Snapshot

The divergence in growth outlook reflected in equities continues to widen, as secular growth in the form of tech and artificial intelligence (AI) developments appears to have the upper hand in determining the overall market direction. This is evident with the tech sector being up (and Japan, for different reasons) while most other sectors and geographies are down over the month. This defies conventional wisdom—that earnings can continue to grow into a recession, but these disruptive developments are indeed significant, and perhaps this is the right directional prognosis should a recession prove to be shallow.

However, while we are still awaiting confirmation that a recession is at hand as data continues to weaken, it is so far falling short of definitive weakness in labour that is usually the precursor for a reinforced downturn in cyclical demand. Indeed, AI disruption could be part of the solution to tight labour markets as some argue that it will be here sooner than most think. But this would be quite unusual given normal adoption rates while it will also take time to take the pressure off inflation that is still proving stickier than most had hoped.

It is an odd cycle to say the least, and conventional wisdom in terms of reading the economic cycle has so far proven ill-equipped to predict what comes next and when. Overall, we lean more neutral as there is little on which stake a firm sense of conviction. However, bottom-up perspectives do inform, and earnings growth opportunities in secular growth do speak to a decent outlook for now.

Yes, a bubble could be forming given the seemingly overnight hype that has surrounded AI, and valuations are indeed looking rich to reflect this mood already, but earnings drive equities and the cycle drives earnings and yields. Combined, we like the diversification currently embedded in equities versus bonds, where both intuitively and practically, correlations are negative and are expected to remain negative so long as growth fears persist.

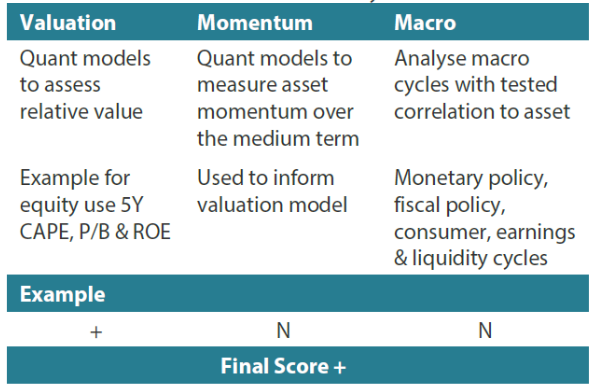

Cross-asset1

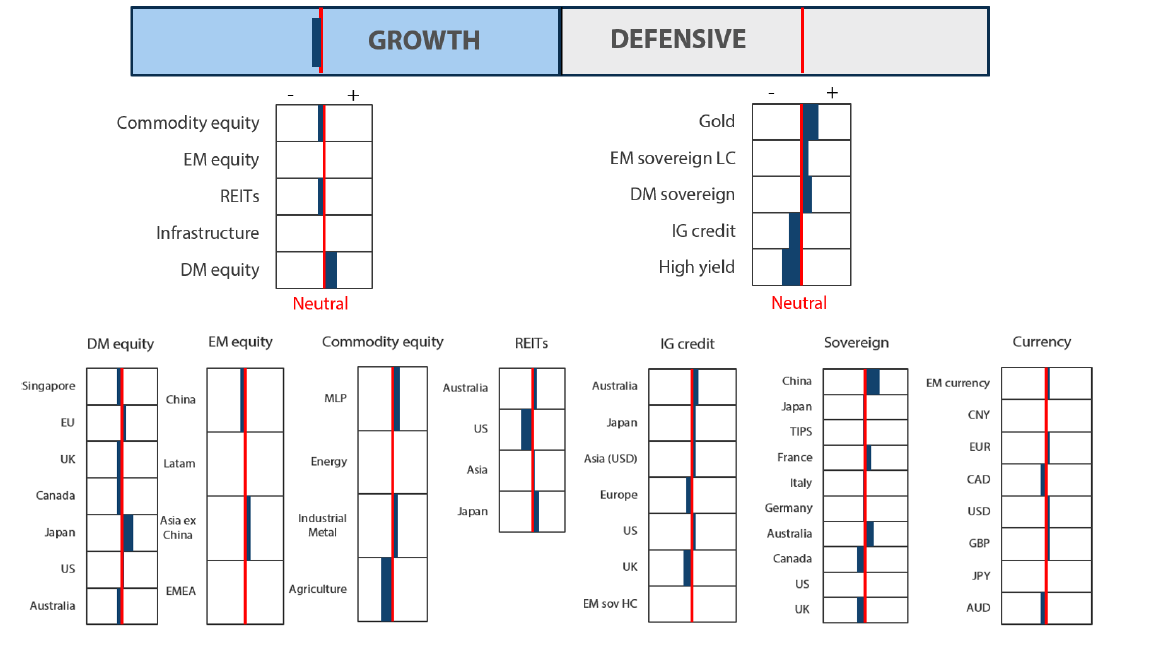

We lifted growth assets to a slightly smaller underweight while maintaining defensives at neutral. We still hold our view that growth assets face formidable headwinds on the back of an aggressive tightening cycle and tighter credit conditions. However, while the macro-outlook remains highly uncertain, the micro data so far remains supportive.

The hard data has so far resisted the headwinds of tighter financial conditions, perhaps owing to a combination of strong private sector balance sheets and the gradual return of China demand on supportive policies. No matter what the reason, it is important not to be too bearish, especially given that few, if any, have been able to accurately predict the current cycle which has proven quite unique compared to any other in history.

Within growth, we increased developed market (DM) equities to a larger overweight, funding it from a reduction to commodity-linked equities which are more acutely exposed to fundamental growth headwinds. Within defensives, we added to emerging market (EM) local currency for the yield and currency stability. This was funded from a reduction of gold to a smaller overweight given its greater sensitivity to a stronger dollar, which incidentally we also upgraded this month for currencies. We also slightly decreased our underweight to investment grade (IG) credit on the recognition that the economy has yet to significantly deteriorate, funded from a small decrease of the overweight to DM sovereigns.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Momentum is picking up, and not from where most would have expected in early 2023—tech and Japan, a seemingly odd pair at first blush. Over the last several months, we have discussed the re-emergence of tech and AI as a new secular growth theme, but perhaps less known is the quiet outperformance of Japan equities over most global peers. We have long found Japan to be an appealing market for its attractive valuations and defensive characteristics—particularly over 2023, but historically the market has largely fallen short of generating significant growth opportunities.

Has something changed? Perhaps, and the story may be even stronger than “Abenomics” back in 2013 in the form of three arrows that ultimately failed to deliver Japan from its deflationary trap in place since the burst of the Japan equity market which peaked back in 1989. Reforms are ultimately the remedy, but policy initiatives were seemingly incapable of dislodging the deflationary mindset until now when actual inflation has changed the mindset rather quickly.

Inflation is ordinarily viewed as negative for an economy, but it just may be better than the deflationary alternative. Real inflation has created a sense of urgency that reforms actually need to be firmly executed as former business practices (sitting on unproductive capital) simply do not work in an inflationary world. Japan is pushing reforms, and business leaders are taking them very seriously not just to abide the directive but rather for survival.

Japan recovery: more than just hope

Reforms succeed when well executed, but the devil is in the details and more importantly the psyche of all the stakeholders. Poor governance has been a headwind for Japan equities over decades; among them is “keiretsu”, when companies own each other’s shares without serious demands for any return on capital.

This is changing with the Tokyo Stock Exchange (TSE) seriously ramping up reforms to require companies to build shareholder value, measured by companies’ price-to-book ratio (PBR), where many fall below the “1" threshold, typically viewed as destroying capital, not creating it.

In a deflationary world, a gradual decline in the capital base might be tolerated as a store of (decreasing) value, but not in an inflationary environment where growth is a necessary hedge. Add to this wage pressures, and companies have no choice but to re-think their business strategy. Buybacks are increasing, and more companies are setting specific targets to increase shareholder value.

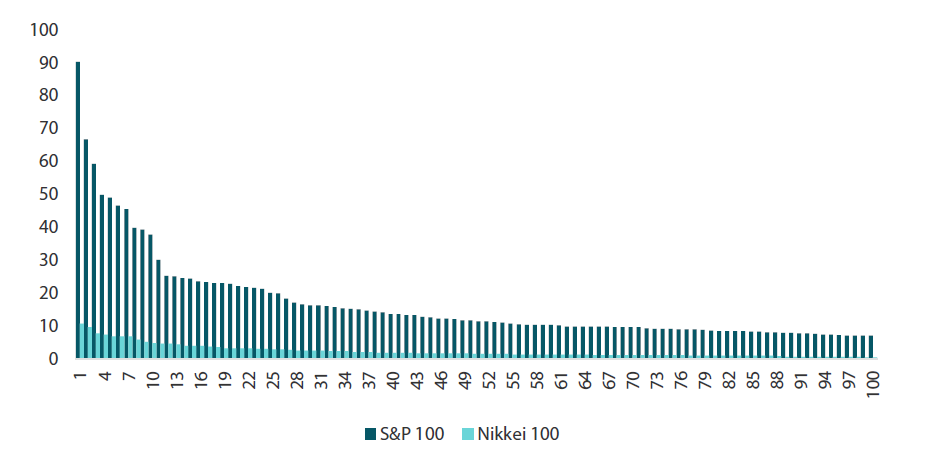

These are early days, but it is nevertheless a notable and necessary shift in corporate behaviour. Shares have significantly re-rated, but are they yet expensive? Compared to its own history, Japan equities do look slightly rich. But compared to other markets around the world, it is still reasonable: 17x forward price-to-earnings versus 19x for the S&P 500 index. In terms of PBR, the largest 100 companies in the Nikkei trade at a massive discount to S&P peers.

Chart 1: Top 100 companies ranked by PBR (Nikkei versus US S&P)

Source: Bloomberg, June 2023

Source: Bloomberg, June 2023

Of course, much of this discount is justified as Japan companies collectively have done a very poor job delivering return on capital. However, as nearly a quarter of the largest 100 Nikkei companies still have a PBR below the TSE “1” stated lower bound (one-seventh of the lowest PBR in the S&P 100), the bar for improvement is quite low and companies should be highly motivated, first to keep their listing and second to remain competitive.

Such reforms are also supporting renewed interest for direct investment in Japan—from semiconductor production to a broad range of products and services to gain access to Asian growth which is increasingly viewed as a safer alternative to investing in China, which remains under the weight of high (and rising) geopolitical tensions. Many in the West are also deeming Taiwan as a riskier investment proposition, though we do not view an invasion as a near-term risk for the island.

Real fundamental change will take time, but the risk does look skewed to the upside for now. Japan is still very externally exposed to a US recession, which could dampen the mood quite quickly if such a recession were deeper than our shallow base case. Still, valuations are attractive, earnings are improving and the spreading sense of conviction that reforms are not just “good” but also very necessary for a sustainable future makes Japan a relatively high conviction overweight.

Conviction views on growth assets

- Favour quality and secular growth: : We are constructive on a mix of high (and future) quality companies with strong balance sheets and durable cash flow with descent segments also partaking of emerging secular growth opportunities.

- Staying defensive on cycle: We still are cautious on cyclicals, leaning defensive in terms of positioning including sector exposures like healthcare and consumer stables.

- Beneficiaries of China demand preferred: China is still working through the deeply scarred sentiment which has proven difficult to shake off for a better local market outlook. Still, demand is improving but for now we prefer exposure to such demand mainly outside of China, including Japan and Europe.

Defensive assets

We maintained our overweight view on sovereign bonds within our defensive asset classes but with a slight downgrade. Major central bank meetings in May all delivered additional rate hikes as expected but the outlook for future hikes is uncertain. Global inflation has turned and is now gradually receding but is still too high relative to central bank targets. At the same time, growth is sub-trend and forward-looking indicators portend further weakness. Central banks now face the difficult task of weighing growth concerns with inflation rates that need to come down more. We expect policy rates to reach their terminal levels soon as demand concerns begin to outweigh inflation concerns.

We also upgraded our view on EM sovereign bonds to overweight. Real yields in this sector are generally very attractive and we prefer quality EM currencies against the backdrop of a generally weaker dollar. These currencies have also proved resilient during recent bouts of dollar strength against developed market currencies.

High grade credit spreads were mixed across regions, but the sector was hurt by rising global benchmark yields. Global growth has been sub-par so far this year and central banks are not showing any signs that interest rate relief is on the horizon. We still expect the twin headwinds of monetary policy tightening and tighter bank lending conditions to increase the pressure on corporate borrowers as 2023 progresses.

We remain positive on gold but tempered our overweight view slightly after its strong run this year. In recent weeks, rising real yields and a stronger dollar have weighed on gold. Renewal of the weaker dollar trend may have to wait for now as China’s contribution to global growth has been disappointing as it continues to reopen from restrictive pandemic policies. Nevertheless, investor positioning in gold remains light and tailwinds are evident from de-dollarisation demand.

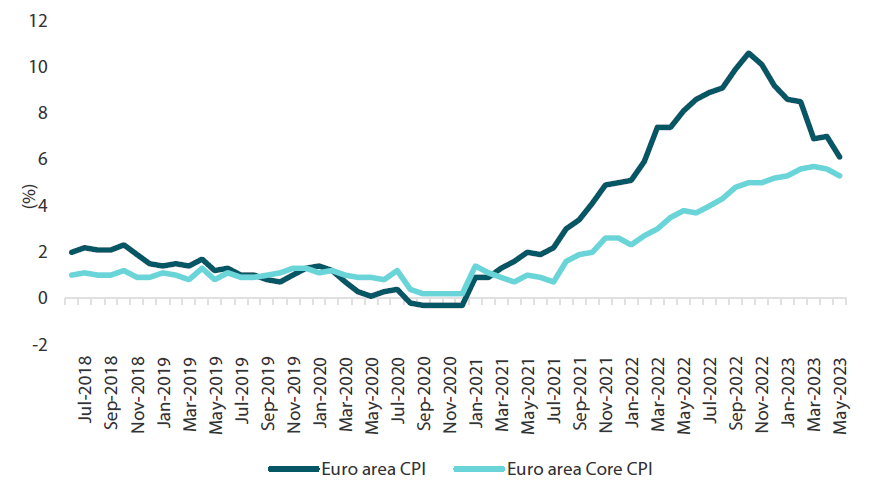

Time limit on ECB hawkishness

A commonly used marker for recessions is two consecutive quarters of negative real GDP growth. Under this definition, the euro area has already been experiencing a mild recession, recording GDP growth of -0.1% in both 4Q22 and 1Q23. A continuation of soft economic data into the second quarter suggests that this streak may continue. Meanwhile, the European Central Bank (ECB) has just delivered its eighth rate hike in a row to bring its total tightening so far to 4%. Quite a change indeed for an economy that was supported by negative interest rates in the eight years prior to the first rate hike in July 2022.

Supply constraints, a surge in goods demand from locked-down consumers and higher energy prices have all played their part in the global surge in inflation that began in 2021. As central banks responded to price pressures with higher rates, the ECB was no exception even if it was somewhat late to the tightening party. Chart 2 shows Euro area inflation for both the headline measure and the core measure, which excludes energy, food, alcohol and tobacco. Both measures moved through the ECB’s inflation target of 2% headline in the second half of 2021 and moved sharply higher before peaking at the highest levels recorded since the European Union was formed in 1993. A test for sure for a central bank that has had a mostly dovish reputation since its creation.

Chart 2: Euro area inflation

Source: Bloomberg

In a recent speech, ECB President Christine Lagarde likened its current policy response to high inflation to that of an airplane climbing to cruising altitude before the pilot levels off on the way to its destination. Her point was that smaller rate increases were now needed as the rate trajectory, like the airplane, had begun to level off but had not yet reached its optimal point to reduce inflation. We would also add that it is equally important to ensure that the airplane does not ascend to such a level that the oxygen becomes too thin and the pilot risks suffocating her passengers.

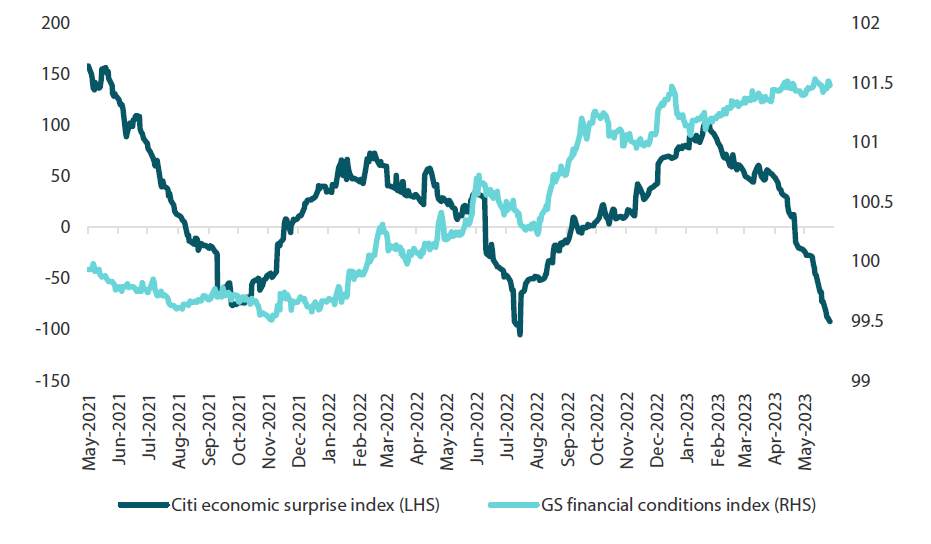

Chart 3: Euro area economic surprises and financial conditions

Source: Bloomberg, Citigroup, Goldman Sachs

Source: Bloomberg, Citigroup, Goldman Sachs

Chart 3 shows both the Citi economic surprise index (CESI), which monitors whether economic data releases are coming in stronger or weaker than consensus forecasts, and the Goldman Sachs financial conditions index for the Euro area. The sharply negative reading for the CESI is likely indicating that the ECB’s tightening so far is beginning to have a chilling effect on Europe’s activity data. Not surprising given that financial conditions have been tightening steadily for the last year. We have no doubt that tighter monetary policy leading to weaker economic growth is exactly what the ECB intended in its fight to bring down inflation. However, a central bank that continues to tighten after inflation has peaked and its economy is already in a recession would seem to be at risk of doing too much. While central bankers have more recently begun to make references to the lagged impact of prior rate hikes, in our view it is fast approaching time for them to heed their own words and let already tight monetary policy do its work.

Conviction views on defensive assets

- Prefer sovereigns over credit: Central bank tightening cycles and banking problems are generally not kind to credit spreads and credit quality. Therefore, we prefer sovereign bond exposures.

- Attractive yields in EM: Real yields in this sector are generally very attractive and we prefer quality EM currencies against the backdrop of a generally weaker dollar.

- Australian bonds attractive : The recent underperformance of Australian bonds has restored attractive relative value. The Reserve Bank of Australia’s newfound hawkishness is puzzling, increasing the prospect of a recession in Australia.

Process

In-house research to understand the key drivers of return: