Reporting season is stressful, but it is nothing compared to parenting a teenage son. Although it may be therapeutic for me, it appears that venting my frustrations at him is met by his invisible cape of disdain. I have therefore resorted to TikTok for advice. If you can't beat them, join them.

The Russell household has reverted to more conciliatory measures centred around the dinner table, which seems to be delivering results. Conversations with our youngest son, a 19-year old student of ancient history at St Andrews, are never dull. Incredibly, studying ancient history, particularly that of Persia, has a significant relevance in today's world, so current affairs are regularly discussed in full. However, recently we have focused on artificial intelligence (AI) and its likely far-reaching impact on life, and particularly the graduate recruitment market—which he will shortly enter.

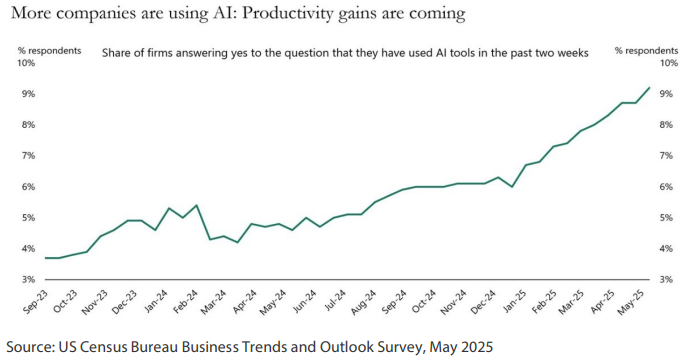

As the next great leap in productivity takes hold, the potential for business owners is huge as savings are made, economic moats are strengthened and markets are expanded. Productivity gains should also accelerate along with AI usage. Consequently, identifying those who might benefit and increase their returns is likely to offer a rich seam of Future Quality ideas. And the changes have only just begun.

Chart 1: Share of firms answering yes regarding use of AI tools in the past two weeks

AI is already impacting the job market

Numerous quotes from prominent industry leaders echo a common sentiment—in short, we are entering a period of tremendous change, some of which will have a profound impact at both the corporate and societal levels.

"AI will lead to significant cost savings and efficiency improvements, but it will also result in job displacement."

- Satya Nadella, CEO of Microsoft

Recent research on the graduate recruitment market 1 indicates a near collapse in white-collar graduate opportunities in areas such as accountancy and consulting. The deployment of technology has already automated the first few rounds of graduate selection; box ticking for the employer (and consequently the candidate) has never been more important. Getting to the interview stage seems an achievement in itself.

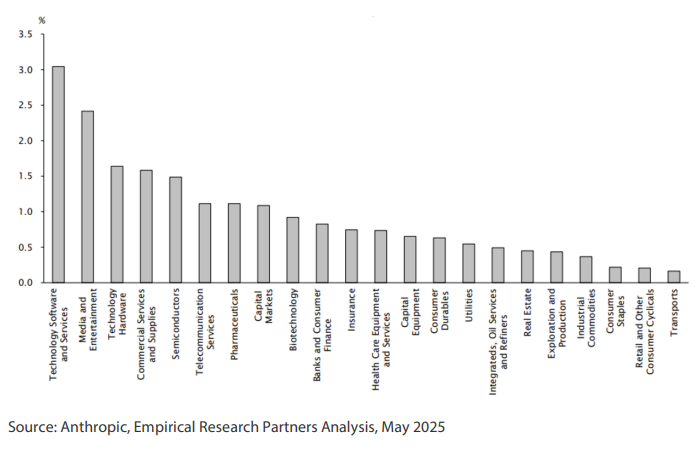

A recent study by Empirical Research Partners (Chart 2) looks at the heaviest users of US AI startup company Anthropic's large language models (LLMs). Not surprisingly, the technology, pharmaceuticals and financial services sectors are heavy users of this technology.

Chart 2: Share of GenAI queries per one million workers by sector - May 2025

The potential for higher returns can already be seen with hyperscalers such as Amazon , Microsoft and Meta , suggesting their AI operations can lead to significant labour savings. Their reach expands well beyond their own businesses as they partner with domain experts such as Genpact to deliver the industry-specific solutions that only a specialist can offer. Each of these companies are held in the portfolio, and identifying the companies that can benefit from AI in the future is likely to yield valuable Future Quality ideas.

While this AI-related trend might be beneficial for shareholders, the current and pending impact on the job market across a range of industries is a concern shared by many—even 19-year-old teenagers—suggesting graduates need to expand their search for employment.

Where can growth be found?

By 2050 (only 24.5 years away), the number of people over the age of 60 in the world is expected to double to 2.1 billion. This change in demographics indicates a significant growth opportunity in "serving" that age bracket, which I hope to join. It also supports our team's long-standing overweight position in the healthcare sector, with companies such as Encompass , the leading provider of in-home rehabilitation services in the US. Care services, in various forms, will continue to grow and much of these services will be performed by humans. However, I sense that caregiving— whether for me in my old age, or anyone else for that matter—is not in my son's immediate sights.

AI can now easily outperform humans in complex reasoning tasks, such as playing poker and chess or solving problems. However, when it comes to operating in the real world, and doing a task that humans find easy, such as tying the laces on shoes, AI still has significant difficulties.

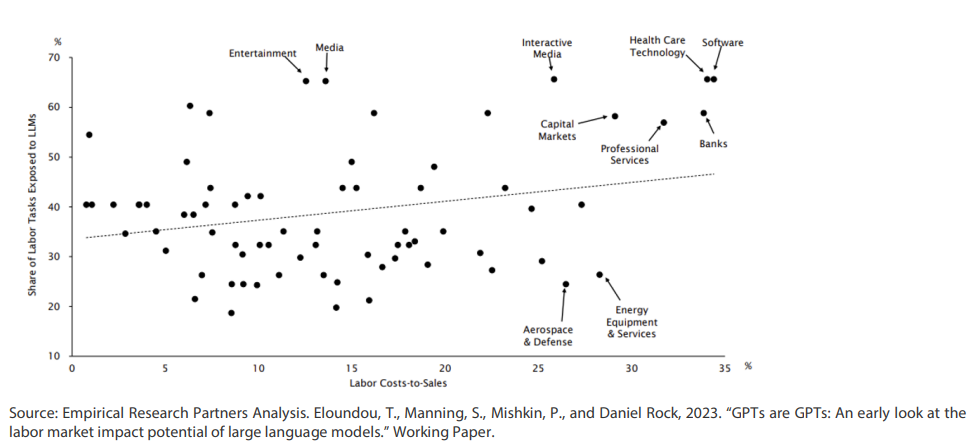

Empirical Research has further explored AI's potential impact by mapping AI tasks per industry against labour costs as a function of sales. The implication here is that high AI use, when combined with high labour costs, will provide the right ingredients for significant cost savings and hence higher economic returns. One conclusion taken from Chart 3 is that industries such as aerospace and defence or energy services are less susceptible—in the short term at least—to displacement of labour by AI. Intuitively, this makes sense.

Chart 3: Share of labour tasks that are exposed to LLM versus labour costs to sales

During a recent dinner table conversation, the topic shifted to aerospace and defence. The moral debate on having any defence capability is never far from Scottish headlines due to the naval base on the west coast of Scotland that supports the UK's submarine-launched ballistic Trident missile system. Reflecting on ancient history, it becomes evident that nations and city states frequently obliterated their rivals; as they say, "the rest is history". In the long run, defending your shores appears to be a good idea and unfortunately that is more applicable today than it has been in the last 50 years.

There are many inadvertent benefits from heavy defence spending, many of which have been highlighted by historian Margaret MacMillan, a Canadian of Scottish lineage. In her publication "How Conflict Shaped Us", MacMillan reminds us that peace, like success, has few worthwhile lessons. The historian explains that "so many of our advances in science and technology—the jet engine, transistors, computers—came about because they were needed in wartime".

AI is vital to national economic and security interests as it has the potential to alter the global balance of power. It could shift global economic competition by dominating key industries, be weaponised for military and ideological purposes, and force national AI technologies and standards on other countries. The first nation to reach artificial general intelligence and artificial superhuman intelligence could control AI supremacy.

"Successful nations will turn resources into competitive advantages—and in this AI age, the critical resources are compute, data, energy and talent".

- OpenAI's EU Economic Blueprint, January 2025

AI requires immense amounts of data, computing power, energy, capital and talent. This has prompted many nations to focus on their "Sovereign AI" capabilities, creating an urgent scramble to expand digital infrastructure, set up domestic semiconductor supply chains and ensure access to cheap, reliable energy sources. In January 2025, US President Donald Trump announced the Stargate Project, which is a venture backed by OpenAI, Oracle, SoftBank and the UAE's MGX that plans to invest USD 500 billion on AI infrastructure in the US over the next four years. The European Union launched its InvestAI initiative, earmarking EUR 200 billion for AI investments, while France announced EUR 109 billion in AI investments from domestic and foreign private sources. The Bank of China recently revealed a CNY 1 trillion (approximately USD 130 billion) investment in AI infrastructure. By now everyone is waking up to the fact that Trump has normalised unilateral action.

"This infrastructure will secure American leadership in AI… This project will not only support the re-industrialization of the United States but also provide a strategic capability to protect the national security of America and its allies".

- OpenAI: Announcing the Stargate Project, January 2025

For many, Trump's second term is a final wake-up call that they have not done enough to defend themselves. European defence spending is estimated to increase by at least USD 250 billion annually if the continent is to reach its revised target of 3.5% of GDP. The Kiel Institute argues that Europe-wide GDP will be boosted by as much as 0.9% to 1.5% if spending on defence rises to the 3.5% target.

AI, defence and energy and the role of nuclear power

The nuclear energy sector is experiencing a renaissance driven by a powerful convergence of supportive government policies, the voracious and rapidly escalating energy demands of the digital age (particularly from AI), and significant technological advancements across a spectrum of reactor designs. Nuclear power, in its various forms, is increasingly being recognised as an indispensable energy source.

To address some understandable concerns about nuclear energy, it is important to recognise that the field has undergone a profound transformation. Today's advanced reactor designs are a world away from the technology of the past, incorporating decades of research and development focused squarely on enhancing safety and efficiency. Many new designs are significantly smaller. Instead of relying on complex interventions, the new designs utilise concepts such as passive safety systems that harness natural forces like gravity and convection to prevent overheating and accidents.

Recent proposed US policy shifts are creating a more favourable environment for nuclear energy. A pivotal development is the series of Executive Orders (EOs) issued by the Trump administration in May 2025, outlining an ambitious vision to quadruple US nuclear capacity from approximately 100 GW to 400 GW by 2050. These directives mandate sweeping reforms, including compelling the Nuclear Regulatory Commission to expedite licensing reviews (e.g., setting an 18-month target for new reactor applications), overhauling Department of Energy reactor testing protocols and significantly bolstering the domestic nuclear fuel cycle. Furthermore, the EOs prioritise the deployment of advanced reactors for national security purposes and to power energy-intensive sectors like AI data centres.

Meta's recent 20-year power purchase agreement with Constellation Energy to procure 100% of the electricity output from the nuclear plant operator's site in Illinois highlights the scale of Meta's long-term demand for nuclear power. This strategic move by a tech giant underscores a broader trend, with companies like Amazon, Google and Microsoft also actively investing in or exploring nuclear power solutions to meet their sustainability goals and immense energy needs.

Consequences for Future Quality investing

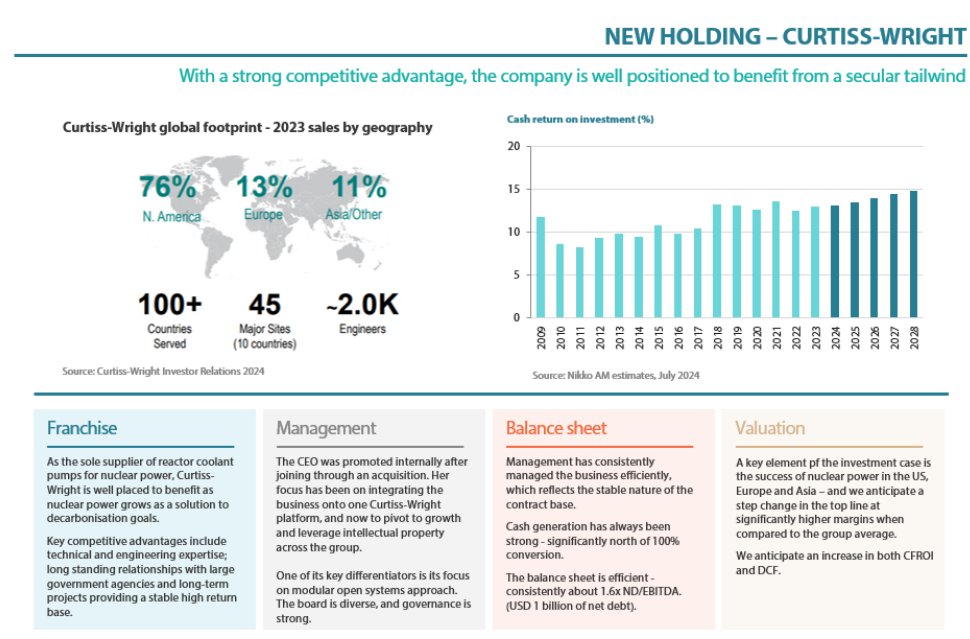

We have held Curtiss-Wright for over a year. Curtiss-Wright is a company that designs, manufactures and services highly engineered products and systems for various industries, including the aerospace, defence and nuclear sectors. The company has a long tradition of providing state-of-the-art, reliable solutions in the defence and nuclear sectors.

The nuclear industry has been hollowed out over the last 50 years, leaving fewer companies with the specialist skills to deliver the required growth over the next few decades. Curtiss-Wright's nuclear business offers significantly higher margins compared to the group average, which may lead to rising returns. Moreover, the future market potential significantly surpasses recent historical figures. Outside of nuclear, over 50% of Curtiss-Wright's business is in the defence industry, with the company selling robotics, sensors, unmanned drones and actuation systems. These products and services are expected to be in heavy demand for the next decade and beyond as economies readjust their defence spending (see Appendix 1). Growth is harder to find in today's low-growth world. However, tailwinds, such as those generated by nuclear power, are expected to deliver rising returns for years to come and alpha may follow.

Appendix1: The Future Quality case for Curtiss-Wright

Curtiss-Wright is a significant presence in the commercial nuclear power industry, playing a supportive role since the first US nuclear plant went into operation in Shippingport, Pennsylvania, in 1957. The company is the sole supplier of reactor coolant pumps for nuclear power in the US, serving both large reactors and small modular reactors (SMRs). This allows it to benefit from the increasing adoption of nuclear power globally.

Furthermore, the company stands to benefit from the multiple plant upgrades that will likely be required to extend the current nuclear capabilities in the US and other developed western economies. Such demand is expected to arise as operating licenses are extended beyond the original 40-year design lifespan of the plants.

Curtiss-Wright also supplies the world's most advanced reactor coolant pump for Westinghouse's AP1000, one of the safest and most economical nuclear plant designs available. This plant design is likely to win significant business across eastern Europe as nations such as Poland expand their nuclear power capabilities.

The US boasts a vibrant ecosystem of SMR developers, with companies like Westinghouse (AP300 PWR), X-energy (Xe-100 high-temperature gas-cooled reactor) and TerraPower (Natrium sodium-cooled fast reactor) naming Curtis-Wright as a supplier. Additionally, Hitachi , which is also held in the strategy, is involved in the GE Hitachi Nuclear Energy SMR development.

Conclusion

As always, we are focused on finding ideas that are supported by the four pillars of Future Quality investing: franchise quality, integrity of management, balance sheet strength and valuation. We seek companies in growing markets or with technology or services that will lead to greater market share, leading to increasing cashflow returns on investment. We expect AI, energy and defence to continue providing attractive investment ideas given the structural changes anticipated in these industries.

For graduates, there are still reasons for hope. The future job market will probably favour those who can work alongside AI and leverage the technology to be more productive while focusing on the interpersonal, creative, and strategic aspects that machines cannot replicate. In that sense, while certain jobs may vanish, new opportunities may open for those with the right mix of technical savvy and human skills. Graduates and companies that understand the potential of AI as a tool rather than just a threat are expected to be well positioned to thrive in what is undeniably a structural evolution of the job market.

In the meantime, there are certain things AI cannot help with, such as tidying up a teenager's bedroom. That remains a job for humans, particularly in the case of my son!

"AI will not replace humans, but those who use AI will replace those who don't".

- Ginni Rometty, Former CEO of IBM

"The future of AI is not about replacing humans, it's about augmenting human capabilities".

- Sundar Pichai, CEO of Google

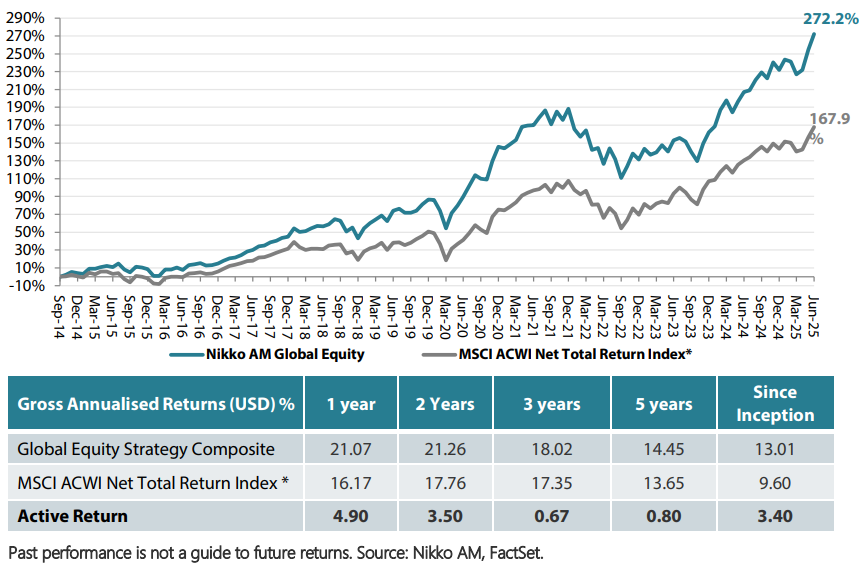

Global Equity strategy composite performance to June 2025

*The benchmark for this composite is MSCI ACWI Net Total Return Index. The benchmark was the MSCI ACWI ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Returns are based on Nikko AM's (hereafter referred to as the "Firm") Global Equity Strategy Composite returns. Gross returns are presented gross of management fees, performance fees, custodial fees and withholding tax but net of all trading commissions. Returns for periods in excess of 1 year are annualised. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

Data as of 30 June 2025.

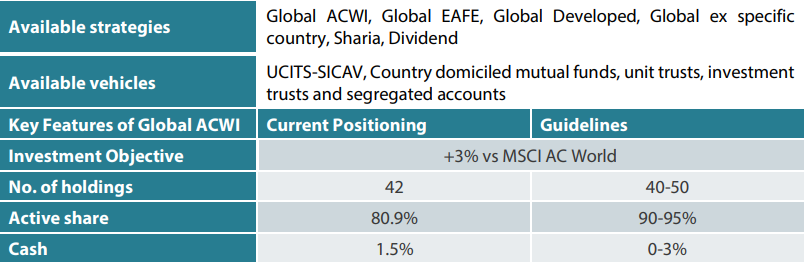

Nikko AM Global Equity: Capability profile and available vehicles

(as at June 2025)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy's risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

Past performance is not indicative of future performance. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually "joining the dots" across geographies, sectors and companies, to find the opportunities that others simply don't see.

There are four key areas that make our strategy different:

- a focus on Future Quality companies - a different and clear philosophy

- a distinctive team culture - a tight-knit team with a process built on openness and respect

- unique execution , including rigorous team challenge of every idea

- differentiated portfolios , with a strong track record in stock-picking and ESG integration

Future Quality companies

We believe that companies with superior long-term returns on investment will deliver better performance. We call these Future Quality companies, and it is only these companies that make it into client portfolios. We search for Future Quality through analysis and financial modelling of companies that we expect to deliver over the next five years, and beyond. This approach is supported by academic evidence that businesses with high and improving returns on invested capital provide superior compound performance over the long term. With this investment time horizon, the sustainability of returns is a crucial ingredient of our Future Quality approach. We have found that companies developing solutions to ESG issues and management teams providing value to all stakeholders are more likely to be successful at sustaining high returns on invested capital over the long-term.

Distinctive team structure and culture

We believe that our collective knowledge and experience are powerful tools for delivering investment performance. Since 2011, we have operated a team-based approach to uncovering Future Quality investment ideas and have fostered a strong group dynamic. Individually, each Portfolio Manager is an expert investor with a broad skillset and experience of many market cycles.

We work in a flat structure, where all our Portfolio Managers have a dual role that combines investment analysis and investment management responsibilities. With individual analytical coverage split along industry lines, each Portfolio Manager is a specialist in the stocks and sectors they cover.

We all actively challenge the ideas and analysis of colleagues throughout the investment process, in an open atmosphere of vigorous and constructive debate. Portfolio Analysts work alongside Portfolio Managers, typically researching thematic trends that could influence and uncover future investment opportunities.

We take collective responsibility for approving stocks for the portfolio, and therefore there is joint accountability for performance. As such, it is in everyone's interest to ensure that the investment analysis is thorough and that no stone is left unturned in the search for Future Quality.

We believe that the broad experience of our Portfolio Managers and distinctive team-based approach that sees everyone contributing to the strategy, increases the probability of successfully uncovering Future Quality.

Unique execution

Our tight-knit team approach and flat structure enable us to execute in a transparent way, including a rigorous team challenge of every idea. By using our strict Future Quality standards, we can identify long-term winners from the broader universe, to narrow down a comprehensive watch list and around 100 deep dive researched ideas. This is within a unique framework of individual accountability for the underlying analysis and company research, combined with the collective challenging of assumptions at the team level. Our proprietary ranking tool creates a disciplined process to compare and rank attractive opportunities and ensures that at the portfolio construction phase, only our best-ranked ideas receive the most committed weights in client portfolios. We believe our culture is key, and the collective ownership of our research process brings the best portfolio outcomes for clients.

Differentiated portfolios

We deliver a high-conviction Global Equity strategy for clients that is not constrained by benchmarks. As such, Future Quality can be sourced from listed businesses across any geography or sector. And, in a world awash with investment prospects, our disciplined, accountable and transparent process helps us to focus solely on building portfolios from companies that best meet our specific Future Quality criteria.

In terms of balancing risk and reward, our track record shows that we consistently deliver attractive returns on a lower risk-adjusted basis compared with peers and the global reference benchmark. The high active share and concentrated number of holdings help ensure that our Future Quality stock-selection process delivers differentiated portfolios.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the strategy will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.

1 US-Educated-but-unemployed-a-rising-reality-for-college-grads.pdf - OxfordEconomics, May 2025

Reference to any particular securities or sectors is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way. There can be no assurance that any performance will be achieved in any given market condition or cycle. Past performance or any prediction, projection or forecast is not indicative of future performance.