Summary

- The Chinese economy and its equity market continue to be significant focal points in broader Asia. China’s real estate sector remains fragile. However, the implementation of additional support measures, both fiscally and in the capital market, combined with a recalibration of market expectations, have helped Chinese equities recover from the panic selling witnessed towards the end of 2023 and into January. As a result, fundamental strengths are now beginning to be recognised in certain areas, which is encouraging.

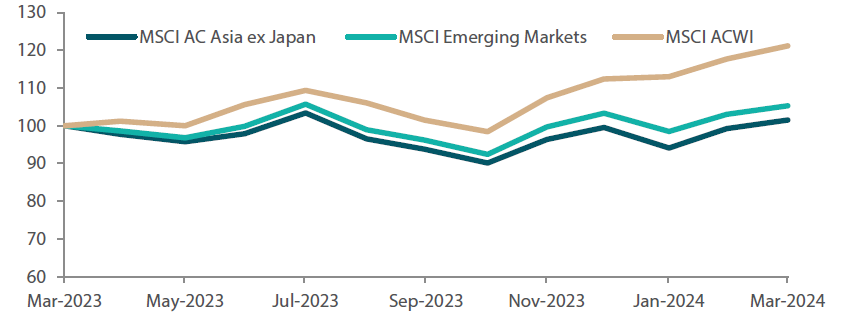

- In March, the MSCI AC Asia ex Japan Index advanced 2.5% in US dollar (USD) terms. The US Federal Reserve (Fed) held interest rates steady and maintained its policy outlook for three rate cuts in 2024. Signs of econmic resilience and ongoing enthusiasm about artificial intelligence (AI) developments also aided market strength.

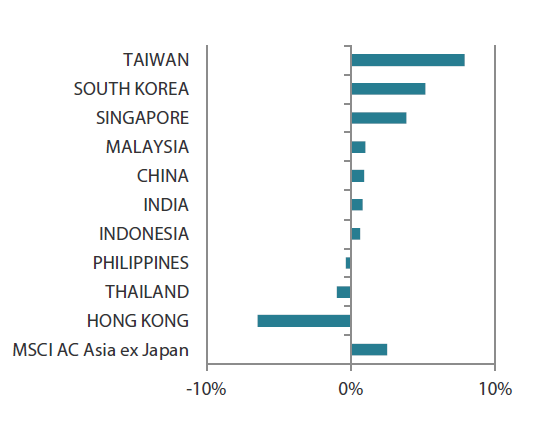

- Taiwan (+7.9%) and South Korea (+5.2%) led the region in March, while Thailand (-1.0%) and Hong Kong (-6.5%) were the laggards.

- US economic conditions remain robust, with participants in Asian and emerging equity markets looking on in the hopes of monetary easing. Such a shift would provide welcome relief to many markets of Asian countries where policymakers have been on hold, waiting for signs of a turnaround. This includes China, which, despite its easing measures, finds its monetary policy constrained by interest rate differentials and pressure on its currency. A weaker US dollar and looser liquidity environment could be a boon for Asia.

Market review

Asian markets climb anew in March

Asian markets ended the month higher in line with global trends, with the MSCI Asia Ex Japan Index advancing 2.5% in US dollar terms. The Fed held interest rates steady in March and maintained its policy outlook for three rate cuts in 2024. Signs of economic resilience and ongoing enthusiasm about AI developments also aided market strength.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Source: Bloomberg, 31 March 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

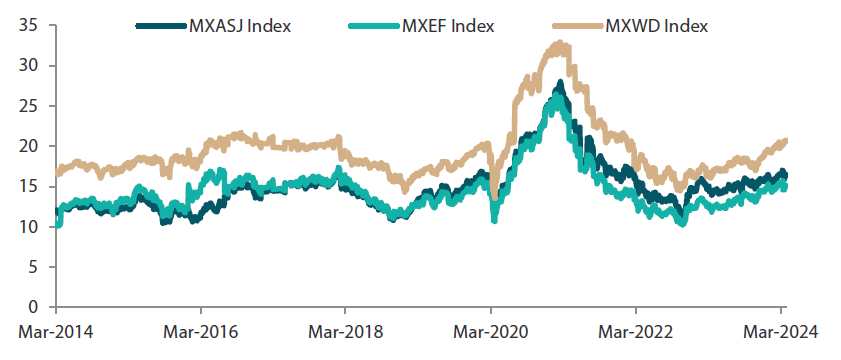

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 March 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

Tech-centric Taiwan and South Korea lead Asia markets higher

In North Asia, the AI boom continued to fuel the tech-heavy markets of Taiwan (+7.9%) and South Korea (+5.2%). Taiwan reported a fourth straight month of export growth in February, with outbound sales rising by 1.3% year-on-year (YoY) to USD 31.4 billion. Taiwan’s central bank unexpectedly raised the benchmark rate by 12.5 basis points (bps) to 2.00%, in a move designed to contain inflation expectations. In South Korea, the authorities are considering additional measures such as possible tax reforms related to its Corporate Value-Up Program unveiled in February. South Korea’s exports jumped 4.8% YoY in February to USD 52.41 billion.

China (+0.9%) held its annual National People’s Congress and set an economic growth target of about 5% this year. The country pledged to take steps towards transforming its development model, defuse property sector risks and curb industrial overcapacity. The Chinese economy made a strong start to 2024. Industrial output grew 7.0% in the first two months of the year. Retail sales, a gauge of consumption, rose 5.5%. Exports beat expectations, recording an increase of 7.1% in the January–February period. China’s CPI also turned positive for the first time in six months, mainly supported by Lunar New Year holiday-linked spending. Hong Kong weakened 6.5% amid caution about corporate earnings.

Mixed performance in ASEAN

ASEAN markets were mixed in March. Core inflation in Singapore (+3.8%) accelerated to 3.6% in February following stronger demand around the Lunar New Year. The central bank of Malaysia (+1.0%) maintained its economic forecast of 4–5%, an outlook grounded in the expansion in domestic demand and improvement in external demand. In Indonesia (+0.6%), Prabowo Subianto was officially declared the winner of the presidential election, setting the stage for his upcoming leadership later this year. Inflation in the Philippines (-0.4%) accelerated to 3.4% YoY in February, the first uptrend in five months, driven by a continuous surge in rice prices. Thailand (-1.0%) postponed its plans to implement a USD 14 billion cash stimulus plan to the final quarter of the year.

Indian equities end the month slightly higher

Indian stocks edged up 0.8%. India’s headline inflation rate remained steady at 5.09% YoY in February. Real GDP growth in the October to December quarter came in at a much higher-than-expected 8.4% YoY. The jump was due to a substantial reduction in key subsidies, which provided a boost to the GDP. However, attempts by authorities to restrict activity in smaller capitalisation stocks and unsecured consumer finance limited overall gains for the month.

Chart 3: MSCI AC Asia ex Japan Index1

|

For the month ending 31 March 2024

|

For the year ending 29 February 2024

|

Source: Bloomberg, 31 March 2024.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market view

A weaker US dollar and looser liquidity environment could be a boon for Asia

US economic conditions remain robust, with participants in Asian and emerging equity markets looking on in the hopes of monetary easing. Such a shift would provide welcome relief to many markets of Asian countries where policymakers have been on hold, waiting for signs of a turnaround. This includes China, which, despite its easing measures, finds its monetary policy constrained by interest rate differentials and pressure on its currency. A weaker US dollar and looser liquidity environment could be a boon for Asia. In addition, North Asian markets continue to gain from their exposure to AI-related earnings and demand from the US. Due to a mix of reforms, demographics and available labour, Indian and ASEAN are emerging as more distinct choices for new foreign investment.

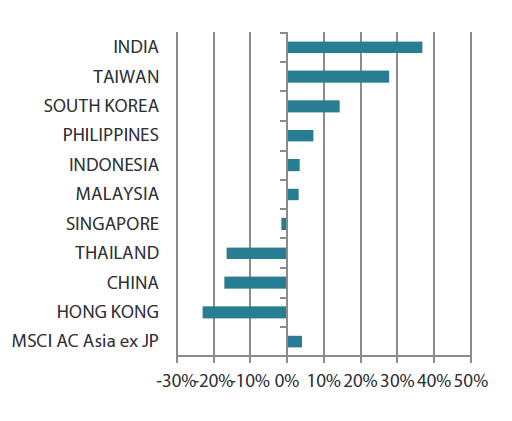

Watching for firm evidence of property market sentiment stabilising

The Chinese economy and its equity market continue to be significant focal points in broader Asia. The property sector, which has been a critical part of China’s economic transition and household confidence, remains fragile. However, this is being offset by additional support measures on the fiscal and capital market front, along with a re-adjustment of market expectations as reflected in record low valuations compared to Asian equities. Chinese equities have started to recover from the panic selling witnessed towards the end of 2023 and into January, with fundamentals starting to be rewarded in some areas. For confidence to improve on a sustainable basis, we believe property market sentiment has to stabilise. As such, we remain watchful for evidence of stabilising sentiment.

Confidence towards India maintained; favourable view of ASEAN increased

In India, both the central bank and the securities regulator (SEBI) have implemented modest tightening measures in areas deemed to be creating unacceptable risks, namely smaller capitalisation stocks and unsecured consumer finance. At this stage, these measures alone are unlikely to undermine the attractiveness of broader Indian equities. This is particularly true if Indian Prime Minister Narendra Modi is elected to a third term, monetary policy easing is implemented and additional positive structural reforms are introduced. While pockets of smaller capitalisation stocks are starting to look overly expensive relative to their fundamentals, we do not believe that is the case for the broader index, especially when considering the positive fundamental change and sustainable returns individual companies offer. We continue to think that India will outperform and have several new ideas under evaluation.

ASEAN and Indonesia also enjoy similar dynamics, albeit to a lesser degree. Economic activity remains relatively robust across most ASEAN countries, and central banks have the capacity to initiate easing cycles. Foreign investment continues to pick up, and domestic credit cycles are buoyed by local consumer demand. Despite a number of positives, we observe that ASEAN equities are often overlooked by many investors, making their valuations attractive. As a result, we view the region more favourably, especially the sectors linked to real estate and consumption.

The tech-centric markets of Taiwan and South Korea continue to ride the wave of structural AI demand as the tech cycle broadens with smartphone and PC replacement phases potentially on the horizon. This is providing strong domestic demand conditions, particularly in Taiwan, where the central bank has had to tighten rates. In this context, we continue to favour exporters over domestic entities. South Korea is on the brink of a potential fundamental change; through its “Value-Up” program, the government is attempting to emulate Japan’s model of improving corporate governance to stimulate a revaluation of local equities. South Korea’s general elections, which were held on 10 April, and their aftermath pose as the first hurdle, after which we will keep an eye out for tangible tax reforms. For now, the indications appear promising.

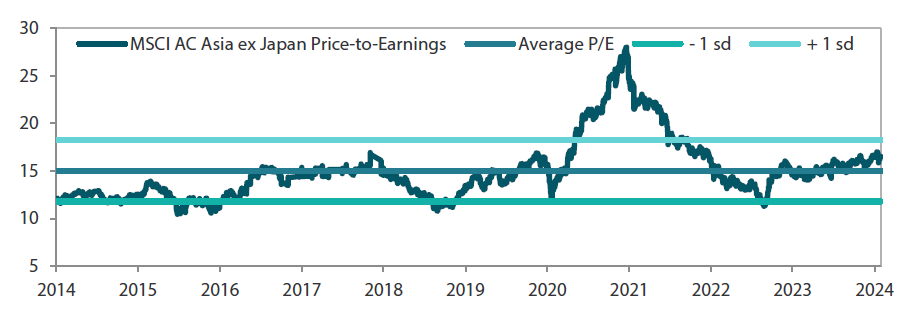

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 March 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

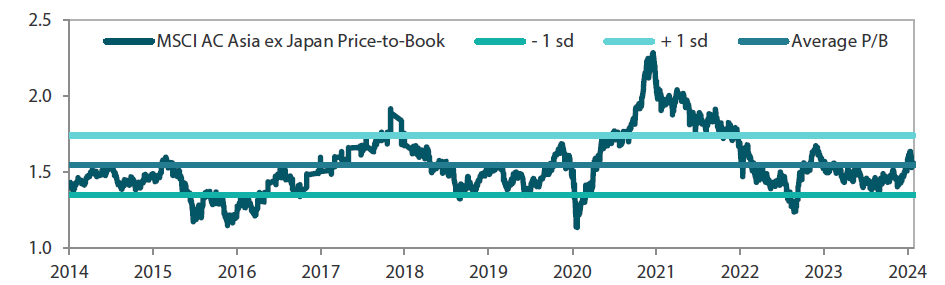

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 March 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.