Summary

- Asian stocks edged lower in June, partly weighed down by a recent spike in COVID-19 cases in the region. Lingering worries about rising inflation and fears of a faster-than-expected tapering of the US Federal Reserve’s quantitative easing programme also dampened sentiment. The MSCI AC Asia ex Japan Index returned -0.1% in US dollar (USD) terms over the month.

- North Asia outperformed. The strong performance of global technology stocks and robust export numbers supported the tech- and export-centric markets of South Korea and Taiwan. Chinese stocks managed to eke out USD gains of 0.1% in June, despite persistent worries over policy tightening by the Chinese central bank.

- In the ASEAN region, the Philippines was the only market with positive returns in June, while Indonesia, Malaysia, Thailand and Singapore all turned in hefty losses relative to their North Asian peers, owing to spikes in COVID-19 infections in the South East Asia region.

- Uncertainties continue to shroud markets as investors continue to grapple with inflation expectations amidst resurgent waves of COVID-19 cases. We continue to lean on our disciplined bottom-up stock picking approach to navigate these uncertain conditions, with a preference for companies undergoing structural positive changes and sustainable returns.

Market review

Regional stocks see marginal USD losses in June

Asian stocks turned in marginal losses in June, partly weighed down by growing concerns about the highly infectious Delta variant, which has caused a recent spike in COVID-19 cases in the region. Lingering worries about rising inflation and fears of a faster-than-expected tapering of the US Federal Reserve (Fed)’s quantitative easing programme also dampened sentiment for regional stocks in June.

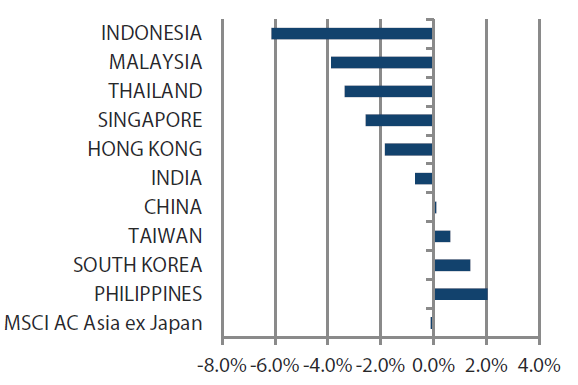

For the month, the MSCI AC Asia ex Japan Index edged lower by 0.1% in US dollar (USD) terms. Within the region, the Philippines, South Korea and Taiwan were the best performers (as measured by the MSCI indices in USD terms), while Indonesia, Malaysia and Thailand were the worst performers.

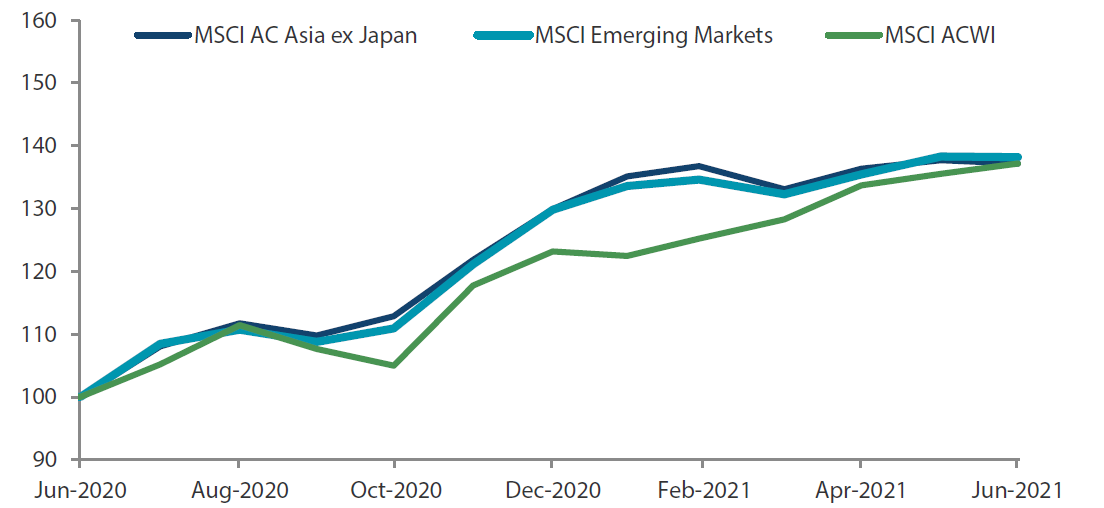

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 30 June 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 June 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

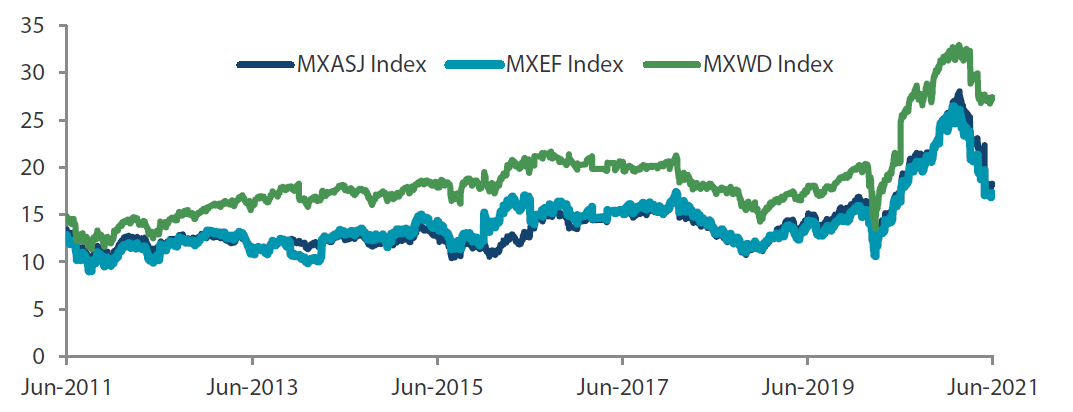

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 30 June 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 June 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

North Asian markets outperform

Recent strong performance of global technology (tech) stocks and robust export numbers supported the tech- and export-centric markets of South Korea and Taiwan, which rose 1.4% and 0.6%, respectively, in USD terms in June. Exports from South Korea and Taiwan (in USD terms) in May expanded 45.6% and 38.6% year on year (YoY), respectively, buoyed by strong demand for semiconductors and electronics equipment. In other developments, the Bank of Korea (BOK) said in June that it is preparing to raise interest rates this year, owing to faster-than-expected recovery in the South Korean economy.

In China, stocks managed to eke out USD gains of 0.1% in June, despite persistent worries over policy tightening by the Chinese central bank. During the month, Beijing imposed stronger regulations on the private tutoring sector and further tightened its grip on cryptocurrency trading, while China’s official June manufacturing Purchasing Manager's Index (PMI) eased slightly to 50.9 versus 51.0 in May. In Hong Kong, stocks fell 1.8% in USD term for the month as energy and IT stocks retreated, owing to the subdued Chinese factory activity data.

India sees negative returns, most ASEAN markets underperform

Indian stocks retreated 0.7% in USD terms for the month, during which lockdown restrictions in the country were eased as COVID-19 cases stabilised. The Reserve Bank of India maintained its repo rate at 4% and warned that high energy prices could stoke inflation, while it cut the growth forecast to 9.5% from 10.5% for the current fiscal year beginning April.

In the ASEAN region, the Philippines (+2.0% in USD terms) was the only market with positive returns in June, while Indonesia (-6.1%), Malaysia (-3.9%), Thailand (-3.4%) and Singapore (-2.6%) all turned in hefty losses relative to their North Asian peers, owing to spikes in COVID-19 infections in the South East Asia region. In the Philippines, stocks hit their highest level in over four months as unemployment rate in the country fell from 8.7% reported in April to an estimated 7.7% in May as its economy slowly reopened. Elsewhere, Indonesia and Thailand announced new social restrictions in a bid to tackle rising domestic coronavirus infections, while Malaysia extended its lockdown indefinitely until daily reported cases fall below 4,000.

Chart 3: MSCI AC Asia ex Japan Index¹

| For the month ending 30 June 2021 | For the year ending 30 June 2021 | |

|

|

Source: Bloomberg, 30 June 2021

¹Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Leaning on disciplined stock picking approach to navigate uncertain macro conditions

Uncertainties continue to shroud markets at the halfway mark of the year as investors continue to grapple with inflation expectations amidst resurgent waves of COVID-19 cases. Investors are struggling to discern if global central banks will be forced to taper earlier than expected if global growth remains strong beyond the next six months, or if we are, in fact, already past the peak of inflation expectations where a combination of resurgent COVID-19 cases, tightening by China and an increasing fiscal drag would suffice to slow growth down materially.

While reality is rarely binary, both these scenarios will have a profound but opposing impact on regional markets. As we read the tea leaves along the way, we continue to lean on our disciplined bottom-up stock picking approach to navigate these uncertain macro conditions, with a strong preference for companies undergoing structural positive changes and sustainable returns. These include companies geared to large domestic markets and structural areas, namely healthcare, environment and areas of technology.

New policy adjustments in China could usher in better quality, sustainable growth

China continues to tighten its screws on its economy, adamant in its deleveraging push and keeping inflation in check. Apart from utilising monetary levers, the central government has also taken the opportunity to tighten policies in areas where social concerns are high, and companies have been seen to be profiteering at the expense of social stability. This has led to significant changes to business models in areas of fintech, e-commerce and education. Some of these businesses, such as education companies, may never return to their glory days. Yet, for others, the new adjustments merely usher in a future of better quality and more sustainable growth. The latter throws up buying opportunities in a rich pool of quality companies available at a discount and would complement investments in areas with a more favourable policy backdrop, such as environmental, industrial upgrade, software and healthcare.

More selective in South Korea and Taiwan

Despite markets outperforming in South Korea and Taiwan, both economies are by no means in the clear. COVID-19 caseloads remain fairly elevated in both countries, despite vaccination rates improving in South Korea. Cross-strait risks have picked up recently, as the administration of US President Joe Biden attempts to deepen bilateral ties with Taiwan. In South Korea, an incrementally hawkish BOK also presents the market with another set of headwinds as excessive domestic liquidity conditions become a cause for concern. As a result, we are more selective in both countries, notwithstanding the fact that we continue to find some very attractive bottom-up ideas in the areas of content, healthcare and specific tech sub-sectors.

Economic recoveries in India and ASEAN depend on pace of vaccination

The economies of India and ASEAN have suffered significant setbacks due to resurgent pandemic waves. The key focus for these countries firmly centres on their pace of vaccinations. Countries which are able to improve their pace of vaccination will set themselves apart from those that lag behind. More importantly, countries such as India and Indonesia, which are able to push through meaningful reforms to open up critical bottlenecks in the economy, would see the most significant outperformance in the longer term. In India, we continue to find companies undergoing accelerated sub-sector consolidation, commercialising of management and innovation development. These positive fundamental changes lead us to favour private banks, logistics, real estate and new economy. Elsewhere in ASEAN, the internet economy remains one of the most significant opportunities relative to the rest of the region.

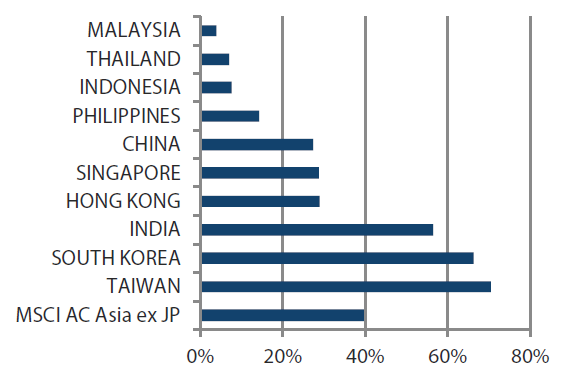

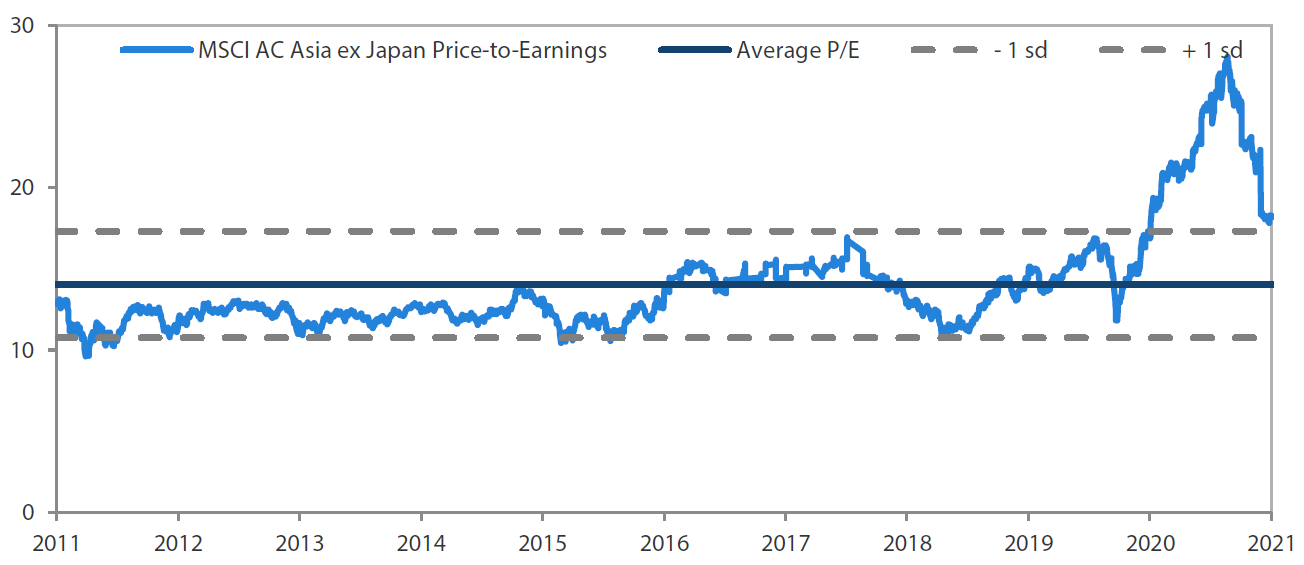

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 30 June 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 June 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

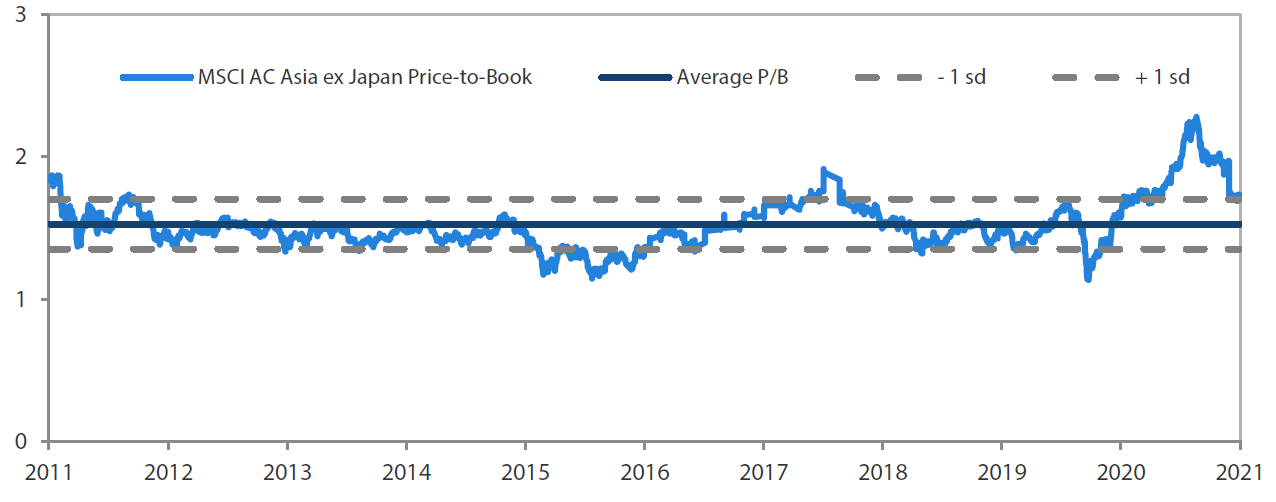

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 30 June 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 June 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.