Summary

- US Treasury (UST) yields rose in January, with the benchmark 2-year and 10-year yields climbing 44.5 basis points (bps) and 26.7 bps, to 1.18% and 1.78%, respectively. The sell-off in USTs was primarily led by increasing expectations of a more aggressive US Federal Reserve (Fed) tightening cycle.

- The inflationary picture was mixed in December. Headline consumer inflation index (CPI) inflation in India, Indonesia and Singapore accelerated, while similar inflation gauges in China, Malaysia, Thailand and the Philippines moderated. Real gross domestic product (GDP) growth in China, Singapore and the Philippines rebounded in 2021.

- Policy actions by monetary authorities diverged across the region. The People’s Bank of China (PBOC) eased monetary policy further. In contrast, the Bank of Korea raised its policy rate by 25 bps and remained hawkish. The Monetary Authority of Singapore (MAS) in an out-of-cycle move, announced that it will make another “pre-emptive adjustment” to combat rising inflation. Bank Indonesia left its policy rate unchanged but announced changes to its reserve requirement ratio (RRR) for banks.

- We remain cautious on bonds of low yielding countries and regional currencies. Meanwhile, we anticipate US dollar (USD) strength to continue as we head into the Fed’s tightening cycle, especially as US real yields are rising.

- The Asian credit market experienced a challenging start to the year. Asian credits retreated 2.19% in January as UST yields jumped. Asian high-grade (HG) credits declined 1.88%, with spreads rising 4.0 bps. Asian high-yield (HY) returned -3.49%, with spreads widening by 42 bps. By major geographical-segments, Hong Kong credits outperformed while Indonesia credits underperformed. Primary market activity picked up in January.

- We believe the macro backdrop and robust corporate credit fundamentals remain supportive of Asia credit spreads, although two key downside risks had materialised. We remain cautious and selective in adding risk over the near-term amid uncertainties surrounding Omicron and the need for more decisive loosening of property sector policies for a sustained turnaround in the China and Asia HY segments.

Asian rates and FX

UST yields rise in January

The UST market started 2022 with its yield curve bear-flattening, with yields climbing across the curve. The sell-off was primarily led by increasing expectations of a more aggressive Fed tightening cycle. This was prompted by data reflecting persistent inflation pressure and the December Federal Open Market Committee (FOMC) minutes which suggested that the Fed’s balance sheet runoff—when the Fed stops reinvesting proceeds from matured bonds—could begin in 2022, close on the heels of its first rate hike. Towards the month-end, the FOMC meeting confirmed market expectations for a March lift-off. While there were no surprises to the statement accompanying the decision, Fed Chairman Jerome Powell’s hawkish comments at the post-meeting press conference were largely construed by markets that there is now a higher risk that the Fed would tighten policy rates at a faster pace compared to the most recent cycle. Overall, the benchmark 2-year and 10-year UST yields rose 44.5 bps and 26.7 bps, to 1.18% and 1.78%, respectively.

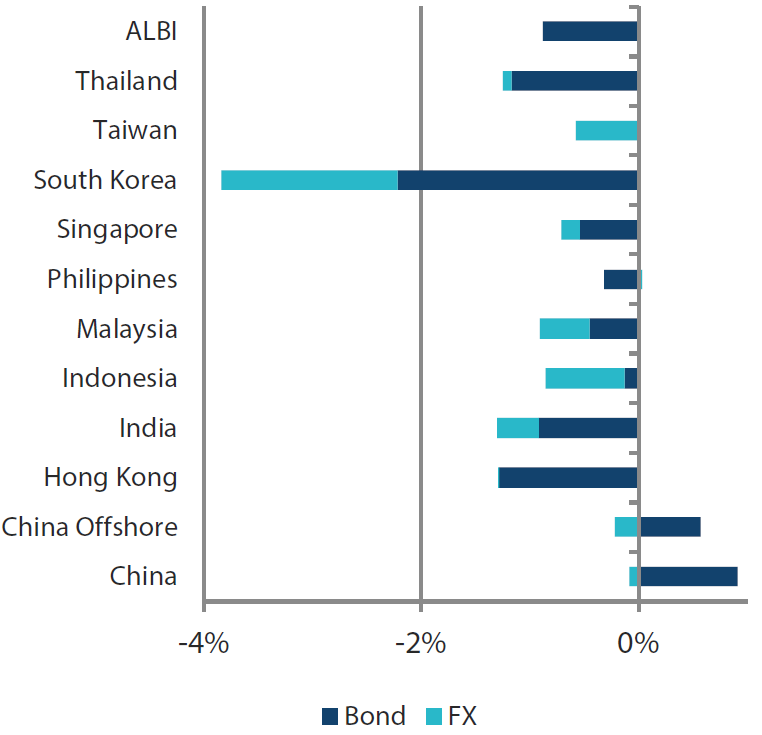

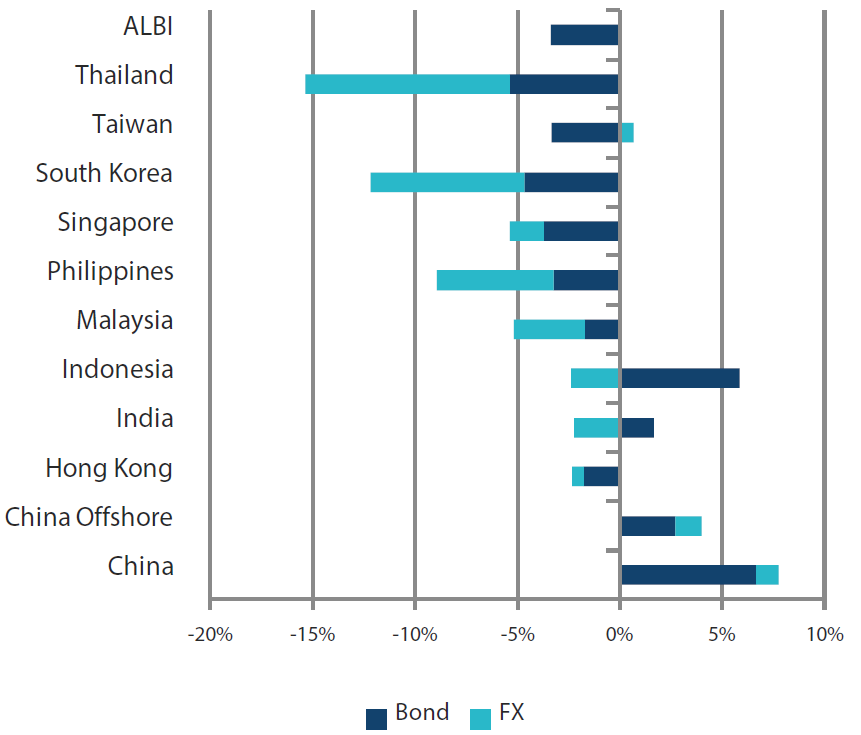

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 31 January 2022 | For one year ending 31 January 2022 | |

|

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 January 2022

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary picture mixed in December

Headline CPI inflation in India, Indonesia and Singapore accelerated in December, while similar inflation gauges in China, Malaysia, Thailand and the Philippines moderated. The 4.0% year-on-year (YoY) headline figure in Singapore was the highest since February 2013. In India, CPI inflation rose to 5.6% YoY in December, partly owing to base effects. Meanwhile, headline CPI inflation in the Philippines moderated, as food and transport inflation fell. Similarly, headline CPI inflation in Malaysia eased in December to 3.2% YoY from 3.3% YoY in November.

Monetary policy actions diverge

The PBOC eased monetary policy further, lowering the one-year medium-term lending facility (MLF) and seven-day repo rates, as well as the one-year and five-year loan prime rates (LPR). In contrast, the Bank of Korea raised its policy rate by 25 bps and remained hawkish, suggesting that although it will likely leave rates unchanged in the near-term, more hikes are possible due to inflation persisting above its target. Meanwhile, in an out-of-cycle move the MAS announced that it will make another “pre-emptive adjustment” to combat rising inflation, slightly raising the rate of appreciation of the Singapore dollar (SGD) nominal effective exchange rate (NEER) policy band. Elsewhere, Bank Indonesia left its policy rate unchanged but announced that the RRR for banks will be raised by 300 bps this year, with the hikes to be delivered in phases.

Real GDP growth in China, Singapore and the Philippines rebound in 2021

China’s real GDP growth moderated to 4.0% YoY in the fourth quarter of 2021, from 4.9% YoY in the July-September period. Still, the country’s annual GDP growth jumped to 8.1% in 2021 from 2.2% in 2020. Singapore recorded full-year GDP growth of 7.2% in 2021, rebounding from the 5.4% contraction in the previous year. In the Philippines, fourth-quarter GDP was an upward surprise, rising 3.1% quarter-on-quarter (QoQ) led by stronger private consumption. This brought full-year growth to 5.6% in 2021 from a 9.6% contraction in the prior year.

Market outlook

Staying cautious on bonds of low yielding countries and regional currencies

There remains significant uncertainty on the Fed’s path towards policy normalisation, and its communications will be keenly watched for more policy signals. We expect UST yields to continue rising heading into the initial lift-off and normalisation phase, but we are projecting a peak following greater clarity on the Fed’s tightening path and easing of inflation in latter part of the year. For now, we deem it prudent to maintain a cautious view on low-yielding countries and keeping a more neutral outlook towards higher-yielding countries due to the “carry cushion”.

While we are relatively cautious on regional bonds in the near-term, we note that foreign positioning in the Asian bond market is relatively light, making risk of capital outflow relatively low. We expect the market to stabilise after the Fed unveils details of its balance sheet reduction plan. Thereafter, we expect differentiation in inflation and growth dynamics in various Asian countries to drive their individual performances for the rest of the year. Similarly, we anticipate a moderation in inflationary pressures in the latter part of the year, which could alleviate some of the upward pressure on yields.

Meanwhile, we expect the dollar to retain its strength heading into the Fed’s tightening cycle, especially as US real yields are rising. Within Asia currencies, we are cautious towards currencies of high net oil-importing nations such as India and the Philippines as energy prices remain high. And as Asian economies recover, we expect the current accounts of countries like India, Indonesia and the Philippines to slightly deteriorate from 2021 as their imports increase, warranting a cautious stance towards their currencies.

Asian credits

Market review

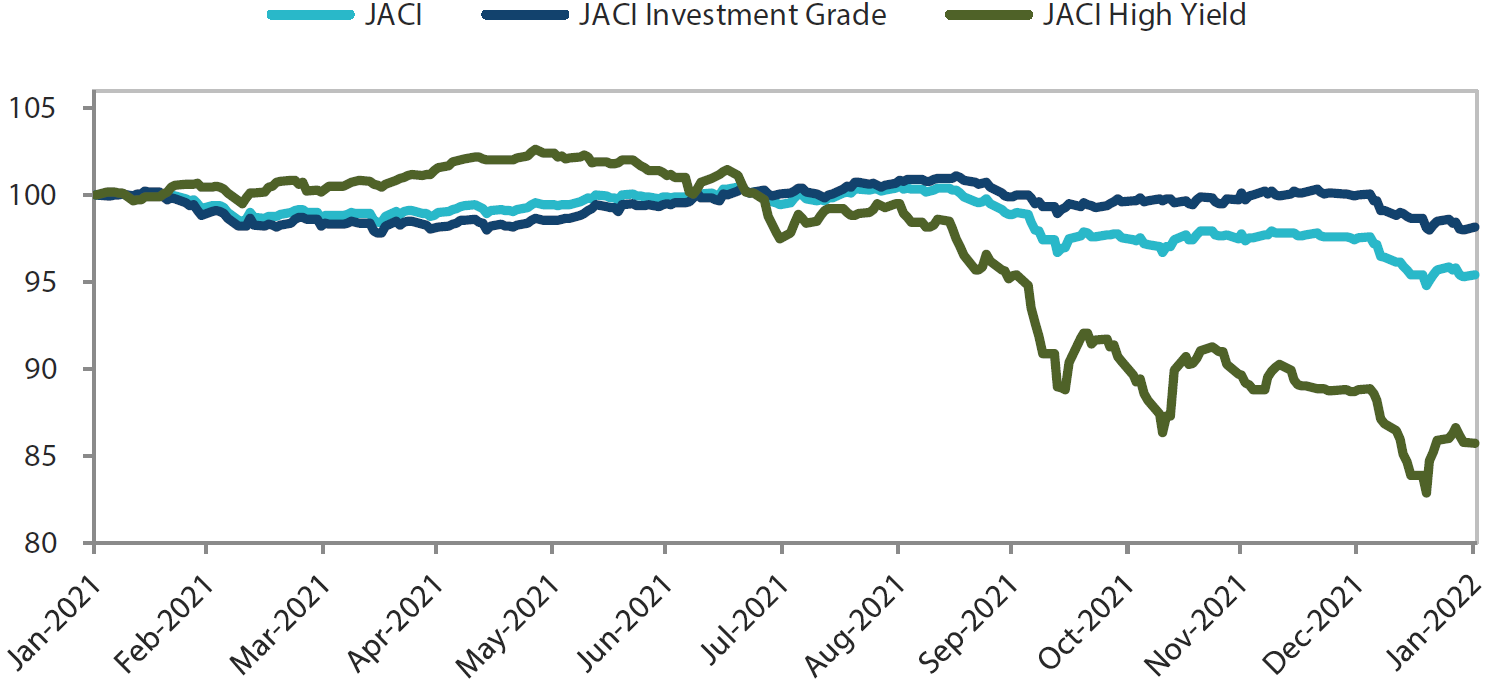

Asian credits retreat in January as UST yields jump

Asian credits retreated by 2.19% in January in total return terms, with losses being driven mainly by the significant rise in UST yields, although overall spreads also widened by 6 bps. Asian HG credits declined 1.88%, with spreads rising 4 bps. Asian HY returned -3.49%, after experiencing marked volatility in the month triggered by more negative China property sector news. Asian HY spreads widened by as much as146 bps during January, eventually ending the month 42 bps wider.

The Asian credit market experienced a challenging start to the year. The volatility in US rates—prompted by US data reflecting persistent inflation pressure together with the hawkish December FOMC meeting minutes—prompted Asian HG credit spreads to widen. Meanwhile, Asian HY fell sharply as sentiment on the Chinese property sector worsened. Increasing concerns of potential contagion risk to other parts of the Chinese economy weighed on China credits overall. Mid-month, news reports suggested that the Chinese government was drafting nationwide rules to make it easier for developers to access pre-sale funds held in escrow accounts. In addition, the PBOC stepped up monetary stimulus. In three separate moves, it lowered the seven-day reverse repurchase, the standing lending facility (SLF), one-year MLF and one-year and five-year LPR. Investors cheered the policy support from Chinese regulators, prompting a narrowing in credit spreads, particularly within China HY.

By major geographical-segments, Hong Kong credits outperformed while Indonesia credits underperformed. Due to their higher sensitivity to rising UST yields, the Indonesian Sovereign and Quasi-Sovereign credit curves steepened, while the Indonesian government’s ban on coal exports weighed on selected Indonesia HY credits.

Primary market activity picks up in January

New issuances for Asian credit picked up in January ahead of the Lunar New Year holidays. In January, 68 new issues raised a total of USD 30.9 billion in the market. The HG space saw 42 new issues amounting to about USD 27.3 billion, including a mammoth USD 4 billion four-tranche issue from Airport Authority of Hong Kong, USD 3 billion three-tranche issue from Export-Import Bank of Korea, USD 4 billion three-tranche issue from Reliance Industries and USD 2 billion Tier 2 capital subordinated debt issue from China Construction Bank. Meanwhile, the HY space saw approximately USD 3.6 billion worth of new issues raised from 26 issues.

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 29 January 2021

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 January 2022

Market outlook

Fundamentals supportive of Asian credit spreads, though downside risks have increased

We believe that the macro backdrop and robust corporate credit fundamentals remain supportive of Asia credit spreads. However, two key downside risks have materialised. First, the more aggressive monetary policy tightening in the US, including a faster pace of rate hikes and balance sheet runoff, may cause outflows from risk assets including Emerging Market (EM) debt funds, thereby weakening demand technicals for EM and Asia credit. Secondly, China is grappling with a severe downturn in the property market, even though authorities have signalled a shift in policy priority to growth stabilisation. While China’s macro is expected to improve, the weakness in the country’s real estate credits, including investment grade issuers, is starting to have a more meaningful impact on broader market sentiment.

While we continue to monitor the developments surrounding Omicron, we believe the economic impact should be less severe than the Delta wave and would not derail the economic re-opening and growth rebound in 2022 across most of Asia. However, China, Hong Kong and Macau may still experience intermittent and localised lockdowns due to their zero-COVID strategy, and their domestic services recovery may remain subdued.

These developments make it difficult for Asia investment grade credit spreads to tighten from current levels, which are already at the tighter end of their historical range. In fact, some modest widening is likely over the near-term. At the same time, more decisive loosening of property sector policies will be needed for a sustained turnaround in the China and Asia HY segment, in our view. We therefore remain cautious and selective in adding risk over the near-term.