Snapshot

The US and China are likely reaching peak growth as stimulus and the initial burst of pent-up demand begin to wane. In China, while the credit impulse has turned negative—usually an ominous sign—demand continues to normalise, shifting from outsized demand in manufacturing back to normal patterns of consumption with authorities still fine-tuning the extension of credit to the parts of the real economy that need it. In the US, hopes for a major stimulus focused on infrastructure are likely to be scaled back, but a combination of still-high levels of excess savings, returning jobs and an easy Federal Reserve (Fed) are supportive of continued healthy demand.

Market concerns for inflation have ebbed to a surprising degree, so much so that rates continue to compress with break-evens steadily rolling down from the mid-May peak. When the Fed struck an ever so mild “hawkish” tone, the market reaction was also surprising in the form of a stronger US dollar (USD), a flattening yield curve and a strengthening preference for growth over value. Some are declaring the reflation trade dead; yet, the overwhelming consensus sees 10-year Treasury yields ending the year higher than the 1.74% peak set at March-end, as do we.

The confusion in the markets is likely born out of the confusion in economic data that is rendered mostly useless for the dislocations caused first by COVID-19-induced lockdowns, then an unprecedented, synchronised global stimulus and now the uneven re-openings dependent on the successes of vaccine rollouts. Virtually any disparate view can be supported based on “the data”, but the truth is no one really knows the extent to which things will just get back to normal versus the knock-on effects of some very unusual policies and the resulting excess liquidity still sloshing around the system. We see a heathy growth outlook both for returning demand and continued policy support, but we are cautious about the volatility that will ensue when data clarity returns, exposing those who may be wrongly positioned for what lies ahead.

Over the last decade, markets seemed almost trained to believe in binary outcomes contingent on stimulus being added or removed, however slowly. This makes some sense following the Global Financial Crisis (GFC) given the extent of systemic damage that did require a more prolonged stimulus programme. This time around, the financial system is healthy and spreading growth has the potential to be more self-sustaining. Of course, the path toward that end will not be easy with spikes in volatility virtually guaranteed, and while we remain cautious on this front, the growth outlook remains quite positive, in our view.

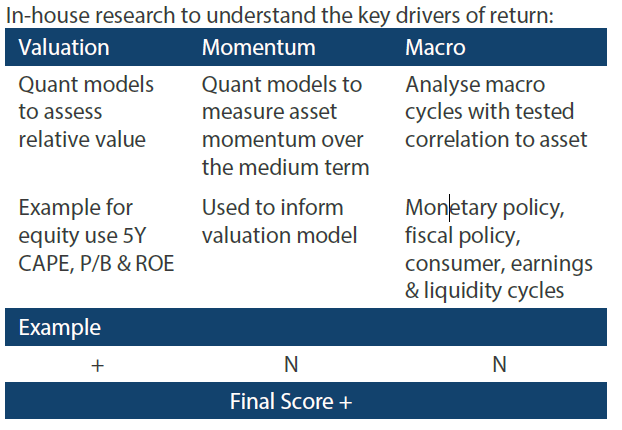

Cross-asset1

We continue to favour growth and have further reduced our cautious view on defensives. The Fed sounded marginally more hawkish this month, while the market read the comments as seemingly more pivotal. The USD strengthened and long-end rates actually (and unusually) compressed, signalling an impression that the Fed’s change in stance will depress long-term growth prospects. The market reaction seems overdone, but it may have been amplified by the slow progress on fresh fiscal stimulus that seems increasingly likely to be downsized with each passing day.

The reflation trade took off in November last year, largely driven by the promise of a large “blue wave” stimulus. Given the extent of the optimism priced in, it is not a surprise to see some pullback. The inflation print likely peaked in May due to rolling base effects, but also some inflation pressures may be coming off at the margin, including commodities and supply chain bottlenecks that are beginning to ease. On the growth side, we again reduced emerging market (EM) equities and bonds on the potential headwinds driven by a stronger USD, offset by increases to REITs and high yield. On the defensive side, we reduced inflation assets such as gold in favour of developed market (DM) sovereigns and investment grade (IG).

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View1)

11The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

The rotation to growth and tech sectors continues while the reflation trade fades. As we have noted before, secular growth remains a compelling opportunity where profit margins remain wide and cash flow abundant. The rotation to value/reopening opportunities is still sensible, but as the Fed considers the timing of its stimulus exit while promises of more fiscal stimulus continue to ebb, it is not a surprise that flows are being redeployed to the “tried and true” tech sector that has delivered phenomenal growth for more than a decade.

The principal driver of the reflation trade is the amount of stimulus—both monetary and fiscal—that has been thrown at the pandemic problem, overtly positioned to err on the side of doing too much than doing too little. Money has flooded into the system worldwide, while excess savings have swelled to record levels, ready to be deployed with the release of pent-up demand on the back of still-limited supply, exacerbated by still-damaged supply chains.

We did witness the boost in pent-up demand including a rotation to services as economies are reopening, but as stimulus is just a one-time cheque and not a full-time job, it seems that consumers are treating their savings more carefully than with the reckless abandon that some had predicted. Services are coming back, while demand for tech and electronics is also staying robust. In other words, while some elements of the reflation trade are at the “wait and see” checkpoint, the outlook for secular growth remains robust and supported by strong earnings. Thus, the pause on the rotation from value back to growth may not be just knee-jerk but actually rational until we get better visibility on the contours of global demand and growth.

Time to buy China?

We turned cautious on China in early 2021, both for the impending rotation to countries and regions such as the US and EU which are benefitting from the vaccine rollout, as well as for tighter policies at home. China equities suffered another difficult week—this time for a crackdown on the ride sharing company Didi that had just completed an IPO. While regulatory risk still runs high, we believe that the worst of China’s underperformance over the last quarter may be behind us.

In the midst of the pandemic in 2020, prior to the rollout of vaccines, China was the clear economic winner, having effectively used lockdowns to contain the virus, while a combination of targeted stimulus and global demand for China products brought a swift return to pre-COVID-19 levels of economic activity. However, as China often does, the government used the swift recovery to reassert its reform objectives. Specifically, it tightened credit to less productive parts of the economy, including property, and imposed new regulations on technology companies that had arguably abused the privilege of their enormous size. Given the combination of fresh stimulus and the vaccine rollout that principally benefited the developed world of the West year to date, it is not surprising that flows followed better opportunities outside of China. However, as growth in the US is likely past its peak, the headwinds for China equities may begin to abate as China begins to ease policies at home.

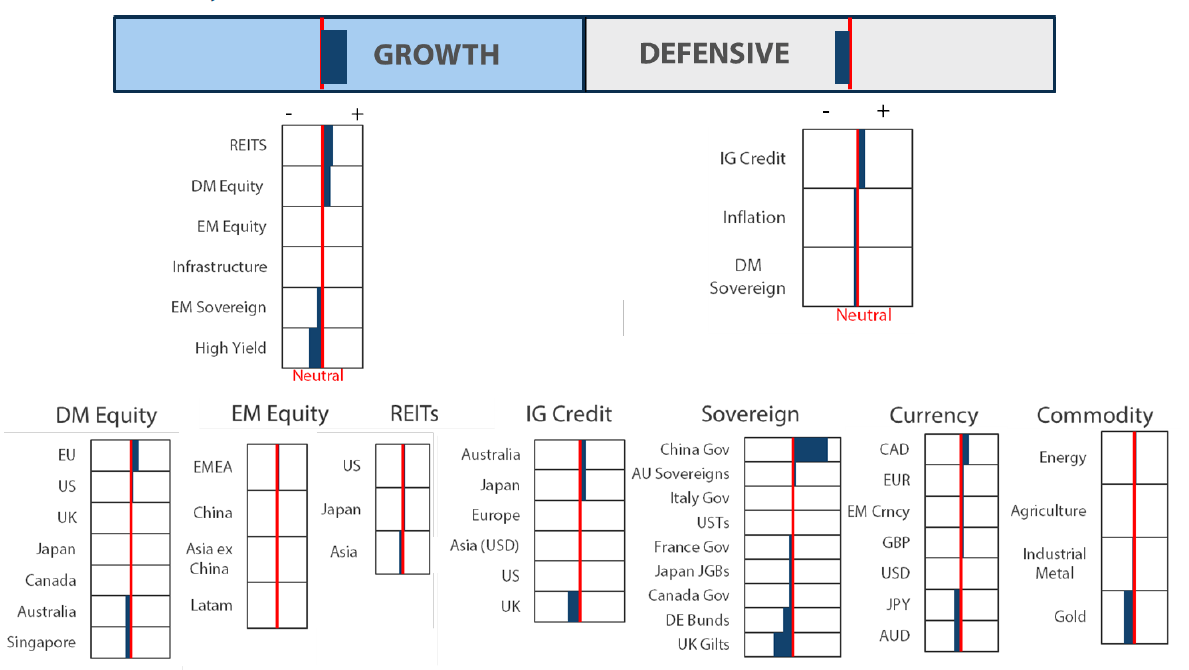

Chart 1: Chinese credit growth

Source: Bloomberg, Nikko AM, July 2021

Source: Bloomberg, Nikko AM, July 2021

Firstly, credit growth deceleration looks to be bottoming. Having declined sharply since November 2020, as shown in Chart 1, current levels of expansion align with the government’s credit growth target, i.e. nominal GDP growth. While the credit impulse is currently negative, this is partly due to base effects of significant stimulus a year ago. Issuance of local government bonds is also expected to gather pace in 2H 2021 to make up the remaining 76% of the net issuance target, implying a boost to infrastructure investment later in the year. Also, while the government has curbed lending to speculators as with property, the government has continued to encourage credit expansion, benefiting the real economy.

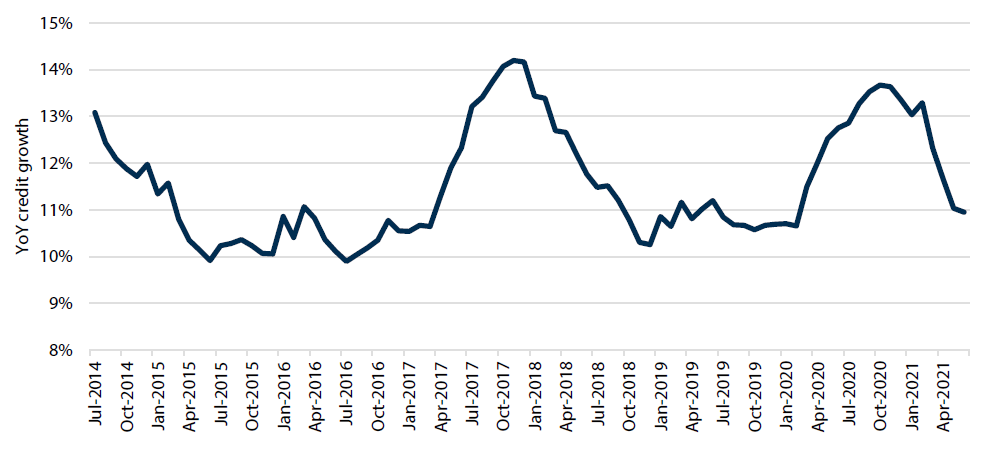

The government’s objective to supply the real economy with needed credit was confirmed last week with the cut of the reserve requirement ratio (RRR) in a broad-based manner. This is the first major easing since mid-2020, that coupled with earlier deposit rate reform is designed to ease banks’ funding pressures and should ultimately expand credit available to the real economy.

Chart 2: China RRR cut

Source: Bloomberg, July 2021

Source: Bloomberg, July 2021

In its efforts to expand credit, the government remains targeted, aiming to direct resources to new economic sectors such as 5G, IoT, AI and advanced manufacturing, which are critical to unlock potential growth and strengthen self-sufficiency. As always, it is a balancing act, redirecting capital away from inefficient use to where it is most needed to grow the real economy, while in the process not inflicting too much economic pain to any one sector.

In addition to stabilising credit that should ease concerns for slowing growth, we also believe regulatory crackdown is at or close to its peak, which should ease concerns for regulatory risk. Of course, many investors will not immediately see it this way given the harsh punishment of Didi early in July, just two days after its US IPO.

The regulatory campaign began in November 2020 when the Ant IPO was suspended to bring tighter controls to the fintech sector. In April this year, Alibaba was issued a hefty fine, albeit one that was ultimately seen by the market as light relative to its revenues. In essence, the regulatory campaign seemed methodical and fair, achieving reasonable government objectives while not bringing undue pain to the tech sector that is still vital in supporting the new economy and jobs growth.

However, the recent harsh punishment of Didi sent new shockwaves across the tech sector. This was exacerbated days later when authorities announced new rules governing tech listings overseas. Still, the recent shakeup does not appear out of scope from the government’s reasonable objectives, so it may be that Didi will mark the peak of regulatory concerns.

China equities could also benefit from the rotation back to growth and tech as the reflation trade loses steam on the back of growth passing its peak, while yield curves continue to flatten. China tech stocks trade at an attractive discount compared to US peers, and if regulatory risk is indeed peaking, it could pose an attractive opportunity, in our view. China’s recent efforts to support credit expansion in favour of the real economy is also a positive inflection point that should avert fears of a deeper slowdown with promises of stronger demand ahead.

Conviction views on growth assets

- Cautious on EM, for now: We turned more cautious on both EM equities and debt, due to the return of dollar strength coupled with weakness in commodity prices and inflation expectations. We also note the China credit impulse shifting negative and the likely downsizing of the US infrastructure stimulus. Of course, EM is still lagging DM peers in terms of the vaccine rollout, and now the rise of the Delta variant is likely to weigh on re-opening efforts as well. That said, we think EM assets are still attractive, mainly showing better value where we seek targeted opportunities.

- Barbelled exposure to equities: We continue to believe that a balance between secular growth and opportunistic value is the best means of positioning in the current environment. We like the re-opening play still and favour quality opportunities that are still showing value are the best means of participating in this upside. Still, opportunities in secular growth areas such as US and North Asia tech are still compelling from a strong earnings growth and cash flow perspective.

Defensive assets

Our view on defensive assets improved again this month but we retain a cautious approach over the medium term. Recent central bank meetings were closely watched for any signs that officials were ready to discuss plans to reduce quantitative easing (QE) purchases, and eventually raise cash rates. While many viewed the Fed as coming closest through changes to its “dot plot”, indicating that the median forecast for the first rate increase was brought forward to 2023, these forecasts have been of questionable value in the past. This was a point that Fed Chairman Jerome Powell made in his post-meeting press conference, and ultimately, the Fed kept its accommodative settings unchanged. The European Central Bank (ECB) also disappointed bond bears as it repeated its dovish message of accelerated QE purchases. With policy changes seemingly several months away, we are still more constructive on global bonds.

Global credit spreads were stable over the month, but lower benchmark US Treasury (UST) yields helped deliver positive returns. Most developed countries have made substantial progress in their vaccination programmes after slow starts, and the global economy is rapidly recovering lost output as the worst of the pandemic recedes. Ongoing fiscal and monetary support are also contributing to an environment of improving credit quality that is supportive of our positive view on IG credit.

Real yields remain sharply negative even as the world’s developed economies continue to reflate. This holding pattern is likely to continue in the near term as markets continue to assess incoming inflation data for evidence of transitory versus persistent price pressures. While negative real yields are generally positive for gold, the precious metal has nevertheless been under pressure from US dollar strength and technical selling. History also tells us that gold prices are likely to trend lower ahead of any formal announcement of QE tapering, as they did back in 2013. These factors combine for a weaker climate for gold and we have turned a little negative on the near-term fortunes of traditional inflation-hedging assets.

Tale of the taper

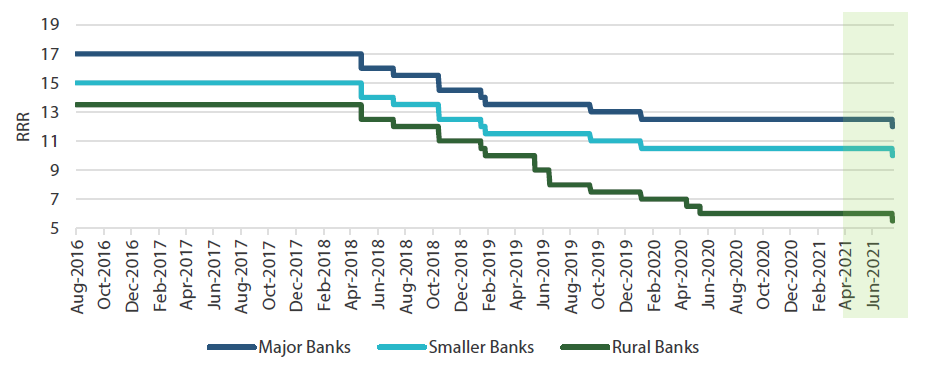

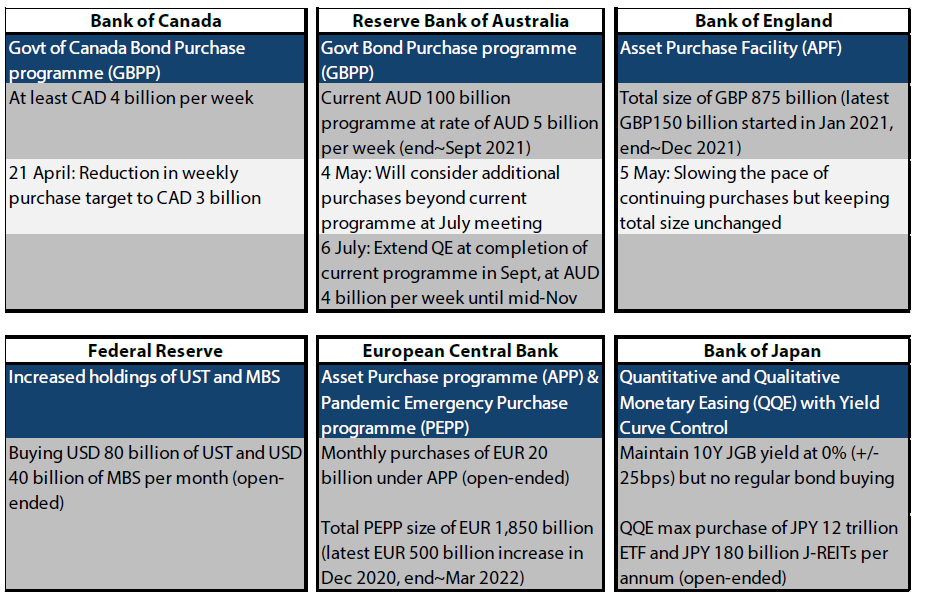

The world’s major central banks have undoubtedly been providing extraordinary support for the global economy throughout the pandemic by using massive QE programmes and near-zero or negative official cash rates. As the pandemic starts to recede for several developed countries, intense focus is now directed at any signs of upcoming changes to these policies. Forward guidance has been consistent across central banks in holding cash rates at current low levels well into the future, with any changes only coming after QE programmes are ended. The current landscape of QE programmes for the major DM central banks is shown in Chart 3.

Chart 3: Major central bank quantitative easing programmes

Source: Bloomberg, July 2021

Source: Bloomberg, July 2021

Earlier this year in our March Multi-Asset monthly, we assessed the relative commitment of these six central banks to prolonging their QE programmes. At that time, we considered that both the ECB and the Bank of Japan would likely hold on to their QE policies the longest and that the Bank of Canada (BOC), Reserve Bank of Australia (RBA) and Bank of England (BOE) would be the first to taper asset purchases. We perceived the Fed to lie somewhere in between these two groups.

In recent months, our perceptions have begun to translate to actions as the most likely central banks have begun to announce QE tapering plans. The BOC was the first to move in April, announcing a reduction in its weekly purchase target from Canadian dollar (CAD) 4 billion to CAD 3 billion. This was followed by the RBA, most recently announcing that it would slow purchases from its current pace of Australian dollar (AUD) 5 billion per week to AUD 4 billion when the current programme was expected to expire in September, effectively prolonging QE until at least November. And arguably, the BOE could also be included in these first movers after announcing in May that it would slow the pace of its purchases even though the size of its program remained unchanged.

In recent months, our perceptions have begun to translate to actions as the most likely central banks have begun to announce QE tapering plans. The BOC was the first to move in April, announcing a reduction in its weekly purchase target from Canadian dollar (CAD) 4 billion to CAD 3 billion. This was followed by the RBA, most recently announcing that it would slow purchases from its current pace of Australian dollar (AUD) 5 billion per week to AUD 4 billion when the current programme was expected to expire in September, effectively prolonging QE until at least November. And arguably, the BOE could also be included in these first movers after announcing in May that it would slow the pace of its purchases even though the size of its program remained unchanged.

While all of this speculation around tapering is interesting, and maybe even entertaining for some, the near-term and longer-term implications of eventual tapering are very different. In the near term, central banks continue to buy large quantities of government bonds at sharply negative real yields. This significant buying continues to be problematic for investors and speculators that had reduced sovereign bond holdings earlier this year in anticipation of reduced QE purchases. This short positioning is being pressured in the near term by the relentless buying activity of central banks. However, in the longer term the tapering of official purchases will require greater participation from other investors. This will again become problematic, but in a different direction, as the same sharply negative real yields that have not deterred central banks will be deemed unattractive by other investors, leading to another potentially sharp reversal towards higher and steeper yield curves.

Conviction views on defensive assets

- IG credit still offers attractive carry: High grade credit spreads are historically tight, but credit quality continues to improve, and the extra yield should be maintained in this environment.

Process