The introduction of the EU’s Sustainable Finance Disclosure Regulation in March 2021 will see significant changes to the way asset management is conducted. It includes new disclosure requirements for investment firms to address environmental, social and governance (ESG) concerns and we welcome it with open arms.

By Iain Fulton and Johnny Russell

The winds of change: Strengthening our commitment to ESG

Heralding a new era of regulation

Michael Chen's1 wintry picture of a tree clearly shows how prevailing winds have shaped it over time. The same can be said for markets. The global pandemic in 2020 resulted in a massive deterioration in public finances. But despite the conditions, markets continued to rise and, for the most part, growth stocks related to new areas of innovation remained the leaders. Hopefully, with an end to the pandemic in sight, a new president taking office in the US and Brexit finally moving on, investors can start considering how the changing conditions may impact them.

In the next 18 months or so, sectors of the economy shuttered by COVID-19 will bounce back strongly and the impact of ongoing stimulus spending will favour more cyclical industries. The role of government within economies has grown significantly and from the US to Europe and China, the spectre of increased regulation and higher tax rates looms larger than it has at any time in the last decade. For investors who have had the wind in their sails for so long, the phrase “caveat emptor” probably never rang so true.

1Global Equity Team portfolio analyst

One wind of regulatory change that investors may be less familiar with is that of the EU’s Sustainable Finance Disclosure Regulation (SFDR). These regulations are important and arguably represent the biggest fundamental change to the way asset management is conducted since the UK’s “Big Bang” de-regulation reforms in the mid-1980s.

Under SFDR, fund managers are required to make firm and product level disclosures that clearly outline and measure how sustainability risks are taken into account in their investment process.

A key feature of this framework is that it provides a definition of sustainable investment and lays down the criteria fund managers must meet to qualify. The definition has two parts. Firstly, the investment must promote an environmental or social characteristic and meet minimum standards of governance. Secondly, the investment must “do no significant harm” to any other area of environmental or social concern.

For our part, we welcome the efforts to bring greater clarity and transparency to an area of investment that has been wide open to highly subjective interpretation. With a new generation of savers looking to invest in funds, which can adhere to a set of principles they can identify with, this regulation should provide the transparency required to select funds that genuinely adhere to these principles.

In recent years, the rush to “green-wash” has been fairly evident as asset managers have sought to capitalise on an increase in fund flows to the ESG segment of the market. The SFDR regulation should ensure that those fund managers are held to account accordingly.

Our view is that good ESG characteristics are necessary for the companies we invest in to achieve “Future Quality” status. Balancing stakeholder interests, governing appropriately and aiming to be part of the solution to social and environmental problems are the requirements that permit companies to earn good returns on capital over the long term.

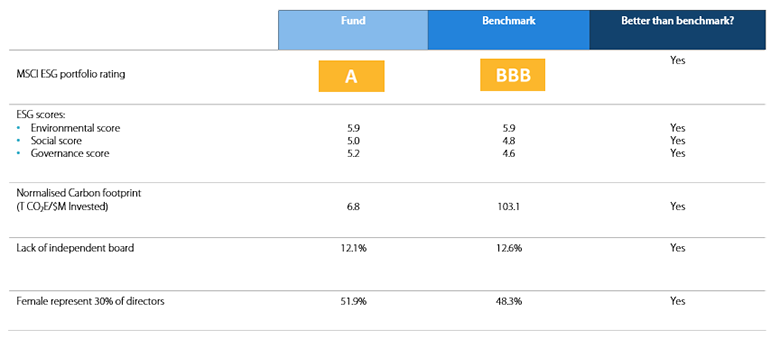

As a result, in response to the regulation, we are tightening the definition of our commitments in this area. We aim to have a portfolio that has above average ESG ratings, has a low carbon intensity and has no major controversies on issues related to the environment and human rights. These commitments can be measured, are appropriate and are certainly consistent with how we have positioned our investments in Future Quality companies over the last decade of investing together. It’s not often we sing the praises of a regulator, but in this instance, the ambitious program set out by the EU is to be applauded.

The ESG breeze is heading to a gale force 10

SFDR is only one small part of a wider framework of EU regulation aimed at redirecting finance towards more sustainable outcomes. Technological advances, demographic changes and the obvious failings of the free market economy are combining to change how we perceive value. Out goes shareholder primacy and growth at any cost and in comes a better, more balanced approach. One that creates value for all stakeholders by considering those externalities that were missing from the “Gordon Gecko” approach to capitalism.

The pursuit of efficient and low-cost supply chains through globalisation has delivered significant economic rewards for many, but it’s come at the expense of the natural environment. We currently spend 1.6 times our planet’s biodiversity and natural resources (see: https://www.gov.uk/government/publications/final-report-the-economics-of-biodiversity-the-dasgupta-review). GDP continues to rise but nowhere in that calculation do we take account of the depleting natural resources. Inequalities have widened and the pandemic has made this worse with young people earnings forecast to fall by GBP 40K over their lifetime due to lost education (see: https://www.ifs.org.uk/publications/15291).

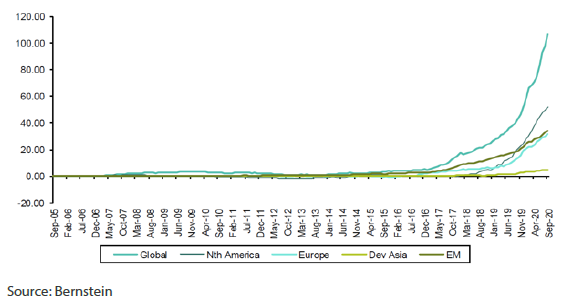

Growth in ESG funds is evidence of this change in attitudes. Although active management has been in a 20-year structural retreat, equity funds classified as having an ESG or SRI focus have been growing rapidly in recent years. The current share of ESG funds may only be about 6% of total active global equity funds, but ESG investing is the only segment to see significant growth in AUM fund flows over the past five years. And ESG is about to take over.

Graph 1: Cumulative flows into ESG Funds (USD billion)

The change appears revolutionary and sudden but has been in the making for some time. COVID-19 is once again the accelerator, and this isn’t just about the finance industry. Everywhere customers are more discerning and are migrating to companies that “do” the right thing; employee loyalty is greater for those who support and retain workers through challenging times. As investors, we have witnessed this in real time in our portfolio stocks over the past 12 months. Shifting attitudes of what represents value, a need for greater resilience in our communities, supported by policy and regulation, means what was once an ESG breeze is now a full gale force storm.

Perfection isn’t the answer

Globally, there are already 60,000 (and growing) ESG-based indices and ETFs to choose from—all offering an ESG solution and a home for the growing ESG fund flow.

Much discussed factors, such as value or growth, are easy to measure. They are based on historically reported data, which is standardised then audited. This doesn’t exist in the ESG world because ESG itself focuses on externalities, which are often not measured by companies themselves, never mind disclosed to the public.

The result is a market wanting exact answers in an uncertain world. It is all too easy to see the headline ESG rating and immediately assume a company is good or bad. There appears to be no middle ground. Rating agencies and asset owners alike cannot afford to have a problem child on their books. Only the best ESG score will do. Those with memories that can stretch back far enough will remember that VW and Wirecard were all part of ESG indices before their issues became all too real.

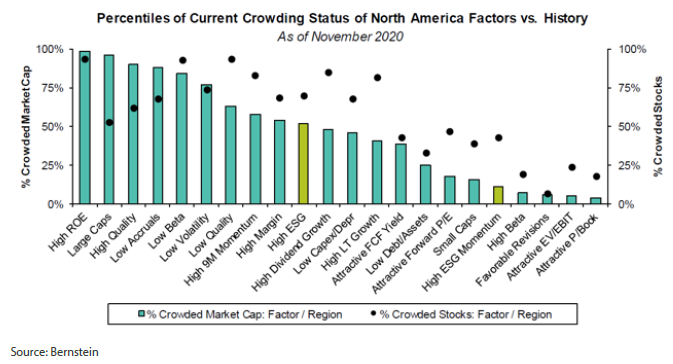

Work carried out by Bernstein suggests the highest ESG scoring companies are already heavily crowded and that greater potential could be found investing in companies with low ESG scores and then enjoying the fruits from improving trends as rating agencies and the market catch up with reality.

Graph 2: High ESG scores appear crowded, whereas rising ESG scores are ignored

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.

This matches our own experience, where rising ESG scores have tended to outperform, whereas those with falling scores underperformed. This could be coincidental—and isn’t statistically material—but it is in line with the outcome we would expect from Future Quality investing.

The embryonic nature of the ESG industry provides an opportunity for active investors to take the lead. To invest ahead of the flows and to engage with management teams about these long-term issues and identify where the market underappreciates value.

The long-term nature of the problems being addressed, and the difficulty of measuring success, suggest this is a natural home for the active investor. A perfect ESG score today may not be the only indicator for tomorrow’s winners.

Engagement: Palomar

We first invested in Palomar in 2020 and continue to be holders. The company provides earthquake insurance to individuals and businesses in the US. Their mission is to leverage technology and data to provide a range of insurance solutions to Americans who have been historically underserved by the industry. These include families and small businesses who turn to Palomar for insurance against a range of natural disasters; from fire to flood to earthquake. Many of these customers are underserved or priced out of the market due to the inefficiencies of the incumbent market participants.

Despite a low ESG rating by MSCI (“B” rated), our assessment of the company regarding ESG has been very positive. The company provides affordable insurance products and services to millions of people living in vulnerable parts of the country. Its largest and original product is earthquake insurance and it leverages technology and data to provide more granular and efficient pricing than peers. It has taken this IT advantage to enter other P&C markets, such as select wind and flood, again being able to analyse and underwrite risk more accurately than peers and then price accordingly.

Formed in 2014, Palomar is a young company with an employee base of about 100. When compared to some of its behemoth incumbent competitors, it is not surprising for the company to have a low ESG rating. However, lack of disclosure is common for young companies and easily rectified. We are confident our ongoing dialogue and long-term support will lead to greater transparency and eventually a more accurate appreciation of the company’s ESG credentials. There are many aspects of this company currently underappreciated by the market.

Balls to the wall?

How are you supposed to react when you’re 25 minutes into a gruelling 30-minute spin class and your virtual cycling instructor shouts out: “Balls to the wall, balls to the wall”?

“Balls to the wall” was borrowed from the aviation industry and refers to the pilot aggressively and without restraint, pulling back a ball shaped throttle. The result is an acceleration skywards—akin to a squeezed GameStop share price (on the way up that is)—or in my case, a release of hidden effort that I had naively thought I’d keep for later. Equity investors have been balls-to-the-wall since March 2020. Increased asset allocation, savings and raised liquidity are driving increased speculation, some of which is undoubtedly bubble like in nature. Stretched valuations in “green” ETFs, such as the ICLN (i-shares Global Clean Energy) ETF—currently trading at about 70x earnings—or a large number of green SPACs, suggests that investors’ expectations are already elevated. Red flags are waving in the wind.

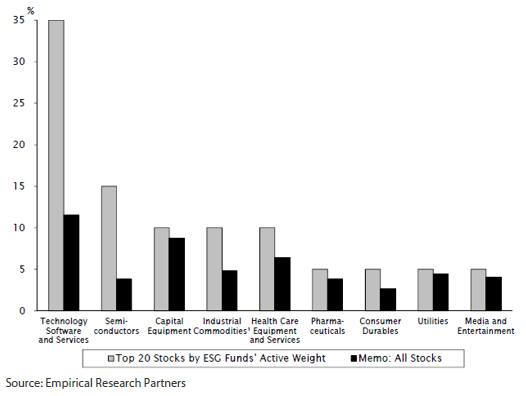

Empirical Research Partners has done work on US stocks and found that in general, there is a limited valuation premium for ESG stocks once the fundamental qualities of the stocks are taken into account. However, they have discovered that there is a skew of “agreed” ESG winners within the ESG universe and at the extreme there is an argument that an ESG premium exists. Graph 3 shows that the skew is heavily weighted to the tech sector where some caution may be warranted; though perhaps only a mirror reflection of leadership in the market in general.

Graph 3: Top 20 stocks by ESG Funds—sector weights

Conclusion

The investment industry has reached a tipping point. Today’s market participants think of ESG as a separate category to active investing, but soon they will be synonymous with each other. In Japan they call it the Fujiwhara effect—when two cyclones come together to create a larger force. Perhaps the prevailing wind isn’t set to change but in fact it is set to strengthen as the shift of capital towards solving our long term environmental and societal issues combines with further technological advances to create an ESG storm that is only now starting. It is a sign that things are changing and in the long run we will all be better for it.

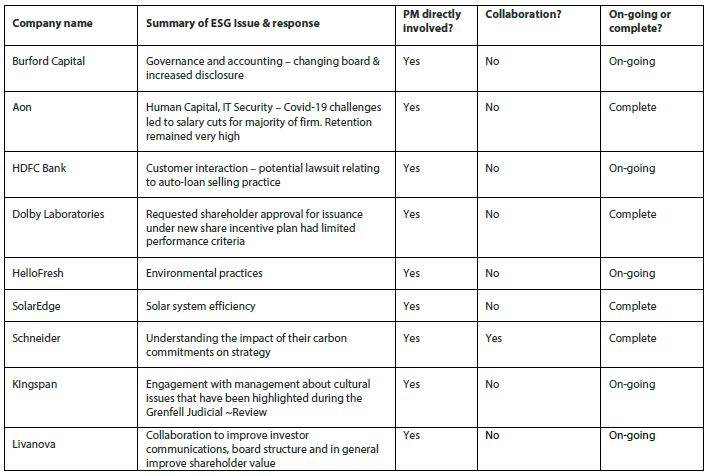

Appendix: Nikko AM Global Equity Engagement Summary – 2H20

Strong ESG credentials

Source: MSCI ESG Fund Ratings, December 2020. Data supplied as per the MSCI definitions. Fund is a representative account of the Nikko AM Global Equity Strategy. Benchmark is the MSCI ACWI.

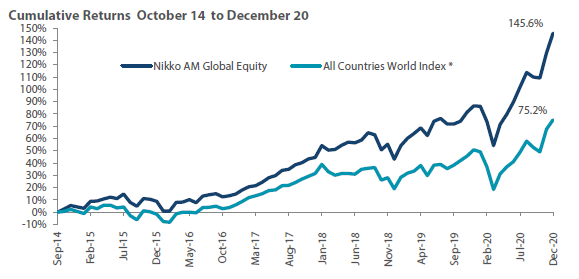

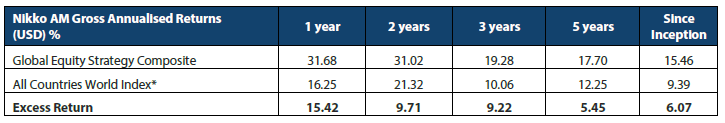

Global Equity Strategy Composite Performance to Q4 2020

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. For more details, please refer to the performance disclosures found at the end of this document. Any comparison to reference index or benchmark may have material inherent limitations and therefore should not be relied upon. Data as of 31 December 2020.

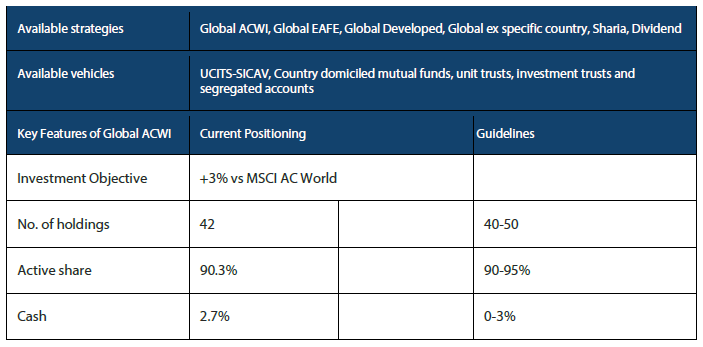

Nikko AM Global Equity: Capability profile and available funds

(as at 31 December 2020)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon.

Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

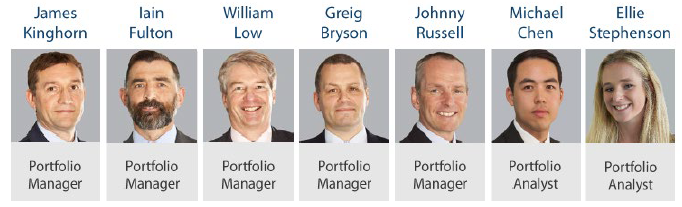

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 23 years’ industry experience and have worked together as a Global Equity team for eight years. In 2019, two portfolio analysts, Michael Chen and Ellie Stephenson joined the team and they are the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of “Future Quality” companies will lead to outperformance over the long term. They define “Future Quality” as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 284.4 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 31 December 2020.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.