As the famous 1980s’ bumper sticker (almost) said, “shocks happen”. The global economy / ecosystem is an inherently dynamic entity, constantly changing its shape and composition. Some of these changes will of course favour some economies while disadvantaging others. A rise in fuel prices is generally bad news for consumers and most companies, but clearly (usually) good for oil producers. Finding Gold in your backyard is good for you, less good for existing holders. The invention of refrigerated transport systems radically changed the opportunities available to Australasian farmers, just as harnessing steam power had transformed UK industry fifty years earlier. The world is constantly experiencing shocks, some good and some bad and these change people’s “wealth”.

More specifically, these shocks will either make the countries that they affect richer or poorer in real terms. If a country is to be made richer relative to its peers – and therefore able to acquire relatively more of the world’s finite resources – this can occur either via an appreciation of the country’s exchange rate, or via the exchange rate staying still and domestic wages and other “internal prices”, such as property, rising.

This is precisely why a rising terms of trade (which makes a country richer) tends to be associated with a rising FX rate, higher wage inflation, and even rising house prices. However, negative shocks which make you poorer require either a depreciation in the nominal exchange rate, or a fall in domestic prices.

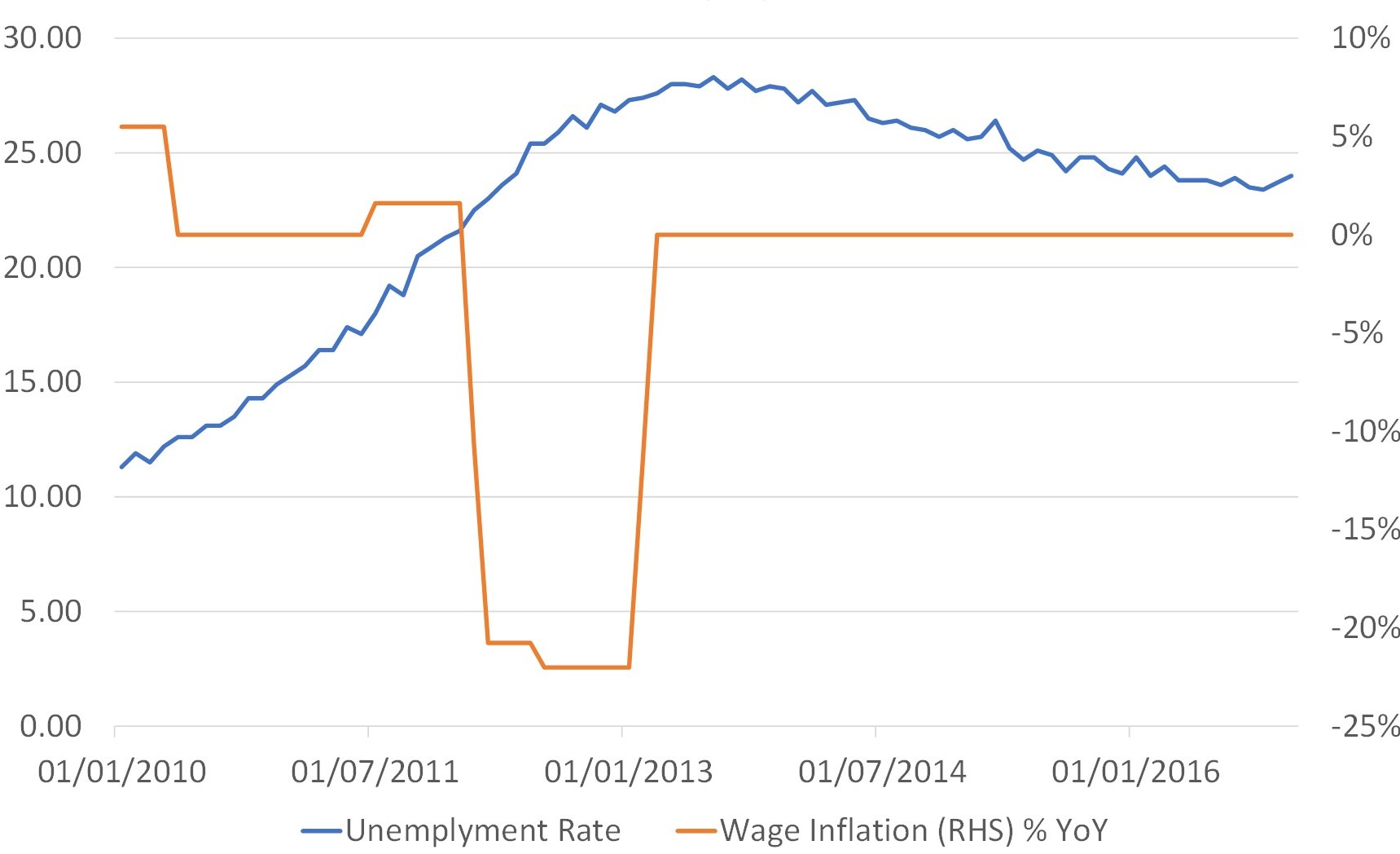

Legend has it that in the pre-unionized world of the nineteenth century, exchange rates could stay stable because wages would deflate whenever necessary, but we are somewhat sceptical that this really happened without creating unemployment and hardship…. We suspect that throughout history, wages have tended to rise much more easily than they have fallen, and this is certainly true today. Policymakers in Europe may like to delude themselves that nominal wages can adjust in both ways without massive economic costs, but real-world experiences have shown this to be an erroneous and costly assumption. Greece discovered this first-hand when it tried to reduce nominal wages recently.

Greece: The Unemployment Sacrifice

This creates an important asymmetry in the adjustment process to shocks – positive shocks tend to be associated with rising equity prices, rising nominal wages and house prices, while negative shocks (ultimately) tend to be reflected in weaker exchange rates as the exchange rate ends up “doing the heavy lifting” so as to ease the burden on the unemployment rate and domestic economy.

Despite the existence of an inherently unstable world and the near constant shocks that affect us all - and which therefore require constantly adjusting real exchange rates - the “Great and the Good” of the major economic powers decided to meet in the Plaza Hotel in New York in 1985 and create a system of managed - or in some cases - fixed exchange rates. Apparently they believed that now that they had defeated the high inflation of the 1970s, they could put their “masters of the universe powers” to work in creating a new world of stable exchange rates.

Although it was only the “G5” that were in fact present, much of Europe was already onside with this concept of managed exchange rates via the European Monetary System (the ill-fated forerunner of the Euro); Asia was already gravitating towards fixed exchange rates vis-à-vis the USD; and LATAM was also looking to move in this direction. Within a few years, even Australia and New Zealand would start talking about experimenting with fixed FX rates and even suggesting an ANZ currency union, although thankfully this idea soon died a death. UK politicians were – and probably remain – divided on the issue, not least of all because the UK’s experience with fixed exchange rate regimes in the past has rarely been positive.

The central objective of the first G5 in 1985 was to manage a depreciation of the USD that they deemed necessary, ostensibly so that the US manufacturing sector could be revived. We in fact wonder whether this was the true objective, it is our sense that the officials that met in that New York hotel possessed sufficient hubris to believe that they could “control” exchange rates, interest rates, yields and ultimately asset prices for their own ends and according to their own targets.

In order to achieve the G5’s initial target of a stronger JPY and a weaker USD, Japan agreed to tighten its domestic policies and the US eased its monetary regime. Japan soon fell into a recession, but the US began an unsustainable boom that involved a sharp inflation of asset prices, primarily on the back of an aggressive corporate credit boom. Then, in 1987, the newly expanded G7 met again, this time in Paris with the new objective of arresting the USD’s freefall – their policies had it seemed worked rather too well. As part of the 1987 Louvre Accord, Japan and the UK eased their policy stance – thereby triggering the troublesome Lawson Boom in the UK and the ruinous Bubble Economy Japan (that it has still to recover from almost forty years later).

In addition, the Federal Reserve began a tightening process that ultimately led to the 1987 Stock Market Crash. It is difficult to imagine a worse conceived set of policies.

At the heart of the deal done in the Plaza Hotel was a commitment by policymakers to artificially move exchange rates “to where they should have been” and also to attempt suppress volatility in other key variables. However, volatility (particularly in a world beset by shocks) is like the air that is trapped in a balloon, if you squeeze it on one place, it simply bulges out somewhere else until the balloon bursts. The Japanese Bubble Economy and the 1987 Crash were just such bulges and bursts….

One might have thought that the G7 would have learnt from their mistakes, but it seems that once policymakers had started down this road, that they had no intention of abandoning it. The European Monetary System of the 1980s became the Euro Project of the 1990s, the G7 became the G20, while currency pegs and targets appeared with increasing frequency, culminating it seems in the Shanghai Accord on RMB/USD.

Of course, as the authorities attempted to suppress the risk in FX, cross border capital flows and in particular leveraged carry trades grew exponentially (and this may even have been the objective), thereby adding ever more risk to the recipient markets, be they the Asian credit markets in the 1990s, the US mortgage markets in the 2000s, Peripheral European debt, and finally China debt over recent years.

Of course, huge apparently “safe” leveraged risk taking across presumed fixed exchange rate links rarely is safe; when the inevitable real shocks occurred, and exchange rates simply had to move, things tended to go wrong, as the litany of market crashes since 1987 has revealed. It is our sense that we have one more crash to go, namely PRC credit as the RMB is forced to depreciate against the USD. Unfortunately, this event seems imminent.

In fact, the central banks were so busy looking to support not only short-term growth, but also to promote a green agenda and a host of other non-core objectives for which they were in no way qualified, that, in the early 2020s, they took their eye off their primary target, namely controlling inflation. However, now that the inflation genie is well and truly out of the bottle, in part due to their negligence, they are being remarkably slow to realize that their superficially stable (but in reality unstable) managed world is no more.

Over recent weeks we have been treated not only to a number of central banks intervening in the FOREX markets but also the Bank of Japan doing immense amounts of intervention in the JGB markets - and thereby adding even more liquidity - in order to prevent yields rising in the face of higher inflation (that can only be solved with less liquidity). The Bank of England conducting similarly unlimited Gilt purchases because it doesn’t like the behaviour of the government bond markets and their impact on financial stability in the long terms saving and insurance markets.

These actions are a world away from long-time former Bundesbank President Pohl, who famously argued that he needed to create financial instability in order to control inflation at source. Pohl was no Volcker-like inflation reducer; he did not have to raise interest rates to extreme levels because he didn’t allow it to rise in the first place, but this lesson was actively unlearnt in what became the Post 1985 orthodoxy.

Financial markets have so far welcomed these interventions but at some point it will surely dawn on people that in the Banks’ efforts to defend the World that they thought they had created, the Central Banks are being obliged to add even more liquidity to systems and economies that are facing a liquidity-driven inflation problem. Once again, the Banks’ attempts to “fix” things are only creating bigger problems for the future.

To re-iterate, we believe that these latest actions are likely no more than – perhaps the last doomed efforts to preserve the Post 1985 World (which to be honest should never have been created much less allowed to endure). It seems that policymakers – many of whom superficially spout free-market rhetoric – are still determined to subvert the markets and prevent genuine price discovery by growing their balance sheets exponentially domestically, and spending money on the FX markets. But, we firmly believe that time is running out for their models.

In the very short term – perhaps only measured in days – policymakers may succeed in controlling market outcomes if their actions are large enough. They also may get some respite on a six month view if we are correct that we are entering some form of China Crisis that will defuse global inflation fears for the early part of next year, but ultimately the revealed desire and willingness of the Banks to keep buying bonds in an effort to hit their beloved financial price targets will simply result in them adding more and more liquidity to a world that is already biased towards higher structural inflation (even if we see inflation rates declining in early 2023 for base effect and China-related reasons).

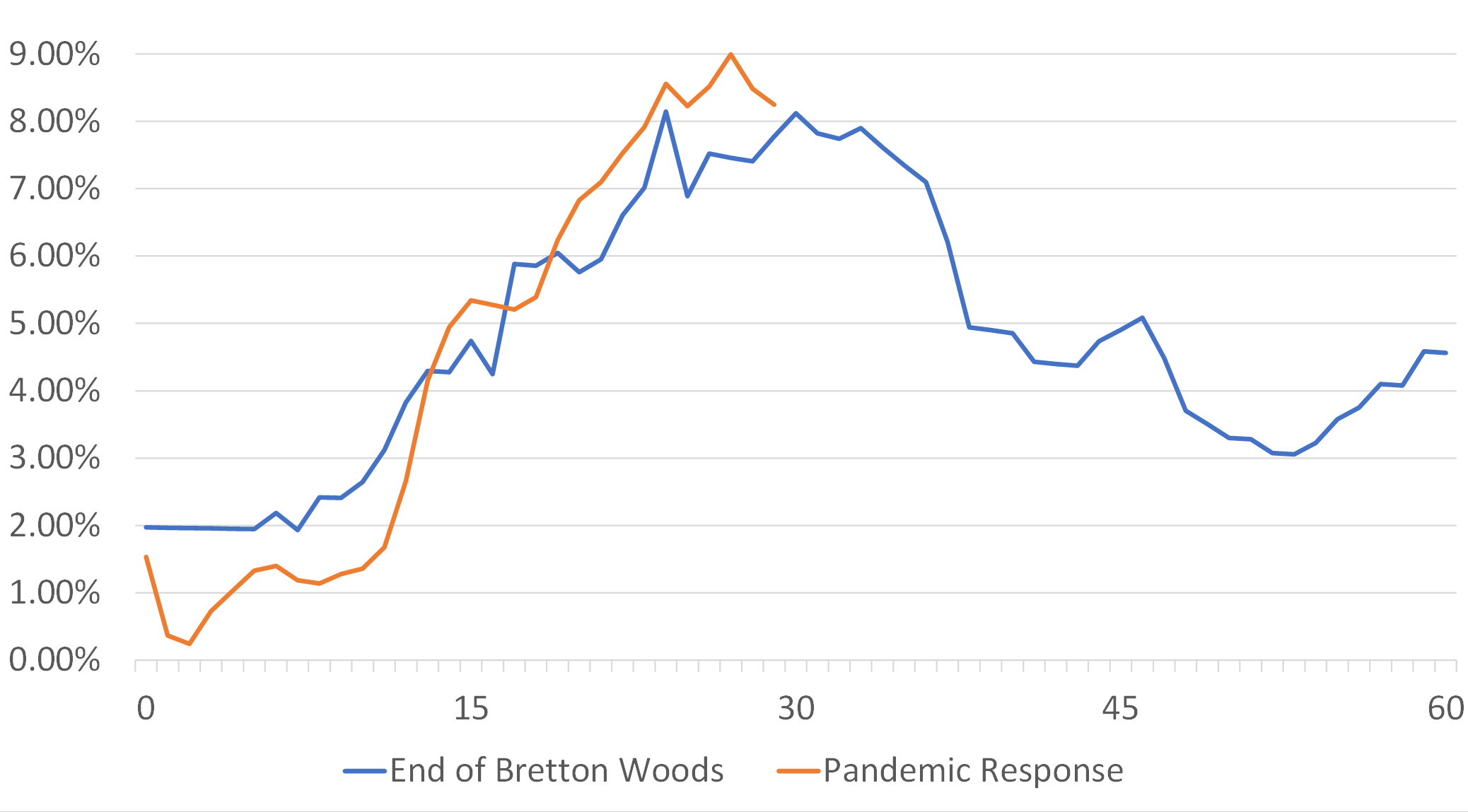

It is therefore our fear that the much-anticipated decline in global inflation in 2023 will prove to be only a temporary event; if central banks do indeed continue on their current paths, then it is probable that inflation will come roaring back in 2024 – just as in did in the late 1970s following the policy-reactions to the admittedly deep recessions of 1974-1975. Specifically, we suspect that the minute that the authorities allow a degree of ”risk-on” to enter the global system, employees will spy an opportunity to gain compensation for their falling living standards over recent years, and companies will be keen to attempt to rebuild their margins. During the 1970s, the peak in inflation came several years after the initial oil shock and the subsequent recession and the same may be about to occur this decade. Bond markets attempted to look through the initial inflation in 1973/4 but it was the resurgence in inflation that occurred fully five years after the initial Bretton Woods Monetary Shock in 1972 that “did the real damage” to bond prices.

USA: CPI Inflation in Months Following Monetary Shock % YoY

In the very near term, we expect still high levels of bond issuance to place further downward pressure on bond prices but, by early next year, the bond markets may well enjoy a rally as the depth of the PRC’s slowdown is revealed. Unfortunately, we suspect that this may represent only a temporary buying opportunity for bonds – if central banks continue to attempt to cling to their Post Plaza World, the late 2020s will see higher inflation and ever weaker bond markets.

Disclaimer: The information in this report has been taken from sources believed to be reliable but the author does not warrant its accuracy or completeness. Any opinions expressed herein reflect the author’s judgment at this date and are subject to change. This document is for private circulation and for general information only. It is not intended as an offer or solicitation with respect to the purchase or sale of any security or as personalised investment advice and is prepared without regard to individual financial circumstances and objectives of those who receive it. The author does not assume any liability for any loss which may result from the reliance by any person or persons upon any such information or opinions. These views are given without responsibility on the part of the author. This communication is being made and distributed in the United Kingdom and elsewhere only to persons having professional experience in matters relating to investments, being investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005. Any investment or investment activity to which this communication relates is available only to and will be engaged in only with such persons. Persons who receive this communication (other than investment professionals referred to above) should not rely upon or act upon this communication. No part of this report may be reproduced or circulated without the prior written permission of the issuing company.