Summary

- The US Treasury (UST) yield curve shifted higher in May, with the benchmark 2-year and 10-year yields ending the month at 4.41% and 3.65%, respectively, up 39.7 and 22.2 basis points (bps) compared to end-April.

- During the month, central banks in the region took divergent monetary paths, while key gauges of overall price pressures eased.

- We remain constructive on relatively higher-yielding Philippine, Indian and Indonesian government bonds, on the back of the relatively supportive macro backdrop for these countries. As for currencies, we expect the Thai baht and Indonesian rupiah to continue outperforming regional peers.

- Asian credits returned -0.82% in May; widening spreads in Chinese property credits along with higher UST yields accounted for the bulk of the losses. Asian high-grade (HG) credit fell 0.39%, while Asian high-yield (HY) credit retreated 3.18%.

- We expect macro and corporate credit fundamentals across Asia ex-China to stay robust, albeit slightly weaker than in 2022. Regional and global uncertainties, coupled with the resilience of Asia credit thus far, make valuation of Asia HG credit look slightly stretched compared to both historical levels and developed market spreads. At the same time, we believe that more meaningful property easing measures from Chinese authorities are needed to stabilise the China HY market.

Asian rates and FX

Market review

The UST yield curve shifts higher in May

Risk assets started the month on a weak footing, weighed down by concerns around a possible US default and renewed stress in US regional banks. The US Federal Reserve (Fed) hiked rates by 25 bps, lifting the upper bound of the policy rate range to 5.25%. Treasury yields fell as the Fed’s forward guidance hinted at a possible pause in the next meeting. Economic data released during the month sent mixed signals but largely tempered fears of a recession. Although US nonfarm payroll (NFP) numbers for April were strong—with NFP increasing by 253,000 against expectations of a 185,000 rise—combined numbers in the two prior months were revised lower by 149,000. Meanwhile, the University of Michigan’s gauge of consumer sentiment for May fell to its lowest level since November 2022 and the US consumer price index (CPI) report revealed price pressures moderated in April. However, the pace of consumer spending quickened and the personal-consumption expenditures index—the Fed’s preferred gauge of consumer inflation—rose and topped estimates in April, highlighting lingering inflation pressures. Developments on US debt ceiling negotiations were at the forefront of investor attention in the latter half of May, with Treasury yields climbing steadily on optimism towards an impending deal between Congress and the Biden administration. Overall, the UST yield curve shifted higher in May, with the benchmark 2-year and 10-year yields ending the month at 4.41% and 3.65%, respectively, up 39.7 and 22.2 bps compared to end-April.

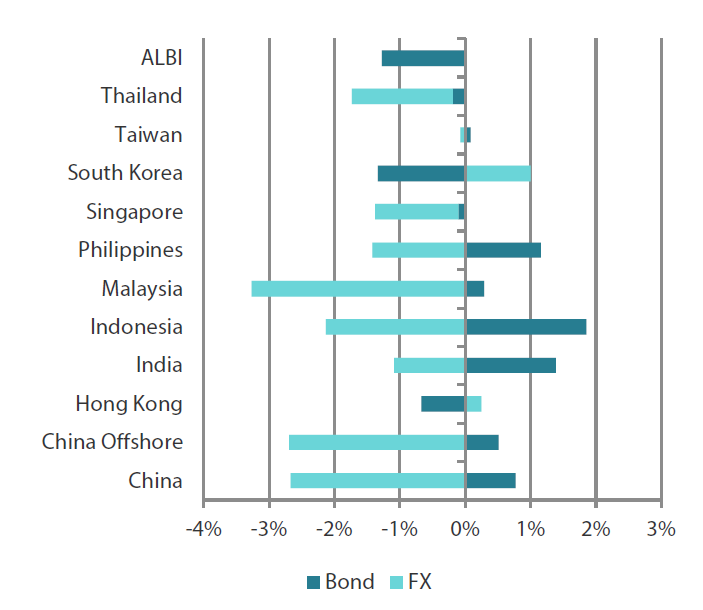

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 31 May 2023 | For the year ending 31 May 2023 | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 May 2023.

Central banks differ in their monetary policy actions

Malaysia’s central bank raised its policy rate by 25 bps to 3.0%, surprising markets which were expecting a pause. According to Bank Negara Malaysia, resilient domestic demand and the need to pre-empt a build-up of financial imbalance risks warranted the move. Similarly, the Bank of Thailand (BOT) raised its benchmark interest rate by 25 bps to 2%, declaring that a gradual, measured policy normalisation “toward a level consistent with long-term sustainable growth” was still appropriate. In contrast, the Bangko Sentral ng Pilipinas (BSP) paused for the first time since the start of its hiking cycle in early 2022. In addition, BSP also revised its CPI inflation forecasts lower for 2023 and 2024, but cautioned that while the headline number is moderating, core inflation has “only eased marginally”. Bank Indonesia (BI) also left its policy rate unchanged, emphasising that its focus now is on maintaining currency stability. BI also maintained its 2023 GDP growth forecast range of 4.5–5.3%, and it continues to expect headline inflation to return to its target range by the third quarter of the year.

Inflationary pressures mostly ease in April

Key gauges of overall price pressures in the region mostly moderated in April, prompted in part by easing food inflation. Thailand’s headline CPI eased to 2.67% (from 2.83%), printing within the BOT’s inflation target range for the second consecutive month. In the Philippines, overall inflation dipped to 6.6% in April from 7.6% in March, remaining above the BSP’s target range of 2–4%. Similarly, inflationary pressures in Malaysia decelerated, with the headline CPI moderating marginally on the back of slower food inflation. Elsewhere, headline inflation in Singapore accelerated while core inflation stayed firm, as lower increases in prices of food, electricity and gas, retail and other goods were more than offset by higher inflation for travel-related services.

1Q23 GDP growth accelerates in India and Indonesia while easing in Malaysia, Singapore and the Philippines

Economic activity in Indonesia accelerated marginally over the period, registering 5.03% year-on-year (YoY) in the first quarter of 2023 (1Q23), up from 5.01% in the previous quarter. Similarly, India’s economic growth accelerated in the January-March quarter, to 6.1% YoY (from an upwardly revised 4.5%), boosted by fixed investments and higher services exports. In contrast, economic growth in Malaysia slowed to 5.6% YoY over the period. Although this was a deceleration from growth in the previous quarter, which was revised up slightly to 7.1%, the 1Q23 print came in well above expectations of a 5.1% rise. Similarly, growth in the Philippines slowed in the first quarter, although it was still better than expected at 6.4%, from a downwardly revised 7.10% in the last three months of 2022. In Singapore, policymakers revised the final reading for Singapore’s 1Q23 growth to 0.4% YoY from 0.1%, reflecting a sharp moderation from the 2.1% growth in the fourth quarter of 2022.

Chinese economic data disappoints; yuan weakens past the 7-per-dollar mark

China’s economic activity and credit data for April were all below consensus forecasts, further supporting the view that the country’s post-COVID recovery is rapidly losing steam. Despite the low base, industrial production growth rose by just 5.6% YoY (from 3.9%), well below expectations of a 10.9% increase. April retail sales surged 18.4% YoY (from 10.6%) but were still short of expectations. Fixed-asset investment increased 4.7% YoY in the January to April period, slowing from the 5.1% rise in 1Q23 and lower than the 5.7% anticipated by markets. Separately, aggregate financing moderated to Chinese yuan (CNY) 1.22 trillion in April from CNY 5.38 trillion in March, and new yuan loans issued by banks slumped to CNY 718.8 billion from CNY 3.89 trillion over the same period. However, due to the low base last year, YoY growth of outstanding aggregate financing and RMB loans held at 10.0% and 11.8%, respectively, unchanged from March levels. Consequently, the yuan weakened past the key threshold of 7 per dollar as optimism over China’s economic rebound faded. Despite the significant weakening in the currency, the People's Bank of China has so far set the currency’s daily fixing broadly in line with the market, refraining from curbing yuan weakness.

Market outlook

Prefer Philippine, India and Indonesia bonds

Headline inflation for most countries in the region have eased considerably, and market focus has shifted to growth. These factors are fuelling increasing expectations of central bank pivots within the latter half of the year. We remain constructive on relatively higher-yielding Philippine, Indian and Indonesian government bonds, on the back of the relatively supportive macro backdrop for these countries. In addition, we expect flows to be supportive as real rates turn positive.

Thai baht and Indonesian rupiah favoured

On currencies, we continue to expect the Thai baht and Indonesia rupiah to outperform regional peers. Optimism towards Thailand’s current account surplus rebounding to a healthy surplus upon the return of Chinese tourists bodes well for the baht. Meanwhile, the positive outlook for Indonesia’s foreign direct investment—backed by the government’s long-term plan of becoming a manufacturing hub for electric vehicle batteries—should benefit demand for the rupiah, in our view.

Asian credits

Market review

Asian credits retreat in May

Asian credits returned -0.82% in May, with widening spreads in Chinese property credits coupled with higher UST yields accounting for the bulk of the losses. Asian HG credits outperformed Asian HY as the latter continued to be weighed down by extreme weakness in the Chinese property sector. Despite spreads narrowing about 2 bps, Asian HG credit returned -0.39% on the back of higher Treasury yields. Meanwhile, Asian HY credit retreated 3.18% as spreads widened 71 bps.

Risk assets started the month on a weak footing due to concerns around a possible US default and renewed stress in US regional banks. Spreads drifted wider after Chinese activity and credit data printed well below consensus expectations, suggesting the country’s growth momentum is rapidly slowing. Growth concerns and uncertainties surrounding Chinese policy response prompted investors to stay cautious. Meanwhile, the sell-off in Chinese property credits intensified amid negative issuer-specific headlines and softening new housing sales momentum, portending lingering challenges facing the sector. The overall risk tone turned positive towards the middle of the month, prompting spreads to tighten, as US debt ceiling negotiations moved closer to an agreement. Encouraging idiosyncratic developments similarly helped to moderate the outflows from Asia HY. By country, spreads of China, Hong Kong, Macau, Philippines and Taiwan widened, while spreads of India, Indonesia, Malaysia, Singapore, South Korea and Thailand tightened in May.

Primary market picks up slightly in May

There was some pick-up in primary market activity in May, although issuances remained relatively subdued on the whole. The HG space saw 15 new issues amounting to about US dollar (USD) 9.55 billion, including the USD 2.25 billion three-tranche sovereign issue from Hong Kong, USD 1.5 billion two-tranche issue from Malaysia’s Khazanah and USD 1.5 billion issue from Export-Import Bank China. Meanwhile, due to the significantly weak sentiment towards Asia HY, the space had just one new issue amounting to USD 50 million in the month.

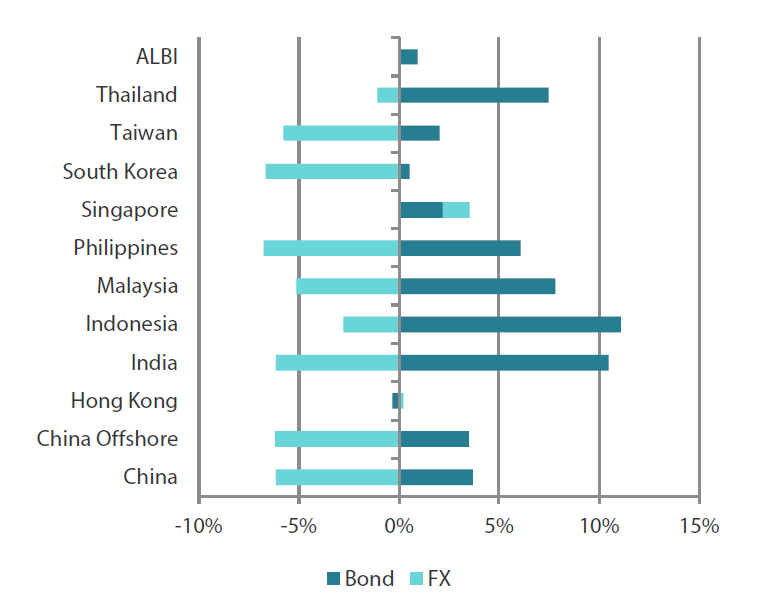

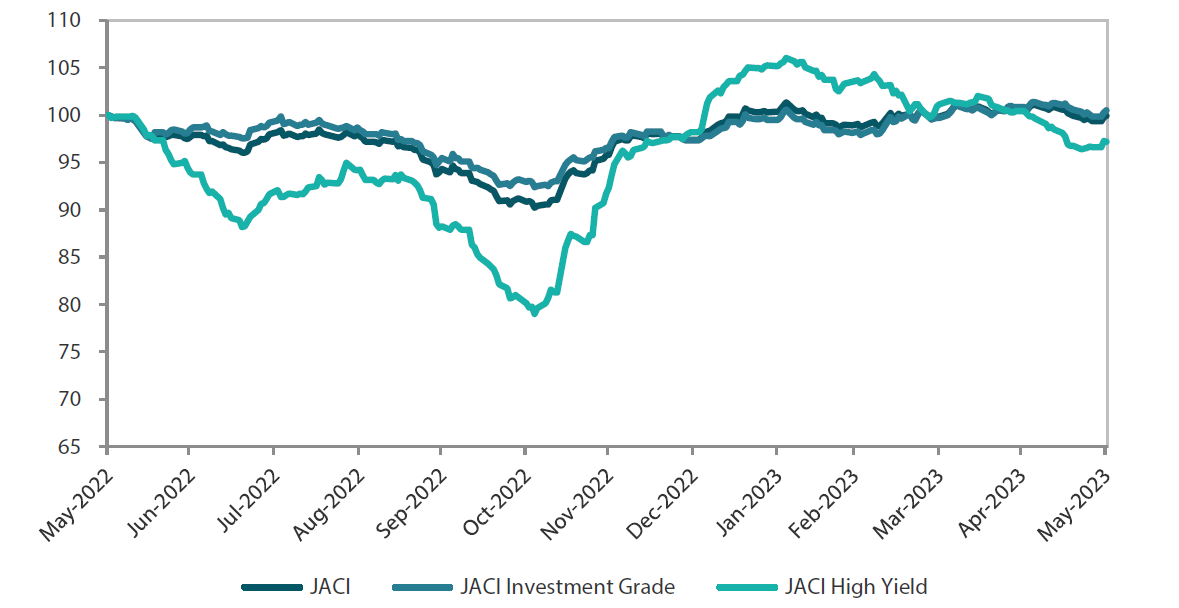

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 May 2023

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 May 2023.

Market outlook

Asia macro and corporate credit fundamentals to stay robust, but valuation somewhat stretched

Macro and corporate credit fundamentals across Asia are expected to stay robust, albeit slightly weaker than in 2022. Resilient domestic demand and the recovery of tourism, particularly in India and ASEAN economies, are seen offsetting the weakness in goods exports. Asian banking systems remain strong; we expect stable deposit base, robust capitalisation, benign asset quality and improving profitability to help Asian banks withstand the banking turmoil in the US and Europe.

However, we are entering a more uncertain phase with multiple cross currents, both regional and global, at play. These include the Fed’s next move, recession risk in the developed markets, softening of China’s recovery momentum and ongoing geopolitical tensions. These uncertainties, coupled with the resilience of Asia credit thus far, make valuation of Asia HG credit looks slightly stretched compared to both historical levels and developed market spreads. At the same time, we think that more meaningful property easing measures from China authorities are needed to stabilise the China HY market—the delivery of which remains uncertain despite growing expectations. As such, we take a more cautious view towards risk in the near term.