Snapshot

As reflationary dynamics gain support from refreshed stimulus in the US and a largely successful vaccine rollout with returning growth already to show for it, the reflation trade appears a bit exhausted as measured by market action. However, we see the current dynamic more as a pause than a conclusion. The lift in US Treasury (UST) yields coupled with strong growth prospects in the US has lent support to the dollar, which is typically disinflationary. We did lift our view on the dollar for these near-term tailwinds of support, but we do not see this dynamic staying in place for the longer term.

Fresh US fiscal stimulus and a speedy vaccine rollout clearly give the US an initial growth advantage. However, we believe this head start will narrow during the summer months as the rest of the world begins to catch up, at least partly driven by elevated US demand. As demand depresses the current account on top of a still very wide fiscal deficit, we see the dollar returning to weakness and with it, returning confidence in the reflationary outlook.

Owning duration has clearly been the pain trade year to date. However, given the aggressive steepening of the curve, the worst of the correction—in terms of velocity—might be easing, at least for now. Of course, likely high headline inflation numbers driven by rolling base effects could once again spook the market, particularly given the high levels of Treasury issuance in the pipeline adding further upward pressure on UST yields. Nevertheless, the acceleration of demand will drive earnings growth that should allow equities to grind higher, albeit with accompanying bouts of volatility as experienced in the first quarter.

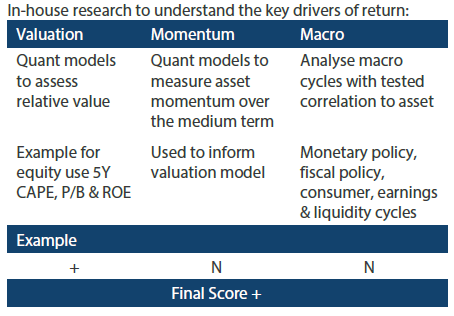

Cross-asset1

We maintained our conviction in growth assets while becoming slightly more cautious towards defensive assets, given the building reflationary pressures that are pushing up yields while the Federal Reserve (Fed) has declined to repress the rapid repricing. It is estimated that the stimulus cheques from the USD 1.9 trillion programme will push personal excess savings to around USD 2 trillion, leaving plenty of dry powder to meet pent-up demand and, perhaps, to put some to work in the stock market as was observed after earlier stimulus.

Meanwhile, the vaccine rollout is going well, particularly in the US and UK, while other geographies face steeper hurdles for procurement or, in the case of Europe, some degree of poor planning and execution. Disparate stimulus and vaccine rollouts likely means disparate growth in the months ahead where the US is likely to lead the world. Between rising yields and a better growth outlook in the US, the dollar has been lent meaningful support, which has added to the sense of risk aversion initially triggered by fast rising yields. In the short term, this dynamic may last, but later in the year, the US growth advantage will dissipate and likely so will the recent bout of dollar strength.

At the asset class level, we upgraded our view on REITs as the best exposure to the opening of economies. Against this we decreased our conviction in emerging market (EM) equities and fixed income, given the near-term headwinds of dollar strength. On the defensive side, we also decreased investment grade (IG) credit to neutral, favouring inflation, given the former is fully priced and the latter has meaningfully corrected. We also downgraded our view on growth over defensive FX given our currently more favourable view of the dollar.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

1Asset Class Hierarchy (Team View1)

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

The price of money is the foundation against which all other asset prices are referenced, and US rates are still the most important reference of the global cost of money. When the price of money changes quickly as with the recent fast steepening of the US yield curve, repricing can be abrupt and deep across other asset classes including the rapid rotation from growth to value assets. Of course, when the repricing pauses—the yield curve settling into a range as it has appeared to do since mid-March—it is not surprising to see the rotation pause as well.

Fed policy, particularly the inflection points of change, is critically important for anticipating the trajectory of risk assets, but it is still only one metric. At the moment, the Fed is playing a bit of “good cop, bad cop” with some governors calling for a tapering of stimulus as early as this year (bad cop) while Chairman Jerome Powell repeats his extended easing mantra, that “we are not even thinking about thinking about tapering” (good cop).

Still, amid the schizophrenic market reactions that hang on to every last word of what future policy might look like, one has to be reminded that while Fed policy is important, it is fundamental growth drivers that matter most. One day, the Fed will begin the tightening process, but it has also repeatedly stated its willingness to let the economy run hot to meet its new symmetric inflation targeting mandate. Through this lens, the growth outlook is quite rosy on the back of a synchronised global recovery fuelled by the re-opening of the global economy that has been heavily backstopped by unprecedented fiscal and monetary support.

A rotation pause

As we have noted frequently in recent months, the quick lift in UST yields is an important driver of the relative performance of growth over value equities. Since growth assets are equivalent to long duration assets (paying a premium for earnings far out into the future), this relative performance makes good sense. What is perhaps surprising is growth’s strong comeback in recent weeks, not because long term rates are compressing, but simply because of their stabilisation with 10-year yields failing to definitively break through 1.70%.

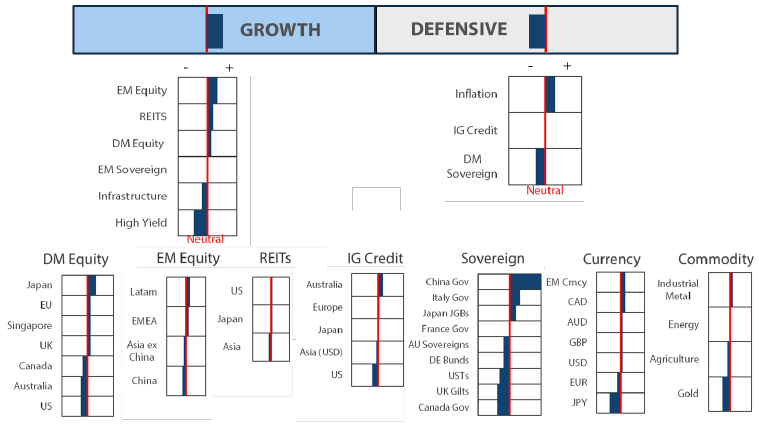

Chart 1: US growth outperformance over value versus US 10Y Treasury yields (inverted)

Is the value rotation over? We do not think so. Technically, the rotation from growth to value might have been overdone—as was the run-up in long-term rates—both due for at least a pause. Fundamentally, as global growth continues to accelerate and the Fed eventually begins to “think about” tapering, long-term rates will once again be pressured to the upside, likely lifting value assets over growth.

A countertrend, linked to UST yields, is the USD which gathers support both from rising yields as well as near-term superior growth connected to the fresh stimulus and successful vaccine rollout. It is a countertrend because as rising yields suggests a better growth outlook that favours value over growth, the strong USD is itself disinflationary or a headwind to global growth, which is negative for value assets.

Over the near term, US growth is likely to be stronger than in the rest of the world, which means continued support for the USD. However, in the second half of 2021, we expect this dynamic to weaken as the rest of the world moves toward herd immunity and the US stimulus supports strong global demand, eventually extended with even more stimulus in support of infrastructure.

Over the next several months, we expect some tug-of-war between bouts of rising rates and returning USD strength. That said, we expect this dynamic to resolve itself as accelerating growth outside the US helps to neutralise USD strength while rates grind higher, which is an environment that likely favours value over growth assets.

Conviction views on growth assets

- Reduced conviction view on EM: We reduced our conviction view on EM—both equities and fixed income—given the potential headwinds of a stronger dollar, though EM FX so far remains reasonably supported. The outlook for EM is still positive over the medium to long term on supportive growth. However, over the near term, the rapid rise in long rates coupled with a stronger dollar could ultimately weaken EM FX and flows to EM in general.

- Lifting REITs: REITs are still attractive from a valuation standpoint, lending support against selling pressures in other parts of the market. REITs also offer exposure to the reopening of the global economy where real estate has been particularly hard hit and while parts of the market will remain damaged, the overall impact of the reopening should be beneficial.

- Reduced FX growth in favour of defensive>: We reduced our cautious view on defensive FX given that rising UST yields is lending support to USD, which could persist over the near term. However, the Japanese yen is still weak, in fact the weakest currency in the world year-to-date.

Defensive assets

We became more cautious on defensive assets this month. The large US fiscal package has now become reality after the US Congress passed the USD 1.9 trillion American Rescue Plan Act. Vaccinations are proceeding rapidly across the country, setting the scene for strong growth. However, the rollout of vaccinations in Europe has been slower and will likely delay recovery relative to the US. Central banks have been doing their best to convince markets that rates will stay low for many months, but it is a difficult message to sell when the other side of the pandemic is in sight. Improving growth outlooks and growing inflation pressures are likely to keep upward pressure on bond yields.

IG credit spreads have now recovered to pre-pandemic levels and valuations are becoming expensive in some areas. A strong global recovery will undoubtedly be positive for corporate credit quality, but rising benchmark yields are also highlighting the duration risk for investors. As a result, we have adopted a more neutral view on high grade credit although the sector is still preferable to sovereign bonds.

Conversely, we have marginally upgraded our positive view on inflation assets. Fiscal stimulus is still a focus in many developed countries and the aggregate consumer balance sheet has remained healthy through the pandemic. Demand growth should be strong as a result, leading to rising price pressures. This shift to a more inflationary environment will continue to support inflation-protected assets.

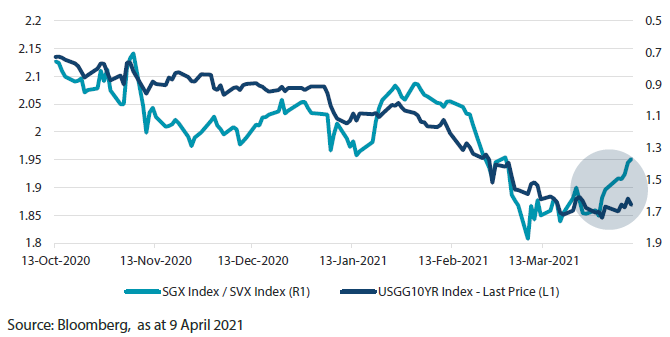

The US pecking order

Since the beginning of the year, we have been most concerned about the outlook for Treasuries within US fixed income. The combination of additional fiscal stimulus and vaccinations had led us and others to the conclusion that the extraordinary monetary policy of 2020 would have a diminishing shelf life in the year ahead. Within the high-grade universe of sovereign bonds, IG corporate bonds and Treasury Inflation-Protected Securities (TIPS), it is USTs that have been lagging in the total return stakes. Chart 2 shows the year-to-date returns of these three asset classes using 7-10 year maturity buckets in order to minimise duration differences.

Chart 2: US high grade bond returns (7-10 year maturities)

IG credit returns have also been hit by rising yield curves but a gradual contraction in spreads to USTs has absorbed some of the rise in benchmark yields. The positive yield spread of corporate bonds has also contributed to their outperformance against USTs. We expect this relative performance to continue as corporate credit quality will benefit from the stronger economy, prompting many investors to take the yield premium offered by corporate bonds in preference to government bonds.

The third asset class in this group, inflation-linked government bonds (ILBs), have been the clear winner over both nominal government and corporate bonds. Rising inflation expectations supported demand for ILBs even as Treasury yields rose. Break-even inflation rates have adjusted higher alongside nominal yields and real yields were sheltered from the rise in global bond yields. However, any further rise in nominal bond yields will likely translate more fully to rising real yields as 10-year break-even rates begin to top out around 2.5%. Looking ahead to the next few months, we expect that US fixed income will retain the same pecking order established over the last quarter.

Conviction views on defensive assets

- Favour China government bonds: China’s bonds offer much higher yields and should prove resistant to further rises in global yields.

- Favour ILBs to nominals: Rising inflation expectations and increases in forward-looking gauges of price pressures will support demand for ILBs.

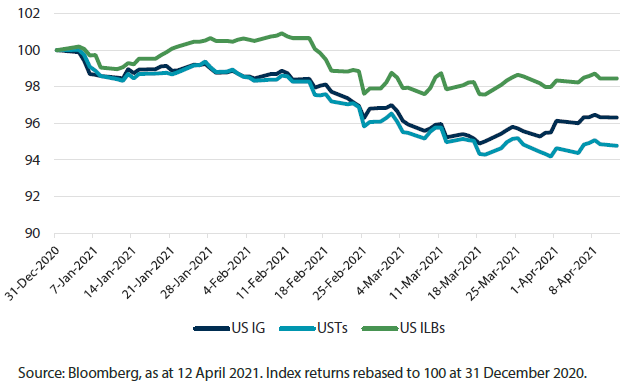

Process