Global equity investment philosophy

Our philosophy is centred on the search for “Future Quality” in a company. Future Quality companies are those that we believe will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies make for good investment. The four pillars we use to assess the Future Quality characteristics of an investment are:

Franchise—does the company have a sustainable competitive advantage?

Management—does the company make sound strategic and capital allocation decisions?

Balance Sheet—is growth appropriately financed?

Valuation—are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high conviction portfolio with a high active share ratio.

Market outlook

Global equity markets continued to push higher into year end, buoyed by an extremely favourable liquidity environment and rising optimism regarding the extent of economic recovery likely in 2021. Governments across the world are rushing to administer vaccines for the coronavirus and this is allowing investors to look through the current deterioration in news flow regarding the pandemic.

News of several virus mutations emerged throughout the month, with the new mutations apparently much more transmissible than the version of the virus that was originally characterised. Newly recorded infections surged higher, which has led to a reacceleration in hospital admissions and fatalities in several countries. Restrictions on mobility have been stepped up in an attempt to contain the spread and mitigate the pressure on healthcare workers. The hope is that these measures will buy enough time for the vaccines to offer a measure of protection to those most at risk from the virus.

November saw “Pfizer Monday”, when news first broke regarding the encouraging efficacy of the vaccine developed by Pfizer and BioNTech. This news led to a sharp rebound in investor confidence and catalysed a meaningful rotation within markets. December, however, saw some of this rotation reverse again, with growth stocks generally outperforming value.

That is not to say that the pro-cyclical trade evident in markets since the middle of the year reversed tack. Materials and financials, for instance, both outperformed again in December and both were among the best performing sectors in Q4. In both cases, it could be argued that starting valuations were relatively reasonable, even in the event of a modest economic recovery. Industrials fared less well in December, reflecting higher investor expectations for the sector, but still outperformed over the quarter. Energy also slightly underperformed in December, despite the ongoing depreciation of the USD against its trading partners and continued positivity regarding commodity prices. November’s strength, however, meant that energy vied with financials for the best performer in Q4.

The main reason why December looked more like the rest of 2020 than November was found in the performance of the information technology sector. Having served as a source of funds for more cyclical investments in November, the technology sector enjoyed a much better December, easily outperforming the market and rivalling materials for the best performing sector.

Defensive sectors underperformed fairly consistently this quarter. Healthcare, consumer staples, real estate and utilities all failed to keep up with the market, with real estate, healthcare and consumer staples actually delivering negative returns in absolute terms.

The pro-cyclical trade has also been evident in foreign exchange markets and the best performing regions in Q4 were those that traditionally benefit from a weaker USD; namely emerging markets and basic resource heavy markets like Australasia. The UK also outperformed, helped by its heavy exposure to commodities and the news that the country had finally agreed a post-Brexit trade deal with the European Union.

Comparative returns are against the MSCI All Countries World (ex Australia) Index

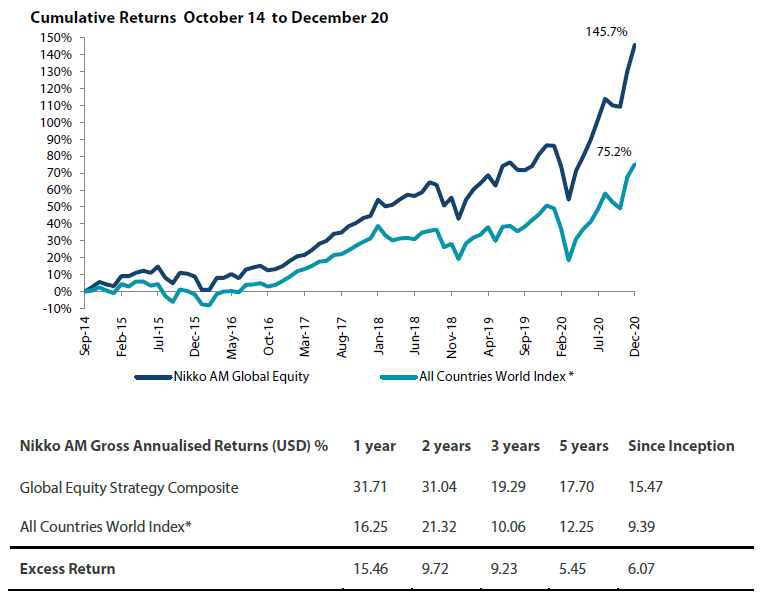

Global Equity Strategy Composite Performance to Q4 2020

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. For more details, please refer to the performance disclosures found at the end of this document. Data as of 31 December 2020.

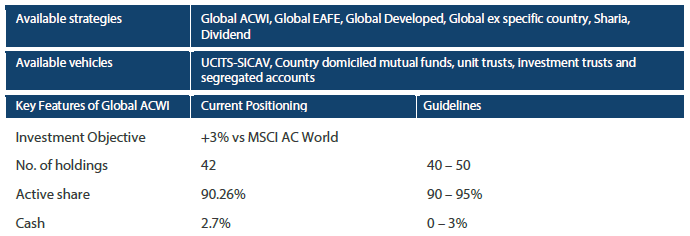

Nikko AM Global Equity: Capability profile and available funds (as at 31 December 2020)

Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

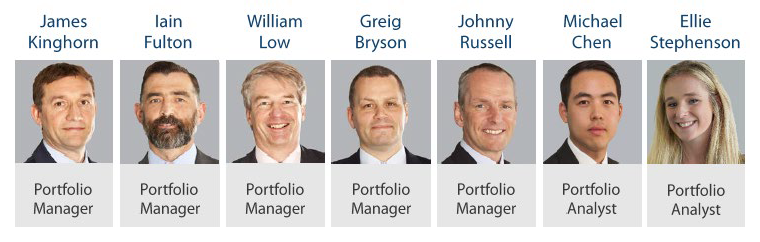

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 24 years’ industry experience and have worked together as a Global Equity team for eight years. Two portfolio analysts, Michael Chen and Ellie Stephenson joined in 2019 and are the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of Future Quality companies will lead to outperformance over the long term. They define Future Quality as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 283.9 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income and Multi-Asset strategies. In addition, our complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 31 December 2020.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.