Introduction

The ongoing bull run by Japan stocks, the likes of which have previously been written off as false dawns, has been turning heads globally. The media attention is certainly palpable; for example, the Financial Times ran a headline on 16 May titled “Japan stock index hits 33-year high as investors warm to Tokyo story”1. The Nikkei Stock Average has continued rising since. It climbed above 32,000 in June for the first time since 1990, when Japan was at the pinnacle of its “bubble” era. As of this writing the Nikkei has gained 28% year-to-date, comfortably outperforming developed market peers like the S&P 500 (+14%), Germany’s DAX (+13%) and the UK’s FTSE (-0.7%).

The boon in Japan equities is driven by a number of factors including the prospect of the country finally shaking off its deflationary mindset, the economy fully re-opening after the COVID-19 pandemic, attention brought upon the market by Warren Buffett’s favourable view of Japanese stocks and ongoing corporate governance reforms. In this article we will focus on the corporate governance reforms and in particular the initiative by the Tokyo Stock Exchange (TSE) urging undervalued, underperforming listed companies with low price-to-book ratios (P/B) to improve their capital efficiency.

TSE reinforces its corporate governance reform drive

Japan’s stewardship code was implemented in 2014, followed by the TSE introducing a Corporate Governance Code in 2015. The introduction of these documents is seen as a watershed which led to institutional investors changing how they interact with the corporations they invest in. Seven years later, in April 2022, reforms continued as the TSE’s five segments were restructured into three sections (Prime, Standard and Growth) which aimed to use listing requirements to improve corporate value and boost sustainable growth. Market participants, however, did not greet the reorganisation with fanfare. The Prime section, whose approximately 1,800 companies included many with unimpressive ROEs, was seen as having been saddled with a host of underperforming firms.

In response to the lukewarm reception by the market, the TSE acted swiftly. On 30 January, the exchange released the following guidelines for Prime- and Standard-listed companies to be implemented in the spring of 2023:

- Conduct management that is conscious of the cost of capital and share prices

- Improve dialogue with shareholders and disclose related information

- Promote constructive dialogue, including re-emphasising the purpose of the “comply or explain” principle

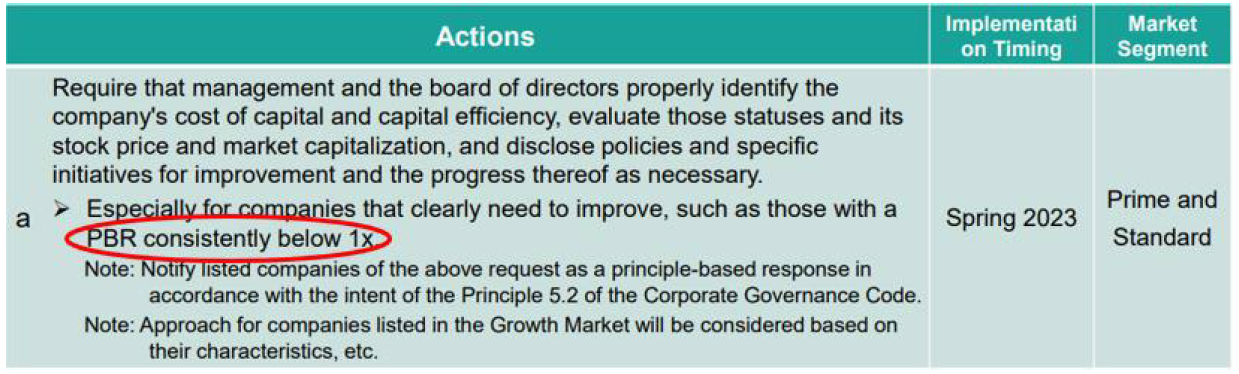

Of the three guidelines, the first is the most significant. It asks listed companies on a regular basis to “properly identify the company's cost of capital and capital efficiency, evaluate those statuses and its stock price and market capitalisation, and disclose policies and specific initiatives for improvement and the progress thereof as necessary”. As highlighted in Exhibit 1, the TSE places particular emphasis on companies trading below book value.

Exhibit 1: An excerpt from the TSE’s latest market initiative

Source: Japan Exchange Group2

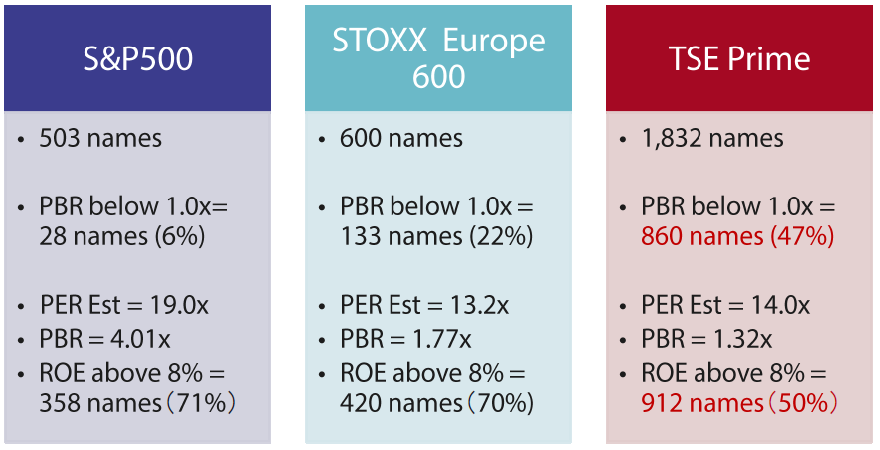

It is unusual for a stock exchange to directly ask companies to take action on their book values, but approximately half of Prime’s listed companies, or 860 names, have a P/B below 1 (Exhibit 2). As Exhibit 2 shows, Japan’s Prime market is characterised by low profitability and a market valuation which is much lower than that of the S&P 500—conditions which likely prompted the TSE to focus on companies trading below book value.

Exhibit 2: Low profitability and market valuation characterise Japan’s market

Source: Bloomberg as at 22 May 2023

The TSE’s guidelines are intended to shift the attention of company management to the cost of capital and profitability from a balance sheet perspective. The exchange makes it clear that it is not looking for companies to resort to temporary measures to reinforce shareholder returns, such as through share buybacks. Rather, it wants to see companies manage their business portfolios to generate returns on invested capital that exceed the cost of capital so they can achieve sustainable growth and increase corporate value over the longer term.

Why TSE’s initiative is positive

In our view, the TSE’s latest initiative is commendable and market positive for two reasons.

Emphasis on the cost of capital and share prices

The first is the TSE’s emphasis on a company management style that focuses on the cost of capital and share prices. In particular regard to the latter, many in listed company management held the view that share prices are determined by the market. The TSE has challenged this notion by promoting the idea that investors may not see any value in the management of companies with P/B below 1 and highlighting the fact that such companies trading below book value make up roughly half of the Prime market.

Emphasis on far-reaching measures, long-term view

The second is that the TSE’s initiative is the latest example of the exchange continuing to require companies to take far-reaching measures so they can generate capital returns that exceed the cost of capital and achieve sustainable growth. The TSE should be commended for clearly stating that it does not expect companies to employ short-term fixes like share buybacks and dividend increases, but to take actions that are continuously beneficial to shareholders in the longer term.

Case study: Dai Nippon Printing

Founded in 1876, Dai Nippon Printing (DNP) is one of Japan’s largest printing companies. Through its long history, DNP has become a conglomerate with a business portfolio that includes electronics, industrial materials and beverages. Although DNP was seen to be highly competitive in some areas—for example, the firm is a global leader in packaging for lithium ion batteries—it was a chronic underperformer in terms of valuation. During the past two decades its ROE averaged a modest 3.4% with a median of 2.8%, and its P/B averaged 0.62 over the last 10 years. A low P/B is seen resulting from factors such as the limited profitability of a company’s financial assets, which often include cross shareholdings.

In response to the TSE’s January initiative, DNP surprised the market in February when it released a “New Medium-term Management Plan” and declared that it has set an ROE target of 10% and aims to raise its P/B above 1 as soon as possible3. DNP’s ROE target of 10% was a positive surprise; the prior target of 5% had been criticised by investors as too low. In March DNP followed up with a more detailed outline4, which included a goal to “reduce strategic shareholding to less than 10% of net assets”. DNP’s targets are ambitious—its stock price needs to rise significantly for its P/B to top 1. But the market response has been positive. As of this writing, DNP’s stock price has gained 50% year-to-date, far outperforming the TOPIX, and its P/B is approaching 1 (Chart 1). DNP’s case can be seen as an example of the TSE’s activist-like initiative, in addition to engagement by investors, seemingly altering the mindset of a company’s management and prompting decisive action.

Chart 1: DNP’s P/B

Source: Bloomberg

Conclusion

The corporate governance reform started nearly a decade ago is an ongoing process, but it received a boost from the TSE’s latest initiative in January. In our view the initiative is positive as it encourages listed companies to increase their corporate value for the long term rather than resorting to one-off measures. It has also become easier for investors to increase the corporate value of listed companies through engagement as TSE’s initiative shifts market attention to the cost of capital and share prices. The latest chapter in corporate governance reform coupled with Japan’s break from a deflationary mindset and the full re-opening of the economy after the pandemic are expected to create a more favourable investment environment for Japanese equities.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.

1https://www.ft.com/content/af96b1e8-59bc-4e01-bf43-863953a51dd2

3https://www.global.dnp/news/detail/__icsFiles/afieldfile/2023/02/09/info_20230209_1e.pdf

4https://www.global.dnp/news/detail/__icsFiles/afieldfile/2023/03/08/info_20230309_1e.pdf