This report is an adaptation of Ishikawa and Hasegawa’s Efficiency of Japanese Corporate Investment in Human Capital and Shareholder Value, which won the Security Analysts Association of Japan’s Security Analysts Journal Prize in 2019. (https://www.saa.or.jp/english/publications/2020_ishikawa_hasegawa.pdf)

Abstract

- Japan struggles with an aging and shrinking population and it is important for the country, both from an economic and social perspective, to improve its relatively low labour productivity by efficiently utilising its human resources.

- By estimating Japanese companies’ efficiency of human capital investments, we argue based on empirical analysis that higher human capital efficiency leads to higher share price performance.

- Furthermore, our analysis indicates that this positive relationship is particularly enhanced among stocks of firms with lower labour productivity, which must be encouraging for Japanese companies which are lower in labour productivity relative to those of other developed countries.

Japanese companies and investment efficiency in human capital

In Japan, where the workforce is expected to decline as its population grows older and decreases, effectively utilizing limited human resources is an important theme for both individual companies and society as a whole.

Japan’s labour productivity (defined as GDP/number of workers) ranks 21st among the 35 OECD member countries and bottom among the seven major developed countries (G7). This inefficiency has been attributed to persistent deflation and long but inefficient working hours which a significant portion of its workforce has been subject to.

It is essential for Japanese companies to create additional value that exceeds increases in labour costs–in other words, to improve labour productivity through efficient investment in human capital–in order to encourage companies to hire more workers and increase wages.

If this trend leads to an increase in consumption, it also raises the likelihood the economy making a break from deflation. We defined human capital investment efficiency as the sensitivity of changes in labour productivity to the change rate in the number of employees and investigated the relationship between human capital investment efficiency and shareholder value. Our research can be positioned broadly as an empirical study of the effectiveness of investments focused on the "S" component of ESG; that is, how corporate efforts to address the social issue of employment affects shareholder value.

Research on the relationship between general investments, such as capital investment, and stock returns has progressed significantly in recent years. These studies observed that companies whose investment is increasing, or is at a high level, have subsequently underperformed the market. It has been argued that this is because investors tend to underestimate the possibility of overinvestment by companies that are aggressively investing and expect such companies to grow faster, which can lead to the overvaluation of equity prices and subsequently cause them to underperform.

As for studies regarding the efficiency of investments, Cohen et al. [2013] defined the sensitivity of subsequent sales growth to research and development (R&D) expenditures as investment efficiency which they called "Ability", and observed that the efficiency of R&D investment has a positive relationship with subsequent stock returns in the US, Japan, the UK and Germany. Based on these results, they discussed the possibility that information on investment efficiency may be anomaly information that has not been fully priced into the market.

Ishikawa et al. [2017] applied a similar approach to capital investment, R&D and human capital investment to examine the relationship between investment efficiency and shareholder value (stock returns and ROE) at Japanese companies. They observed that high human capital investment efficiency has a positive effect on subsequent shareholder value, especially in labour-intensive companies with low sales per employee (i.e., low labour productivity).

Based on our earlier work (Ishikawa and Hasegawa, 2018), which examined the potential of ESG investment from the perspective of Creating Shared Value (CSV), we further advanced the study of the relationship between investment efficiency in human capital and shareholder value with a focus on improvements in labour productivity in this paper.

Human capital investment efficiency and stock returns

Efficiency of Japanese corporate investment in human capital

Companies with efficient human capital investment are those that, by increasing the number of employees, create additional value that exceeds the additional labour costs and therefore improve their labour productivity.

Labour productivity for individual companies is defined as value-added (= operating income + depreciation and amortization + labour costs) divided by labour costs. The idea is to calculate the value that is added purely by the company by rebating the cost of sales activities, and then evaluate how many times the amount of labour costs the value-added is equivalent to.

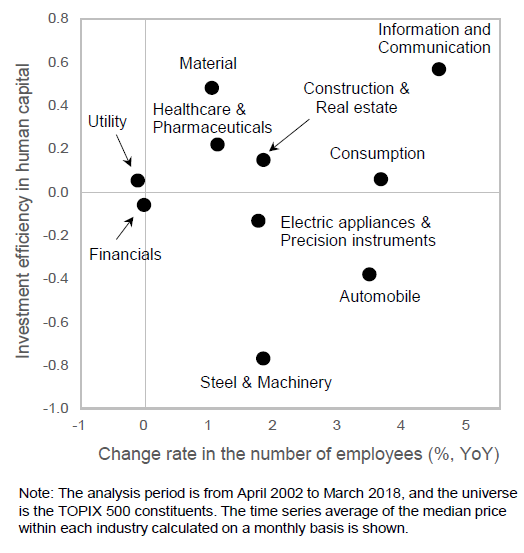

Our analysis of the time-series average of the median labour productivity for the TOPIX 500 constituents from March 2002 to February 2018 showed that the industries with the highest human capital investment efficiency was information and communication, material, and healthcare & pharmaceuticals. Conversely, the industry with the lowest human capital investment efficiency is steel & machinery, followed by automobile and electric appliances & precision instruments. Information and communication, which represents the "new economy", appears to show high investment efficiency, while heavy industries, such as steel & machinery and automobile, which represent the "old economy", appear to show low investment efficiency.

Exhibit 1 shows scatter plots between human capital investment efficiency and the change rate in the number of employees by industry, which is based on the time-series average for the median within each industry (we used 10 industry categories based on the Tokyo Stock Exchange's 33 industries).

Exhibit 1. Human capital investment efficiency and change in number of employees in major Japanese firms by industry

Investment efficiency and stock returns

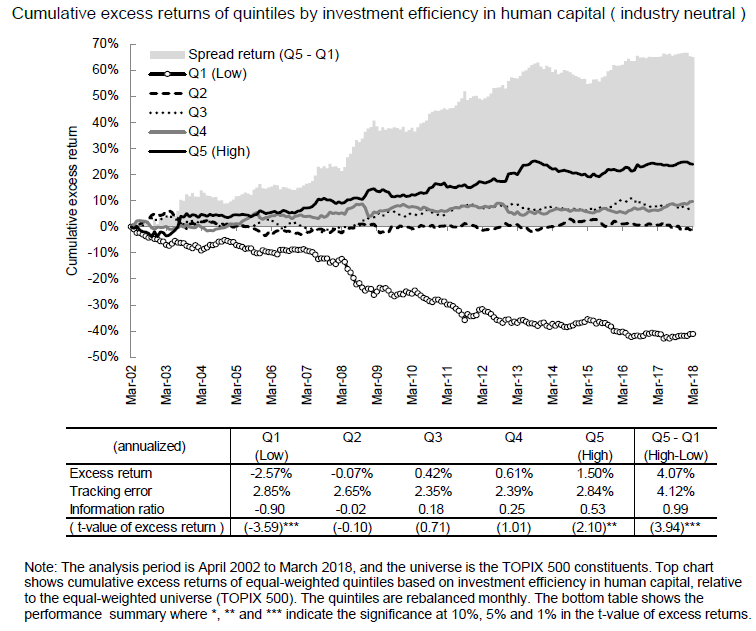

Next, we examined the relationship between human capital investment efficiency and stock returns through a grouping analysis of TOPIX 500 constituents from April 2002 to March 2018. At the end of each month, companies were divided into five quintiles based on their human capital investment efficiency levels standardized within each industry, and five equally-weighted baskets were constructed. The quintile with the highest human capital investment efficiency significantly outperformed, while the quintile with the lowest human capital investment efficiency significantly underperformed.

Exhibit 2. Grouping analysis by investment efficiency in human capital

Stock selection, labour productivity level and human capital investment efficiency: Their impact on shareholder value

Labour productivity and stock returns

Next, we examined how the level of labour productivity itself is related to subsequent stock returns and the impact it has on the relationship between human capital investment efficiency and shareholder value.

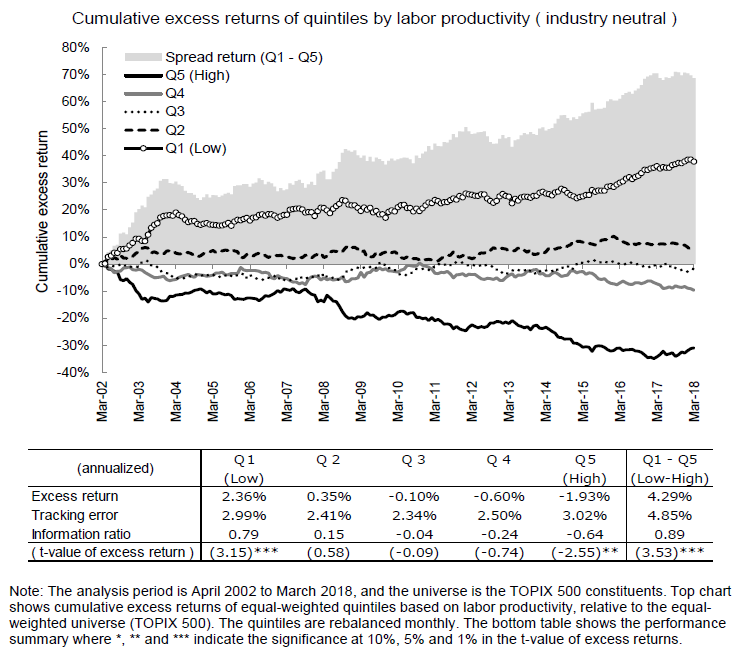

We based our analysis on the knowledge from prior studies, which suggest that stocks of companies with lower productivity subsequently show higher returns. We again used the TOPIX 500 as the universe, covering a period from April 2002 to March 2018. We constructed five equally-weighted quantile baskets at the end of each month based on the standardized level of labour productivity within each industry. Our analysis showed that the basket with the lowest labour productivity produced significantly positive excess stock returns, while the basket with the highest labour productivity produced significantly negative excess stock returns.

On the other hand, since lower labour productivity is equivalent to higher labour distribution, lower labour productivity can be interpreted as a reflection of companies actively returning profits to employees. In this case, the tendency for companies with lower labour productivity having higher stock returns can be said that companies more proactive in returning profits to their employees tend to have higher stock returns. In the Japanese market, it has been observed that companies with strong reputations for human capital utilisation (Saito and Ito [2017]) and higher job satisfaction among employees (Yamada et al. [2017]) tend to have higher stock returns, which is consistent with the observation here if higher labour distribution is associated with a stronger reputation for human capital utilisation and higher employee job satisfaction.

Exhibit 3. Grouping analysis by labour productivity

The impact of labour productivity and investment efficiency in human capital on shareholder value

Further analysis revealed that companies with lower levels of labour productivity tended to have higher subsequent stock returns. In particular, we found that companies with low labour productivity and high human capital investment efficiency generate significant positive excess returns accompanied by improvements in ROE, and conversely, companies with high labour productivity and low human capital investment efficiency generate significant negative excess returns accompanied by deterioration in ROE.

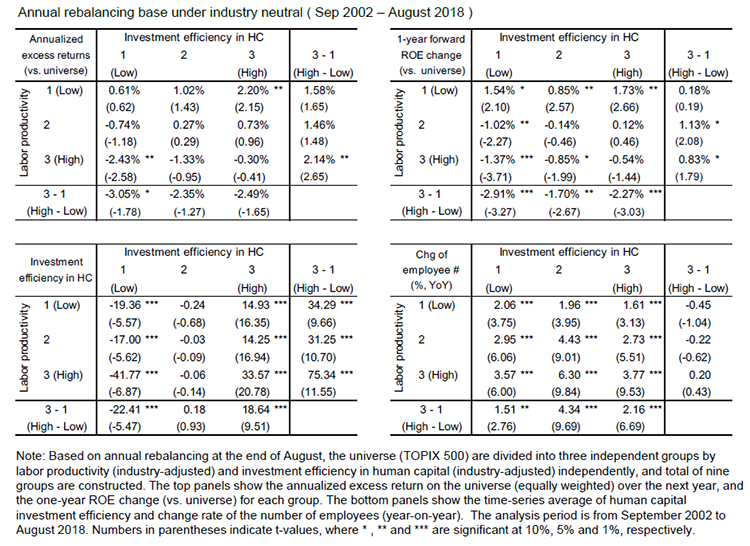

Our grouping analysis period was from September 2002 to August 2018; we divided the universe into three independent groups based on the levels of labour productivity and human capital investment efficiency (taking into account industry neutrality), constructed a total of nine equally-weighted baskets, and examined their features.

Exhibit 4 measures, among other things, the one-year forward change in ROE relative to the universe (top right table), along with the one-year excess return (top left table) for the nine baskets constructed by the annual rebalancing.

We found that the group with the highest labour productivity and the lowest investment efficiency in human capital significantly underperformed, while the group with the lowest labour productivity and the highest investment efficiency in human capital significantly outperformed.

Exhibit 4. Grouping analysis independently sorted by labour productivity and investment efficiency in human capital

We can see that the higher (lower) ROE of companies with higher (lower) labour productivity tend to revert to the mean and deteriorate (improve) in one year. In particular, the ROE of companies with high labour productivity and low human capital investment efficiency have deteriorated the following year with high significance, while companies with low labour productivity and high human capital investment efficiency have improved their ROE in the following year with high significance.

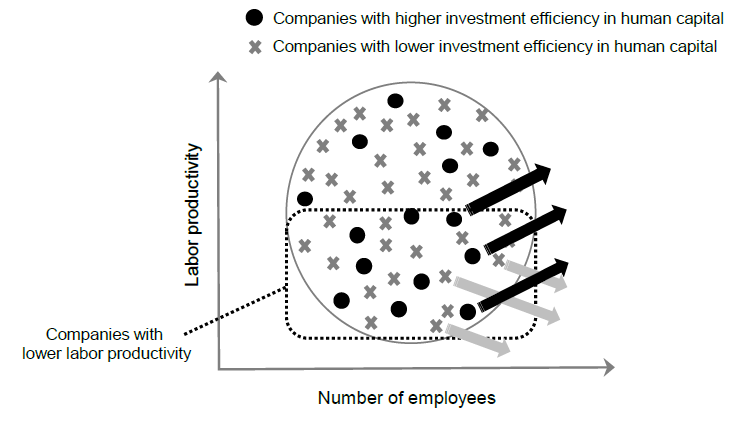

These observations suggest that companies with low labour productivity and high human capital investment efficiency have more room to improve their ROE and can therefore increase shareholder value by efficiently increasing the number of employees (see Exhibit 5).

On the other hand, the lower right-hand corner of Exhibit 4 shows the average change rate in the number of employees in each basket (year-on-year), where the change rate in the number of employees is significantly positive for all groups, but the change rate in the number of employees also tends to increase as labour productivity increases.

Given these results, it can be stated that companies with lower labour productivity and higher investment efficiency in human capital (positive efficiency on average) tend to increase shareholder value by increasing employees efficiently. Conversely, companies with higher labour productivity and lower investment efficiency in human capital (negative efficiency on average) tend to damage shareholder value by increasing employees inefficiently. In particular, the high degree of damage to shareholder value found in the latter group of companies could be due to the high pace of employee growth despite the high degree of negative investment efficiency in human capital.

Exhibit 5. Interaction between labour productivity and human capital investment efficiency

Conclusion

We examined the effect of investment efficiency in human capital on shareholder value in Japan, mainly stock returns, by defining this efficiency as the sensitivity of the change in labour productivity to the prior change rate in the number of employees. Companies with higher efficiency in investing in human capital tended to have higher subsequent returns. Furthermore, companies with lower levels of labour productivity tended to have higher subsequent stock returns. In particular, we found that companies with low labour productivity and high human capital investment efficiency generate significant positive excess returns accompanied by improvements in ROE, and conversely, companies with high labour productivity and low human capital investment efficiency generate significant negative excess returns accompanied by deteriorations in ROE.

We observed that positive contributions from efficient investment in human capital have a greater significance for companies with lower labour productivity. This is an encouraging result for Japanese companies, which are under pressure to improve their labour productivity by investing efficiently in a limited labour force, with Japan’s labour productivity being one of the lowest among the major industrialized countries.

Finally, we also observed that companies that have experienced a significant decline in labour productivity as a result of reducing the number of their employees are also identified to be highly efficient in their human capital investment.