Summary

- With inflationary issues subsiding across most of Asia, many regional central banks are now holding interest rates steady, if not cutting rates in the case of China. The US, meanwhile, is still warning of further rate hikes despite some overall softening in data. Of more concern to us is what China does next.

- For the month, the MSCI AC Asia ex Japan Index rose 2.7% in US dollar terms. Global stock markets bounced back in June, fuelled by investors’ optimism that inflation is easing and interest rates might not climb much further.

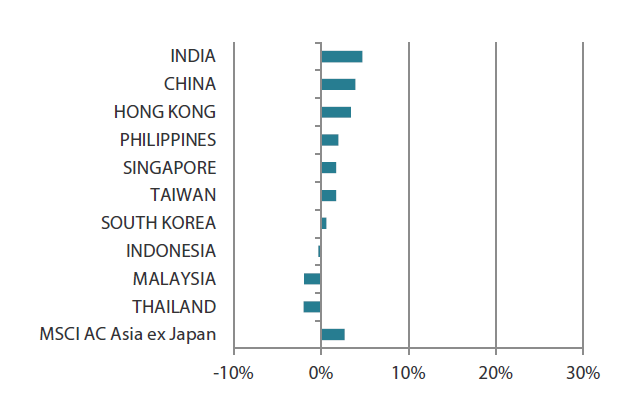

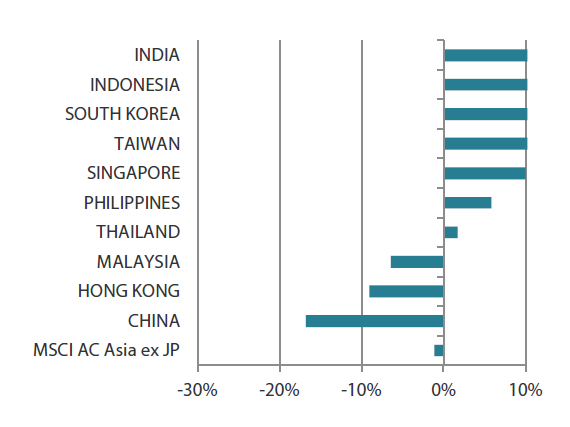

- India (+4.7%), China (+4.0%) and Hong Kong (+3.4%) led the gains, whereas the technology-centric markets of South Korea (+0.6%) and Taiwan (+1.7%) saw moderate returns. In the ASEAN region, market performance was mixed.

- While valuations are now very cheap across China, our focus remains on areas that are of strategic importance. Innovation in the healthcare, environmental technology and industrial technology space will continue to give rise to a large pool of high-quality companies with high sustainable returns and positive fundamental changes, in our view.

Market review

Asian markets rebound on optimism that inflation is easing

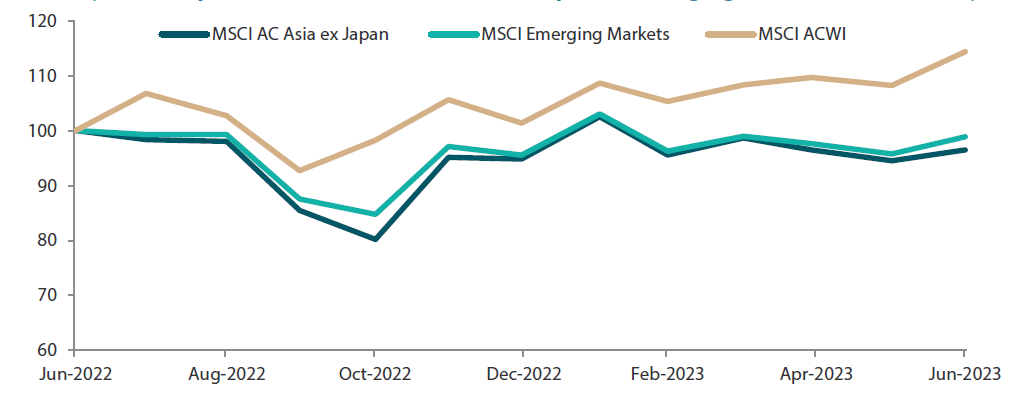

Regional equities, as measured by the MSCI AC Asia ex Japan Index, returned 2.7% in US dollar (USD) terms in June. Global stock markets bounced back during the month, fuelled by investors’ optimism that inflation is easing and interest rates might not have much further to climb. An upwardly revised US GDP print for the first quarter of 2023 also helped lift investor sentiment, undercutting widespread expectations that the US is heading towards a recession.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Source: Bloomberg, 30 June 2023. Returns are in USD. Past performance is not necessarily indicative of future performance.

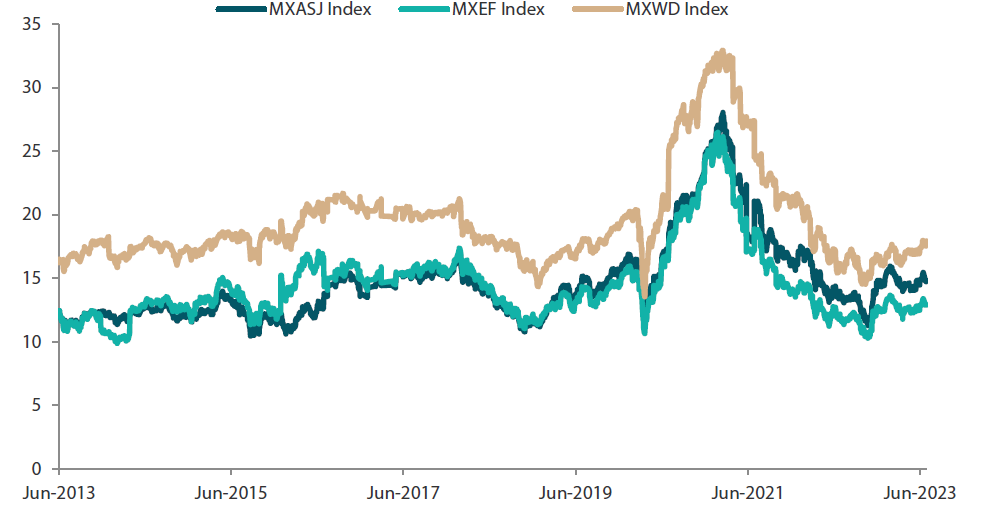

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 30 June 2023. Returns are in USD. Past performance is not necessarily indicative of future performance.

China and Hong Kong lead the gains in North Asia

Despite persistent concerns that China’s economic recovery is losing steam amid a lack of aggressive stimulus from the Chinese government, China and Hong Kong stocks still managed to turn in decent gains of 4.0% and 3.4%, respectively, for the month. The rebound in China stocks was supported by a series of interest rate cuts by the Chinese authorities to stimulate the world’s second largest economy. In June, the People's Bank of China trimmed the one-year and five-year loan prime rate by 10 basis points (the first time in 10 months) and lowered the one-year medium-term lending facility rate and the seven-day reverse repo rate by the same margin. Still, Beijing’s modest stimulus fell short of market expectations, disappointing investors, who were concerned about China’s weak consumer spending and the lacklustre manufacturing data reported during the month. Meanwhile, China's consumer price index (CPI) rose 0.2% year-on-year (YoY) in May, inching up from April's 26-month low of 0.1%. In Hong Kong, its CPI increased 2% YoY in May, easing from 2.1% in the previous month.

After surging in the previous month, the technology-centric markets of South Korea (+0.6%) and Taiwan (+1.7%) saw more moderated gains in June as the recent strong rally in global tech stocks ran out of steam after the US Federal Reserve warned that more rate hikes could come by the year’s end. Shares of South Korea’s index heavy Samsung Electronics, however, continued their uptrend on optimism about the global chip demand. In Taiwan, the central bank held its key discount rate steady at 1.875% during its June meeting, pausing from a year-long tightening cycle.

ASEAN markets mixed in performance

The performance of equity markets in the ASEAN region was mixed in June. Thailand (-2.0%), Malaysia (-1.9%) and Indonesia (-0.3%) turned in losses, while the Philippines (+1.9%) and Singapore (+1.7%) saw decent gains. In Thailand, political uncertainties and an accounting scandal that has led to a bond default at a listed electric cable maker shook investor confidence. Malaysian stocks fell amid lingering concerns on the outcome of the state elections that are fast approaching. The central banks of Indonesia and the Philippines kept their benchmark interest rates unchanged, with both signalling that rates will be steady in the near term as price pressures ebb. Singapore stocks gained despite manufacturing output and key exports contracting for an eighth straight month.

Indian equities register strong gains

For the month, the Indian equity market advanced 4.7% as its retail inflation cooled to a 25-month low of 4.25% in May. The Reserve Bank of India kept its key benchmark policy rate unchanged at 6.5% for a second consecutive meeting. In other developments, India's current account deficit narrowed to USD 1.3 billion or 0.2% of GDP in the January-March quarter, helped by a moderation in the trade deficit and an increase in services exports.

Chart 3: MSCI AC Asia ex Japan Index1

| For the month ending 30 June 2023 | For the year ending 30 June 2023 | |

|

|

Source: Bloomberg, 30 June 2023.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

More targeted support expected for China, but widespread stimulus is unlikely

One could be forgiven for missing some of the underlying economic changes with the artificial intelligence (AI) fervour currently sweeping markets. With inflationary issues subsiding across most of Asia, many regional central banks are now holding interest rates steady, if not cutting rates in the case of China. The US, meanwhile, is still warning of further rate hikes despite some overall softening in data. Of more concern to us is what China does next. Under the current stewardship, the focus is rightly on quality and not quantity, and that has consistently disappointed markets this year and led to subdued confidence and activity on the mainland. There are incremental signs of support in China, but again these are very targeted. In recent weeks, electric vehicles (EVs), large medical devices and white goods have all seen supportive measures, and we would expect more to come but not a return to widespread policy stimulus observed in past cycles.

While valuations are now very cheap across China, we continue to focus on areas that are of strategic importance. Innovation in the healthcare, environmental technology and industrial technology space will continue to give rise to a large pool of high-quality companies with high sustainable returns and positive fundamental changes, in our view. Increasing consumption’s contribution to the economy is also a long-term goal despite the near-term headwinds.

Al fervour in South Korea and Taiwan masking relatively weak areas in technology

Within the technology-heavy South Korean and Taiwanese markets, AI fervour is again masking relatively weak and much larger parts of the hardware technology markets. End demand for both personal computers and smartphones continues to weaken while cloud/data centres have received some additional boost from hyperscale demand. In our opinion, the market appears to be extrapolating too broadly the fundamental changes being brought about by the current AI boom.

Structural reforms and capex cycle boosting the appeal of India and Indonesia

The positive effects of continued geopolitical friction are most clearly being felt in India and ASEAN at present. Reforms in India and Indonesia are catalysing this fundamental change most proactively and with peaking local interest rate cycles, we are likely to see more interest return to these markets. For India, hope continues to build for a capital expenditure (capex) cycle alongside a long housing upcycle. Early indications are positive as gross fixed capital formation has begun to move up as a percentage of nominal GDP, and new project announcements in the private sector have continued to grow. Corporate balance sheets are also at the healthiest level in more than 15 years. The aforementioned factors continue to drive our favourable view of high-quality banks and companies leveraged to domestic consumption, capex cycle and EV supply chain in India and Indonesia.

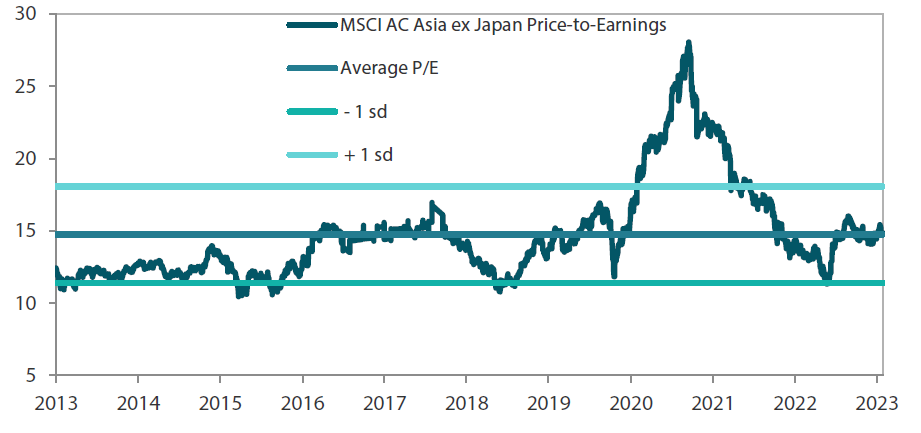

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 30 June 2023. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

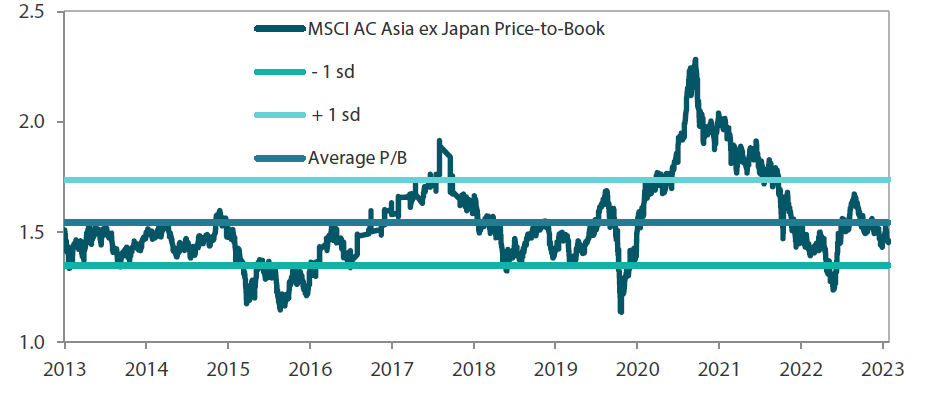

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 30 June 2023. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.