“The Only People calling for an end to the US Dollar as a reserve currency are people that don’t have any”. George Magnus, Oxford University “In the event of a Debt Ceiling Default, no one knows whether UST will still be useful as collateral”. Ben Ashby, former CIO of JP Morgan Chase “Forty Years ago, nobody in the West really talked about or cared about reserve currencies”. Rodney Jones, ex Soros Fund Management “Whatever may be being said on social media, the Yuan can’t be a reserve currency while it operates capital controls and runs a current account surplus. Fact.”

The quotes that we record above came independently from a number of commentators that we regard as being informed and credible. In many ways, we regard the third quote – from a long-standing Asian economy specialist - as the most important. As an undergraduate economist, the subject of foreign exchange reserves and reserve currencies garnered scant attention because we were in a world of floating currencies in which FX intervention, when it did occur, was only ever modest and temporary. It was only in the mid-1980s, when a number of overtly mercantilist economies in Asia began linking their (frequently undervalued) currencies to the USD and acquiring specie that global reserves became a “topic”. During the 1990s, New Zealand operated without reserves.

At the time, the use of the dollar as a reserve currency was probably viewed positively in Washington, as it offered a way for the US financial sector to grow internationally and the government a way to help fund its endemic budget deficits. It is also of no coincidence that the prominence of “reserves” in terms of both their size and the attention that they occasioned increased as more of the World once again became enamoured with Fixed Exchange Rate links.

In order to be a Reserve Currency, the supply of the currency to non-residents must be expanding. If it is not, then the global monetary base will shrink, and a (usually painful) global deflation will likely occur. Indeed, it is a requirement of a reserve currency economy that they bear the burden of increasing the global base by exporting their currency, usually via a domestic-employment-sapping current account deficit, or significant outflows of capital. There are therefore not insignificant costs involved for the donor in operating a reserve currency, as Mr Triffin noted seventy years ago. Moreover, the providers of a reserve currency tend to have to have strong asset management sectors – particularly vis-à-vis external assets in order for them to avoid national bankruptcy.

There may come a time when the PRC could fulfil this role, but not while it runs endemic current account surpluses and operates what look to be highly effective capital controls. A global monetary system based on the RMB would be a deflationary disaster at the present moment; the World would be permanently short RMB, which would then soar in value as the World deflated.

We can however quite understand why the authorities in Beijing would like to move away from the dollar for a host of reasons, including a need to conserve their stock of dollars. We know that many commentators are transfixed by China’s trade surpluses and reported high savings, but the truth of the matter is that the PRC is an economy with huge outstanding FX (USD) debts. These were amassed from 2014/15 onwards and, although the PBoC’s data my deny / not record their existence, their existence is obvious in third party data, in the revealed behaviour of China’s banks and authorities, and even some of the PRC’s data if you chose to look hard enough.

Quite understandably, the CCP is keen to discharge these debts as quickly as possible for macro-prudential, micro-prudential, and even geopolitical reasons and this requires that the country runs the largest possible dollar surpluses in its current account (and capital inflows balance). At the highest level, this means maximizing exports and minimizing imports, although clearly there is an incentive not to pay for imports in USD wherever possible. Hence, Beijing has been very keen to enact trade deals with other countries that are willing to avoid the USD, most likely because they also have a dollar shortage (Pakistan, Argentina, etc…) or which have a political reason for wanting to economize on their use of dollars. These are however all essentially bilateral deals between consenting parties. They are not a global system.

Arguably, however, the US no longer entirely deserves its reserve currency status. The political landscape casts doubt on whether the country is still prepared to bear the costs of supplying the reserve currency. Relatedly, the Debt Ceiling issue undermines the use of UST for collateral, or even as a store of reserves.

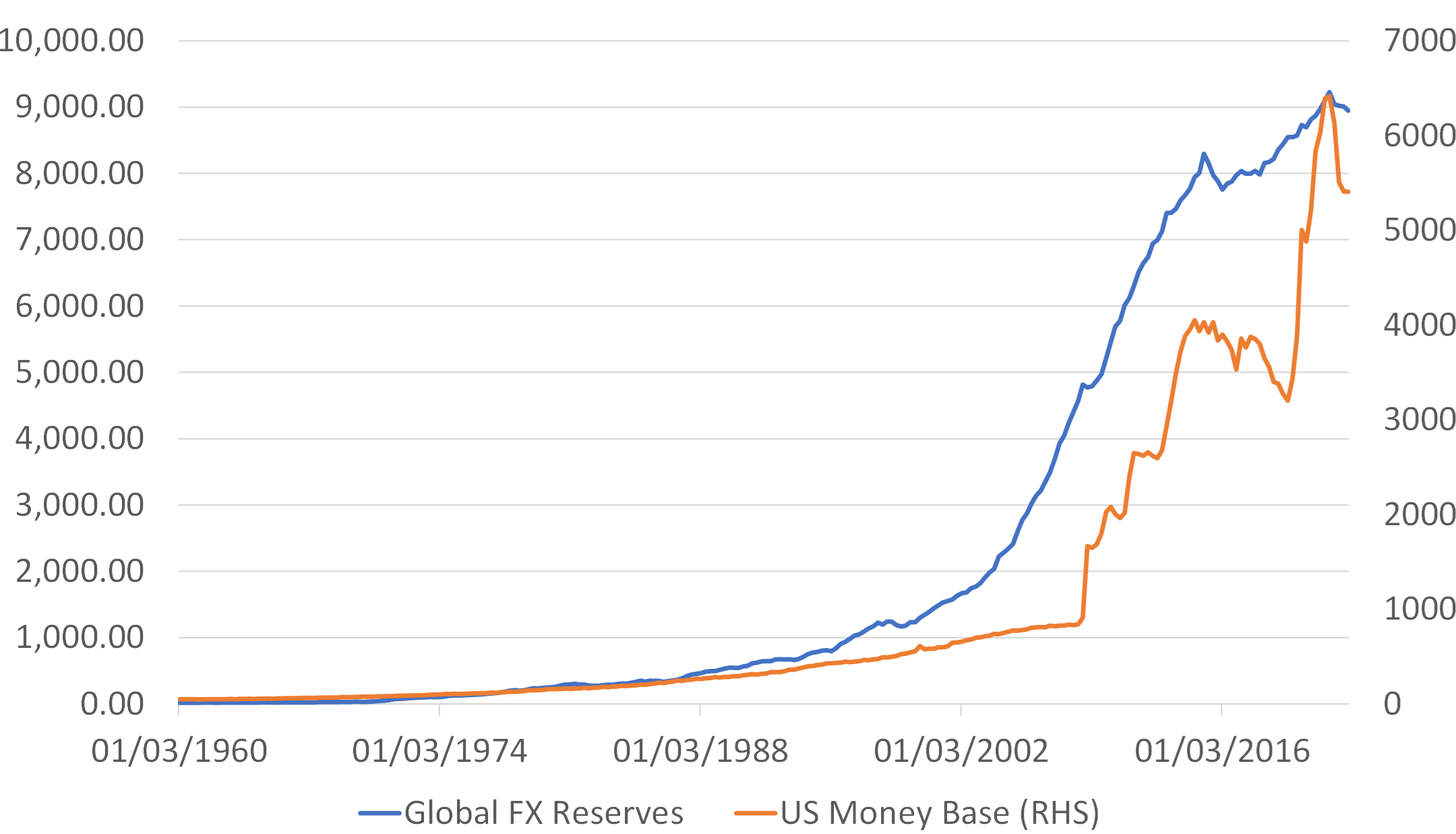

In addition, it is now apparent that the FRB massively over-inflated the supply of dollars during the Pandemic, not just domestically but internationally as well. Quite simply, the US exported too many dollars in 2017 and 2020/1, just as it did in the mid 1920s, late 1960s and the early 1970s, but today it also seems determined to take the supply of dollars back out of the system, much as the authorities attempted to do in the late 1920s ahead of the Great Depression.

Historically, whenever the supplier of the reserve currency makes mistakes of this magnitude, the prevailing (almost by definition fixed exchange rate) monetary regime usually crumbles. The intermittent failures of the Gold Standard from the 1870s, the demise of Bretton Woods in the early 1970s, and even the Asian Financial Crises of the late 1990s can at least at some level be attributed to excessive ebbs and flows in the supply of the reserve currency. At present, the USD certainly does not represent an ideal reserve currency.

Global FX Reserves & US Money Base USD billion, source IMF

However, if the utility of the USD is slipping as a reserve currency but there-is-no-alternative, then we would argue that, just as we did during the 1930s and 1970s, we are going to have to move to non-reserve based monetary system.

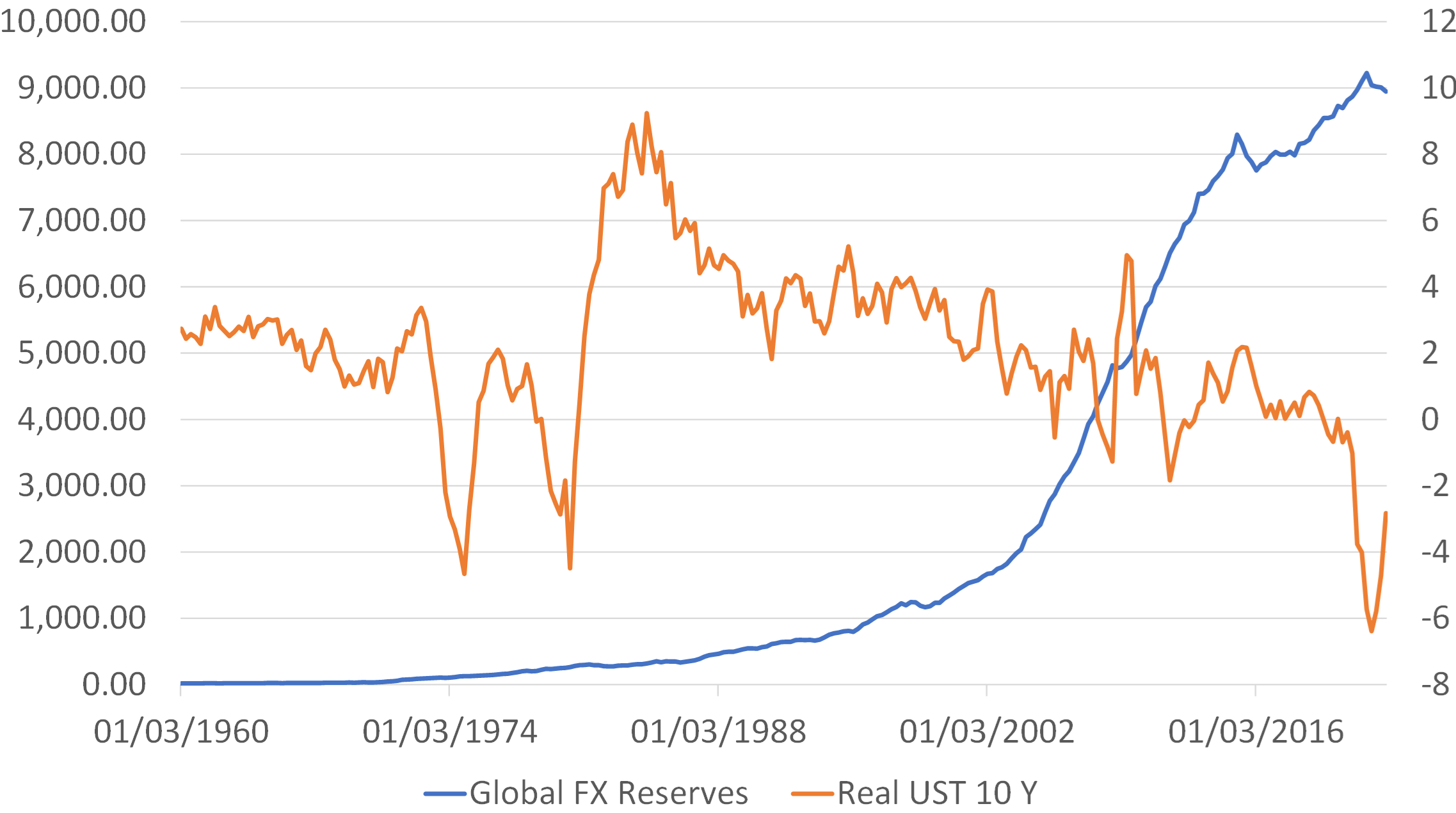

What does this imply for investors? Firstly, the infatuation with fixed exchange rate regimes will fade and currency volatility will become de riguer – the parallels with the 1930s and of course 1970s are obvious here. We would also suggest that there may also be more bond market volatility and quite probably higher real yields in bond markets as the “reserve subsidy” on government borrowing costs is removed.

Global FX Reserves & US 10 Year Real Yield USD billion, % YoY

Which currencies should one hold in this new World – which will be the new Hard Currencies? Clearly the DEM cannot be one; it no longer exists and in any case Germany seems to have lost all fiscal discipline. The Euro is beset by structural problems (chiefly the miss-match between its physical and political borders) and the EZ economy will struggle in any global trade slump. Moreover, the EUR is itself a fixed exchange rate regime. The Yen is a contender, but Japan’s demographics and the BoJ’s recent failings argue against it. On paper, there is no reason that the GBP could not become a hard currency, but political and institutional failings make it more likely to be a soft currency. Australia and Canada could offer alternatives, although its credit-dependent domestic economies could yet prove fragile. We are too pessimistic on the outlook for offshore financial centres – which include the CHF – to believe that these offer a solution either. In the near term, those looking for a store of value may simply need to hold a basket of currencies and currency-like alternatives. Gold and other commodities may have their day in the sun.

At some point – most likely in the second half of this decade – (middle class) savers will require a reliable store of value and the resultant political pressure will start to force at least some governments into establishing the institutional frameworks that will lead their currencies to become “Hard”. We will be looking for those countries that adopt some form of Nominal / Monetary Targeting (i.e. nominal stability), that possess a lack of mortal hazard in their financial markets; fiscal discipline; strong productivity growth in their traded goods sectors; and political stability. We believe that a combination of these factors would likely lead to a self-reinforcing positive cycle that led to the creation of a hard currency, probably with a digital version attached. Finding the 2030s’ equivalents of the 1970s era JPY, DEM and CHF will provide potentially handsome gains for investors. Macro will matter in this world...

Disclaimer: These views are given without responsibility on the part of the author. This communication is being made and distributed by Nikko Asset Management New Zealand Limited (Company No. 606057, FSP No. FSP22562), the investment manager of the Nikko AM NZ Investment Scheme, the Nikko AM NZ Wholesale Investment Scheme and the Nikko AM KiwiSaver Scheme. This material has been prepared without taking into account a potential investor’s objectives, financial situation or needs and is not intended to constitute financial advice and must not be relied on as such. Past performance is not a guarantee of future performance. While we believe the information contained in this presentation is correct at the date of presentation, no warranty of accuracy or reliability is given, and no responsibility is accepted for errors or omissions including where provided by a third party. This is not intended to be an offer for full details on the fund, please refer to our Product Disclosure Statement on nikkoam.co.nz.