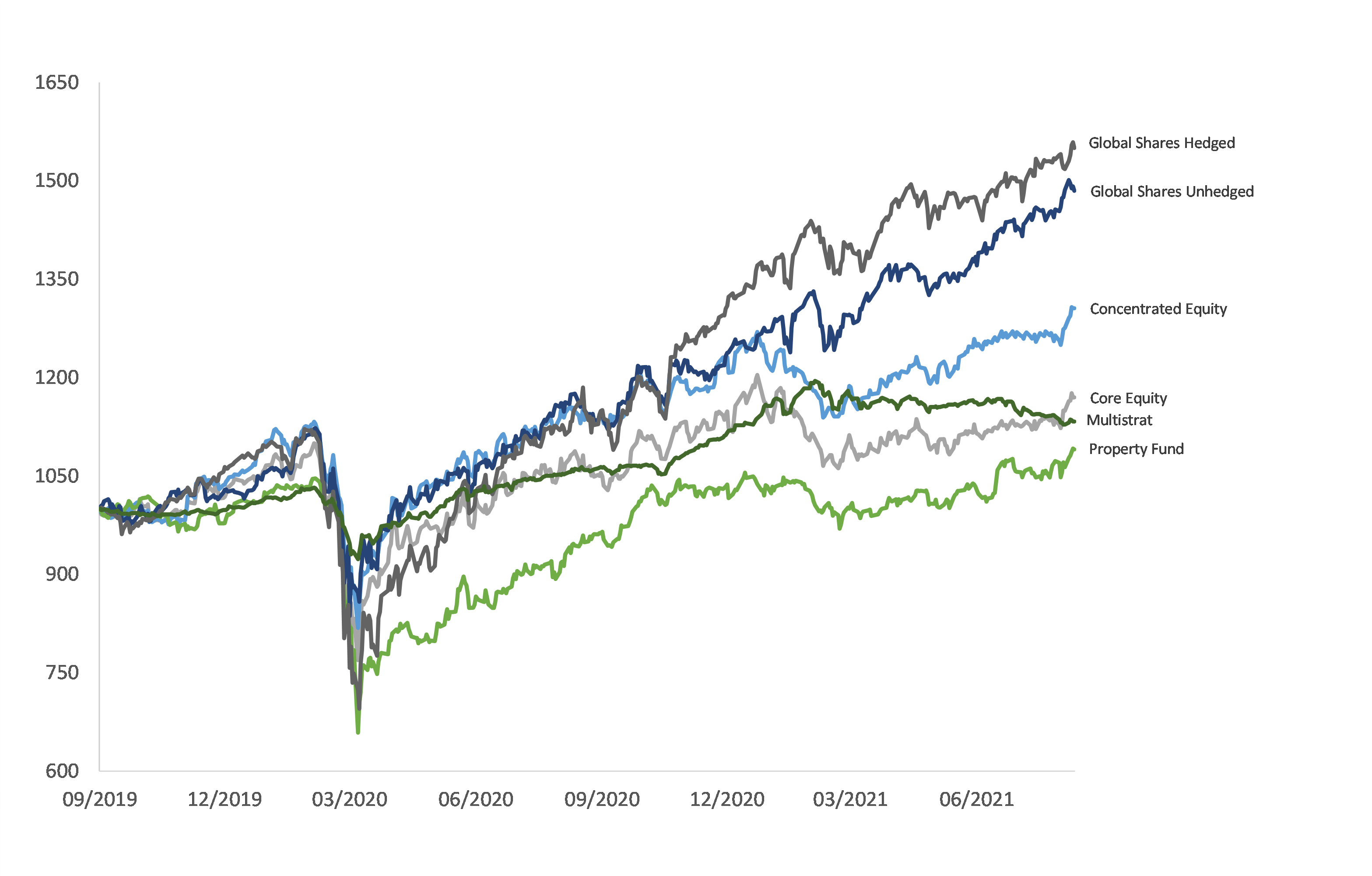

Figure 2: relative performance of the ‘growth’ sectors (ex-ARK) and Multi-Strategy

From this graph we can clearly see the general shape of a sharp fall around Feb-Mar 2020, followed by a significant rebound. However, within this we can also see Multi-Strategy’s journey was overall gentler, as it participated in the following upswing and didn’t fall nearly as far in the downturn. With this observation we can say that the fund exhibited some equity-type characteristics but remained far more muted than the pure equity strategies.

We’ll now shift our graph to compare Multi-Strategy to fixed income and cash sectors:

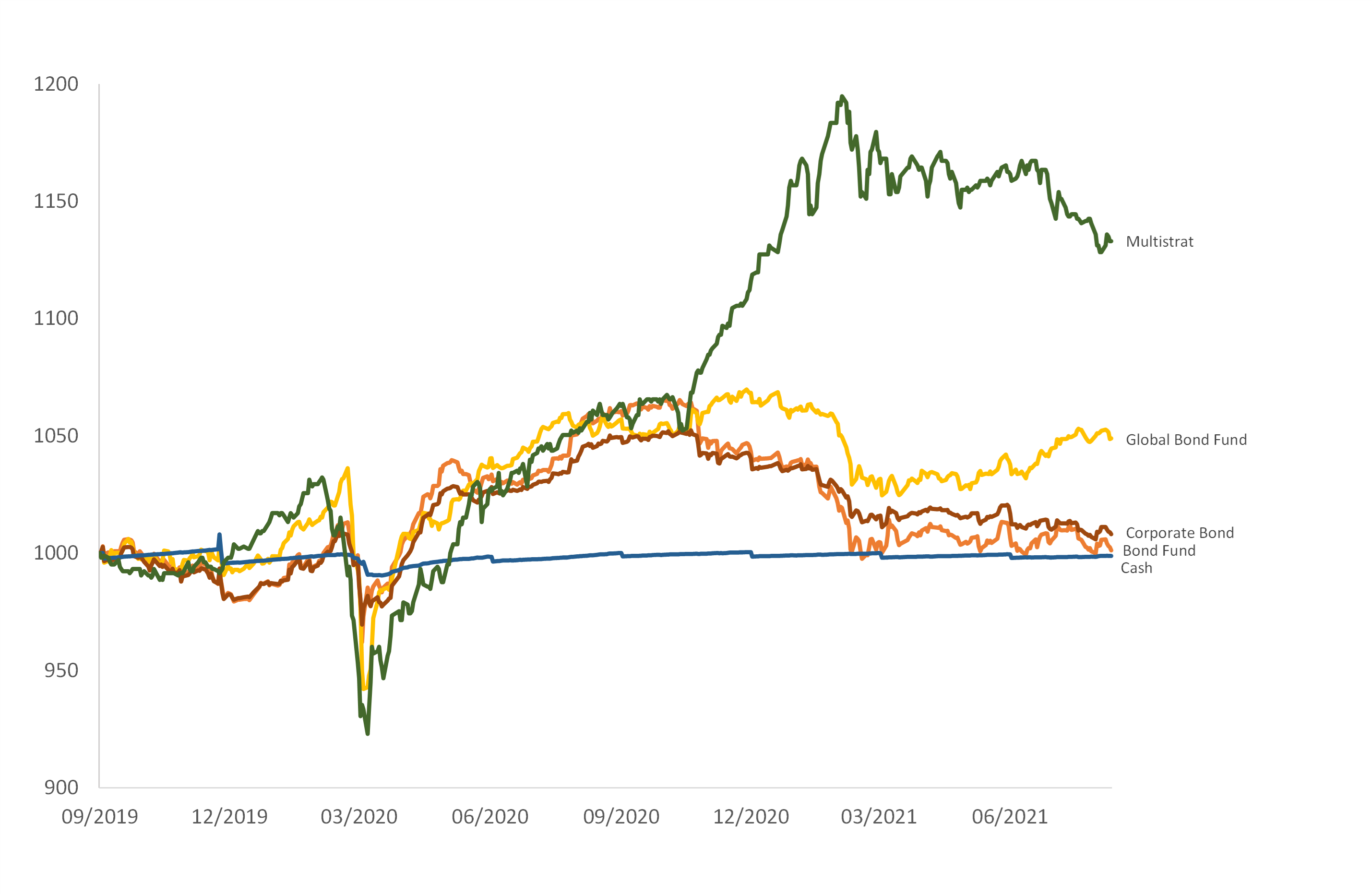

Figure 3: relative performance of the ‘income’ sectors and Multi-Strategy

In Figure 3, we first note the scale is much more compressed, with the drawdown taking the initial $1,000 close to $900 (very different to the equity drawdowns of 20-30%). We can also see the fixed income didn’t provide the same size of rebound, and in fact softened slightly towards the end of 2020 into 2021. By contrast, the Multi-Strategy Fund saw a similar ‘bond-type’ level of drawdown, but also had some participation in the resulting equity type upswing.

Although we can see Multi-Strategy provides desirable characteristics from both the growth and bond sectors, observing its performance over time will be equally useful to checking whether this type of performance is reliable.

Multi-Strategy over 10 years

When looking at Multi-Strategy retrospectively, we recognise a similar picture surfacing in its past performances. For example, a quick overview shows the Multi-Strategy annual calendar year returns are in a range of approximately 2 – 15%, with their volatility averaging around 4 - 6% p.a. (depending on the period). This looks reasonably similar to the annual calendar year returns for global fixed interest (calendar returns ranging from 2 – 10%, and volatility around 3 - 4% p.a.) and domestic fixed interest (calendar returns ranging from 1 – 13%, and volatility around 3 - 4% p.a.).Interestingly, this behaviour is quite different from equities which, depending on whether you’re considering domestic, global, hedged and unhedged, have seen calendar returns ranging from -10% to +30% (and that’s ignoring the GFC which is now more than 10 years ago), and their volatility typically around 10 -15% p.a. The long-term data is supportive of the dynamics shown in Figures 1, 2 and 3, as it shows the fund providing a differentiated pattern of returns from traditional sectors. This is because the diversified approach of the Multi-Strategy model has demonstrated some bond-like protection in market drawdowns, whilst offering some participation in equity upswings overall.

Multi-Strategy Going-Forward

Although historical accounts are important, we understand the past is only of marginal interest for analytical purposes, as we investors want to know what will provide the right outcomes going forward. In the current environment, some of our bond yields have moved upwards (hence the recent weaker performance on a mark-to-market basis) but yields are still at historic lows and, the yield to maturity in bond funds are around 1.5 - 2.5% p.a. This means that achieving returns above these levels over the next few years will be challenging or unlikely, albeit that the income characteristics and low levels of volatility lead to fixed income securities still having a role to play in a diversified portfolio. Nevertheless, these low levels of expected returns are unlikely to be sufficient to meet many investors’ return objectives. Equities on the other hand have enjoyed a strong run. The large QE (or asset purchase) programmes from central banks have supported prices and the low interest rate environment has provided additional impetus for equity price rises. Given these current market conditions, it seems particularly attractive to have exposure to a sector which offers something of the protection provided by bonds, whilst also delivering some of the upside from equity markets.

From a purely investment-based standpoint alongside a diversification and risk/return/correlation perspective, it’s clear the allocation of our Multi-Strategy Fund to our diversified funds has proven both desirable and reliable overall. Moreover, with the current environment, we believe the Multi-Strategy fund should prove especially useful in mitigating some of the equity volatility and drawdown risk, as well as dodging the particularly low yields available in bond funds. Conversely, we do recognise that the reasons for inclusion and relative weights will vary from time to time in the funds, however we believe continuing to include the Multi-Strategy Fund is beneficial for diversified funds and KiwiSaver specifically.

Nikko Asset Management New Zealand Limited is the licensed Investment Manager of Nikko AM NZ Investment Scheme, Nikko AM NZ Wholesale Investment Scheme and the Nikko AM KiwiSaver Scheme. This material has been prepared without taking into account a potential investor’s objectives, financial situation or needs and is not intended to constitute personal financial advice and must not be relied on as such. Recipients of this material may wish to consult a Financial Advice Provider (FAP) and the relevant Product Disclosure Statement (available on our website) www.nikkoam.co.nz. Past performance is not a guarantee of future returns.