Summary

- US Treasury (UST) yields moved higher again in October. Overall, 2-year and 10-year yields ended the month at 0.499% and 1.555%, respectively, about 22.2 basis points (bps) and 6.7 bps higher compared to end-September.

- Economic growth in China, South Korea and Singapore moderated in the third quarter of 2021. Meanwhile, the Monetary Authority of Singapore (MAS) increased the FX policy slope, and the Reserve Bank of India (RBI) withdrew excess liquidity from the financial system.

- The inflationary picture was mixed across Asia. September headline consumer price index (CPI) prints in Malaysia, Thailand and Singapore rose, while similar gauges of inflation in China, South Korea, India and the Philippines eased from August levels. In China, President Xi Jinping called for “proactively and steadily” promoting property tax legislation, which is part of his “common prosperity” programme that aims, among other things, to enhance housing affordability.

- Asian credits returned -1.35% in October, with credit spreads widening by 5.0 bps as UST yields rose. The marked divergence in performance continued between Asian high-grade (HG) and their high-yield (HY) counterparts, as concerns around the Chinese property sector escalated. At end of month, Asian HG returned -0.31%, as the 7.0 bps tightening in spreads was insufficient to offset the rise in UST yields. HY retreated 5.17%, with spreads widening by 100.1 bps.

- We are slightly cautious on rates markets and expect Indonesian bonds to outperform. On currencies, we expect the US dollar (USD) to resume its ascent against regional currencies when US rates adjust higher, with the Singapore dollar (SGD) likely to outperform.

- We believe medium-term fundamentals remain supportive of moderately tighter Asian credit spreads over the next six months. However, near-term downside risks and market volatility have increased, which calls for a more gradual and selective approach to adding credit risk over the next few months.

Asian rates and FX

Market review

US Treasury yields rise anew in October

Inflation worries and fears of premature tightening caused a twist flattening of the UST yield curve in October, with the front-end to the belly trading weakest on the curve. Yields marched higher at the start of the month despite nonfarm payrolls rising by a significantly weaker-than-expected 194,000, as the market remained focused on the US Federal Reserve’s (Fed) tapering plans. Subsequently, hawkish rhetoric from Bank of England Governor Andrew Bailey prompted a meaningful repricing in global front-end markets, including USTs. Thereafter, minutes of the Fed’s September meeting revealed that the central bank will most likely commence tapering its asset purchases next month. In addition, some members voiced concern that current inflation pressures might last longer than anticipated. Towards month-end, hawkish comments from a number of developed markets (DM) central banks pushed up short-end rates, while concerns about the economic outlook—as data fell short of expectations—pulled down longer-dated UST yields. Overall, 2-year and 10-year yields ended the month at 0.499% and 1.555%, respectively, about 22.2 bps and 6.7 bps higher compared to end-September.

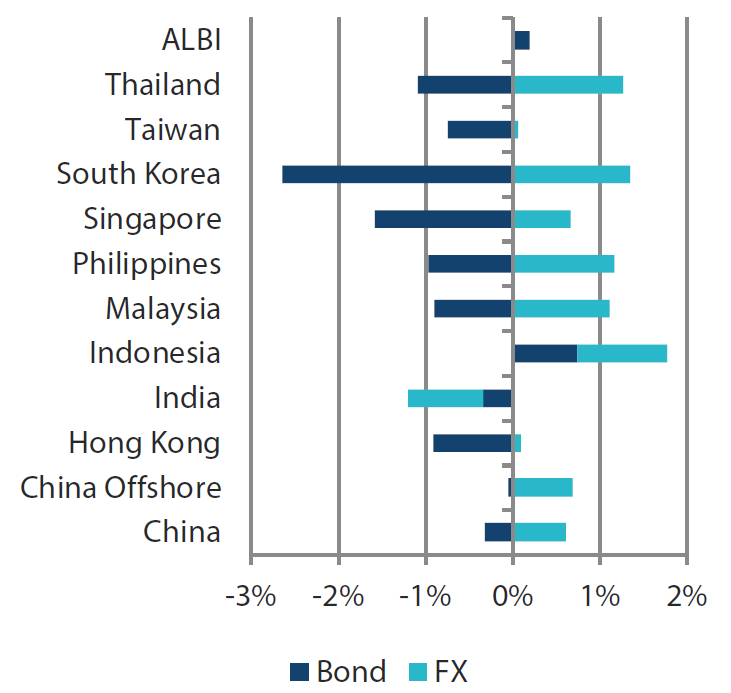

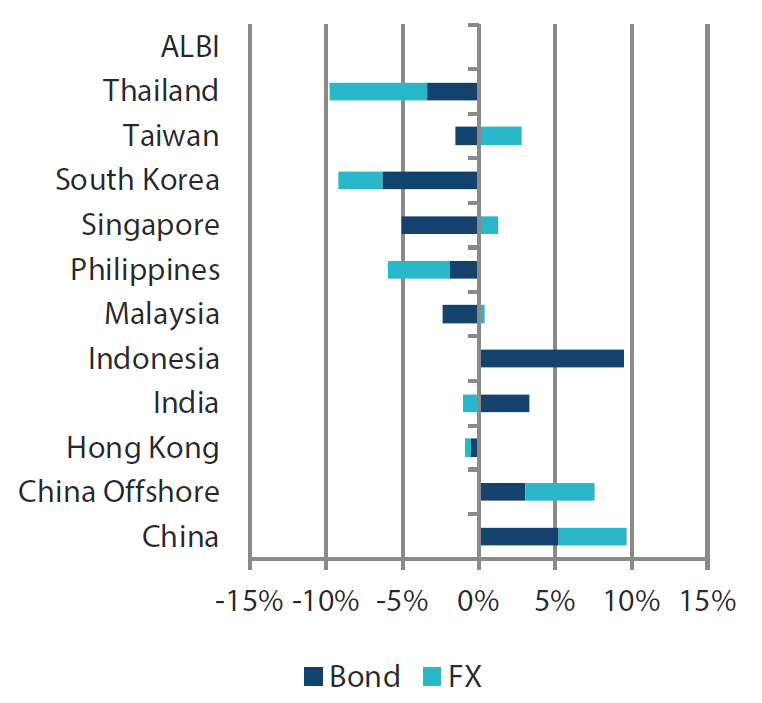

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 31 October 2021 | For the year ending 31 October 2021 | |

|

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 October 2021

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Economic growth in China, South Korea and Singapore moderates in the third quarter of 2021

Chinese real gross domestic product (GDP) growth in the third quarter dropped to 4.9% year-on-year (YoY)—the slowest pace of growth in a year. The slowdown in economic activity was due partly to power shortages and regulatory tightening in the property sector. Meanwhile, the Singapore government’s advance estimates showed that GDP growth moderated to 6.5% YoY in the third quarter, from an upwardly revised 15.2% in the April to June period. Growth in the manufacturing sector was driven mainly by the electronics and precision engineering clusters, while growth in the construction sector was largely due to low base effects. In South Korea, third quarter GDP growth expanded 4.0% YoY in the third quarter, down from 6.0% in the previous quarter, as subdued private consumption and weak construction and facility investment offset robust exports.

MAS increases the FX policy slope; RBI withdraws excess liquidity from the financial system

The MAS surprised markets by announcing a “slight” increase in the slope of the SGD NEER policy band, while keeping unchanged the width of the policy band and the level at which it is centred. The accompanying statement sounded slightly hawkish, with the monetary authority noting that global growth is forecast to register above trend in 2022, and domestic growth should “return to around its potential” next year. At the same time, it added that core inflation is expected to “rise steadily from below 1% on average this year to 1–2% in 2022”. Separately, the RBI left the policy repo rate unchanged and retained its guidance of a continued accommodative stance “as long as necessary to revive and sustain growth on a durable basis”. The central bank maintained its 9.5% YoY forecast for GDP growth in Fiscal Year 2022 (ending March) and revised down its CPI inflation forecast for the same year to 5.3% (from 5.7%). Importantly, the bank decisively moved to withdraw excess liquidity from the system, tapering its quantitative easing programme to zero and increasing the variable reverse repo auction size to Indian rupee (INR) 6 trillion (from INR 4 trillion).

Inflationary picture across Asia mixed

September headline CPI prints in Malaysia, Thailand and Singapore rose, while similar gauges of inflation in China, South Korea, India and the Philippines eased from August levels. Thailand’s consumer price index rose 1.68% YoY in September, registering the fastest growth in four months. The higher-than-expected print was driven partly by higher oil prices and the end of state subsidy for water and electricity charges. Similarly, overall inflation in Malaysia increased in September, as food inflation rose. In China, CPI inflation moderated slightly to 0.7%, driven partly by weak consumption demand. Elsewhere, the Philippines’ headline CPI print eased slightly. Slower transport inflation was the primary factor that caused the moderation, although prices of food and non-alcoholic beverages also rose at a slower pace.

Chinese President Xi calls for “proactively and steadily” promoting property tax legislation

In China, the National People’s Congress (NPC) announced that the State Council will expand pilot schemes to tax residential and commercial property in cities. Policy makers have not declared when the tax will be rolled out, nor locations where it will be introduced, but mentioned that legally owned rural households will be excluded. According to states news agency Xinhua, the pilot programme will last for five years before the NPC turns it into a nationwide law. The proposed property tax is part of President Xi’s “common prosperity” programme which aims, among other things, to enhance housing affordability.

Market outlook

Slightly cautious on rates markets; expect Indonesian bonds to outperform

Concerns around persistent inflation and the risk of markets ramping up global rate hike bets should keep US rates elevated in the near-term, in our view. That said, cognizant of the sharp repricing in the Fed fund rate last month, we are taking a slightly cautious view on rates markets.

We expect Indonesian bonds to outperform, as demand is supported by positive supply technicals. We note that the government’s financing requirements have largely been met, thus remaining auctions for 2021 may be cancelled. Meanwhile, we see bonds of low-yielding countries like Singapore, South Korea and Thailand prone to bear flattening, driven mainly by UST movement.

On currencies, we expect the US dollar to resume its ascent vis-à-vis regional currencies when US rates adjust higher. The Singapore dollar is likely to outperform, following the MAS’s surprise shift to a tightening stance, while the South Korean won, Philippines peso and Indian rupee could be most vulnerable to further sharp moves in oil prices. Thailand has relaxed quarantine measures for selected travellers, and in our view Thai baht performance will be highly dependent on the success of revival in tourism.

Asian credits

Market review

Asian credits retreat in October

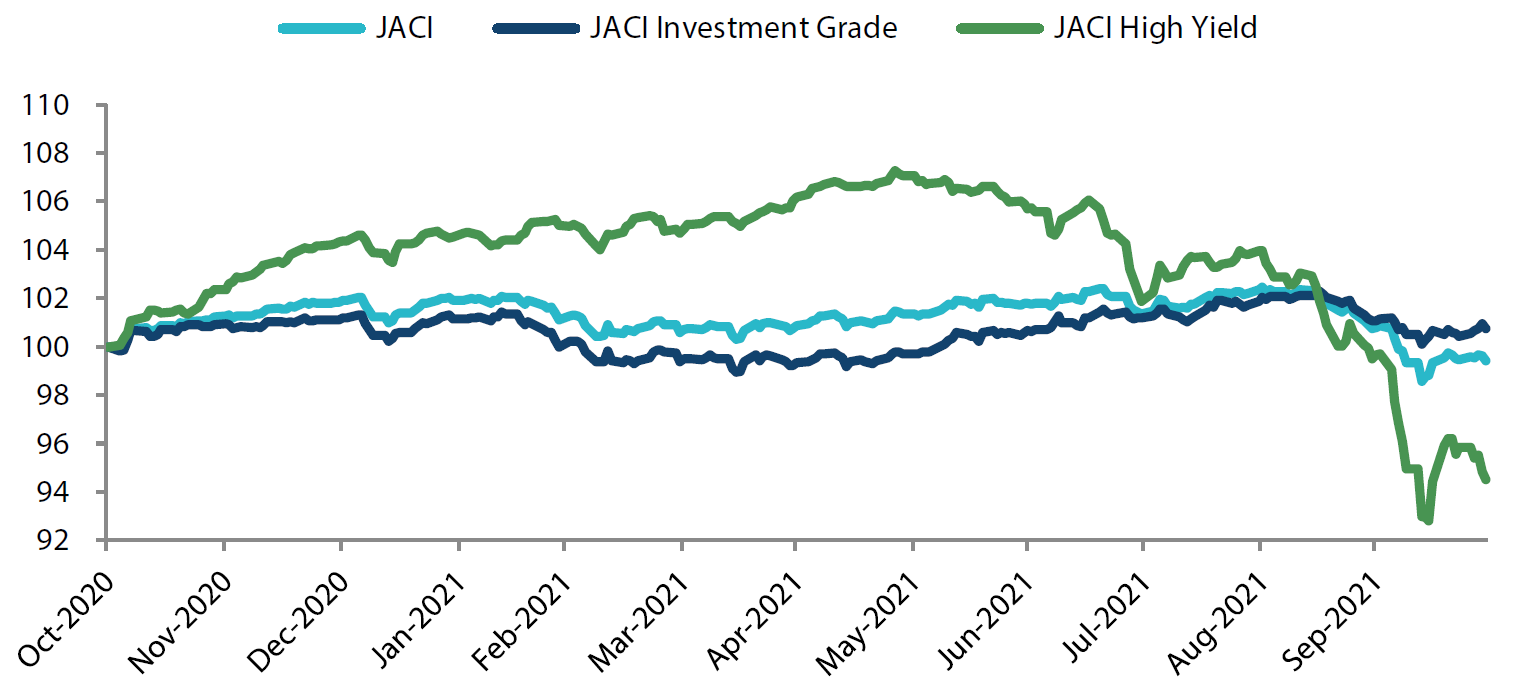

Asian credits returned -1.35% in October, with credit spreads widening by 5.0 bps as UST yields rose. As with the previous month, there was a marked divergence in performance between Asian high-grade (HG) and their high-yield (HY) counterparts, as concerns around the Chinese property sector escalated. At end of month, Asian HG returned -0.31%, as the 7.0 bps tightening in spreads was insufficient to offset the rise in UST yields. HY retreated 5.17%, with spreads widening by 100.1 bps.

Sentiment towards Asia credit remained weak, particularly on the HY side, as contagion fears were further fuelled by more Chinese property companies failing to make payments on their offshore bonds. Chinese developer Fantasia’s default in early October took the markets by surprise, given that the company had earlier assured offshore investors of sufficient liquidity to support debt repayment. With most investors caught unaware, the subsequent loss of confidence in Chinese credits triggered a massive sell-off in Chinese HY names. Market sentiment eventually improved following a slew of reassuring comments from policymakers and regulators. At the same time, Evergrande managed to stave off a default by paying interest owed to international bondholders. Towards month-end, the Chinese property sector succumbed to another sell-off—albeit weakness was significantly contained this time around—after at least two more developers reported missed payments to bondholders.

A significant amount of US and Chinese macro data fell short of expectations. That said, US economic data suggested the country’s economy remained on a recovery path. Meanwhile, the ongoing power shortage in China continued to place downward pressure on the economy, at the same time pushing the producer price index (PPI) inflation to a record high.

The striking gap between China and the rest of the region remained within Asian credit. Chinese credit spreads widened by about 29 bps, while all other large country segments saw spreads tightening. By sector, considerable spread widening was similarly focused on real estate, with spreads in other sectors ending the month mostly narrower. In frontier markets, Moody’s downgraded Sri Lanka’s sovereign rating by a notch to “Caa2” and kept the outlook at “stable”, citing “the absence of comprehensive financing to meet the government’s forthcoming significant maturities, in the context of very low foreign exchange reserves, raises default risks”.

UST 10-year yields ended the month at 1.56%, about 7 bps higher compared to end-September. The UST yield curve twist flattened during the month on inflation worries and fears of premature tightening. Minutes of the Fed’s September meeting revealed some members voiced concern that current inflation pressures might last longer than anticipated. Meanwhile, hawkish comments from a number of DM central banks reverberated throughout the month. Some concerns about the economic outlook arose towards month-end in the wake of disappointing economic data.

Primary market activity subdued in October

Weak market sentiment and long holidays for China issuers contributed subdued primary market activity in October. Forty-one new issues raised a total of USD 24.36 billion in the market. The HG space saw 29 new issues amounting to about USD 16.34 billion, including a USD 4.50 billion four-tranche issue from TSMC Arizona Corp and USD 1.50 billion two-tranche issue from Korea Development Bank. Meanwhile, the HY space saw approximately USD 8.02 billion worth of new issues raised from 12 issues, including the USD 4.0 billion four-tranche sovereign issue from China, and USD 1.70 billion perpetual issue from China Cinda Asset Management.

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 October 2020

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 October 2021

Market outlook

Fundamentals supportive of tighter Asian credit spreads, though downside risks have increased

We believe medium-term fundamentals remain supportive of moderately tighter Asian credit spreads over the next six months. However, near-term downside risks and market volatility have increased, which calls for a more gradual and selective approach to adding credit risk over the next few months, in our view.

The tentative improvement in the COVID-19 situation across many Asian economies reinforces our view that the setback to growth is likely to be temporary. Progress on vaccine rollout, the gradual re-opening in a number of countries, as well as still supportive fiscal and monetary policies, should revive the growth momentum as we head into 2022. Similarly, overall Asian corporate credit fundamentals are expected to remain robust, although the positive earnings momentum in the second half of 2021 could be softer and may vary in degree by sector. Notably, weak sales and liquidity pressure could continue to impact the weaker developers in the China real estate space, potentially leading to more distress or defaults. However, there have been tentative signs of authorities stepping in to stabilise credit access and market sentiment to prevent an overcorrection that could lead to systemic risks. Credit selection will remain key although overall valuation and more benign policy environment going forward argue for spread tightening and opportunities in this space.

Other key downside risks that could derail this constructive outlook include a deeper China economic slowdown, more aggressive tightening of monetary policy in the US and other major economies in response to prolonged elevated inflation and a failure by US Congress to raise or suspend the country’s debt ceiling. Meanwhile, despite some recent positive developments, uncertainties over US-China relations also remain in the background.