Summary

- Asian stocks fell in November on concerns that the spread of the new Omicron COVID-19 variant could derail global reopening plans and delay economic recoveries. For the month, the MSCI AC Asia ex Japan Index declined by 3.9% in US dollar (USD) terms.

- North Asia broadly underperformed. China and South Korea were weighed down by domestic COVID-19 outbreaks, while Hong Kong fell on the back of soft tech earnings. Taiwan was a bright spot, returning 2.2% in USD terms on strong expected GDP growth.

- ASEAN and India also saw muted returns as investors weighed the impact of the Omicron variant and some governments began to tighten borders. The Philippines gained 2.6% and was the best-performing market in the region, buoyed by better-than-expected GDP growth.

- The emergence of the highly mutated Omicron variant has introduced new uncertainties to a market which had been chiefly concerned about the permanence of rising inflation. We continue to navigate these uncertain times by leaning on our bottom-up stock picking philosophy of harvesting growth and harnessing change.

Market review

Regional equities gain in November

Asian stocks fell in November on concerns that the spread of the new Omicron COVID-19 variant could derail global reopening plans and delay economic recoveries. Separately, the US Federal Reserve (Fed) signalled at month end that it could hike rates sooner than expected, with Chair Jerome Powell stating that inflation could last longer than anticipated, and that he now advocates a quicker tapering of the central bank’s stimulus measures.

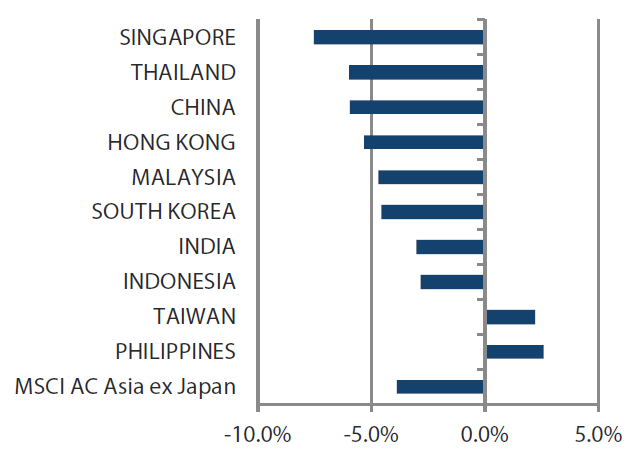

For the month, the MSCI AC Asia ex Japan Index declined by 3.9% in US dollar (USD) terms. The Philippines and Taiwan were the only markets to post positive USD returns, while Thailand and Singapore saw the biggest declines.

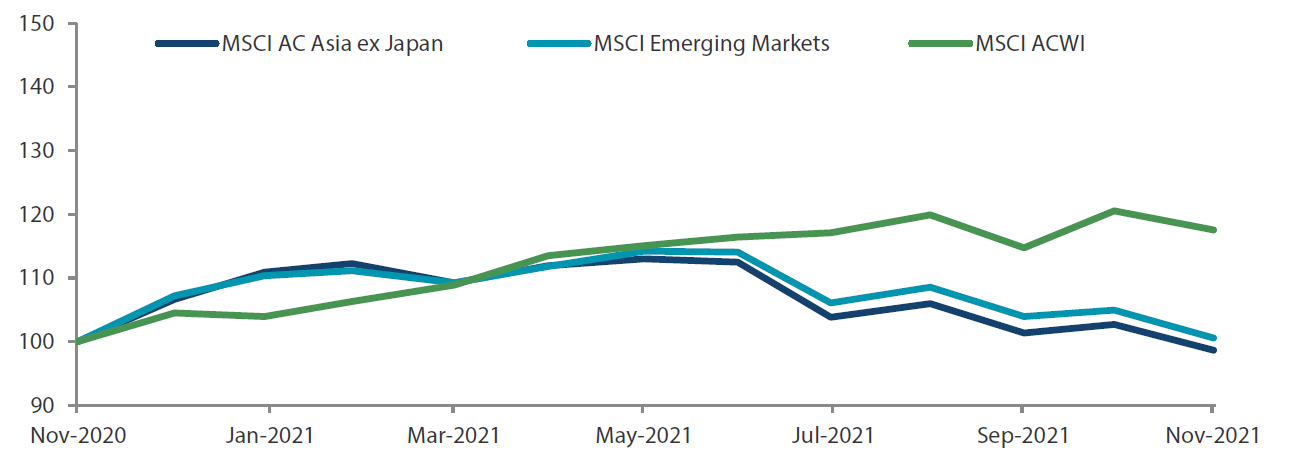

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 30 November 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 November 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

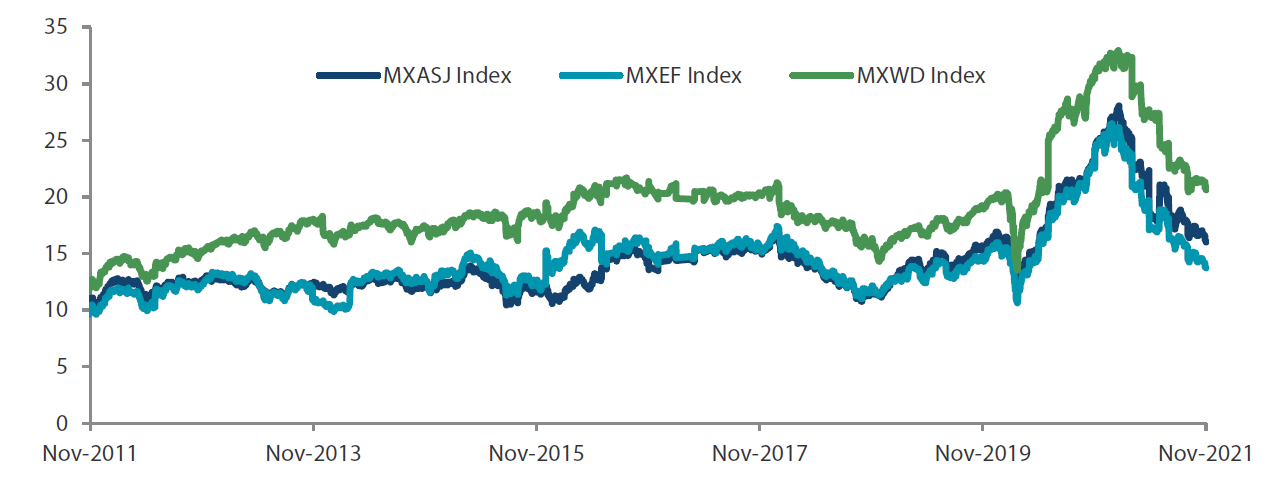

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 30 November 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 November 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

North Asia underperforms

North Asia broadly underperformed the regional index. Sentiment in China (-6.0% in USD terms) was dampened by an outbreak of domestic COVID-19 cases which prompted Shanghai to cancel flights and shut schools. The property sector also continued to struggle, with residential sales and new home prices falling. Separately, China’s manufacturing purchasing managers' index (PMI) unexpectedly rebounded to 50.1 points in November, its first expansion in two months, as power shortages eased. Hong Kong (-5.3%) tracked the decline in global markets—weak technology (tech) earnings and the ongoing regulatory crackdown on the Macau gambling sector added to investor concerns over the month.

South Korea (-4.6%) grappled with a spike in COVID-19 infections, reporting an average of over 4,000 daily cases. The Bank of Korea raised interest rates by 25 basis points (bps) for the second time this year, citing concerns about rising inflation and household debt. Elsewhere, Taiwan was a bright spot, returning 2.2% in USD terms over the month. Its economy is expected to grow 6% in 2021, its fastest pace over a decade, on the back of strong export performance.

ASEAN markets also decline, with the exception of the Philippines

The ASEAN region also saw muted returns as investors weighed the impact of the Omicron variant and governments began to tighten borders. Indonesia (-2.8%), Malaysia (-4.7%) and Thailand (-6.0%) saw their economies shrink in the third quarter on renewed COVID-19 restrictions, while Singapore (-7.5%) expects economic growth to slow to between 3% and 5% in 2022 amid an uneven domestic recovery and persistent uncertainty over global growth. In contrast, the Philippines (+2.6%) was the best-performing market in the region, buoyed by better-than-expected GDP growth of 7.1% year-on-year in the third quarter.

India weighed down by news of the Omicron variant

India retreated by 3.0% in November, also buffeted by fears of the new virus variant. In other news, the Indian parliament voted to repeal a set of contentious agricultural reform laws that would have removed the sector’s protection from the free market, and that had sparked a year of massive protests by farmers.

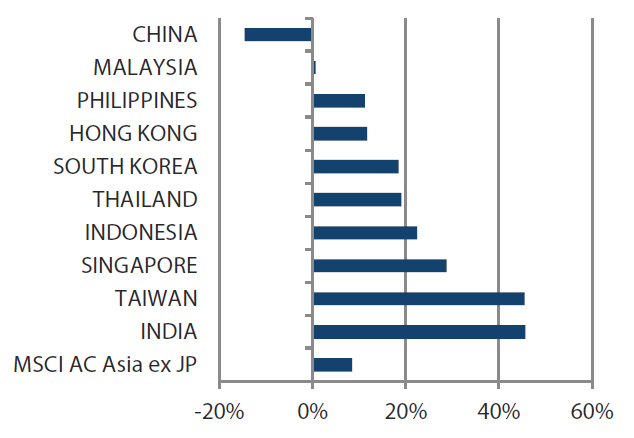

Chart 3: MSCI AC Asia ex Japan Index¹

| For the month ending 30 November 2021 | For the year ending 30 November 2021 | |

|

|

Source: Bloomberg, 30 November 2021

¹Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Leaning on disciplined stock picking approach to navigate uncertain conditions

The emergence of the highly mutated Omicron variant has introduced new uncertainties to a market which had been chiefly concerned about the permanence of rising inflation. While it is too early to know the exact impact of the new variant at the time of writing, there is a possibility that the recovery of global economies could be further delayed. That said, the world is now better prepared to deal with the ongoing pandemic, and updated vaccines and drugs could be ready in a few months. Asia, however, should still find some support in the next few quarters as growth rebounds on the back of easing supply bottlenecks. The region is also on firmer ground as core inflation remains under control with current accounts relatively strong. Nevertheless, we continue to navigate these uncertain times by leaning on our bottom-up stock picking philosophy of harvesting growth and harnessing change.

Focus on industrial technology, AI software, renewables and electric vehicles in China

On the note of change, China has been undergoing one of its biggest policy shifts in the last few decades. Since the 19th Party Congress in 2017, we have consistently been referring to China’s structural shift from “quantity to quality”, and it is increasingly evident that this shift is motivated by considerations surrounding the 3S’s—namely social, stability and state considerations. In particular, social considerations are now becoming a major policy driver as evidenced by the slew of regulations around the cost of property, education and healthcare, as well as in the areas of labour treatment and entertainment. What has also become apparent is that bad actors not aligned with the 3S’s have been ruthlessly dealt with. These are important reasons why our strong focus on ESG analysis has been richly rewarded by the market over the last six months. Against this backdrop, companies aligned with the 3Ss are likely to benefit. Apart from companies that seek to reduce the cost of living for consumers, we also find opportunities in companies that are aligned with state considerations, including those in the areas of industrial technology, AI software, semiconductors, renewables and electric vehicles.

Valuations looking more attractive in South Korea and Taiwan

With increasing signs that semiconductor chip and shipping shortages could ease over the next few quarters, tech companies in Korea and Taiwan could find better support in the near future. In the long run, the digitisation of everything will need computing and memory chips—both areas that companies in Taiwan and South Korea excel at. With valuations looking more palatable after recent corrections, we retain a favourable outlook on areas such as integrated circuit design, content enablers, and software.

Monitoring valuations in India, ASEAN expected to outperform

The significant progress of reforms in India should continue to see investment intensity of the economy improving. Apart from increasing formalisation and urbanisation, localisation policies such as “Made in India” will continue to be key long-term drivers of a capital expenditure cycle in India. In the near term, the Indian market should find some reprieve as energy prices show signs of cooling. We continue to find opportunities in areas enjoying structural growth, where valuation still offers upside—these include real estate, private banks, new economy and healthcare.

The pandemic has been a critical accelerator of the new economy in emerging countries, especially in the ASEAN region. Some countries are further along than others, with ingredients in place for better quality economic growth—such as Singapore, Indonesia, and the Philippines. As a result, we changed our view towards ASEAN for the first time in a number of years and now expect the region to outperform.

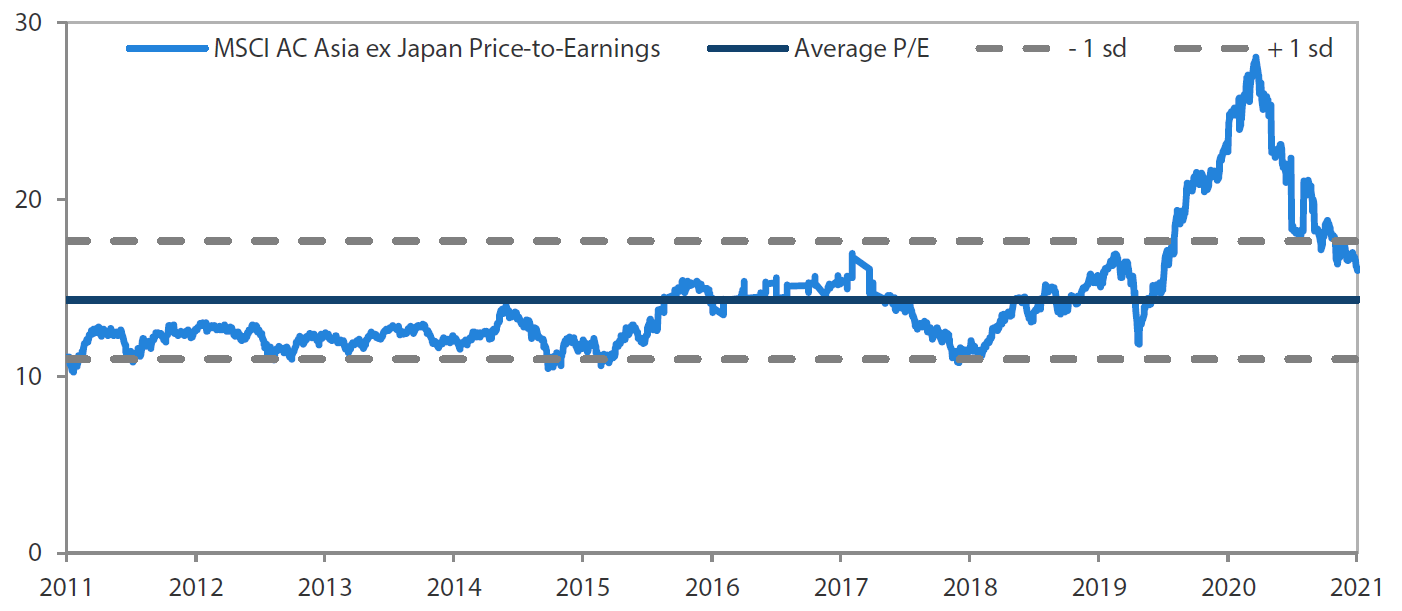

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 30 November 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 November 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

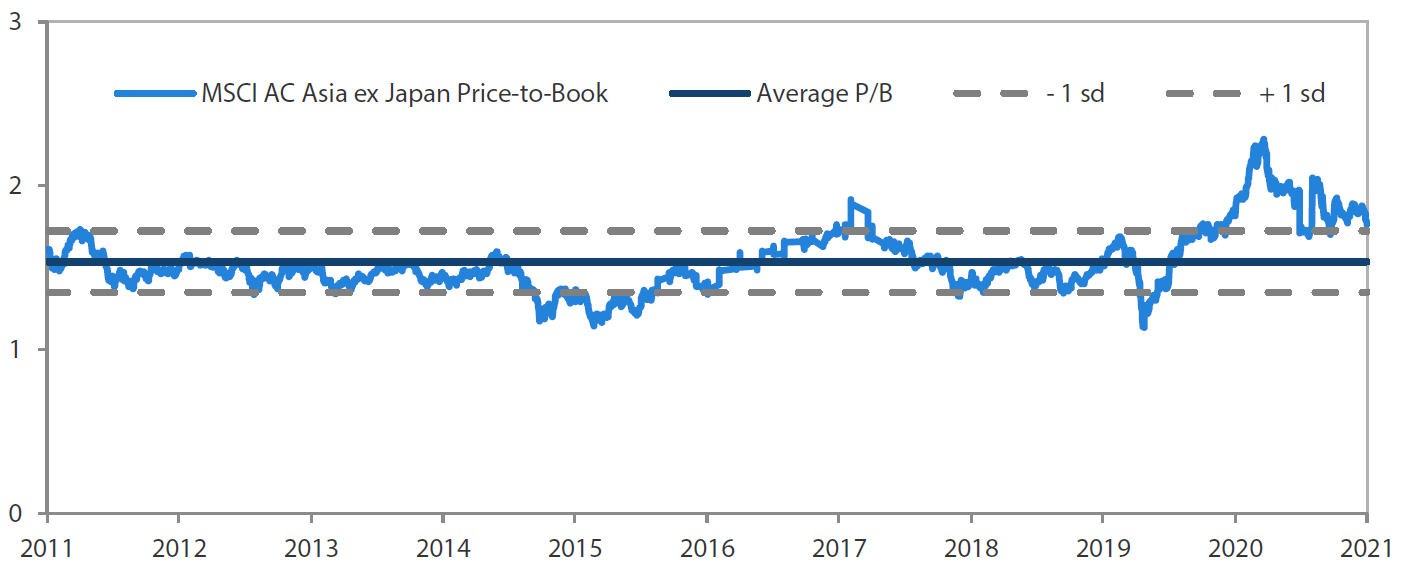

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 30 November 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 November 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.