The Covid-19 pandemic has accelerated the adoption of internet-based healthcare services. Growing in importance, penetration and acceptance, telemedicine will revolutionise and augment Asia’s healthcare systems.

Crises present opportunities to drive change

Global health crises and pandemics have caused considerable anguish, trepidation and devastation to humanity through the ages. But global outbreaks of infectious diseases—as history has shown—have also spurred widespread medical innovation, new vaccines and advances in healthcare services, as societies put in concerted efforts to combat the challenges.

The Black Death, which plagued Europe in the 14th century, resulted in better living and working conditions for the poor, according to academics, as governments became cognisant of the importance of public sanitation in the control of infectious diseases.

The 1918 Spanish Flu pandemic that killed an estimated 20 to 50 million people globally not only taught us that quarantine and social distancing were the most effective measures against the spread of infectious diseases; the “flu that changed the world” also revolutionised public health through the development of centralised public health systems, greatly advancing research in Epidemiology, Microbiology and Diagnostics. Over time, this has brought about significant improvement in patient care and established the foundation of modern medicine as we know it today.

In the future, we will likely debate the lessons learnt from the ongoing Covid-19 pandemic.

Over the past eight months, we have witnessed a plethora of healthcare-related innovation that facilitates greater social distancing in the electronic age. Some examples include patient-facing apps, wearable devices and wireless sensors for patients, rapid diagnostic kits, remote patient monitoring and many others.

More importantly, the current pandemic has accelerated the adoption of internet-based healthcare services or telemedicine, which allow patients to have online consultations with physicians and medical experts via video conferencing, followed by the delivery of electronically prescribed medication direct to their homes.

The push to digitalise healthcare delivery

To be sure, the global health crisis at hand has forced healthcare systems around the world to prioritise and mobilise resources to treat an outsized number of patients with the coronavirus, while minimising the threat of infections.

With traditional healthcare systems currently facing stress, many countries have turned to digital technology as a conduit to deliver contactless medical services to non-emergency patients.

Indeed, telemedicine not only helps to minimise Covid-19 exposure between patients and doctors, as well as curb the spread of the disease, it also frees up valuable hospital resources and capacity to treat cases that require in-person interaction with the doctor.

To incentivise people to use online medical consultations, governments of several countries, including some in Asia, have also allowed medical reimbursement under universal healthcare insurance schemes for users of telemedicine.

In our view, seeing a doctor via tele or videoconferencing could become part of a “new normal” even in a post-pandemic setting. Growing in importance, penetration and acceptance, internet healthcare services is beginning to revolutionise and augment Asia’s healthcare systems.

Asia’s current healthcare delivery model isn’t sustainable

Supporting Asia’s future healthcare needs will be a strain given today’s centralised healthcare model, which is laden with long lead time, high costs and poor access. The rising life expectancy in Asia and the growing healthcare demands of large and aging populations in many regional countries are other factors that are increasingly putting stress on the healthcare systems in Asia.

First and foremost, the region’s life expectancy, which has risen by almost 20 years 1over the past five decades from 55 years1 in 1970 to the average of 74 years1 in 2019, is likely to continue to increase going forward.

With declining fertility and increased longevity, the relative size of older age groups versus younger age groups looks set to increase significantly, putting considerable strain on the region’s healthcare systems.

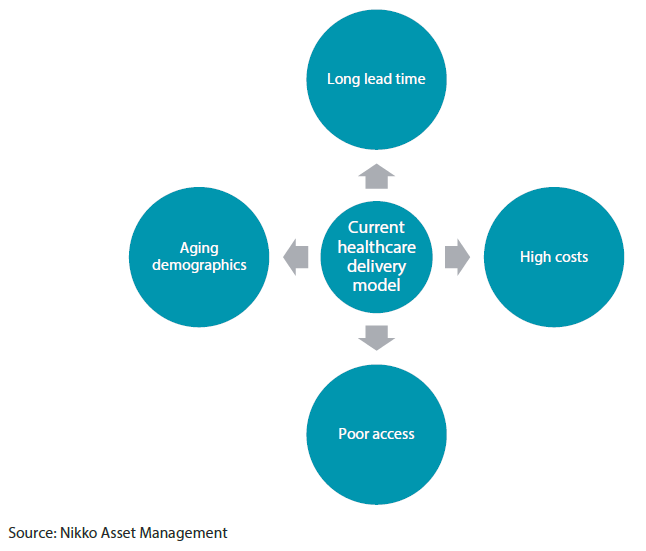

The current healthcare delivery model in Asia (see Chart 1) is generally characterised by:

- Long lead time (or amount of time from the start of a process until its conclusion) due to the need to travel to access medical services; long waiting time at clinics and the emergency rooms; considerable lag time for diagnostic tests; and lengthy scheduling time for specialist consultations.

- High costs of consultations, prescriptions, diagnostic tests and hospitalisation.

- Poor access of the masses to pertinent medical services, which are constrained by availability of physicians and specialists.

Due to these drawbacks, which are exacerbated by the region’s aging demographics, the “old normal” of healthcare delivery in Asia is unlikely to be sustainable over the long term in our view. We think that Covid-19 offers the opportunity to rethink, reset and revamp the existing healthcare delivery model in Asia in order to offer greater convenience, better accessibility, lower costs and higher standard of care to patients in Asia as well as to cater to the unmet healthcare demand in certain countries.

Chart 1 – Asia’s current unsustainable healthcare delivery model

Technology as an enabler

Digital technology, utilising artificial intelligence (AI) and data analytics, could provide the solution to upgrade and augment the current medical care delivery systems in Asia. For instance, hospitals can use AI to determine the order of treatment for patients via triage, which is the process to ascertain the priority of patients' treatments by the severity of their conditions or the likelihood of recovery with and without treatment.

With technological innovation in healthcare, such as telemedicine, patients’ home could effectively be turned into virtual hospital wards, where doctors can be available on demand via video links; wireless sensors are used to monitor chronic medical conditions; and prescriptions are conveniently delivered at the doorsteps of patients.

Telemedicine isn’t new but had seen a slow take-up rate in many countries before the Covid-19 outbreak. However, the pandemic has changed users’ behaviour towards telemedicine, and many are now embracing digital healthcare services.

Asia at the forefront of e-healthcare

It is encouraging to see that Asia is currently far ahead on the telemedicine adoption curve versus other regions.

In populous Asian countries, such as China and Indonesia, online medical services have seen an explosion in internet traffic volume and new user numbers of late, as demand for contactless healthcare services surged during Covid-19.

In Indonesia, for instance, telemedicine provider Alodoktor received more than 60 million web visits2 and had more than 33 million active users2 in March 2020. Its application has been downloaded more than 5.5 million times2 and the number of patient-doctor interactions has increased to more than 750,0002 during that period. The number of Alodoktor’s monthly active users also surged three-fold to about 18 million2 in April 2020. Another Indonesian telemedicine provider Halodoc also reported a similar sharp increase in web volume, as patients flock to its online medical services amid the Covid-19 pandemic.

The growth of telemedicine in Asia is led by the private sector, most notably in China, where high-profile corporations (including Ping An Insurance, Tencent and Alibaba) have developed and spun off e-healthcare platforms.

Even before the Covid-19 pandemic, several Asian governments have demonstrated strong support for telemedicine services by establishing regulatory policies and rules around reimbursement in this new area of healthcare delivery. Since the outbreak, we have seen governments further strengthen national support for internet healthcare by expanding reimbursement.

Meanwhile, many technology-embracing medical institutions in the region have upgraded their hospital information systems, digitised medical records and developed their digital technology infrastructure, all of which are required for telemedicine platforms to take off in a sustainable way. To boost affordability, Asia’s e-healthcare platforms are also working and building relationship with government agencies overseeing the regulatory aspects of online healthcare services in order to have drug rebates and fee reimbursement, which can be passed on to consumers.

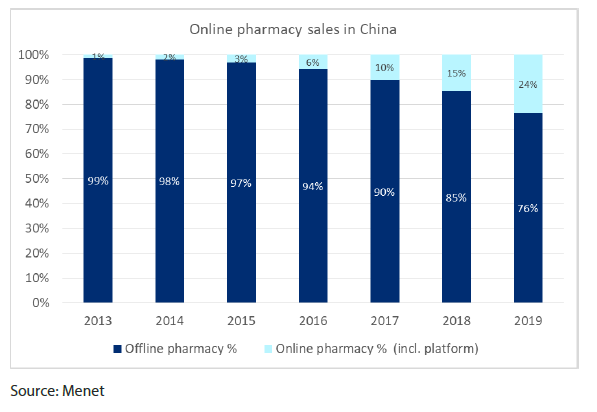

Internet healthcare platforms will need to achieve economies of scale, critical mass in terms of user numbers and technological capability in order to establish a sustainable business model in online consultations, consumer healthcare e-commerce and online prescription sales. In our opinion, emerging and developing parts of Asia, given their large smart-enabled, internet-savvy population with high unmet healthcare needs, are the ideal markets for telemedicine players. In China, for instance, online pharmacy sales are expected to nearly double to 40% of total sales by 2022 (see Chart 2).

Chart 2 – Rising online pharmacy sales in China

Asia’s telemedicine players

In China, the leading companies in the internet healthcare service space include Alibaba Health3, Ping An Healthcare and Technology3 and soon-to-list WeDoctor. In Indonesia, the key telemedicine players Halodoc and Alodoktor remain unlisted.

Alibaba Health Information Technology (0241.HK)

Alibaba Health Information Technology (Alihealth) is the healthcare subsidiary of Chinese e-commerce giant Alibaba Group and the largest healthcare e-commerce platform in China. Over the years, Alihealth has built a comprehensive health platform, integrating medical resources to provide better technical support for the Chinese pharmaceutical and healthcare industry, and leveraging on Alibaba Group’s strengths and experience in Internet and AI. The company is a key beneficiary of the relaxation of regulatory controls over online drug prescription and reimbursement in China.

Ping An Healthcare and Technology (1833.HK)

Ping An Healthcare and Technology is an online healthcare software company in China that offers a mobile platform, Ping An Good Doctor (PAGD), for online consultations, hospital referrals and appointments, health management and wellness interaction services. It has become one of the leaders in China's online medical services sector. As of December 2019, registered PAGD users totalled around 300 million, while its monthly active users exceeded 66 million. PAGD has a full-time, in-house doctor team and uses AI auxiliary diagnostics system based on accumulated consultation data, which greatly improves the productivity of doctors.

WeDoctor

Compared to PAGD, which mainly provides online healthcare services through in-house doctors rather than cooperation with hospitals, WeDoctor is more focused on working with hospitals and reimbursement. WeDoctor has helped Chinese hospitals to establish online healthcare platforms by building standardised electronic health records for patients. It cooperates with hospitals to conduct chronic disease management; connects families to general practitioners in primary medical institutions; and collaborates with local governments in China to build medical alliances.

Key takeout

We believe that the strong growth in the adoption of e-healthcare services and telemedicine in Asia will continue as a result of Covid-19 and could even accelerate in a post-pandemic world due to overwhelming demand for medical services in the region. Internet healthcare companies in Asia that are able to take advantage of this long-term structural shift in healthcare will thrive in a post Covid-19 era.

Footnote

1Source: United Nations (UN), Department of Economic and Social Affairs, Population Division (2019)

2Source: CLSA; Deloitte, 21st Century Health Care Challenges: A Connected Health Approach; and The Jakarta Post

3Any references to particular securities are for illustrative purposes only and are as at the date of publication of this publication. This is not a recommendation in relation to any named securities and no warranty or guarantee is provided.