"Nowadays people know the price of everything and the value of nothing", quipped Oscar Wilde.

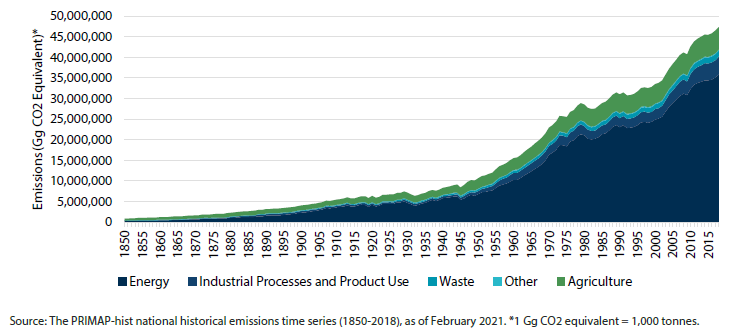

He wasn’t far off the truth when it comes to the cost of progress. Certainly, humanity has progressed substantially in the post-industrial era. But this has come at the cost of the environment. Economic development and wealth creation arising from industrialisation resulted in a rapid increase in energy usage, and a concomitant increase in greenhouse gas (GHG) emissions. These GHG, or carbon, emissions have contributed to the steady rise in global temperatures.Chart 1: Global emissions

Now, we will refer to an overused cliché about a crossroad from “The Road Not Taken” by Robert Frost.

“Two roads diverged in a yellow wood,And sorry I could not travel both

And be one traveller, long as I stood

And looked down one as far as I could

To where it bent in the undergrowth;”

One path, maintaining status quo, leads to a hotter planet than we’d like. As things stand, the total of all GHG emissions thus far make a 1.5°C warming of the planet almost inevitable.

Science has shown that the detrimental effect of global warming worsens with temperature, and unfortunately, the relationship is not linear. To put it simply, hot gets hotter, cold gets colder, wet gets wetter, and dry gets drier. But since humans don’t seem to understand any language but that of money, Nature Magazine stated that “the cost of meeting 1.5 degrees rises dramatically—from 1.3 trillion dollars per year of inaction in 2010 to over 5 trillion dollars per year in 2020”1.

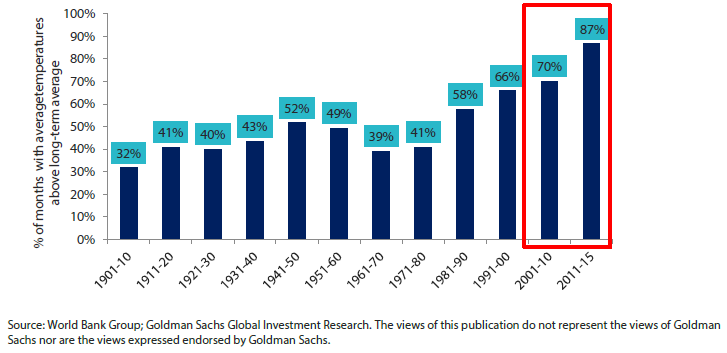

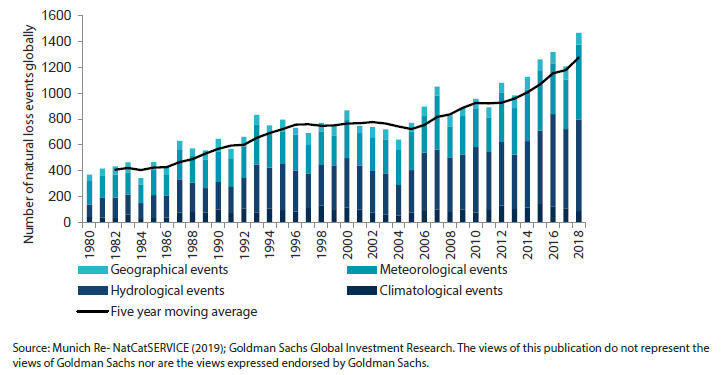

Yet, climate change still has its deniers, disappointingly, even among educated audiences. Thus, below are a couple of charts to show that incidences of extreme weather have increased substantially in the recent past, and the cost of damage and subsequent repair has been steadily rising.

*1"Assessing the costs of historical inaction on climate change", Benjamin M. Sanderson & Brian C. O'Neill, Nature magazine, June 2020

Chart 2: Percentage of months with mean temperatures above the long-term average

Chart 3: Number of natural loss events globally

So, if we remain on the current path, looking “to where it bent in the undergrowth”, things will only get bent out of shape; please excuse the pun.

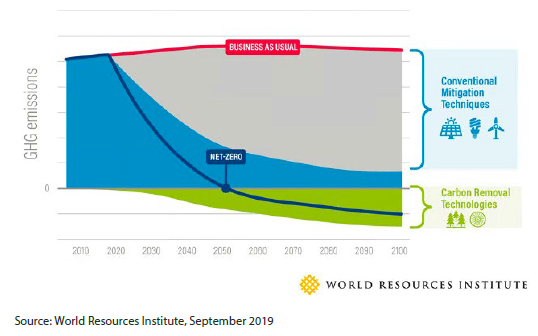

A look down the other road: what net zero carbon means

The other path offers a way to limit the damage, adapt, and potentially find ways to undo the harm that has been done. Over the past few years, there has been a global push to reduce human-caused emissions to as close to zero as possible, and simultaneously find means to absorb carbon from the environment—such that the net result is zero carbon emissions, or "net zero carbon".

Chart 4: How to achieve net zero carbon

Corporations across sectors are now urging action:

- Apple: Lisa Jackson, Vice President of Environment, Policy and Social Initiatives

“The choice between a healthy planet and good business strategy has always been a false one, and we’ve proved that with a company that runs on 100% clean energy and a supply chain transitioning to do the same. As Apple works towards 100% carbon neutral products and a carbon neutral supply chain by 2030, we’ll continue to call for the strong global targets we need to reduce greenhouse gas emissions and protect this planet for future generations”.2 - British Petroleum (BP): Bernard Looney, CEO

“The world’s carbon budget is finite and running out fast; we need a rapid transition to net zero. We all want energy that is reliable and affordable, but that is no longer enough. It must also be cleaner. To deliver that, trillions of dollars will need to be invested in replumbing and rewiring the world’s energy system. It will require nothing short of reimagining energy as we know it. This will certainly be a challenge, but also a tremendous opportunity. It is clear to me, and to our stakeholders, that for BP to play our part and serve our purpose, we have to change. And we want to change – this is the right thing for the world and for BP”.3 - Siemens AG: Joe Kaeser, CEO

“Climate change is one of humanity’s greatest challenges of our time. Businesses need to lead the way towards accelerated decarbonisation. In September 2015, Siemens became the first global industrial company to commit to achieving carbon neutrality for our global operations by 2030. Today, we reemphasize our commitment to this goal and are looking forward to joining forces with other Climate Pledge companies to help ramp up global efforts”.4

*2September 2020, in an open letter written by business leaders from various industries urging the EU to adopt an emissions target for 2030

*3February 2020, when BP announced its goal to become net zero carbon by 2050

*4September 2020, when Siemens joined the Climate Pledge, which was co-founded by Amazon and environmental organisation Global Optimism to challenge signatories to achieve net zero carbon 10 years ahead of the Paris Accord’s 2050 target

Countries too have signed up to do their bit. Half a decade after the Paris Climate Agreement came into force, more than 100 countries have pledged to get to net zero carbon emissions by 2050, with China committing to a 2060 deadline.

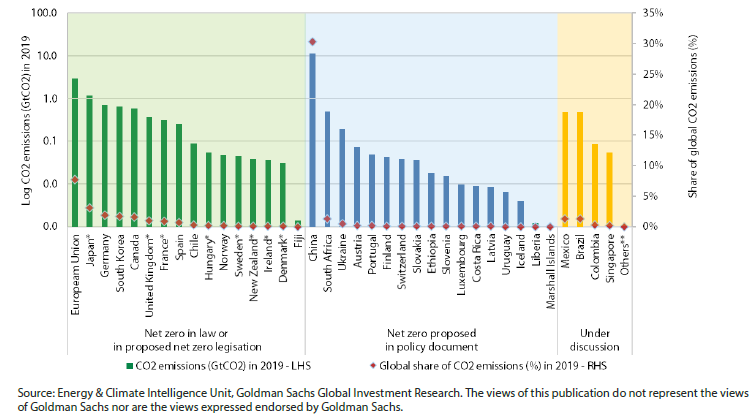

Chart 5: Countries committed to achieving net zero carbon emissions

Two countries—Bhutan and Suriname—are in fact already carbon neutral; 16 countries (and counting) have enshrined their net zero commitments in law or will do so shortly, and another 17-20 countries have proposed some form of policy document vis-à-vis their net zero promises. These efforts to decarbonise are focused on carbon conservation and carbon sequestration.

Carbon conservation

Carbon conservation is essentially reducing the amount of carbon emitted into the environment.

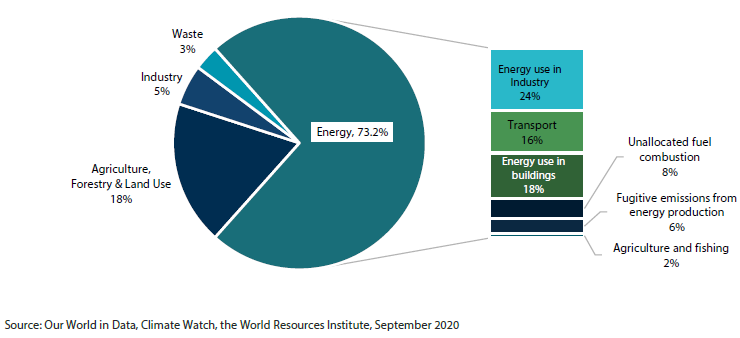

In order to minimise the amount of carbon emitted, a natural starting point is to understand what the big sources of carbon emissions are. The worst culprits are power generation, industrial activities, agriculture, buildings and transportation.

Chart 6: Global greenhouse gas emissions by sector for 2016

Going a level deeper shows the key areas under each of these buckets that need to be tackled:

- Power generation

- Switch to entirely “clean” renewable power—hydro, solar, wind, hydrogen power—over the longer term. This is a critical first step because virtually every human activity relies on power.

- Switch from “dirty” coal as raw material to less “dirty” gas as an intermediate solution i.e. phase out coal plants altogether over time.

- This will require a viable energy storage solution to be able to harness excess “clean” energy.

- Industrial activities

- Most manufacturing and processing of metals involves high temperature combustion; switch from “dirty” power to “clean” power with new methods of production and use alternate methods of production where possible (switching from a blast furnace to an electric arc furnace to make steel, for example).

- Improve the efficiency of industrial processes.

- Use “clean” hydrogen both as raw material (in petrochemicals, for instance) and as a source of energy.

- Agriculture

- Manage land more efficiently—usage of land, water table management, forest fires, etc.

- Manage livestock better.

- Buildings

- Use hydrogen and/or renewable energy (instead of “dirty” power) for building heating/cooling.

- Make buildings more efficient through better design, retrofitting energy efficient fixtures, better insulation, and optimisation of energy usage.

- Transportation

- Shift to electric vehicles for short-haul transport, particularly passenger vehicles.

- Use hydrogen-powered electric vehicles for long-haul commercial transport.

- Use cleaner fuels such as liquefied natural gas and/or hydrogen in sea transport; some progress on this front is underway following the implementation of IMO2020 regulations.

- Improve efficiency of air transport through more fuel-efficient designs and use of more sustainable fuels; aviation however is one of the hardest sectors to decarbonise.

These carbon conservation solutions all rely on “clean” energy and applying that “clean” energy as extensively as possible. Given finite resources, the three key areas of focus are “clean” power (i.e. renewable power), energy storage solutions (i.e. batteries), and “clean” hydrogen. We will explore each of these threads in a series of notes over the course of the year.

Carbon sequestration

Carbon sequestration is the process of capturing and storing atmospheric carbon dioxide. There are two main reasons that sequestration is a critical part of the solution:

- Even if the ambitious targets set out by countries around the world are met, annual carbon emissions aren’t going to zero by 2050, or 2060 for that matter.

- Humans tend to take less seriously any threat that isn’t clear and present5. Problems such as rising sea levels are, for most people, somebody else’s problem. Therefore, despite well-intentioned promises by governments around the world, actual reduction in carbon emissions is likely to undershoot projections.

*5Harvard Psychology professor Daniel Gilbert op-ed in the Los Angeles Times in 2006

Thus, the world needs a solution to mop up the “excess” carbon. The most intuitive example of carbon sequestration is trees—they are natural carbon sinks, processing carbon dioxide in the air and releasing oxygen. However, land is finite, limiting the degree to which afforestation can alleviate the problem, necessitating a more “human” solution.

Carbon Capture Utilisation & Storage (CCUS) technology is a means of capturing and storing carbon dioxide before it is released into the atmosphere. These technologies can take many forms depending on the industry in question—be it iron and steel, cement, or fertilisers.

A third means of decarbonising the planet is via Direct Air Capture and Carbon Storage (DACCS), a technology that extracts carbon from the air directly. DACCS pilots are underway in a handful of countries, and if successful, could offer unlimited potential to decarbonise, regardless of the source of carbon emissions.

Considering the costs

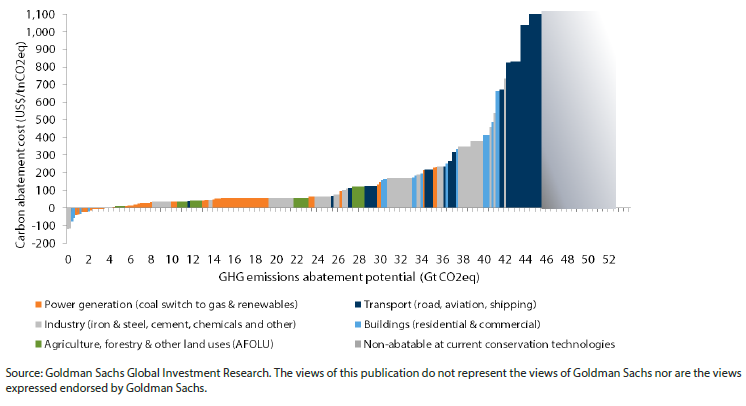

All the conservation and sequestration initiatives outlined above translate into a plethora of solutions at a granular level. Collating these based on the cost of each solution and the estimated reduction in carbon emissions results in a “cost curve”. Admittedly, this exercise involves estimating the future impact and future cost based on the current state of technology. It is worth noting that technology is constantly evolving for the better, and innovation could dramatically lower the cost while increasing the impact. Included below is a cost curve estimated by Goldman Sachs—one of the most comprehensive we have come across.

Chart 7: Estimated cost curve of carbon abatement initiatives

Even allowing for some margin of error, the cost curve drives home the need for significant investment to deliver even 80% of the net zero target by 2050. The spot carbon dioxide emissions EU allowance price (under the EU Emissions Trading Scheme) is currently about EUR 45/ton. If this carbon price was applicable globally, it would only incentivise investment to the tune of EUR 300-350 billion per annum. This would result in the abatement of about 23 gigatons (Gt) of CO2 equivalent, out of a target of roughly 53 Gt in annual emissions, or only 44%. Given the steep rise in the cost curve towards the right, we estimate that the investment required to abate 85% of carbon emissions (not quite net zero!) by 2050 is in the order of USD 20 trillion. The remaining 15% of emissions will require a significantly higher investment to abate. How quickly countries and companies choose to invest will determine the annual bill.

A significant undertaking

To meet the Paris Agreement commitment to net zero carbon emissions by 2050, massive investment in infrastructure is required. These investments are unlikely to offer a return profile that most private enterprises are accustomed to, implying that governments will need to play a key role in incentivising these investments through a combination of lower-cost, longer tenure financing and/or taxes, regulation, and even invest solely, or jointly, via public-private partnerships and commercial take-or-pay arrangements. Besides commercial consideration, there will be political implications as not all these actions will please the voting masses (in countries where that is possible, of course). Still, governments will not be the only ones on the line for big-ticket investment; several corporations will also need to clean up their act. To coax private capital, governments will need to ensure higher prices for carbon credits such that it offers an additional revenue stream for a “clean” business compared to a “dirty” one while also ensuring “carbon parity” across countries—a tall ask at the best of times. Avoiding potential international trade disputes arising from this differential “taxation” between rich (and therefore likely “clean”) and poor (“dirty”) countries, will require international cooperation at an unprecedented level.

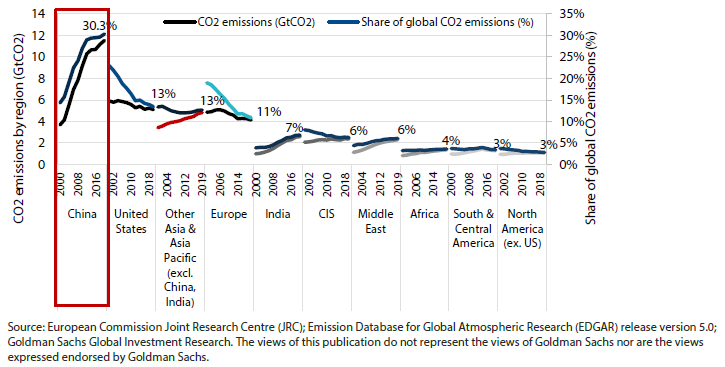

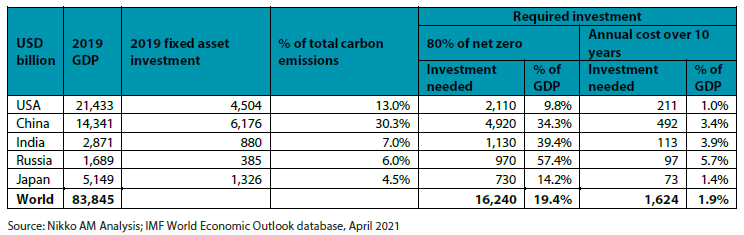

Therefore, it begs the question—is there the ability and the willingness to stand by the Paris Climate Agreement commitments? To answer this question, the first step is to identify which countries are the biggest carbon emitters, then assess the investment needed by that country to get to the 2050 carbon net zero goal, and review that in the context of the country’s governance and economic output.

China, the US, India, Russia, and Japan are the top five carbon emitters in the world. Assuming the investment required to decarbonise to net zero is proportional to a country’s carbon emissions, these top five emitters will need to likely invest approximately USD 10 trillion over the next decade. This works out to an additional 1.0-5.7% of GDP every year for the next 10 years. Presumably, China, the US, and Japan can afford the investment; India and Russia will likely struggle to foot the bill given the state of their government finances.

Chart 8: Share of global CO2 emissions by region

Chart 9: Investment needed to decarbonise

Having addressed the ability issue, let’s move to willingness. Except for Japan, which accounts for about 4% of global emissions, none of the other four big carbon emitters have enshrined their net zero commitment in law. Unfortunately, legal commitment does not alchemically ensure that net zero emissions by 2050 will happen. Indeed, there are reports that Prime Minister Yoshihide Suga extended Japan’s “80% reduction by 2050” goal to 100% without input from experts. As we have shown, the path from 80% to 100% is exponential, both in difficulty and cost.

China’s 14th Five Year Plan outlined targets for renewable energy to reach 20% of the energy mix by 2025, to reduce carbon emissions per unit of economic output by 18% from 2020 to 2025, and to reduce energy intensity of the economy by 13.5%. But viewed in the context that China’s carbon net zero commitment deadline is 2060, already a decade behind the Paris Agreement, these plans suggest an undershoot is likely even on the 2060 target. The caveat is of course that there is sudden recognition of this lackadaisical pace in the corridors of power, resulting in a meaningful pick-up in efforts; China has shown time and again that the country can be bent to the will of the Communist Party. In this regard, it is noteworthy that China rolled out the world’s largest Emissions Trading Scheme (ETS) earlier this year. The ETS regulates some 2,200 companies from the power sector and covers 4Gt of emissions.

Under President Joe Biden, the US has re-joined the Paris Agreement, an essential but not sufficient step. The proposed USD 2 trillion infrastructure investment bill is another positive move; however, a big chunk of the investment will go towards fixing the country’s outdated infrastructure rather than focus on reducing its carbon footprint. Further, this spending will be partly financed by raising taxes—not a move popular with the Republicans or indeed the tax-paying masses, and one that could well be rolled back if a Republican takes over the White House.

Meanwhile, India was still debating whether to set a formal goal for its carbon emissions targets as recently as March 2021. Further, India is still early in its growth phase, while China is arguably closer to the end; this suggests India’s emissions are likely to rise meaningfully before showing any signs of stabilising or diminishing. In Russia, a staggering 30% of carbon emissions are categorised as “fugitive emissions”, attributable to flaring, leakages, and poor disposal. The country’s reliance on energy and commodity exports means that these “fugitive emissions” will be hard to rein in. In Russia’s long-term strategy draft for economic development and reducing emissions, submitted to the executive authority in late March, figures show that emissions are in fact expected to be higher in 2050 than they are currently, redefining the meaning of “low emissions”.

It therefore appears that willingness is sporadic, and where present, it is more talk than walk at the moment.

Taking stock

- There is global awareness that something needs to be done to prevent climate change from worsening, with 2050/2060 set as the deadline to get to net zero carbon emissions.

- The key technology solutions to get us there rely on “clean” power (i.e. solar, wind, hydro, and hydrogen), batteries to store this “clean” power, electrification or “hydrogenisation” of transport, and carbon capture.

- It will require significant investment to make these targets realistic.

- Some of the biggest emitters have the ability to make the investments needed; most do not.

- Willingness however is another matter, with most appearing to toe the line for now. So, the 2050/2060 deadline looks ambitious.

On a more optimistic note, financial capital appears to have grown a conscience in the recent past and is doing its bit. Investment strategies with any connection to ESG (Environment, Social, and Governance), no matter how tenuous, are benefiting from sizable capital inflows, and any self-respecting investment professional is raising ESG matters in meetings with companies, consultants, and investment managers. The cost of capital for “green” projects is in fact measurably lower than non-“green” projects. This trend is here to stay. It therefore behoves public equity investors to truly integrate ESG into their investment process, not just pay it lip service. And besides focusing on opportunities in the areas noted above, opportunities abound even in “dirty” industries such as cement, iron and steel or shipping, where a handful of companies are genuinely focused on cleaning up their act.

“I shall be telling this with a sigh

Somewhere ages and ages hence:

Two roads diverged in a wood, and I –

I took the one less travelled by,

And that has made all the difference.”

Robert Frost’s final verse is open to two interpretations. One interpretation in Frost’s own words was "no matter which road you take, you'll always sigh and wish you'd taken another". The other is a more hopeful one, where the “sigh” is a satisfactory one for having taken the “right” path—the “clean” path.

After all, Earth is the only planet with chocolate!