The June 2025 Global Investment Committee (GIC) meeting was held on 18 June.

Key takeaways from the meeting are as follows:

- Many of the tariff measures that were initially announced have been temporarily placed on hold. Building on the probability-weighted scenarios from our April extraordinary GIC meeting , the GIC now believes that the probability of slower, yet positive US growth has risen. Nonetheless, since the number of finalised trade deals remains limited and considering the recent escalation of conflict in the Middle East , alongside signals of a tighter global supply chain, we still see risks of modestly higher inflation in the US.

- Although market volatility subsided as initial US tariffs were put on hold, we are likely in a high volatility regime for risk assets. We still see positive US EPS growth for the time being, but we believe that uncertainty is likely to keep US stock valuations under pressure going forward, with interim bouts of volatility.

- Last quarter, the GIC identified turning points in European and Chinese equities as opportunities to diversify global portfolios. We expect earnings growth in these regions to be slower than that in the US. However, selective diversification into these regions may pay off. We continue to look for assets that are resilient to inflation and external shocks—including renewed tariff threats—to hedge tail risks.

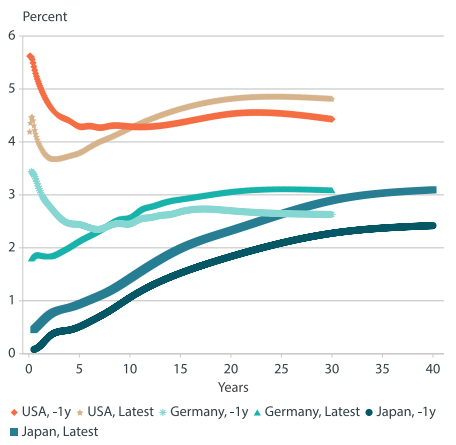

- We believe that super-long Japanese government bond (JGB) yields have peaked, as Japan makes adjustments in the supply of short and long-term bonds. We remain constructive on the Japanese yen and, to a lesser extent, the euro as portfolio diversifiers amid an uncertain US outlook.

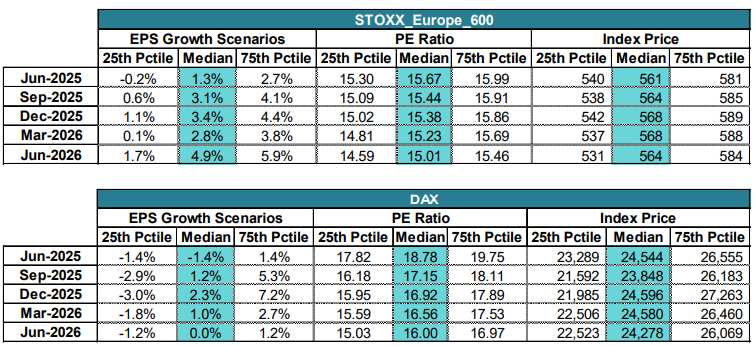

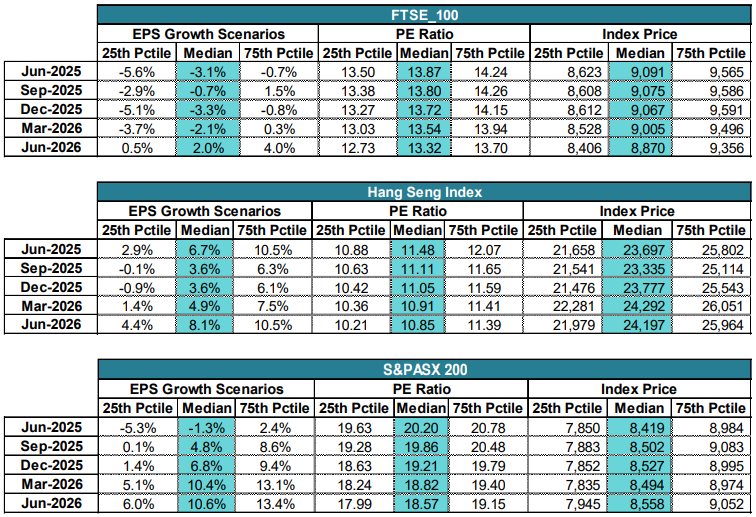

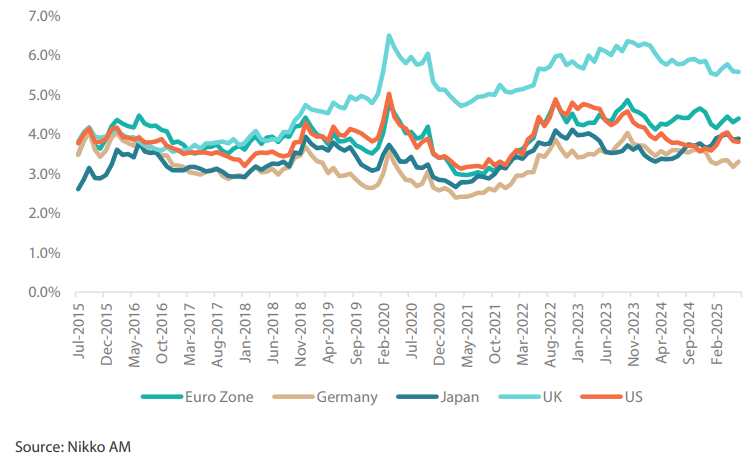

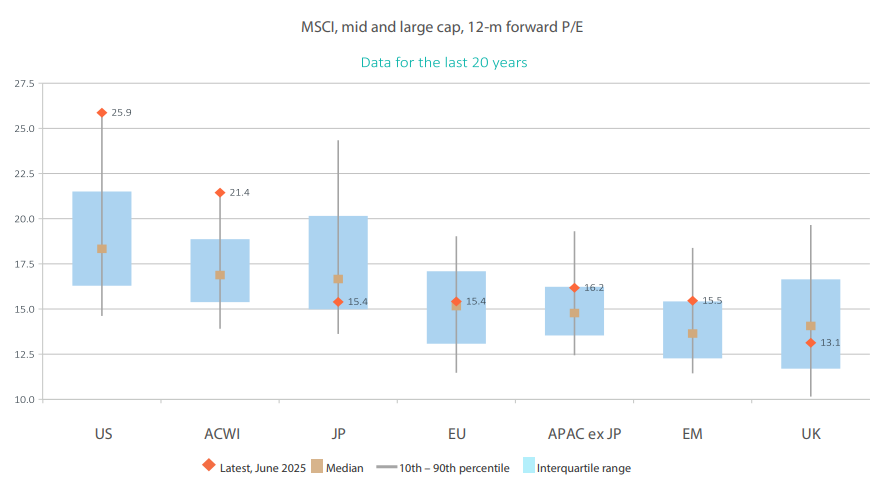

- The risk premium offered by Japanese equities is now competitive with that of the US (Chart 1). We believe Japan remains a good diversification option to mitigate risk concentrated in large-cap US technology. Given ongoing indications of Japan's structural reflation and relative undervaluation, we continue to look for value among Japanese domestic demand-related stocks. That said, uncertainty over trade and ensuing volatility in the Japanese stock market is unlikely to disappear. We continue to follow the example of domestic investors and look for opportunities to buy on volatility-fuelled dips, with the belief that the market will demonstrate resilience.

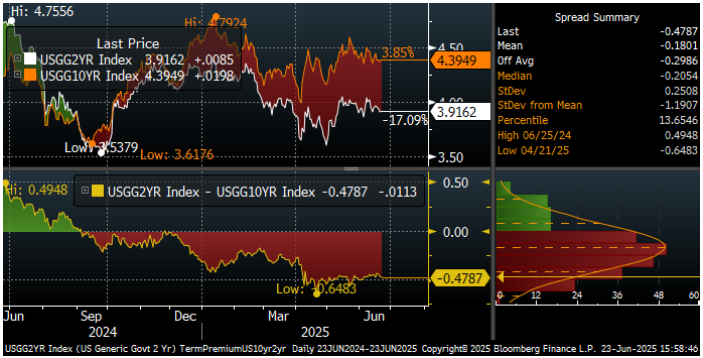

- The current expectations for short-term US interest rates have already priced in several interest rate cuts by the Federal Reserve (Fed), resulting in the bull-steepening of the US yield curve. With a debt-to-GDP of around 120%, the US yield curve remains vulnerable to fiscal risks and trade uncertainty. In the short term, the drawdown of Treasury reserves may help keep liquidity intact until later this summer, when budget negotiations could extend the debt ceiling. US debt levels are at their highest since World War II; in addition, geopolitical developments are adding to inflation risks. These factors should keep the term premium intact.

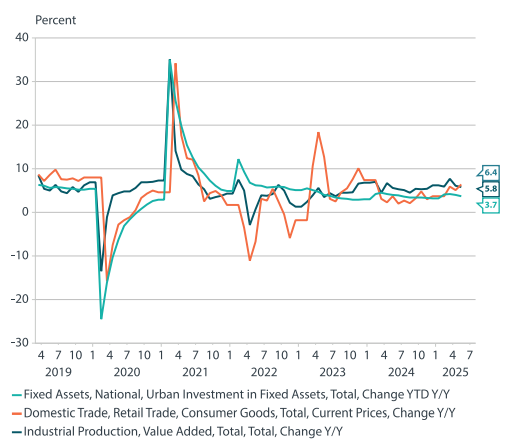

- Macroeconomic policies announced last quarter at China's National People's Congress were seen as providing support to consumption. Additionally, front-loaded demand ahead of the implementation of tariffs have so far kept Chinese domestic investment and exports from deteriorating. However, the second half of the year may bring new challenges, with Chinese growth potentially struggling to meet the annual 5% target. China has also announced new plans for RMB internationalisation . While there are signs that fiscal stimulus may not be enough to keep growth above target, additional stimulus measures may still be introduced in the latter part of 2025. The introduction of such measures, however, may depend on developments in trade negotiations.

Chart 1: Japan offers competitive equity risk premium vs. US; UK and Eurozone higher still

Q2 Takeaways: bond, currency markets began the diversification shift

As Q2 commenced, the announcement of “reciprocal” and product-specific tariffs hit the markets, prompting us to develop the scenario-based extraordinary outlook . Since then, fears of the “worst case” trade scenario have diminished somewhat, although the outlook for US policy and trade remains murky. Meanwhile, positive surprises in jobs data and lower-than-expected inflation improved sentiment. The markets have re-evaluated their prior views of “US exceptionalism” and the dollar has taken the brunt of this reassessment so far. Moreover, recent bond market gyrations following tariff threats and a US credit rating downgrade have underscored the importance of maintaining stable and low funding rates for both external and internal US debt. This stability remains a crucial part of US policy success, and therefore signals from the US bond market are crucial in gauging the likelihood of policy proposals being implemented effectively.

While we observed upgrades to both short and long-term interest rates in the US in Q1, inflation has very recently surprised on the downside. This may support the case for monetary easing, but the Fed has recently downgraded growth expectations yet upgraded inflation expectations. Whether it will follow through on its median expectations of two more rate cuts in 2025 will continue to depend on the data.

In Japan , another year of record wage rises from the “Shunto” spring negotiations has kept intact the virtuous circle of wages and prices , despite uncertainty over external demand. Prior to the announcement of “reciprocal” tariffs, growth slowed but remained healthy on a nominal basis. It was inflation that detracted most from growth , highlighting the need for the Bank of Japan (BOJ) to retain its rate hike bias (see Japan plays the long game to keep structural recovery intact ).

Recently, markets were surprised by a spike in super-long 30 year JGB yields , a result of a supply-demand imbalance. The BOJ then announced that it would slow the pace of its balance sheet reduction next fiscal year; by then, the central bank may have made significant headway in winding down its bank lending facility (“fund provisioning measure”) as part of its commitment to return to conventional monetary policy. Meanwhile, the Ministry of Finance has proposed adjusting the issuance balance between long-term and short-term debt.

In the US, earnings expectations are finally pricing in slower growth, especially in some sectors like large cap non-tech. P/E ratios have adjusted somewhat following the escalation in US trade tensions in April.

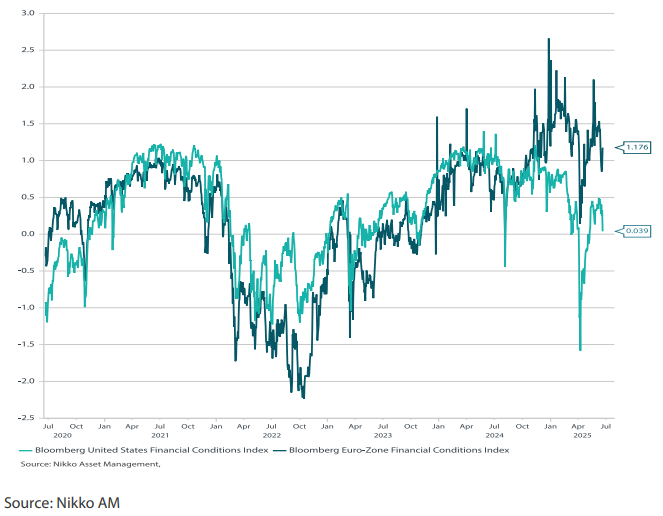

The combination of the loosening European fiscal stance and ECB easing has led to extremely accommodative financial and monetary conditions, surpassing those in the US (see Chart 2). European stocks have re-rated subsequently. With Germany anticipated to increase fiscal spending while the UK faces prospects of limited fiscal stimulus, the market is starting to price in an anticipated divide in earnings growth between the two countries.

Chart 2: European and US financial conditions indices

China's stimulus measures have had some impact on consumption, but not enough to bring inflation back into positive territory. Front-loaded investment and exports have helped prevent growth from collapsing. The recent US-China tariff “resolution” assuaged immediate fears of an all-out trade war, although it does not rule out the possibility of additional unilateral action from the US.

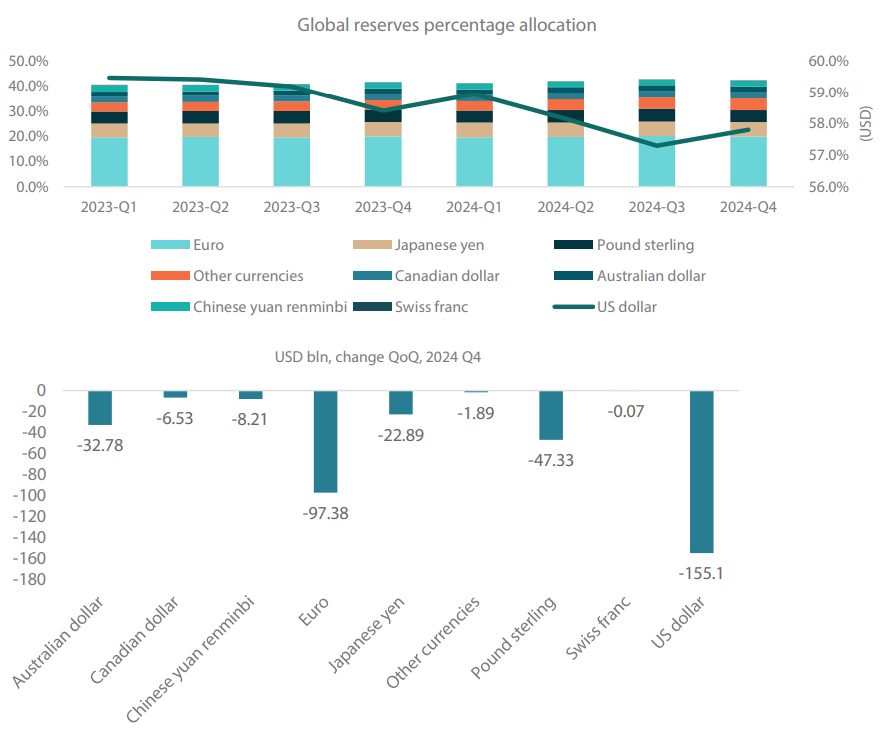

The dollar has slumped across the board since Q1. Our expectations were for the dollar to weaken slightly against the yen . However, the dollar was sold broadly, with the decline triggered by threatened and imposed US tariffs. Despite the dollar's significant share in international reserves, the currency could still be sold off, as we saw from the broad reduction in global reserves in Q4. While the absolute balance of dollars decreased the most, the percentage of global reserves held in dollars rebounded slightly. This is because the other global reserves that were sold off—notably those denominated in the British pound, Australian dollar and the euro—were of the greater proportion of balances held.

Macroeconomics: focus on slower growth and inflation uncertainty in the US

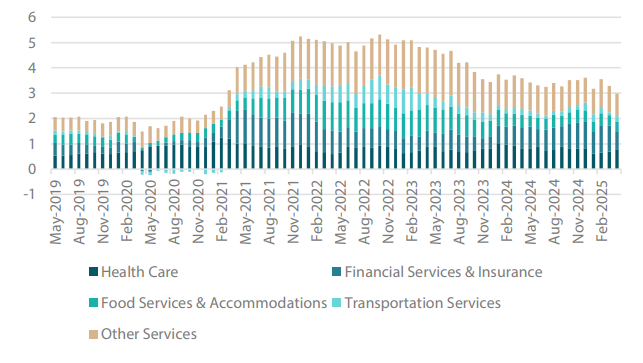

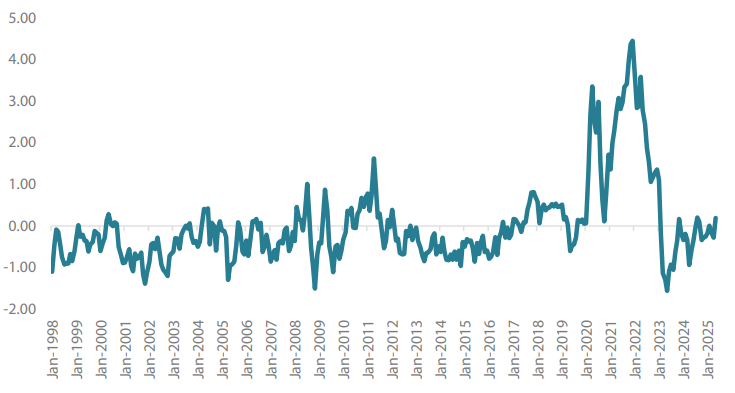

US macroeconomic indicators have stayed resilient, but firms, consumers and investors remain wary of the impact of both ongoing trade disputes and escalation of geopolitical conflict. Although such uncertainty may invite downside risks to growth, the risks to inflation appear to be converging toward the upside. So far, core prices have been weaker than expected in Q2, and the slowdown in inflation has been concentrated in “sticky” items such as housing and non-residential services (see Chart 3). Yet tariffs and rising geopolitical risks warn us to not disregard the possibility of goods inflation, a phenomenon which may keep inflation expectations elevated. One element flagged by the New York Fed was its Global Supply Chain Pressure Index, which had subsided into negative territory in 2023 and 2024 but is now edging back into positive territory (see Chart 4). These challenges to the global supply chain may contribute to inflationary pressures not only in the US but other regions as well.

Chart 3: Contributions to 12-month “supercore” services PCE inflation

Source: Federal Reserve of San Francisco PCE Inflation Contributions from Goods and Services - San Francisco Fed

Chart 4: Global Supply Chain Pressure Index

Source: Federal Reserve Bank of New York Global Supply Chain Pressure Index (GSCPI) - FEDERAL RESERVE BANK of NEW YORK

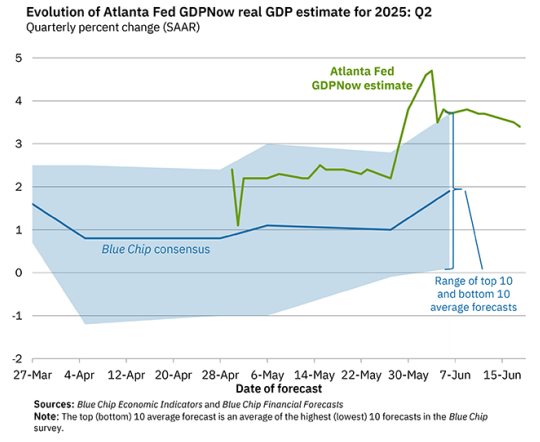

On the growth side, current estimates of GDP growth, known as “nowcasts” (e.g. those compiled by the Atlanta Fed, as shown in Chart 5), have recovered from their March and April doldrums. However, uncertainty persists in the outlook, particularly in light of the rise in geopolitical pressures and oil prices. This uncertainty is compounded by the lack of clarity surrounding US tariffs, which have been threatened, postponed or imposed by Washington. Although the pace of employment growth has been slowing, recent job data remains on the robust side of expectations.

Chart 5: Atlanta Fed GDP “nowcast” recovers from March plunge

Source: Atlanta Fed, GDPNow - Federal Reserve Bank of Atlanta

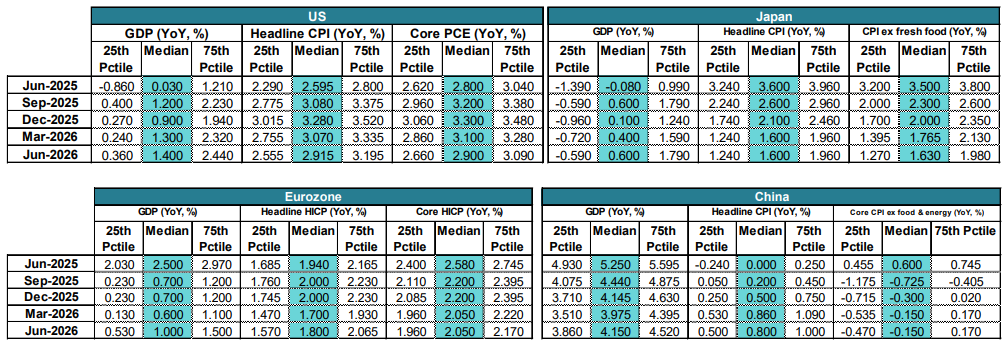

Global Outlook: macroeconomic guidance for narrower growth gaps

The GIC foresees US growth remaining positive over the next year but slowing to 1-2%, with an interim quarterly dip below 1% before the end of 2025. This marks a slowdown from the recent US growth rate of 2-3%. The GIC foresees growth slightly above zero at the 25th percentile and above 2% at the 75th percentile. This growth outlook is consistent with the trade détente scenario elaborated in our extraordinary GIC meeting in April. We expect the growth gap between the US and other developed countries to narrow.

In contrast to the mild disinflationary outlook consistent with the April détente scenario, the GIC believes stubborn inflation is more the norm than the outlier. The GIC sees core personal consumption expenditures (PCE) remaining well above the Fed's 2% target over the coming year. Our inter-quartile range of expectations remains above the 2.5% level for the duration of the coming year, with a probability of 25% or less that inflation will breach the 3.5% year-on-year (YoY) mark. If realised, this is likely to complicate decision-making for the FOMC, which remains on a rate cut trajectory.

We foresee Japanese growth in 2025 fluctuating around the potential growth rate of 0.5% per BOJ estimates; however, the fall-out of trade tensions and geopolitical risk may lead to quarterly contractions over the coming year. The GIC predicts a probability of 25% or less that Japanese growth will turn negative year-on-year in any given quarter. On the upside, growth could exceed 1% year-on-year in any given quarter. The optimistic outlook is supported by historically strong wage hikes, which could stimulate domestic consumption. In addition, companies have shown willingness to utilise their comparatively large cash reserves to invest in long-overdue upgrades to fixed and intangible capital, as well as offering competitive wages to attract and retain workers. Inflation meanwhile may prove more difficult than anticipated to conquer. The GIC's central scenario is for headline inflation and core inflation to slow gradually to below 2%, primarily due to year-on-year base effects resulting from high inflation in the second half of 2024. The GIC attributes a probability of 25% or less that inflation could experience a more delayed slowdown and fail to converge towards the 2% target until a year later, potentially requiring additional tightening from the BOJ. The GIC does not foresee a return to deflation.

In the previous quarter, the GIC saw Eurozone growth reach an inflection point, leaving negative growth in the rear-view mirror. Since then, not only has the ECB engaged in additional monetary easing, but fiscal accommodation also appears forthcoming, particularly with an increased commitment to defence spending in response to ongoing trade challenges from the US. The GIC now expects growth to remain slow but positive, with the inter-quartile range firmly above zero over the coming year. Growth is expected to accelerate to around 1% a year from now, with a probability of 25% or less that Eurozone growth will exceed 1% in any given quarter until then. Despite moderate headline HICP inflation (with inter-quartile range foreseen between the mid 1% to low 2% range), the GIC foresees a mild upside bias to core European inflation . The inter-quartile range for core inflation is expected to be above 2% for most of the year, with only a 25% or lower probability that core inflation will fall below this level by the end of the forecast period.

Although it is possible that China has escaped the worst-case scenario of escalating trade tensions with the US, the GIC expects Chinese growth to continue tapering off gradually as the impact of US tariffs are felt, especially in the absence of significant additional stimulus. This means despite the positive impact of second and third-quarter basis effects from weak growth in 2024, GDP may trend lower, approaching or even falling below 4%. The GIC projects a probability of 25% or less that Chinese growth will remain mired below 4%, most likely in the event that tariff negotiations stall. There may also be some upside risk in the form of fiscal stimulus not yet priced in. China has “dry powder” it may yet use, for example, in conjunction with the autumn Politburo and other policy-related meetings (such as the Standing Committee of the CPPCC National Committee), once the full extent of US tariff measures becomes clear. The GIC foresees Chinese headline inflation staying in positive territory and rising toward 1%, while core inflation is expected to remain negative. The GIC places a probability of 25% or less of core inflation returning to positive territory by June 2026.

Chart 6: China H1 growth retained on front-loaded investment and fiscal stimulus

Source: Nikko AM, PBOC, NBS, Macrobond

Qualitative global macro views: contingent on trade, geopolitics

We present a selection of GIC voters' diverse views and considerations on the global economy, which on aggregate contributed to the downgrading of our central growth expectations across the board and upgrading of our US and Japan inflation outlooks.

US:

- The US likely faces a slowdown, but this is unlikely to be growth “falling off a cliff”.

- No big calls. Domestic politics, geopolitics and policy are all sources of uncertainty.

- CPI has room to come lower.

- Higher real rates are coming; it is a matter of time before mortgage and corporate refinancing rates head higher and create headwinds for the economy.

- We came into the year bullish but now there are more reasons to be nervous.

- Slower employment and higher inflation may be a double hit for consumers.

- The economy has been growing 2% on trend, and softness may be temporary.

- The impact of tariffs on inflation has not yet materialised and if inflation comes off further, the Fed will have an easier time cutting rates, and this may push growth back above trend.

- It may take some time for tariffs to pass through into prices.

Japan:

- There is an ongoing recovery. While not a slowdown, the recovery is slow and remains vulnerable to external shocks from tariffs. There can be a knock-on impact to investment.

- CPI is expected to slow due to basis effects as well as a stronger yen.

- The biggest unknown on the trade front is the product-specific tariffs, especially those related to autos and semiconductors.

China:

- China tariffs may be half of the initial anticipated worst case (60% additional).

- Growth may be stronger in H1 than H2 given the front-loading in exports as well as the impact of fiscal stimulus on consumption (thanks to coupon and equipment upgrade programs). However, activity may slow when the coupon programs expire.

- For full year 2025, we may see growth slightly above 4.5%; growth in Q3 may be particularly weak.

- China can afford to negotiate but ultimately, it cannot absorb all its production domestically. It has incentives to settle on some deal with the US.

- Events that may provide catalysts in H2 2025 include the politburo (expected top be held in fall) which tends to focus more on economic and fiscal policy and also may coincide with the Standing Committee of the CPPCC National Comittee.

Interest rates: uncertainty in the US policy outlook

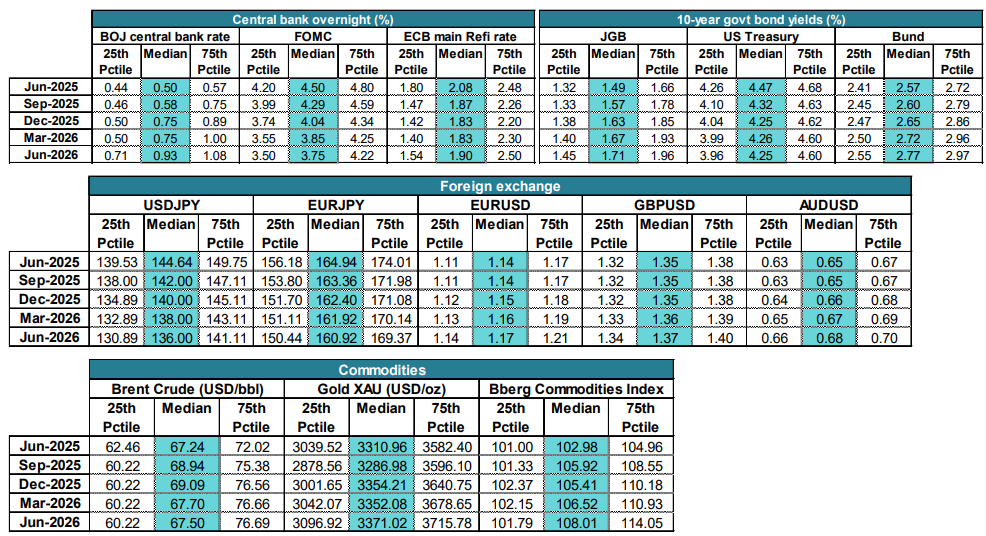

FOMC: the GIC's central scenario is still for the Fed funds rate to drop below 4%, but the move is now expected to be delayed until 2026 due to higher-than-expected inflation and uncertainty surrounding future price trends. The GIC anticipates two rate cuts in 2025, which is in line with the subsequently released FOMC's Summary of Economic Projections, along with an additional 25 bp cut in the first half of 2026. The inter-quartile range of expectations broadens out as we look further ahead. By June 2026, there is a 25% probability of rates being at 3.5% or lower (reflecting a total easing of 1%) and an equal probability of rates being at 4.25% or higher (indicating one 25 bp cut). We emphasize the heightened uncertainty in the inflation and rate outlook as signalled by the FOMC itself in FOMC: projections highlight heightened uncertainty in rate outlook .

BOJ policy rates: with inflation riding higher than the BOJ's 2% target for three years, the GIC expects the BOJ to raise interest rates again, though ongoing policy uncertainty has likely pushed forward the timing of such a hike. Our main scenario is for the BOJ to hike rates towards the end of the year. However, given the impact of basis effects, there also remains the risk that if the BOJ holds steady and a rate hike does not take place by September, it may have to delay hikes into 2026 (we attribute a 25% probability to the BOJ hiking in September; we also attribute a 25% probability to the central bank delaying hiking rates into 2026). The GIC has priced out any significant probability of BOJ cuts, given the limited room the central bank has for downward adjustments and the limited benefit of a rate cut in the event of an external shock to growth.

ECB: The GIC anticipates that the ECB is nearly done cutting interest rates. Fiscal policy is seen as an alternate source of stimulus for growth. The probability of additional rate cuts remains mostly priced into the lower 25th percentile, but if the ECB were to reduce rates further, it may implement a 50 bp cut. In case of an unexpected surge in inflation, the GIC acknowledges a possibility of a 50 bp tightening within the next year, although such a scenario is attributed a probability of 25% or less.

10-year interest rates: how far can the bull steepening go?

US Treasuries (USTs): the median GIC outlook is for the 10-year UST yield to remain range-bound and reach around 4.25% by the end of June 2026. However, given the base case expectation of three rate cuts by the Fed over the coming year, the premium priced into the UST curve is expected to persist for some time. That said, the GIC foresees a possibility of the term premium narrowing in the short term (as long-end yields adjust alongside Fed rate cuts), although we anticipate the term premium to widen out again before the year concludes. If inflation deviates to the downside, the potential for bull steepening is expected to be limited as longer-term rates decline. Conversely, if inflation deviates to the upside (towards the upper end of our inter-quartile range), the Fed's inability to cut rates (while maintaining confidence in controlling inflation expectations) will likely prevent the yield curve from steepening significantly. It is important to note that while a stagflation scenario is a tail risk, it is not our central scenario.

Chart 7: The stubborn US term premium

Source: Bloomberg

JGBs: Despite the recent surge in super-long JGB yields, the GIC foresees that yields have peaked for now. Indeed, the yield surge, which initially occurred due to a supply-demand imbalance, subsided following an announcement by the Ministry of Finance (MOF) that it would adjust 20-, 30- and 40-year JGB issuance amounts by a greater scope than the market expected. The GIC expects the 10-year JGB yield to gradually rise over the next year, reaching 1.7%. The rise by the 10-year yield is expected to accompany another BOJ rate hike, and therefore lead to a gradual decline in the term premium. In the event the BOJ does not hike rates, the GIC attributes a probability of 25% or less that the 10-year yield will remain close to current levels near 1.4% in a year's time.

Bunds: The GIC expects the 10-year German Bund yield to rise gradually towards 2.8% by June 2026, which would imply a gradual steepening in the Bund curve over the coming year. The expectation for new issuance to fund greater fiscal expenditure may keep the long end of the Bund curve under pressure. However, expectations also remain for the curve to steepen alongside an acceleration in European growth, which is anticipated to keep the ECB on hold for most of the coming year.

Chart 8: Steeper yield curves across geographies

Source: Nikko AM, US Treasury, Macrobond, JBT

Foreign exchange: across-the-board dollar weakness; keep eye on RMB

Although the share of the dollar as a component of global foreign reserves increased, this coincided with the selling of reserve dollars along with other currencies (see Charts 9 and 10). This highlights the need for central banks to move gradually when reducing their dollar reserves. The current predominance of dollars in foreign reserves relative to dollar-denominated cross-border transactions highlights the vulnerability of central banks to any sudden drop in the dollar. It also emphasises the importance of reducing this vulnerability over time.

Charts 9 and 10: Dollar's share rebounds only on overall reserve sell-off

Source: Global Foreign Exchange Reserves Trends

The GIC expects the dollar to remain weak against the yen over the coming quarters, and it also sees the US currency depreciating against a broad variety of its peers in the long term. The central scenario is for the dollar/yen to breach 140 and settle in the mid-130s by June 2026. The euro/dollar is seen climbing to a range between 1.14 and 1.21 over the same period. Gains in the British pound are expected to be relatively modest, reaching above 1.35 versus the dollar by the end of June 2026. There is potential for the Australian dollar to rebound above 0.65 against the dollar; however, the Aussie is expected to remain below 0.7 over the year. Another significant theme going forward may be China's move toward greater Renminbi internationalisation, as announced at the Shanghai Lujiazui Forum . We note that according to SWIFT data, the dollar's share of global payments is a full 10 percentage points lower than the dollar's share in global reserves, while the RMB's share is the fourth-largest, representing roughly 4.5% of global payments as of May 2024 (compared to below 2% on average in 2020).

Commodities: stronger gold, uncertain oil

We highlighted last quarter the US administration's strategy to curb inflation by relying on lower oil prices , upon which OPEC subsequently increased supply. Yet the ongoing escalation of violence between Iran and Israel (which the US recently joined) remains a risk to these plans. While the 18 June GIC preceded US action against Iran, we recognised the escalation in geopolitical risk. The GIC's central scenario is for the nearest Brent crude future to decline once more below USD 70 per barrel over the next year. However, the GIC also anticipates fluctuations of between USD 60–77 per barrel over the coming year as events in the Middle East unfold. Meanwhile, although the GIC continues to expect gold to remain in demand as global investors seek diversifiers from dollars, evidence of somewhat stretched short-term positioning may mean potential for an interim correction back below USD 3,300 an ounce by mid-year before resuming an upward path again in 2026.

Qualitative GIC views on fixed income, foreign exchange and commodities

We present a selection of GIC voters' diverse views and considerations on interest rates, foreign exchange and commodities.

Policy rates:

- Although the BOJ is likely to be very sensitive to trade and geopolitical risk, near-term real interest rates remain very low and still require adjustments.

- Expectations for slower growth mean room for the FOMC to cut rates; it remains a good environment for the credit market and for investment.

- If tariff-related price rises do not materialise, the FOMC will have an easier time cutting rates.

- Two rate cuts from the Fed : the central bank will probably offer much more dovish guidance than actual rate cuts and remain careful to act because of inflationary risks.

- The ECB has already cut rates substantially and is probably near completion. We are already in the ballpark of the ECB's inflation target.

10-year government yields:

- The JGB supply/demand imbalance surprised the long end of the JGB curve, but the worst is probably over, as the MOF will adjust issuance.

- Once there is a BOJ rate hike , rates are likely to adjust higher across the curve .

- “Higher real rates [in the US ] are coming.”

- The 30-year US Treasury yield may break higher once again but this may be temporary - the bond may bounce back in price again.

- Germany can spend its extra budgets and finance them in additional Bund supply, which may keep the long end of the curve under pressure.

- If the Fed does not move and the BOJ slows down and backs away from hikes, this could make unhedged UST investment more attractive.

Foreign exchange:

- It is becoming increasingly difficult to wait for the Fed to act. On the other hand, if a rate cut to 3% becomes priced in, the USD carry may no longer be favourable.

- Despite the higher interest rates in the US vs Japan , the interest rate advantage has been eroded by hedging costs, which now puts the return of hedged USTs below that of long-end JGBs (intra-curve carry).

- Short-term, if there is any rebound in risk appetite , this could support the dollar/yen toward 150 and make carry more attractive short-term.

- It is now more advantageous to take positions in euro-yen-hedged investments than in dollar-hedged investments; OATs still have a positive carry for yen-funded investors.

Commodities:

- Gold remains a diversifier of risk, uncorrelated with equities, which is what keeps it in demand. However, gold may have overshot in the short term.

- For oil , uncertainty reigns supreme. However, there remains the possibility that Iran may push for a diplomatic solution with the US.

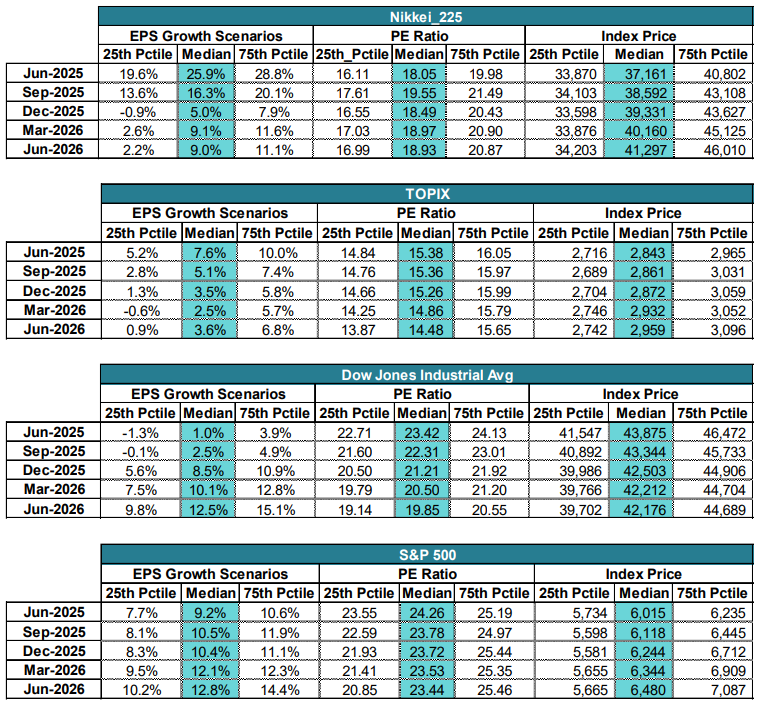

Equities: Slowing toward single-digit EPS growth, diversified valuations

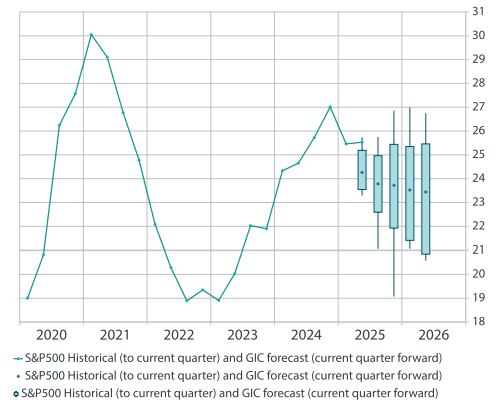

US: The days of double-digit earnings growth may be numbered, even in the US. The GIC expects EPS growth for the tech-dominated S&P500 to remain in positive territory. However, the GIC downgraded expectations to between single and low double-digit growth for the remainder of 2025, as well as early 2026. This is down from March, when confidence over double-digit earnings growth was greater. Meanwhile, valuations have likely peaked, and we expect them to take a mild downward trajectory over the coming year. Reflecting the volatility in equities, the projected inter-quartile range of price/earnings ratios has widened as we extend our projections (see Chart 11). By the June quarter 2026, the GIC expects S&P P/E ratios to be fluctuating between 20 and 25, falling short of the lofty pre-tariff highs. This benign slowdown is dependent on a scenario of reduced global tariffs and geopolitical tensions, although risks remain. As we emphasise above, the growth differential between the US and other developed economies is likely to narrow.

Chart 11: Greater uncertainty for US valuation as time progresses

Source: Nikko AM, Macrobond

Japan: Tariff uncertainty remains a predominant theme for Japanese corporates, as Japan negotiates to eliminate tariffs in the auto sector and firms in the semiconductor sector similarly hope for exemptions. There are some signals that firms generally intend to pass through price increases but to balance such increases with their downward impact on sales volumes. The possibility for a near-term dip into negative YoY earnings growth within 2025 is present as such adjustments progress. It will take some time for tariffs to pass through into final prices and therefore to impact profit margins. The GIC anticipates that earnings growth may slow to the low single digits around year-end 2025 and then rebound again by mid-2026. Large industrials may rebound toward 8-9% while the broad-based TOPIX may see earnings growth pick up more slowly but remain positive over this time. Meanwhile, as Japan plans to make large investments into AI infrastructure such as data centres and into energy infrastructure to meet the electricity demand that comes alongside these, it is anticipated that large amounts of investment will be necessary for quarters to come, providing a domestic source of demand for many manufacturers. Meanwhile, domestic demand-related firms are anticipated to continue their slow and steady single digit growth, on trend. In contrast to US valuations, which we expect to have peaked, Japanese P/E valuations remain close to 20-year lows and, as such, we anticipate a rebound over the coming year, even as volatility-driven selloffs may punctuate price moves (see Chart 12). On volatile dips, we foresee deep and broad-based cohorts of cash-rich buy-and-hold domestic investors (corporates, households and financial institutions) likely to continue keeping valuation downside limited.

Chart 12: US valuation back at “exceptional” levels again, Japan P/E still relatively low

Source: Nikko AM Global Strategy, Macrobond

Europe: for many quarters, European equities have been deemed a value trap by global investors, mired by slow economic growth within the region, limited fiscal stimulus, slower investment and a tighter regulatory environment compared to the US. However, as investors started looking to diversify their portfolios beyond the US tech sector, they turned their attention to the European markets. The ECB's more accommodating monetary policy and a significant increase in fiscal spending, especially in defence, have given Europe an edge against the US in terms of financial and monetary conditions (refer to Chart 1). The Draghi report, sponsored by the European Commission and released in late 2024, may have signalled a turning point in European competitiveness. Relaxation of competition rules, structural reforms and investments in innovation may gradually benefit Europe's regulatory environment compared to the less regulated US market. The recent rally in European stocks is expected to continue, to some extent, in the coming quarters. The GIC expects EPS growth to continue slowly accelerating to the mid-single digits over the coming year, with a possibility of exceeding 5% YoY. With valuations having risen from historically low levels, earnings are expected to be the primary driver of equity prices going forward. As earnings improve, P/E may come under mild downside pressure.

Qualitative GIC views on global equity markets

We present a selection of GIC voters' diverse views and considerations on global corporate earnings growth and equity valuation.

US equities:

- Equities are likely to have a “soft landing”. AI infrastructure investment continues at a rapid pace and there is a consensus that AI penetration can go further. Equity investors are looking through both geopolitical and global trade risk, assuming détente on both. However, such optimism could itself be a risk.

- Looser fiscal and monetary policy have typically been very supportive of equities and P/E forward multiples.

- “There may be disappointing growth for the average US company”.

- The AI capex cycle has not turned yet. But the US risk premium has started to rise; US stocks are now dependent on volatility always quickly subsiding after spikes.

- From a flows perspective, the rise in long-end yields may provide some reason for pension funds to reduce their equity exposure and allocate back to fixed income, reducing their risk.

Japan equities:

- Earnings are expected to remain under pressure from tariff uncertainty in late 2025, and stabilise going into 2026. Large manufacturers' growth may return to high single digits of 8-9%.

- If long-term interest rates start to surge, growth stocks could be vulnerable. This is a risk but not the central scenario.

European equities:

- Growth by European stocks may be slow, but they could offer some long-term value in relative terms. Changes in European fiscal policy will take some time to feed through into earnings.

- Despite Europe's growth challenges, it may be emerging as a good diversifier amid lofty US valuations.

Risks to our outlook: inflation, stagflation, fiscal and geopolitical spillovers

Compared to the probability-weighted scenarios we reviewed at our April extraordinary GIC, we have observed a decrease in uncertainty. We have therefore placed greater confidence on the scenario of trade détente and slower, yet positive, US and global growth. However, we emphasise that tail risks remain persistent. Below, we summarise the key risks reviewed at our June GIC:

- Geopolitical risks and spillovers: The ongoing Iran-Israel tensions escalated as the US took part in the conflict. One significant risk mentioned by several GIC voters, with probabilities ranging between 5-20% and considered to have a moderate to high impact, was the possibility of escalation leading to spillovers to areas currently not involved in violent conflict. This risk may intersect with supply chain and inflation risk, particularly for oil supplies passing through the Strait of Hormuz, which would impact Asia most immediately. Another lower-probability yet high-impact scenario involves political violence spreading to areas currently not afflicted by war, as global political and economic tensions intensify.

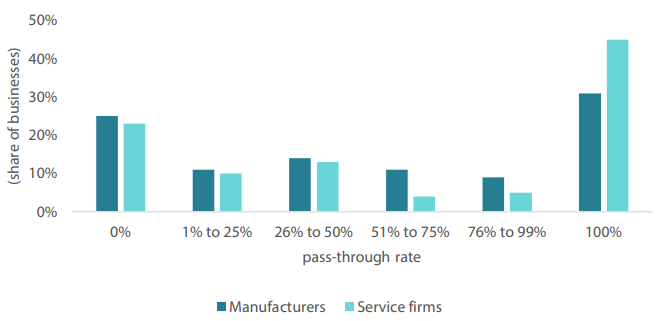

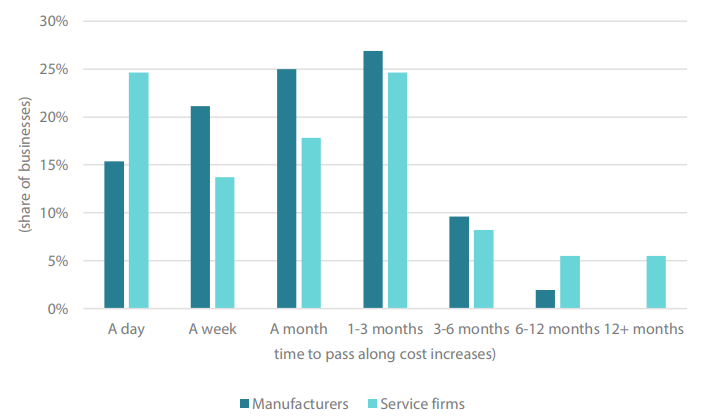

- Trade and tariff escalation: The probability of risks related to the potential implementation of the US's “reciprocal” tariffs, including the scenario where the Supreme Court rules in favour of their implementation, ranges from 10% to 42%. These risks carry a wide range of potential impact, from high (such as a judicial decision in favour of reciprocal tariffs) to low (a higher-probability resurgence of US-China trade frictions that could prolong trade negotiations). Companies are primarily responding to tariffs by passing on price increases (see Charts 13 and 14), most commonly with a lag up to three months, and such risks are likely inflationary.

Chart 13: Most businesses passed through some or all of the tariffs

Federal Reserve Bank of New York, Regional Business Surveys, May 2025.

Note: Figures are based on businesses that reported an increase in the cost of their imported goods owing to tariffs over the past six months.

Chart 14: Tariff-induced price increases happened quickly

Federal Reserve Bank of New York, Regional Business Surveys, May 2025.

Note: Figures are based on businesses that reported an increase in the cost of their imported goods owing to tariffs over the past six months.

- Inflation surge or stagflation: As noted above, a spike in oil prices resulting from an intensification of conflict in the Middle East is one potential risk which is low in probability but high in impact. A re-imposition of the reciprocal tariffs in July or later might also lead to a resurgence in inflation, and this scenario has been assigned a higher probability and high impact. Additionally, the greater fragmentation of global supply chains, stemming from both geopolitical tensions and trade disputes, could make disruptions more permanent. Another concerning scenario is a slowdown in US housing markets coinciding with uncomfortably high inflation and a slump in consumption, to which the Fed may have limited response capability due to its dual mandate focusing on growth and inflation. This remains a minority tail risk but may have significant impact if realised.

- Fiscal risks disrupt bond markets: The US faces vulnerabilities with its double deficits and historically high debt-to-GDP ratio, which could hamper a growth response to tax cuts currently under Senate review. The situation could be exacerbated by cuts to safety net measures for consumers during a downturn. The US government has limited fiscal “dry powder” left to respond to an economic downturn, and as a result longer-end yields may remain stubbornly high. Meanwhile, although Japan has made gradual progress towards achieving a primary balance and has reduced its outstanding debt relative to tax receipts, recent gyrations in 30-year JGB yields have reminded the markets that deviating from fiscal responsibility may have repercussions. One high-impact yet lower-probability (10-30%) risk is the minority government failing to gain a consensus on limited fiscal stimulus or losing a Lower House snap election. This scenario could result in more populist fiscal policies leading to a spike in JGB yields. If fiscal discipline waivers, or if the BOJ does not respond firmly to inflation, funding costs for Japanese banks could increase, which could have repercussions for corporates and consumers, presenting a tail risk.

Investment strategy conclusion: narrower growth gap with inflation risks

Following up on from the probability-weighted scenarios from our April extraordinary GIC meeting, the GIC assesses that the probability of slower yet positive growth in the US has increased. Although we still expect US EPS growth to remain positive for the time being, uncertainty is likely to pressure US stock valuations, leading to interim bouts of volatility. We anticipate a narrower growth gap between the US and other developed markets.

The risk premium offered by Japanese equities remains competitive with that of the US. Given ongoing indications of Japan's structural reflation and relative undervaluation, we continue to look for value among Japanese domestic demand-related stocks. That said, uncertainty over trade and ensuing volatility in the Japanese stock market are unlikely to disappear. We continue to follow the example of domestic investors and look for opportunities to buy on volatility-fuelled dips, anticipating resilience from the market. Similarly, we see diversification value in European and Asian stocks as growth differentials between regions narrow.

Short-term US interest rate expectations have already priced in several Fed rate cuts, resulting in the bull-steepening of the US yield curve. With a debt-to-GDP ratio of around 120%, US duration remains vulnerable to fiscal risks and trade uncertainty. In the short term, the drawdown of Treasury reserves may help keep liquidity intact until later this summer, when budget negotiations may extend the debt ceiling. US indebtedness is at its highest since World War II and with geopolitical developments keeping inflation risks in play, the term premium is likely to remain intact. Meanwhile, we believe that super-long JGB yields have peaked, as Japan adjusts its short and long-term bond supply.

We remain constructive on the Japanese yen and, to a lesser extent, the euro as portfolio diversifiers amid an uncertain US outlook.

The GIC's guidance ranges may be found in Appendix 1 of this document.

Appendix 1: GIC Outlook guidance

Global macro indicators

Central bank rates, forex, fixed income and commodities

Equities