This month we take a closer look at Japan’s 2Q GDP surge and analyse the factors that could offset a potential slowdown in exports; we also assess why the markets are less perturbed by a weak yen compared to a year ago and discuss the prospects of the currency strengthening in the months ahead.

Taking a closer look at Japan’s 2Q GDP surge

Thanks to strong exports, Japan’s economy grew at an annualised rate of 6% year-on-year in the April-June period, roughly doubling market expectations. While the headline figure of 6% was impressive, a closer look at the second quarter gross domestic product (GDP) data shows that growth was lopsided, mostly accounted for by robust exports. In contrast, domestic demand, highlighted by a 0.5% annualised slip in private consumption, was weaker than expected. The latest GDP figures raise two questions: can we expect an eventual domestic demand recovery, and how will the economy cope if exports lose steam?

Weak domestic demand was not surprising given that consumers are still getting used to an inflationary environment, especially as inflation is rising at a faster pace than wages. However, two factors could lead to the increase in wage hikes shifting into another gear and overtaking the rate of inflation. The first is tight labour market conditions. Current demand for workers in export-oriented sectors is greater than supply and a similar phenomenon could emerge in sectors linked to domestic demand; this, in turn, is expected to accelerate the rise in wages. Second is the prospect of inflation decelerating as the impact from commodity and energy-related factors are beginning to show signs of decreasing, not only in Japan but globally. We may witness a robust post-pandemic recovery in domestic demand should the pace of wage hikes overtake that of inflation.

Japan’s exports, while currently strong, could face a number of headwinds towards 2024. For example, the Federal Reserve (Fed) could go too far with monetary policy tightening and depress US consumer spending, in turn curtailing demand for Japanese goods. The resulting levelling off in exports will not be positive for the Japanese economy, but that could be offset by a recovery in domestic demand, which we think has yet to complete its comeback from pandemic-era restraints. We believe that as the labour shortage is resolved gradually over time, there will be a boost in private consumption. One point to remember, however, is that until recently Japan was steeped in a deflationary, defensive mindset. This means that there is some risk of companies refraining from active capital expenditure if exports level off; in addition, people could begin directing a greater portion of their income to savings instead of consumption if wages continue rising.

That said, increased wages and ensuing consumption, in our view, will be crucial if the economy is to make a full domestic demand-led, post-pandemic recovery. Increases in supply to meet higher consumption demand will create a virtuous cycle of tight labour conditions leading to higher wages and increased consumption. If such a cycle takes hold, Japanese stocks could make a renewed push higher. As mentioned previously in this series, bonuses paid out this winter could become a turning point.

Why a weaker yen is not generating as much concern this time

The yen caused a significant stir in the markets nearly a year ago when it weakened beyond the 151 per-dollar mark to hit a 32-year low. Back then, the yen’s depreciation, which took place amid widening US-Japanese interest rate differentials, was blamed for a number of ills including a rising cost of imports. Japanese currency authorities eventually intervened in the market to prop up the yen. After appreciating for several months following the intervention, the yen has been weakening again as the Bank of Japan hints that it is not in a hurry to end its monetary policy easing. The yen is edging towards last year’s lows, but the currency’s losses have not generated as much alarm, and the market is seemingly less concerned about the authorities intervening.

One reason behind the market’s more sanguine view is that the recent depreciation so far has been taking place at a relatively gradual pace with the currency retracing levels already witnessed last year. The authorities tend to intervene primarily to reduce volatility in what can be dubbed as smoothing operations. We have yet to see the kind of volatility that gripped the dollar/yen last year and likely prompted the authorities to intervene. Another reason is that compared to a year ago, the prices of commodities have declined. A year ago, a rise in commodity prices and the yen’s weakening occurred simultaneously and was seen as a double blow for consumers. This time, however, lower commodity prices have helped offset the negative effects of a weaker yen, likely limiting calls for intervention.

Furthermore, the yen may not remain on the back foot versus the dollar indefinitely. This is because the Fed could halt raising rates as early as Q1 2024, removing support for the greenback. The yen could be reinforced by domestic factors as well; the chances of inflation becoming a well-entrenched economic phenomenon are increasing, with rising wages providing support. If the rise in wages equal or exceed the inflation rate, that may help trigger a full-fledged recovery in domestic consumption; this in turn will lead to greater capex and boost demand for funds, ultimately pushing up yields and causing the yen to appreciate.

Market: Japan stocks mixed in August with losses pared as US policy woes ease

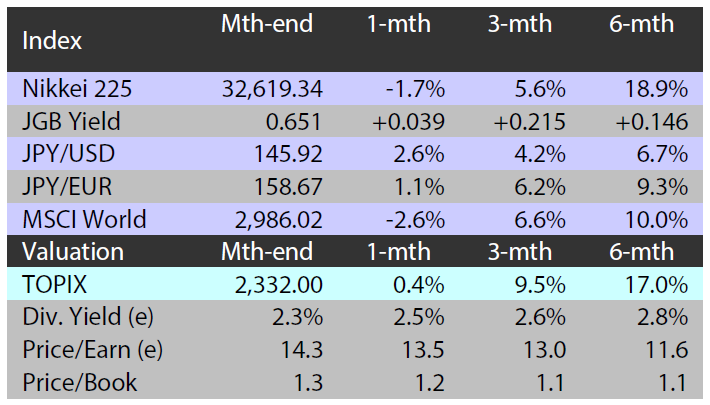

The Japanese equity market was mixed in August, with the TOPIX (w/dividends) rising 0.43% on-month and the Nikkei 225 (w/dividends) falling 1.60%. The market was bearish up until mid-month due to factors including a major rating agency downgrading US debt and concerns regarding an economic slowdown in China stemming from the announcement of lower-than-expected macro indicators. In the latter half of the month, Japanese stocks rebounded to an extent as excessive anxieties surrounding US monetary tightening dissipated following US Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Economic Policy Symposium, which was largely in line with expectations.

Of the 33 Tokyo Stock Exchange sectors, 24 sectors rose, with Marine Transportation, Mining, and Oil & Coal Products posting the strongest gains. In contrast, 9 sectors declined, including Precision Instruments, Electric Appliances, and Air Transportation.

Exhibit 1: Major indices

Source: Bloomberg, as at 31 August 2023

Source: Bloomberg, as at 31 August 2023

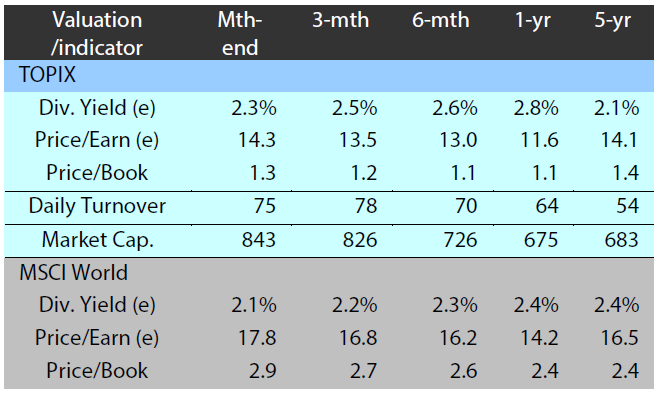

Exhibit 2: Valuation and indicators

Source: Bloomberg, as at 31 August 2023

Source: Bloomberg, as at 31 August 2023