Summary

- With the Chinese economy on the brink of deflation, the timing of the Chinese government’s recent pro-growth directives was a very welcome signal. If carried out, they can lead to structural changes that can potentially lead to an improvement in consumer confidence and growth in the Chinese economy, in our view.

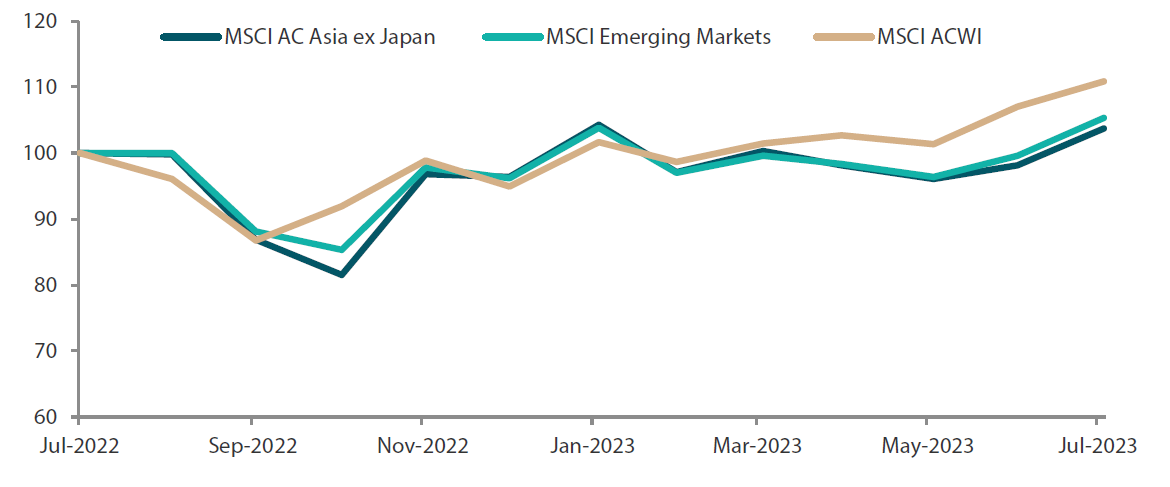

- For the month, the MSCI AC Asia ex Japan Index surged 6.1% in US dollar terms as softer-than-expected US inflation data spurred risk appetite. Regional stocks were also supported by optimism over more stimulus measures in China.

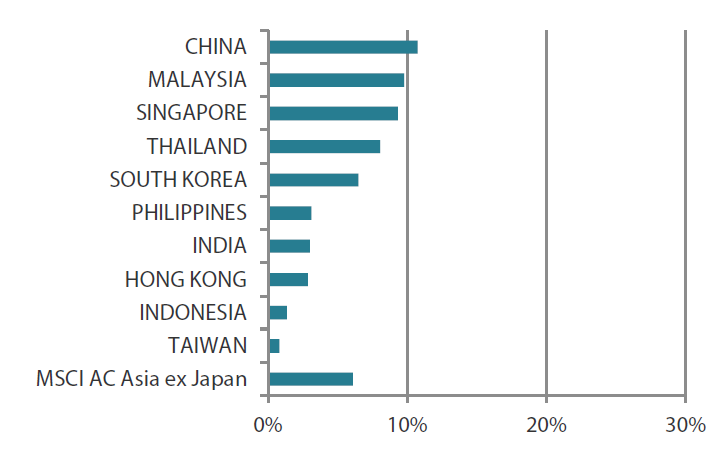

- China (+10.8%), Malaysia (+9.7%) and Singapore (+9.3%) led the gains, whereas Taiwan (+0.8%) and Indonesia (+1.4%) underperformed relative to other markets. Overall, it was a good month for regional equities as all Asian markets turned in positive returns.

- The structural arguments for why the Indian market is attractive remain unchanged. India, where earnings growth is robust, inflation is under control and interest rates are steady, continues to attract investments. Elsewhere, we believe that the outlook for ASEAN is tied to the demand for energy transition materials and its impact on the domestic economies.

Market review

Asian markets jump on cooler US inflation data and China optimism

Regional equities, as measured by the MSCI AC Asia ex Japan Index, surged 6.1% in US dollar (USD) terms in July as softer-than-expected US inflation data spurred risk appetite. Regional stocks were also supported by optimism over more stimulus measures in China. The US consumer price index (CPI) increased 3.0% year-on-year (YoY) in June, down from 4.0% in May. The Federal Reserve (Fed) raised interest rates by 25 basis points, as expected, at its July meeting, adding that further rate increases will depend on data. Markets, however, took the rate hike in stride on hopes that the Fed’s aggressive tightening cycle is ending.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Source: Bloomberg, 31 July 2023. Returns are in USD. Past performance is not necessarily indicative of future performance.

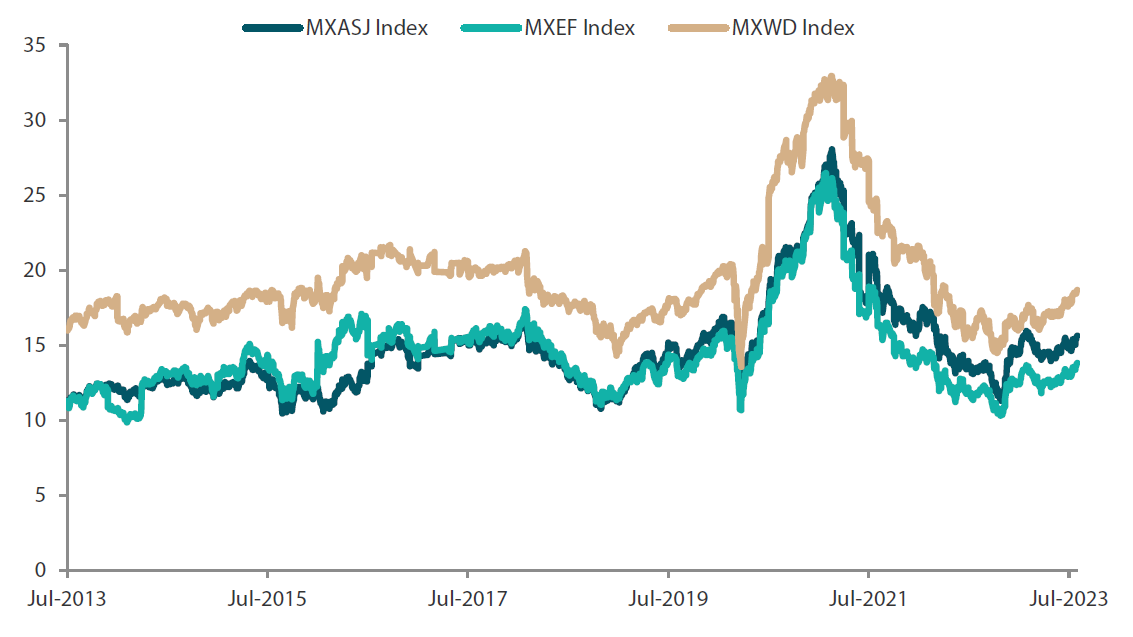

Chart 2: MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index price-to-earnings

Source: Bloomberg, 31 July 2023. Returns are in USD. Past performance is not necessarily indicative of future performance.

China and South Korea lead the gains in North Asia

In China, stocks jumped 10.8% in USD terms in July after its top leaders pledged at a recent Politburo meeting to roll out more policy support to shore up the nation’s flagging economy, focusing on boosting domestic demand and aiding the ailing property market. China’s GDP expanded 6.3% YoY in the second quarter of 2023 (2Q23) but fell short of market forecasts. In Hong Kong, stocks rose 2.8% in July after recovering from a steep decline earlier in the month.

South Korea (+6.5%) surged during the month, boosted by a rebound in electric vehicle battery-related stocks and the country’s faster pace of economic growth. The South Korean economy expanded 0.6% quarter-on-quarter (QoQ) in 2Q23, accelerating from 1Q23’s growth of 0.3%. Taiwan (+0.8%), however, underperformed other regional markets, weighed down by a correction in index heavyweight Taiwan Semiconductor Manufacturing Company, which cut its 2023 sales outlook after reporting its first YoY drop in quarterly profit in four years.

ASEAN markets turn in solid performance

In the ASEAN region, all equity markets advanced in July. Malaysia (+9.7%), Singapore (+9.3%) and Thailand (+8.1%) delivered strong gains, while the Philippines (3.1%) and Indonesia (+1.4%) saw more muted returns. In Malaysia, Bank Negara Malaysia paused its rate tightening cycle, leaving the overnight policy rate at 3% as inflation in the country cooled, while Malaysian Prime Minister Anwar Ibrahim unveiled a plan to boost the Malaysian economy. According to advance estimates, Singapore’s economy unexpectedly expanded 0.7% YoY and 0.3% QoQ in 2Q23, avoiding a technical recession. In Thailand, political gridlock continued as the parliament blocked Move Forward Party leader Pita Limjaroenrat from running for prime minister. Elsewhere, the Philippine central bank warned that inflation could remain elevated due to the impact of El Nino and wage increases, while Indonesia’s central bank left rates unchanged for a sixth time at its July meeting.

Indian equities register decent gains

For the month, India advanced 3.0% as investors continued to re-rate the growth potential of its economy. The International Monetary Fund bumped up India’s growth forecast for financial year 2024 to 6.1%, citing strong domestic investment. Meanwhile, India’s CPI accelerated for the first time in five months, rising 4.81% YoY in June, from an increase of 4.31% in May.

Chart 3: MSCI AC Asia ex Japan Index1

| For the month ending 31 July 2023 | For the year ending 31 July 2023 | |

|

|

Source: Bloomberg, 31 July 2023.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

China’s pro-growth directives expected to continue boosting market confidence

July saw a shift in narratives around the world that looks to be supportive of growth for the rest of 2023. The news that moved the markets the most was the announcement from the Chinese authorities. In the coming months, they would be issuing directives to support the property market through a combination of reductions in mortgage rates and transaction fees, attract private capital to make investments, promote consumer spending and focus on profitability and returns for state-owned companies. With the Chinese economy on the brink of deflation, the timing of the pro-growth directives was a very welcome signal. If carried out, we believe that the directives can lead to structural changes that can potentially lead to an improvement in consumer confidence and growth in the Chinese economy. The proof is in the pudding, however, as we await the roll-out of actionable policies at the regional and city levels.

Foreigners remain underweight in Chinese equites, and the sharp rally in China stocks after the Chinese government’s recent announcements suggests that there was an element of short-covering by foreign investors involved. We expect to see more foreign buying as confidence returns, depending on the strength of the policies enacted.

India remains attractive despite high valuations; ASEAN balance sheets healthiest in years

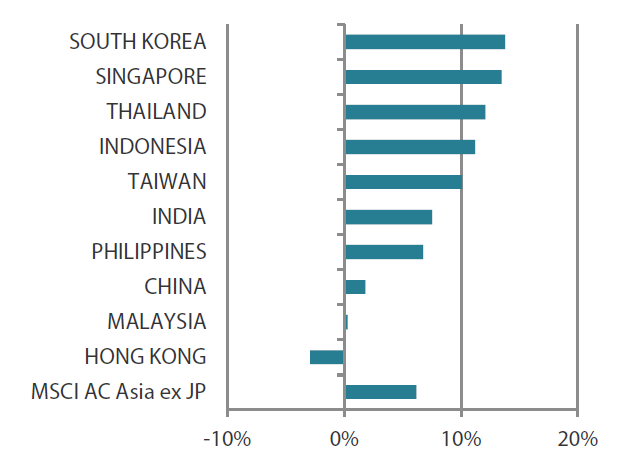

Flows into China may impact the Indian market, which had previously benefited from the portfolio outflows from China. The structural arguments for why the Indian market is attractive remain unchanged. India, where earnings growth is robust, inflation is under control and interest rates are steady, continues to attract investments. However, valuations are high with the market trading at 10% above its 10-year average, and that could prove to be a headwind.

The outlook for ASEAN is tied to the demand for energy transition materials and its impact on the domestic economies. Indonesia has led the transition and been the best performing ASEAN market, along with Singapore. Corporate balance sheets are also at the healthiest level in more than 15 years.

The aforementioned factors continue to drive our favourable view of high-quality banks and companies leveraged to domestic consumption and capex cycle in Indonesia and India.

Remain selective in South Korea and Taiwan

Notwithstanding our constructive long-term view on innovation tech leaders in South Korea and Taiwan, we remain selective in this space due to uncertain Western demand in consumer tech as economic growth in the West slows. However, we could be reaching the trough of the cycle.

Outside of the region, inflation is either stable or trending lower. However, there is risk from the food and energy components of inflation which may be more persistent than expected due to the termination of the Russian-Ukraine grain agreement and lack of supply increase from the Organization of the Petroleum Exporting Countries even as demand expectations rise.

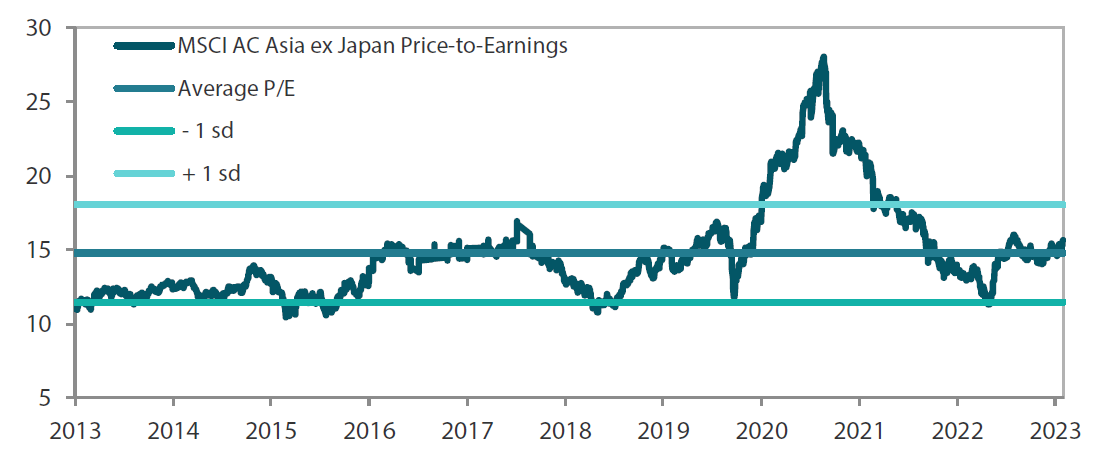

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 July 2023. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

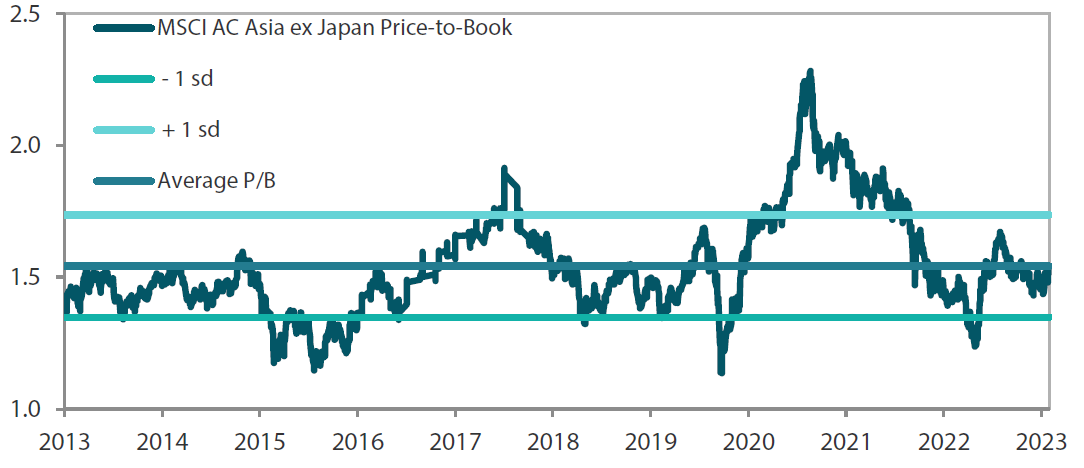

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 July 2023. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.