Middle-aged Scottish men (of which there are a few in our office), tend to become subjects of good-natured ribbing. Some of it, admittedly, is deserved. One of the shortcomings often noted is their reluctance to seek medical help in the face of mounting evidence that it is the right thing to do. Unfortunately, this “head in the sand” tendency often produces bad outcomes that could otherwise have been avoided.

Source: Shutterstock

Ignoring the healthcare sector has been easy to do over the last couple of years—even though the case for owning it has never been stronger.

Part of the reason the healthcare sector has been overlooked is due to the financial volatility caused by the COVID-19 pandemic. Some companies benefited from increased demand for their products and services during the dark days of 2020–2021 and then lost out as (thankfully) the pandemic subsided. Others lost out and then benefitted, as patients returned to their doctors for more routine healthcare needs. Over the last couple of years, many healthcare companies have been labelled as “too difficult” due to the challenges of determining their financial standing. This includes assessing whether they were on the positive or negative side of the ledger, and predicting when “normal” demand might re-emerge.

Time and patience have been necessary to reveal the answers. As we move into 2024, the fog of uncertainty is starting to lift, providing a clearer perspective. It is now widely accepted that a fair picture of COVID-adjusted trend growth can be obtained by combining two years of pre-pandemic growth rates, two years during the pandemic, and two years post-pandemic. Even if the healthcare sector has endured a difficult 2022–2023, we will not be afraid to add to our positions in areas where we believe that the trend growth looks strong and sustainable, and the valuation attractive.

Our holdings in the life science tools subsector, such as Danaher and Bio-Techne, are good examples. Due to unprecedented post-pandemic destocking, a Chinese regulatory clamp down and a necessary return to more focused investments by the biotech industry, 2022 and 2023 have been difficult years. However, we believe that we are only in the very early stages of a new wave in scientific/medical advances—one in which a greater understanding of the human genome allows us to target new areas for medicines with artificial intelligence (AI) expediting the identification of treatments that are most likely to work. Consequently, the order books at both companies could start to fill up quickly as we move into the second half of 2024.

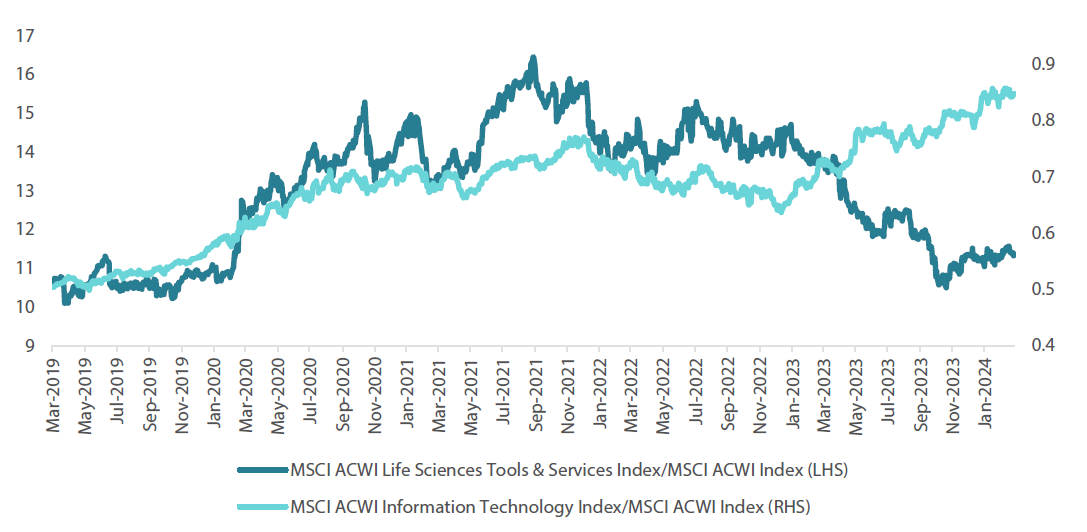

A return to growth should allow the life sciences and tools subsector to recouple with (or even outperform) other growth sectors such as IT that consistently deliver high cash returns on investment. The IT sector quickly addressed its own post-COVID demand growth blip through very assertive cost cutting and the rise of AI.

Chart 1: Life sciences and tools vs. IT

Source: Bloomberg as at 21 March 24

Why take an umbrella when it is sunny outside?

It is also fair to note that economic conditions have remained better than many observers expected. In particular, labour markets have been tight—allowing positive real wages in many sectors and supporting consumer confidence. Why increase your exposure to a relatively defensive sector like healthcare when the economy is purring, the Fed is about to cut rates and we could enjoy the softest of soft landings?

We are far from economic doom mongers. In fact, we do not subscribe to any extreme economic viewpoints. We would always prefer our stock selection to speak for itself, rather than require a bit of amplification from macroeconomic conditions.

Given the optimism observable at present, in terms of stock market levels and financial conditions, we do think that a bit of insurance makes sense—just in case interest rates do not come down as quickly as expected or if emerging pockets of economic softness grow in size.

It helps also that our most defensive holdings within healthcare all have stock-specific attractions that matter more to us than their average beta of 0.7. Cencora, Elevance and Encompass Health are all expected to benefit from sustained, demographics-led demand growth; they also offer services that will be indispensable in lowering the cost of healthcare delivery.

Cencora stands to benefit from improved distribution dynamics as US dollar 200 billion worth of US prescription drugs lose patent protection over the coming five years, a change that will also benefit patients. Elevance has embraced value-based care, tying the payments that they receive as healthcare insurers to the health benefit received by patients (and replacing the old, less efficient fee-for-service model). Meanwhile, Encompass Health’s inpatient rehabilitation facilities are increasingly recognised as providers of the best quality post-acute care for patients. Often, they offer a more cost-effective solution compared to alternatives such as nursing homes or general hospitals.

You don’t want all your eggs in one (AI) basket

By staying invested in healthcare, it is not just the possibility of an economic downturn that we are protecting our clients’ capital against. The sector also offers welcome diversification from some of today’s most exciting parts of the market. To borrow a seasonal metaphor, we do not want all our (Easter) eggs in one (thematic) basket.

Source: Shutterstock

We are firm believers that the infrastructure for generative AI will be developed, even as we wait for the emergence of pivotal applications. We do not have to wait, however, for healthcare’s socio-economic necessity to be established. We have long remained convinced that companies whose technology allows us to maximise our economically-active years and minimise the cost of delivering these will enjoy the sustained, profitable growth that is the hallmark of Future Quality.

There is gold in them there pills…

Admittedly, when gold assayer Matthew Fleming Stephenson made his famous remark in 1849, he was referring to hills, not pills. Indirectly quoted in Mark Twain’s novel The American Claimant, Stephenson declared, “There’s gold in them thar hills” in an attempt to slow the emigration of gold prospectors from his native Georgia to California1. Indianapolis and Denmark are not known for their hills, but the only gold that investors have uncovered in healthcare in the last couple of years has been found there (in the form of Eli Lilly and Novo Nordisk). Their reformulation of well-established diabetes agents into effective treatments for weight loss, and clever marketing, has created huge excitement.

A relatively little-known fact is that Scotland has had an important role to play in the creation of this craze. The music for the “Oh Oh Ozempic” commercial which has become synonymous with these drugs in the US (Ozempic having the same active ingredient as weight loss product Wegovy) is from a 1970s hit “Magic” by Edinburgh pop rock band Pilot. The share price impact of these drugs has certainly been worthy of another Edinburgh-based creation, Harry Potter.

The parabolic increase in share prices for these two companies has seen them almost keep pace with the champions of generative AI. Similarly to AI, the science behind these new drugs is not as new as the stock market’s reaction would have you believe. While it may not date back as far as the formative research on AI in the 1950s, GLP-1 was discovered in 1986 and it has taken almost 40 years of scientific research to get to the current level of understanding.

It will take longer still to resolve several questions that remain outstanding regarding these drugs. How long will patients need to take them for? Will weight be regained if they stop? How safe it is to lose up to 25% of your weight in one year? How much will they cost, in the long term? And can the supply of the drugs keep up with demand?

The most important questions in the long term, however, are: can the US healthcare system afford to pay for these drugs? Or, put another way, can it afford not to, given the high cost of treating many of these patients already being borne by the system?

We are continuing to carefully research in this area, and that research extends beyond Lilly and Novo. It appears to us that the most lucrative place to be in the long run could be among the providers of the “picks and shovels” necessary for this seam to be successfully exploited. These picks and shovels span everything from active pharmaceutical manufacturing and distribution to the glass vials and injectors used in sterile fill and finish.

Conclusion

We remain very strong supporters of the healthcare sector. In addition to the well-known demographic drivers (ageing societies, rising prevalence of chronic illness etc), innovation is enabling structural changes in healthcare delivery and in our view these changes will confer years of strong organic growth opportunities if we choose the right companies.

Mark Zuckerberg famously encouraged his employees to “move fast and break things”. However, breaking things can lead to severe consequences in a clinical setting; furthermore, it is not in keeping with one of the core principles of the Hippocratic oath: “first do no harm”. As a result, change happens more slowly in healthcare than in other sectors. The changes underway at present, however, are profound, and we believe it will play out longer than in other areas.

When you need medical attention, waiting seldom makes things better. It normally just means that a more assertive intervention is needed when the time comes. Similarly, waiting to invest in the secular growth on offer in the healthcare sector, whilst putting all your bets on an economic soft landing and/or the eternal rise of AI may lead to a bad outcome.

1When the Georgia Gold Rush came to an end in the 1840s, many prospectors headed west to join the California Gold Rush. Stephenson did not agree and is said to have proclaimed in a Georgia town square, "Why go to California? In that ridge lies more gold than man ever dreamt of. There's millions in it".

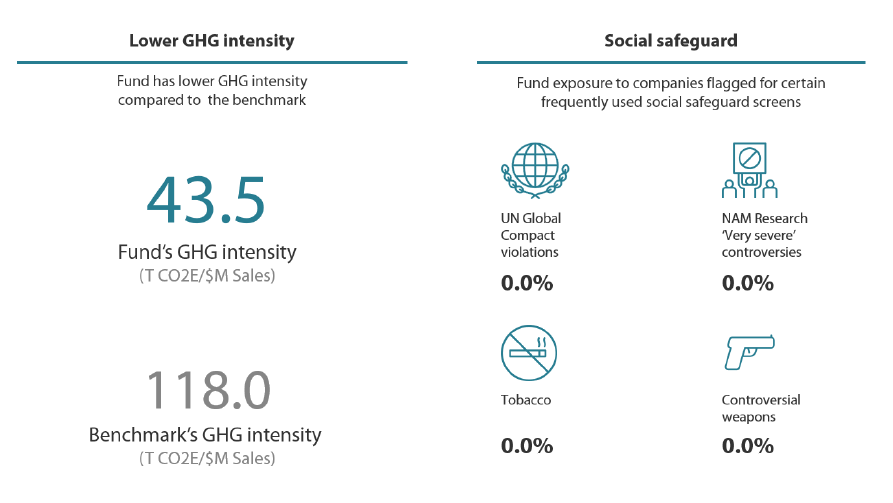

Source: MSCI ESG Research, NAM Research 29 February 2024. Underlying score is the MSCI ESG Quality Score. Carbon Footprint is Weighted Average Carbon Intensity. The above is a representative account of the Nikko AM Global Equity Strategy. Benchmark is the MSCI ACWI Net Total Return Index. Data is subject to change without notice. Any comparison to reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

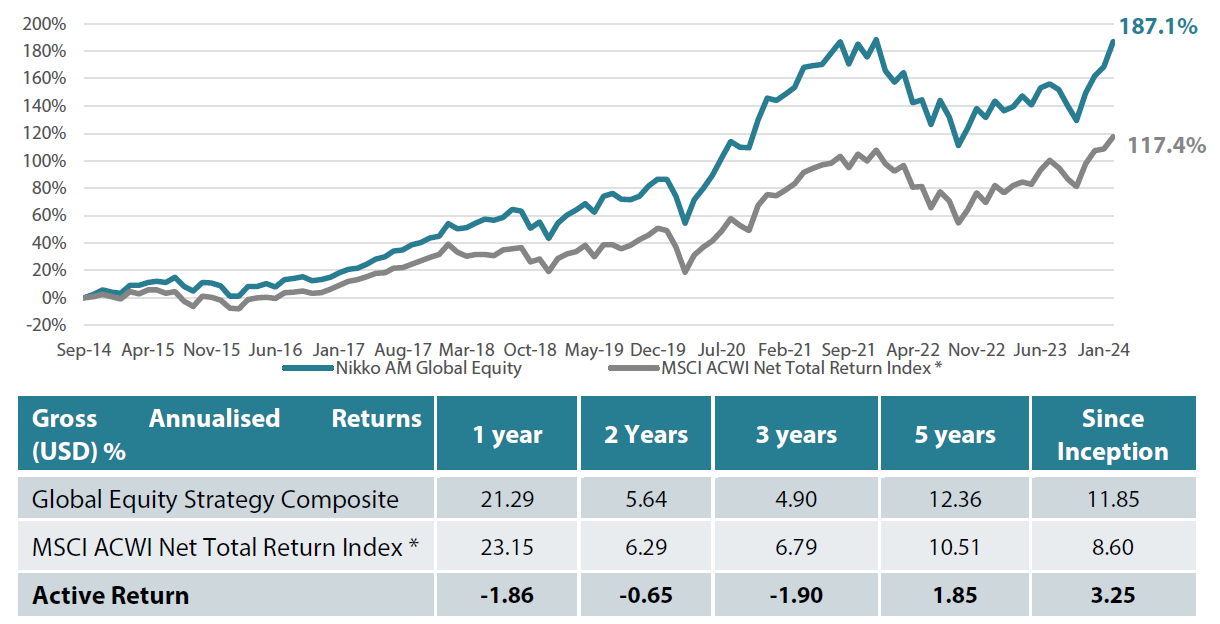

Global Equity strategy composite performance to February 2024

Past performance is not a guide to future returns.

*The benchmark for this composite is MSCI ACWI Net Total Return Index. The benchmark was the MSCI ACWI ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it.. Data as of 31 October2023.

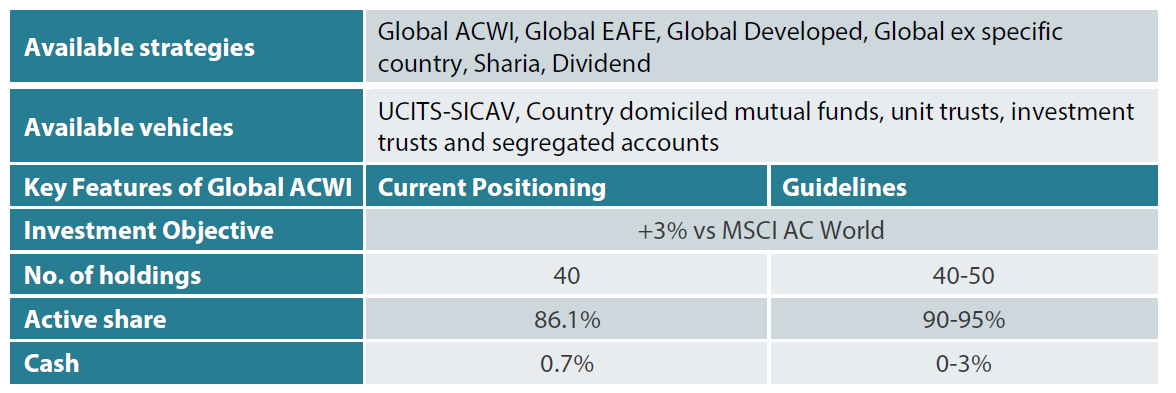

Nikko AM Global Equity: Capability profile and available vehicles

(as at February 2024)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

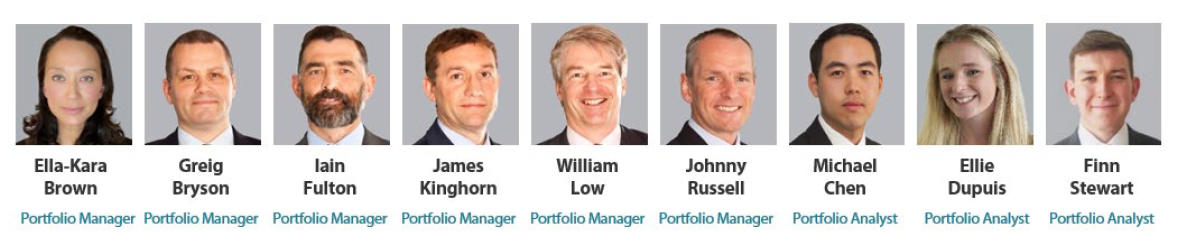

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

There are four key areas that make our strategy different:

– a focus on Future Quality companies – a different and clear philosophy

– a distinctive team culture – a tight-knit team with a process built on openness and respect

– unique execution, including rigorous team challenge of every idea

– differentiated portfolios, with a strong track record in stock-picking and ESG integration

Future Quality companies

We believe that companies with superior long-term returns on investment will deliver better performance. We call these Future Quality companies, and it is only these companies that make it into client portfolios. We search for Future Quality through analysis and financial modelling of companies that we expect to deliver over the next five years, and beyond. This approach is supported by academic evidence that businesses with high and improving returns on invested capital provide superior compound performance over the long term. With this investment time horizon, the sustainability of returns is a crucial ingredient of our Future Quality approach. We have found that companies developing solutions to ESG issues and management teams providing value to all stakeholders are more likely to be successful at sustaining high returns on invested capital over the long-term.

Distinctive team structure and culture

We believe that our collective knowledge and experience are powerful tools for delivering investment performance. Since 2011, we have operated a team-based approach to uncovering Future Quality investment ideas and have fostered a strong group dynamic. Individually, each Portfolio Manager is an expert investor with a broad skillset and experience of many market cycles.

We work in a flat structure, where all our Portfolio Managers have a dual role that combines investment analysis and investment management responsibilities. With individual analytical coverage split along industry lines, each Portfolio Manager is a specialist in the stocks and sectors they cover.

We all actively challenge the ideas and analysis of colleagues throughout the investment process, in an open atmosphere of vigorous and constructive debate. Portfolio Analysts work alongside Portfolio Managers, typically researching thematic trends that could influence and uncover future investment opportunities.

We take collective responsibility for approving stocks for the portfolio, and therefore there is joint accountability for performance. As such, it is in everyone’s interest to ensure that the investment analysis is thorough and that no stone is left unturned in the search for Future Quality.

We believe that the broad experience of our Portfolio Managers and distinctive team-based approach that sees everyone contributing to the strategy, increases the probability of successfully uncovering Future Quality.

Unique execution

Our tight-knit team approach and flat structure enable us to execute in a transparent way, including a rigorous team challenge of every idea. By using our strict Future Quality standards, we can identify long-term winners from the broader universe, to narrow down a comprehensive watch list and around 100 deep dive researched ideas. This is within a unique framework of individual accountability for the underlying analysis and company research, combined with the collective challenging of assumptions at the team level. Our proprietary ranking tool creates a disciplined process to compare and rank attractive opportunities and ensures that at the portfolio construction phase, only our best-ranked ideas receive the most committed weights in client portfolios. We believe our culture is key, and the collective ownership of our research process brings the best portfolio outcomes for clients.

Differentiated portfolios

We deliver a high-conviction Global Equity strategy for clients that is not constrained by benchmarks. As such, Future Quality can be sourced from listed businesses across any geography or sector. And, in a world awash with investment prospects, our disciplined, accountable and transparent process helps us to focus solely on building portfolios from companies that best meet our specific Future Quality criteria.

In terms of balancing risk and reward, our track record shows that we consistently deliver attractive returns on a lower risk-adjusted basis compared with peers and the global reference benchmark. The high active share and concentrated number of holdings help ensure that our Future Quality stock-selection process delivers differentiated portfolios.

About Nikko Asset Management

With USD 228.6 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 29 February 2024.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the strategy will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.

There can be no assurance that any performance will be achieved in any given market condition or cycle. Past performance or any prediction, projection or forecast is not indicative of future performance.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way. There can be no assurance that any performance will be achieved in any given market condition or cycle. Past performance or any prediction, projection or forecast is not indicative of future performance.